This was a guest contribution by Kanwal Sarai from Simply Investing

Updated on December 18th, 2025 by Nathan Parsh

Investors can follow several different strategies for stocks. Some investors follow momentum strategies, trading stocks with high price gains. Other investors follow a high growth strategy focusing on tech stocks, like Apple (AAPL) and Amazon (AMZN).

Yet another type of investor seeks income by buying and holding high-yield stocks, like utilities and real estate investment trusts (REITs).

A fourth approach is dividend growth investing, focusing on stocks that pay a growing dividend annually. This strategy is increasingly popular, and the type of stocks are categorized into the Dividend Achievers, Contenders, Aristocrats, Champions, and Kings.

The Dividend Aristocrats are a group of 66 stocks in the S&P 500 Index, that have increased their dividends for 25+ consecutive years.

You can download an Excel spreadsheet of all 69 Dividend Aristocrats (with metrics that matter such as dividend yields and price-to-earnings ratios) by clicking the link below:

This article will discuss dividend growth investing, and several of the various lists of dividend growth stocks.

What is Dividend Growth Investing?

Dividend growth investing is an approach to buying and holding the stock of companies increasing their dividend annually.

Dividend growth investors are looking to invest in undervalued stocks paying a dividend instead of overvalued stocks that do not.

In addition, these investors rationalize that dividends require real cash to pay shareholders and thus are an indicator of the companies’ actual earnings and health.

Furthermore, a company demonstrating the ability to raise the dividend annually over time probably has a good business model.

On the other hand, a company cutting or suspending its dividend is obviously struggling.

Dividend growth stocks are sorted into groups called the Dividend Achievers, Contenders, Aristocrats, Champions, and Kings, but what exactly are they?

What are the Dividend Achievers, Contenders, Aristocrats, Champions, and Kings?

Dividend Achievers are companies that have raised their dividends for ten years in a row or more. Besides the 10-year dividend growth streak, companies must be listed on the New York Stock Exchange or Nasdaq and have a three-month average daily trading volume of $1 million.

Currently, there are about 400 Dividend Achievers. Many companies are from the Consumer, Industrials, Financials, and Utilities sectors. In addition, the group includes technology companies like Microsoft (MSFT), etc.

The next category is the Dividend Contenders. They are stocks raising the dividend for between 10 and 24 years. The list is similar to the Dividend Achievers list, but since it is capped at 24 years, the total number of companies is smaller.

Currently, there are around 370 Dividend Contenders. The sector with the most significant representation is Financial Services, followed by Industrials and Utilities. This group includes companies like Home Depot (HD), Huntington Ingalls Industries (HII), and many local and regional banks.

The Dividend Aristocrats are companies that have raised their dividends for 25+ years and are a part of the S&P 500 Index.

In addition, they must have a minimum market capitalization of $3 billion and a $5+ million average daily trading volume for the three months before the rebalancing date.

There are currently 69 Dividend Aristocrats. The number is relatively small because of the stricter requirements. Sectors with the most significant representation are Consumer Staples and Industrials.

Companies on this list are often larger, well-established companies that are market leaders. For example, companies like International Business Machines (IBM), Colgate-Palmolive (CL), Coca-Cola (KO), and Consolidated Edison (ED) are on the list.

The Dividend Champions are like the Dividend Aristocrats. However, the only requirement is increasing the dividend for 25 or more years. Consequently, the number of companies on the list is greater at 133.

In addition, the list includes companies that are a part of the Dividend Aristocrats and ones with a market capitalization of less than $3 billion and are not a member of the S&P 500 Index.

The two sectors with the most representation are Industrials and Financial Services. Smaller companies on this list include MGEE Energy (MGEE), and Sonoco Products (SON).

The last category is the Dividend Kings. To attain this status, a company must increase the dividend for 50+ consecutive years. There is no other requirement; however, the task is not an easy one.

Currently, there are only 56 companies on the list. Examples of companies on this list include Federal Realty Trust (FRT), Emerson Electric (EMR), Johnson & Johnson (JNJ), and Procter & Gamble (PG).

Dividend Aristocrat Highlight: Atmos Energy Corp. (ATO)

Since humble beginnings in 1906, Atmos Energy has grown to be one of the larger utility companies in the country. The company distributes and stores natural gas in eight states, serving more than 3 million customers. The company has annual sales of $5 billion and a market capitalization of $27.

