Netflix is expected to showcase strong earnings growth from its advertising and content initiatives, making it an attractive buy.

American Airlines is a sell with multiple headwinds likely to result in disappointing results and substantially reduced forward guidance.

Looking for actionable trade ideas? Subscribe now to unlock access to InvestingPro’s AI-selected stock winners!

U.S. stocks ended higher on Friday, after President Donald Trump made positive remarks on China and signaled a meeting with President Xi Jinping is likely at the end of the month, while investor anxiety eased over the financial health of regional banks.

Source: Investing.com

For the week, the 30-stock rose 1.6%, the benchmark S&P 500 added 1.7%, while the tech-heavy Nasdaq Composite advanced 2.1%. The small-cap jumped 2.4%.

More volatility could be in store in the coming days ahead as investors assess the outlook for the economy, inflation, interest rates and corporate earnings amid renewed U.S.-China trade tensions. The prolonged U.S. government shutdown continues to weigh on market confidence as it stretches into a third week, adding further uncertainty for investors.

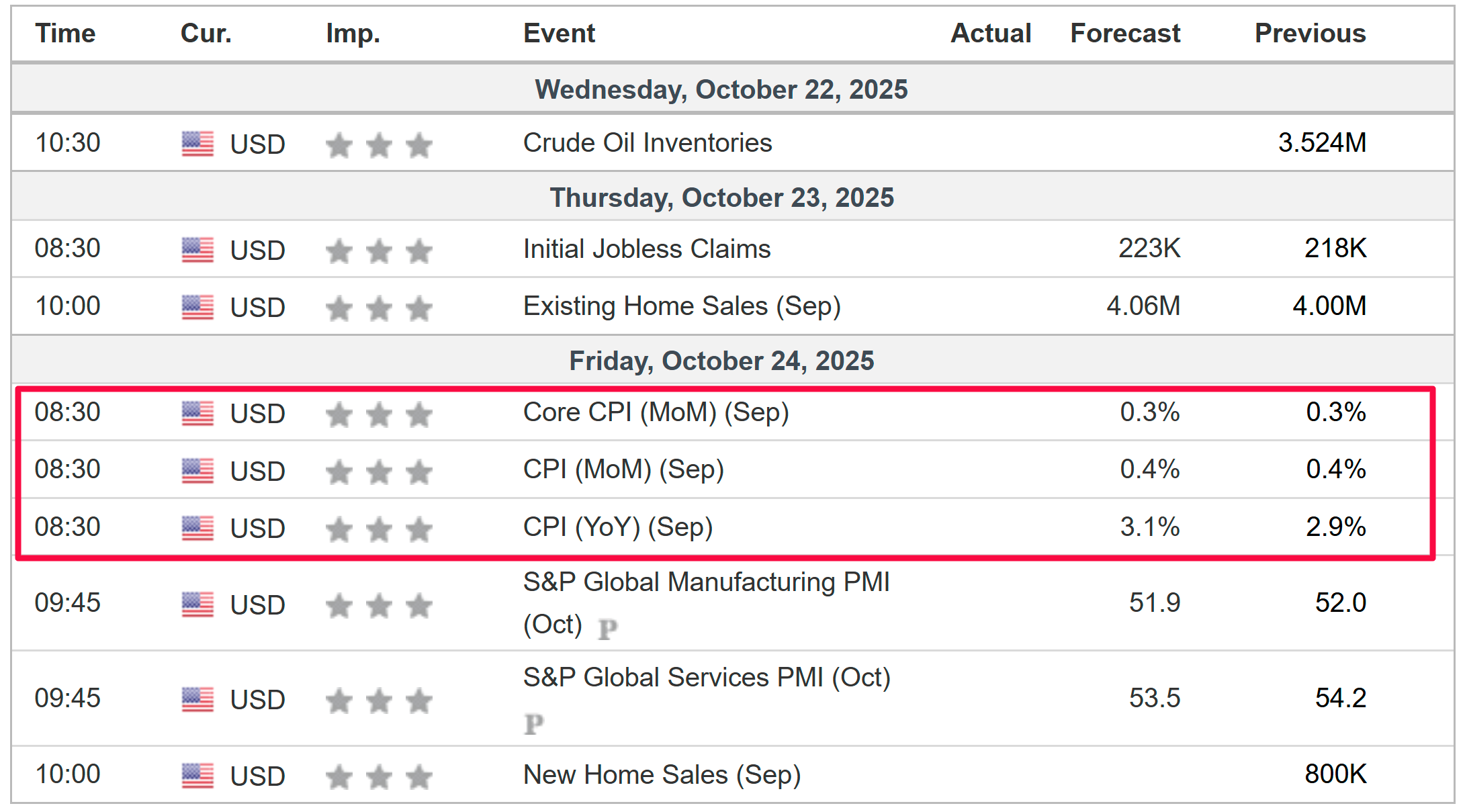

On the economic calendar, most important will be Friday’s U.S. consumer price inflation report, which is forecast to show headline annual CPI rising 3.1% year-over-year in September, accelerating from 2.9% in August.

Source: Investing.com

The Q3 earnings season shifts into high gear, with reports expected from and . Other high-profile companies on the agenda include , , AT&T(NYSE:T), , , , , , , , , , , , , and .

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see fresh downside. Remember though, my timeframe is justfor the week ahead, Monday, October 20 – Friday, Oct. 24.

Stock To Buy: Netflix

My pick for a “buy” this week is streaming giant Netflix, which is set to report its latest quarterly earnings after the U.S. market closes on Tuesday at 4:00PM ET. A call with co-CEO’s Ted Sarandos and Greg Peters is set for 5:00PM ET.

The Los Gatos, California-based Internet television network is in a powerful position to deliver a strong report and issue a confident outlook, driven by the successful execution of its key growth initiatives.

Market participants predict a sizable swing in NFLX stock after the print drops, according to the options market, with a possible implied move of +/-8.0% in either direction.

