• PCE inflation data, Fed speakers, Trump tariff news will be in focus this week.

• Lululemon’s strong brand presence, innovative product lines, and effective marketing strategies position it favorably for a robust earnings report.

• Dollar Tree’s downbeat profit and sales growth prospects suggest a more cautious approach, potentially making it a stock to sell.

• Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

U.S. stocks ended slightly higher on Friday, with the major indexes averting a fifth straight week of losses, after President Donald Trump signaled “flexibility” on upcoming reciprocal tariffs.

For the week, the jumped 1.2%, the gained 0.5%, while the tech-heavy rose 0.2%.

Source: Investing.com

The week ahead is expected to be another busy one as investors continue to assess the outlook for the economy, inflation, interest rates and corporate earnings amid President Trump’s trade war.

Most important on the economic calendar will be Friday’s core PCE price index, which is the Fed’s favorite inflation gauge. That will be accompanied by a heavy slate of Fed speakers, including district governors Tom Barkin, Raphael Bostic, Neel Kashkari, and Alberto Musalem all set to make public appearances.

Source: Investing.com

Elsewhere, on the earnings docket, there are just a handful of corporate results due, including Lululemon (NASDAQ:), GameStop (NYSE:), Chewy (NYSE:), McCormick (NYSE:), KB Home (NYSE:), and Dollar Tree (NASDAQ:).

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see fresh downside. Remember though, my timeframe is just for the week ahead, Monday, March 24 – Friday, March 28.