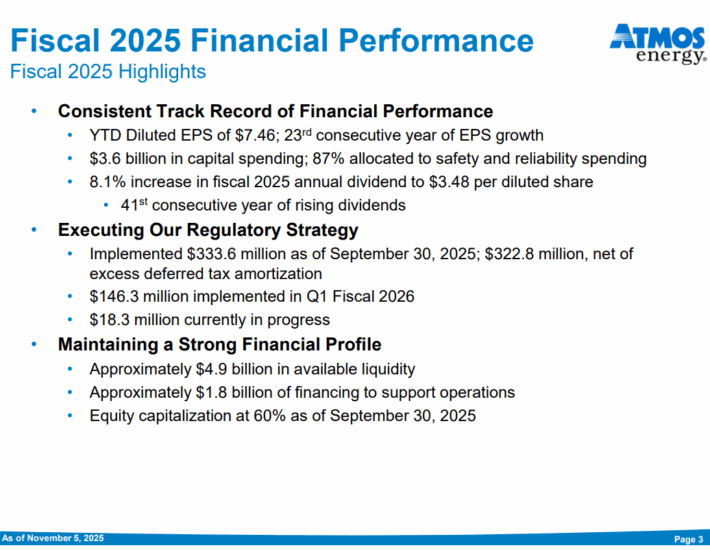

Atmos Energy released fourth-quarter and fiscal year results on November 5th, 2025.

Source: Investor Presentation

Core sales, which exclude the impact of currency rate movements, acquisitions, and dispossessions, were down 1% year over year.

Results were better than expected, with full-year earnings-per-share of $7.46, which was up 9.2% from the prior year. Capex totaled $3.6 billion for the year, with 87% of that spending focused on safety and reliability. The company ended the year with $4.9 billion in available liquidity.

Atmos Energy also increased its quarterly dividend nearly 15% to $1.00 per share, extending the company’s dividend growth streak to 42 consecutive years.

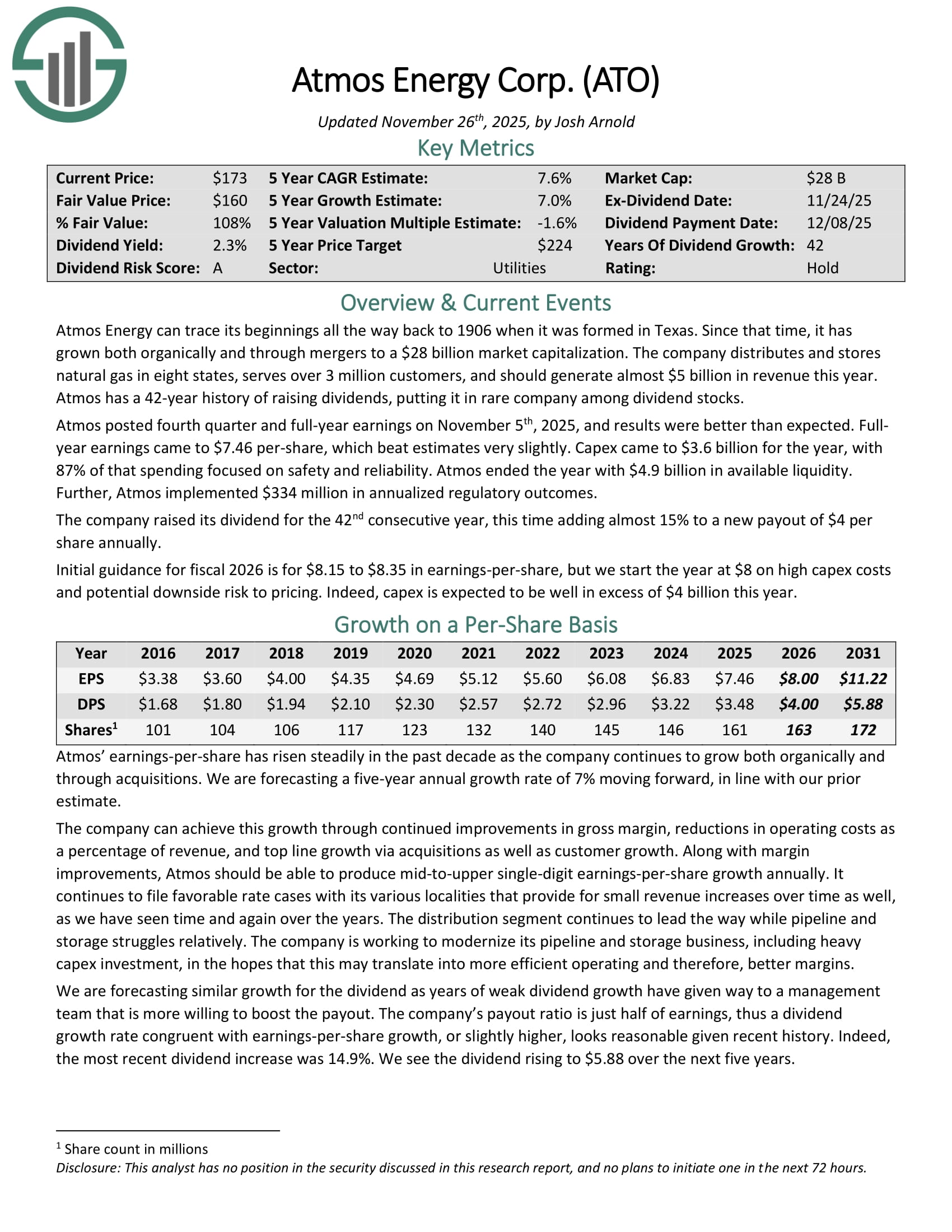

Click here to download our most recent Sure Analysis report on Atmos Energy Corp (preview of page 1 of 3 shown below):