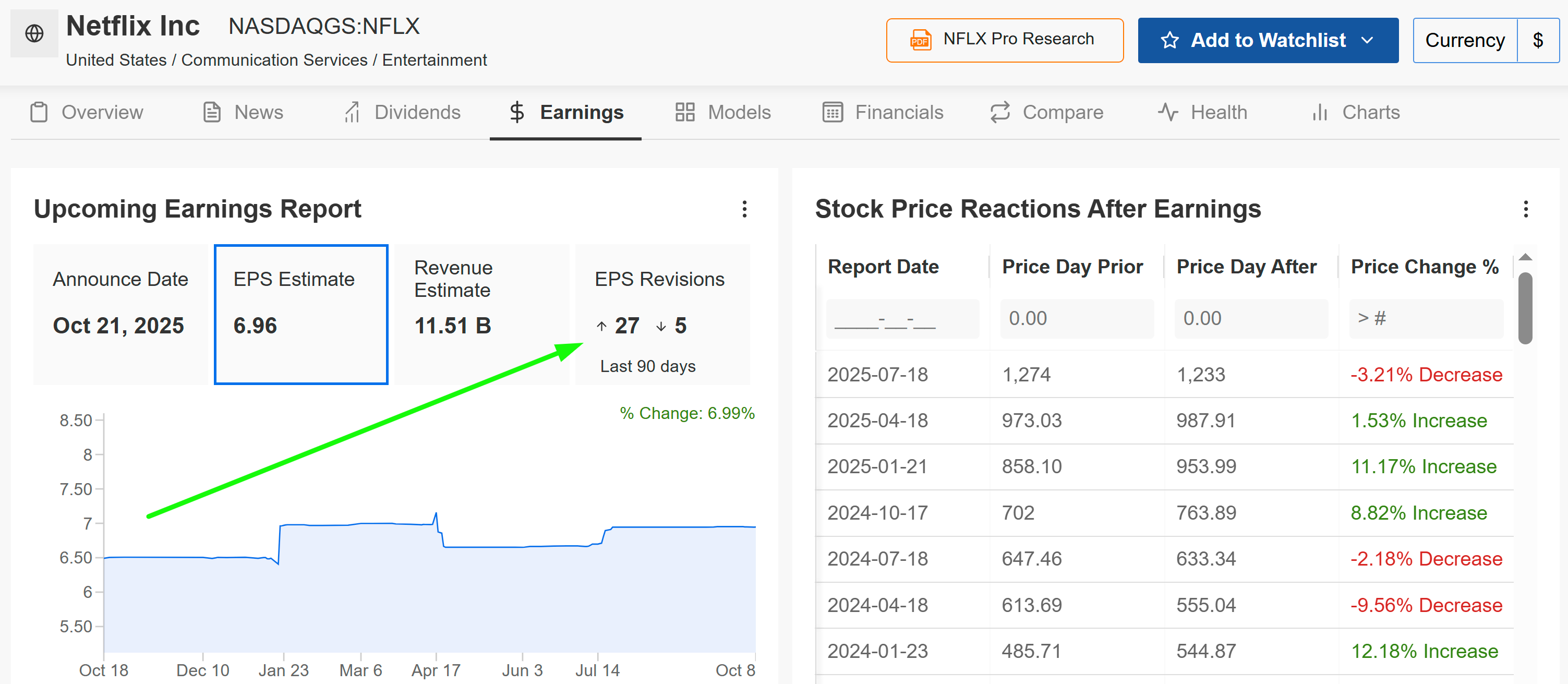

Source: InvestingPro

Profit estimates have been revised upward 27 times in the last 90 days, reflecting growing confidence among analysts. Only five downward revisions have been noted, underscoring Wall Street’s bullish sentiment toward the entertainment powerhouse.

Netflix is seen earning $6.96 per share, representing a 28.9% increase from the prior year and marking another quarter of accelerating profitability. Meanwhile, revenue is forecast to jump 17.2% year-over-year to $11.5 billion.

Key drivers of this growth include the expansion of Netflix’s ad-supported tier and its foray into live events, like sports and exclusive programming, both of which have expanded its revenue streams and subscriber base.

Looking further ahead, Netflix’s full-year guidance presents additional upside potential. The company’s planned $18 billion content spend signals a substantial investment in producing high-quality, diverse content—an essential factor for retaining existing subscribers and attracting new ones.

Source: Investing.com

NFLX stock ended Friday’s session at $1,199.36, just below its 52-week high of $1,341.15. Short-term technicals (1h) signal strength: a “strong buy” on indicators and “buy” on moving averages, with RSI near neutral (48.13) and price trading just below the 50-day average but well above the 200-day.

Additionally, InvestingPro’s AI-powered models rate Netflix with a “GREAT” Financial Health Score of 3.23, reflecting consistent profitability, a strong cash flow position, and analysts forecasting further profits in the coming year.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Subscribe now for $9/month and position your portfolio one step ahead of everyone else!

Stock to Sell: American Airlines

On the other hand, American Airlines faces operational challenges and tepid growth, making it less attractive in the current market environment. The company is scheduled to report its third quarter earnings report before the stock market opens on Thursday at 7:00AM ET.

The expected move post-earnings in the options market for AAL stock is about 7.5% up or down. Shares fell over 9% after the last earnings report came out in July.