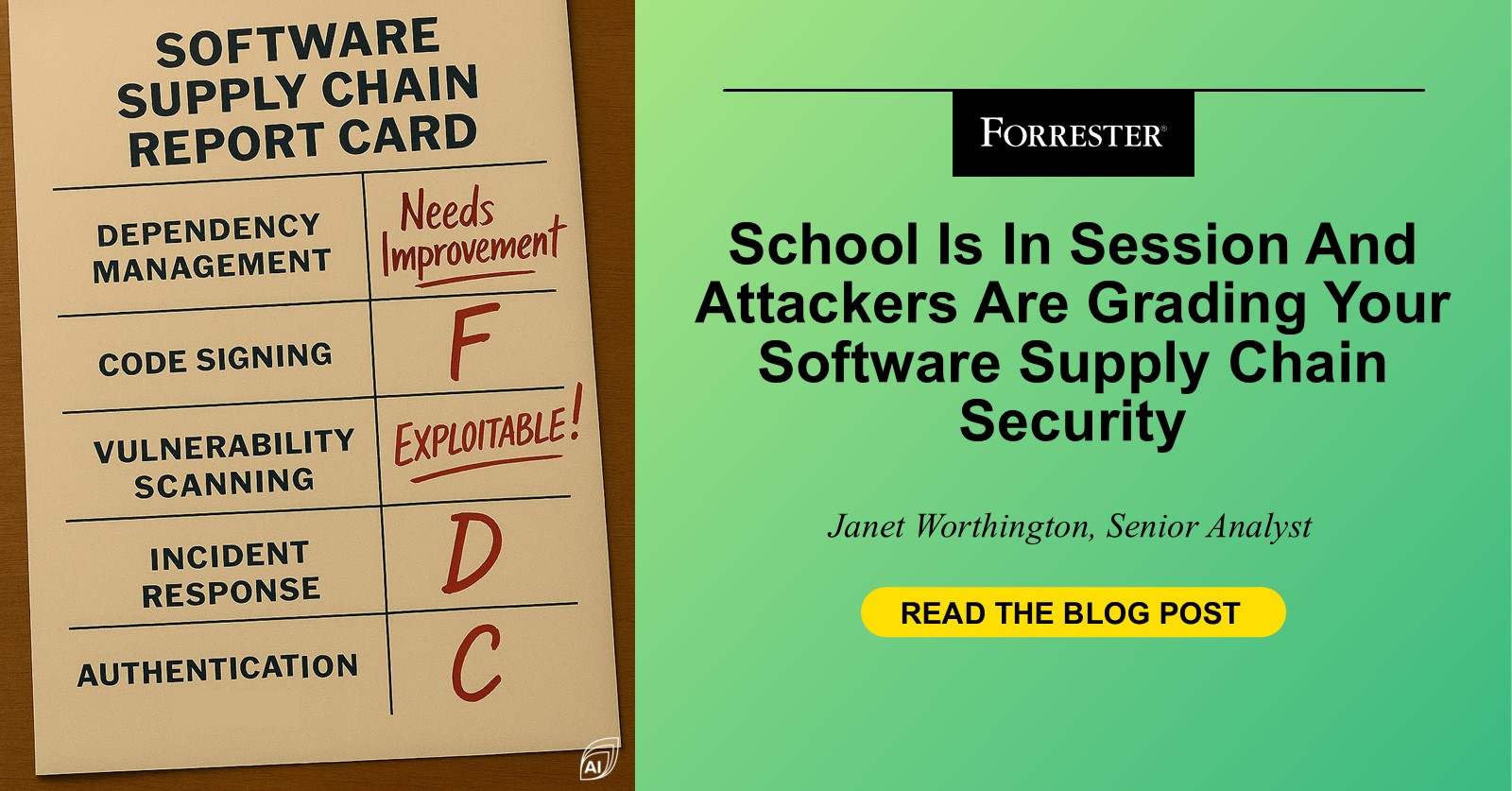

Stock To Buy: Lululemon

Lululemon, the Canadian athletic wear giant, is preparing to unveil its fourth-quarter earnings on Thursday at 4:05PM ET. According to the options market, traders are pricing in a swing of about 10% in either direction for LULU stock following the print. Shares gapped up 16.7% after the last earnings report came out in December.

Renowned for its innovative products, strong brand loyalty, and expanding market presence, Lululemon has long been a favorite among both investors and analysts. Recent optimism has been evident, with profit estimates revised upward 26 times in the weeks leading up to the report—compared to zero downward revisions, according to InvestingPro.

Source: InvestingPro

The company is expected to report better-than-feared earnings and guidance, driven by several key factors. Consensus estimates call for Lululemon to deliver Q4 earnings per share of $5.87, rising 11% from EPS of $5.29 in the year-ago period.

Meanwhile, sales for the period are expected to increase 11.5% annually to $3.58 billion as the athleisure maker enjoyed a strong holiday shopping season amid robust consumer demand for its yoga gear and sportswear.

While investors are bracing for weaker guidance, it is my belief that Lululemon’s management will provide a better-than-feared outlook for the current fiscal year as it benefits from an improved inventory approach and promising fundamentals. Additionally, the company’s expansion into new markets, both domestically and internationally, and its continuous innovation in product lines and fabrics have broadened its appeal, leveraging the growing trend of athleisure.

Source: Investing.com

LULU stock ended Friday’s session at $322.62. Year-to-date, shares are down 15.6%, underperforming the broader market over the same timeframe. Lululemon has a market cap of around $39 billion, making it one of the most valuable athletic apparel companies in the world.

It should be noted that Lululemon demonstrates exceptional financial health with an overall score of 3.06, earning a “GREAT” rating according to InvestingPro metrics. The company particularly excels in profitability with an impressive 4.35 score. LULU also performs strongly in cash flow generation (3.59) and growth metrics (3.47).

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Subscribe now and position your portfolio one step ahead of everyone else!

Stock to Sell: Dollar Tree

On the flip side, Dollar Tree is bracing for a tough week as it prepares to release its fourth-quarter financial results on Wednesday at 6:30AM ET. The struggling discount retailer has been navigating a host of negative headwinds that have impacted its business.

Market participants expect a sizable swing in DLTR shares after the report drops, with a possible implied move of approximately 14% in either direction as per the options market. The Chesapeake, Virginia-based variety store operator’s margins are under pressure, and an InvestingPro survey reveals that analysts have slashed their profit estimates by over 20% in the past 90 days.

Source: InvestingPro

This bearish sentiment reflects concerns about Dollar Tree’s ability to navigate the increasingly competitive discount retail sector, especially as consumer spending shifts towards larger, more established players that offer better deals and a broader product selection.

Dollar Tree is expected to post a profit of $2.20 for the fourth quarter, falling 13.7% from EPS of $2.55 in the year-ago period. Revenue is seen inching down 4.7% year-over-year to $8.23 billion amid fierce competition from retail giants like Walmart (NYSE:) and Amazon (NASDAQ:), as well as Chinese e-commerce platform Temu.

Looking ahead, I expect that the retailer will provide disappointing full-year sales and profit guidance due to the tough macro climate. Dollar Tree’s adherence to its $1 price point, while iconic, has become increasingly unsustainable in the face of inflation, limiting its ability to pass on costs to consumers.

Source: Investing.com

DLTR stock closed at $66.75 on Friday. At current valuations, Dollar Tree has a market cap of $14.3 billion, making it the second largest U.S. dollar store in the country after Dollar General (NYSE:). Shares, which are trading below their key moving averages, are down 11% in 2025.

Not surprisingly, InvestingPro’s AI-powered quantitative model rates Dollar Tree with a ‘FAIR’ Financial Health Score of 2.08, citing concerns over weakening profit margins, spotty sales growth, and declining free cash flow.

Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

• ProPicks AI: AI-selected stock winners with proven track record.

• InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

• Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

• Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the via the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Invesco Top QQQ ETF (QBIG), Invesco S&P 500 Equal Weight ETF (RSP), and VanEck Vectors Semiconductor ETF (SMH).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.