Dividend King Highlight: Abbott Laboratories (ABT)

Abbott Laboratories is one of the largest medical appliances and equipment manufacturers in the world. The company has four reportable business segments, including Nutrition, Diagnostics, Established Pharmaceuticals, and Medical Devices. The company employees 114,000 across more than 160 countries around the world, generates $24 billion in annual revenue, and has raised its dividend for 54 consecutive years.

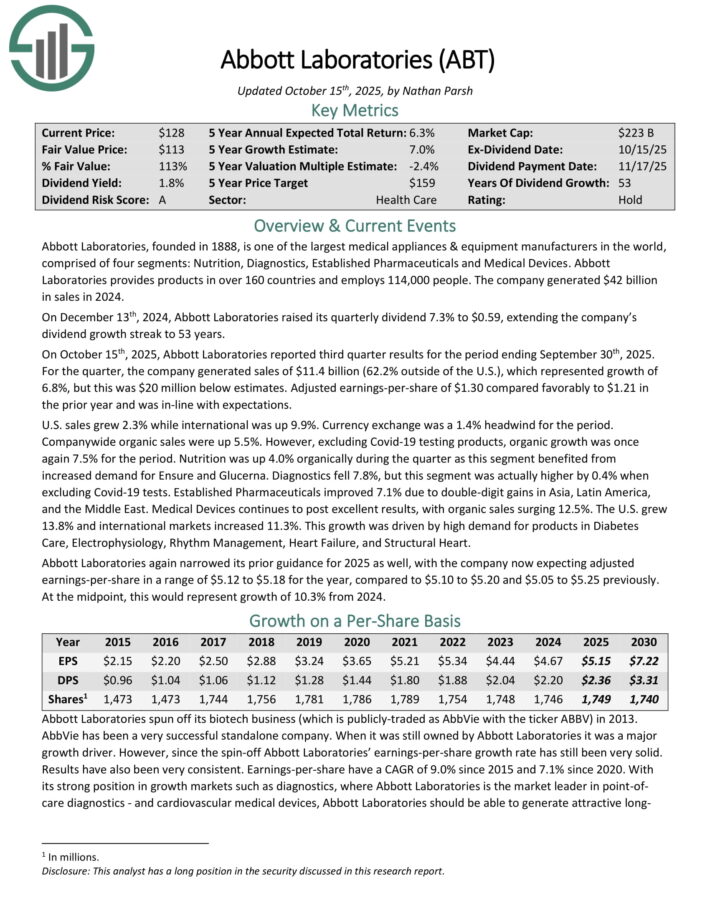

Source: Investor Presentation

Abbott Laboratories reported third-quarter results on October 15th, 2025. For the quarter, revenue grew 6.8% to $11.4 billion, though this was $20 million less than expected. Adjusted earnings-per-share of $1.30 was up from $1.21 in the prior year and matched estimates.

Sales for the U.S. grew 2.3% while international was higher by 9.9%. Organic growth was 5.5% for the period, but this figure expanded to 7.5% when excluding Covid-19 testing products. Nutrition grew 4.0%, Established Pharmaceuticals was up 7.1%, and Medical Devices improved 12.5%. Diagnostics was down 7.8%, but up 0.4% when excluding Covid-19 tests.

On December 12th, 2025, Abbott Laboratories announced that it was raising its quarterly dividend 6.8% to $0.63. The company has now declared 408 consecutive dividends while raising its dividend for 53 years.

Click here to download our most recent Sure Analysis report on Abbott Laboratories (preview of page 1 of 3 shown below):

Which stocks should I invest in?

At the end of the day the most important question for investors is: Which stocks should I invest in? The simple answer is: Invest in quality dividend paying stocks when they are priced low (undervalued).

The Simply Investing online course teaches you exactly how to identify when a stock is a quality stock (and when it isn’t a quality stock), and when a stock is undervalued (and overvalued).

A simple checklist of 12 rules of investing helps you to select quality stocks when they are undervalued, and easily filter through the list of dividend Achievers, Contenders, Aristocrats, Champions, and Kings.

Other Dividend Lists

The following lists contain many more high-quality dividend stocks:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].