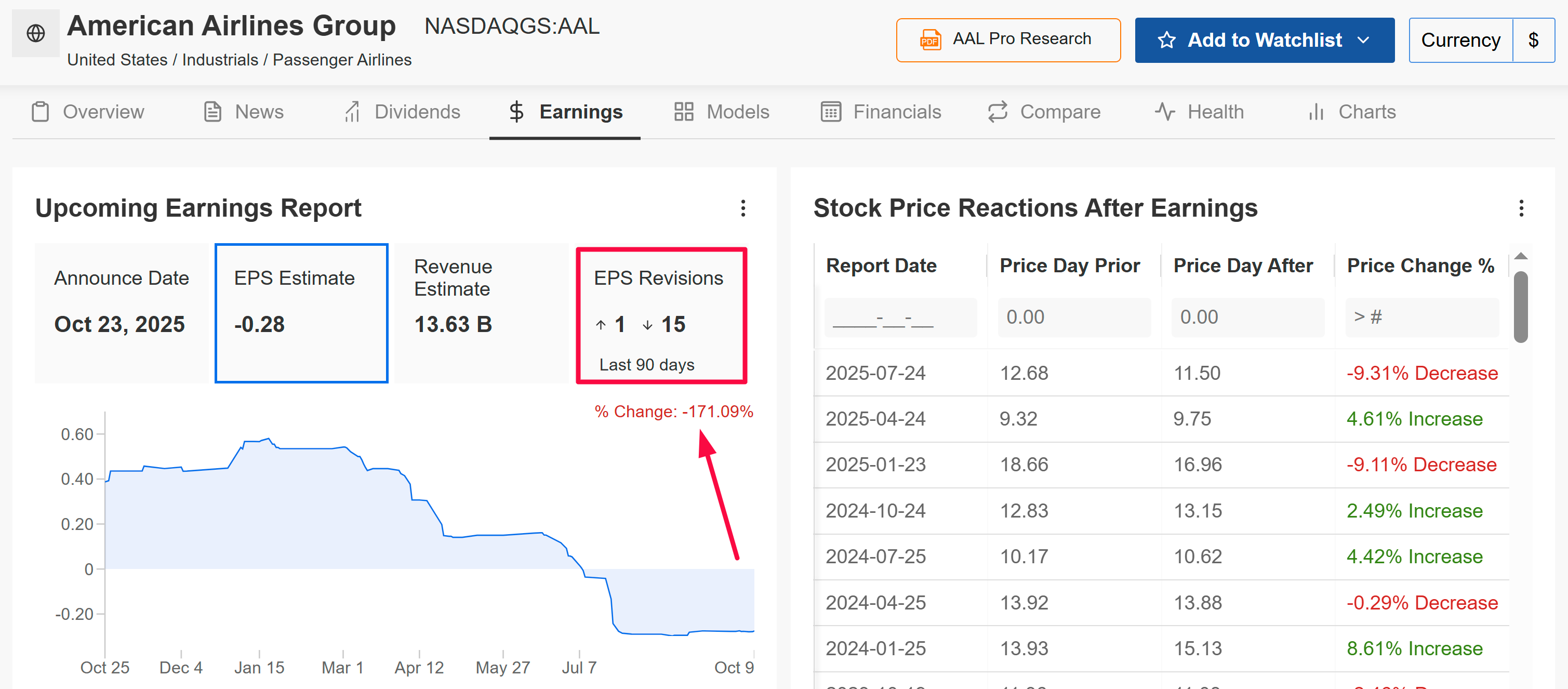

Underscoring several challenges facing American Airlines, 15 out of the 16 analysts surveyed by InvestingPro cut their profit estimates ahead of the print, citing soft consumer demand and a challenging outlook.

Source: InvestingPro

Wall Street sees the Fort Worth, Texas-based airliner swinging to a loss of $0.28 per share from a profit of $0.30 in the year-ago period due to weaker demand, cost pressures, and mounting operational disruptions. Meanwhile, revenue is expected to come in at $13.6 billion, representing a modest decline of 0.3% from last year, reflecting issues like delayed flights and an uncertain outlook amid trade policy concerns.

Keeping that in mind, management is likely to strike a cautious tone regarding the company’s fiscal full-year outlook. Operationally, the recent disruptions from the U.S. government shutdown are expected to have a tangible impact, leading to costly delayed and cancelled flights that hit both revenue and customer satisfaction.

On a macro level, the uncertain tariff outlook creates an environment of caution for corporate spending, which could dampen demand for high-margin business travel.

Source: Investing.com

AAL stock closed at $11.86 on Friday and the technical story is overwhelmingly bearish in the near term. On the 1-hour chart, AAL shows “strong sell” across both indicators and moving averages. RSI (44.36) is low, and the stock is stuck well below both its 50-day and 200-day averages.

Furthermore, it should be noted that American Airlines currently has an InvestingPro ‘Financial Health Score’ of 2.79 out of 5.0, underscoring concerns over its spotty balance sheet, declining free cash flow, and weakening growth prospects.

Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

ProPicks AI: AI-selected stock winners with proven track record.

InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF (SPY), and the . I am also long on the , and Invesco S&P 500 Equal Weight ETF (RSP).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.