Updated on December 12th, 2025 by Bob Ciura

Canadian oil stocks have proven over the past decade that they can navigate downturns in commodity prices.

Canadian oil stocks also tend to pay higher dividends than many U.S.-based oil stocks, making them potentially more appealing for income investors.

Valuations have also remained quite low recently, boosting their respective total return profiles as a result.

In this article, we’ll take a look at 9 major Canadian oil stocks:

Canadian Natural Resources (CNQ)

Suncor Energy (SU)

Enbridge, Inc. (ENB)

Imperial Oil (IMO)

InPlay Oil Corp. (IPOOF)

Whitecap Resources (WCPRF)

Paramount Resources (PRMRF)

Tamarack Valley Energy (TNEYF)

Freehold Royalties Ltd. (FRHLF)

In this article, we will rank them in order of highest expected annual returns over the next five years.

Note: Canada imposes a 15% dividend withholding tax on U.S. investors. In many cases, investing in Canadian stocks through a U.S. retirement account waives the dividend withholding tax from Canada, but check with your tax preparer or accountant for more on this issue.

These top 9 Canadian Big Oil stocks are shareholder-friendly companies, with attractive dividend payouts. With this in mind, we created a full list of nearly 80 energy stocks.

You can download a free copy of the energy stocks list by clicking on the link below:

More information can be found in the Sure Analysis Research Database, which ranks stocks based on their dividend yield, earnings-per-share growth potential, and changes in the valuation multiple.

The stocks are listed in order below, with #1 being the most attractive for investors today.

Read on to see which Canadian oil stock is ranked highest in our Sure Analysis Research Database.

Table Of Contents

You can use the following table of contents to instantly jump to a specific stock:

The top 9 Canadian oil stocks are ranked based on total expected returns over the next five years, from lowest to highest.

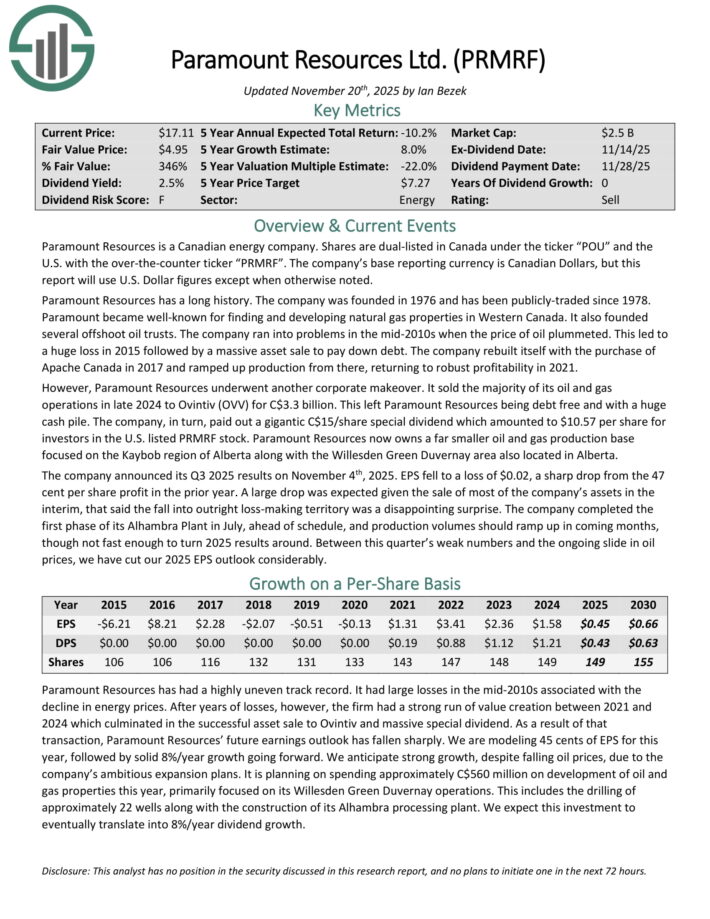

Canadian Oil Stock #9: Paramount Resources (PRMRF)

5-year expected returns: -11.3%

Paramount Resources is a Canadian energy company. Paramount Resources has a long history. The company was founded in 1976 and has been publicly-traded since 1978.

Paramount Resources now owns a far smaller oil and gas production base focused on the Kaybob region of Alberta along with the Willesden Green Duvernay area also located in Alberta.

The company announced its Q3 2025 results on November 4th, 2025. EPS fell to a loss of $0.02, a sharp drop from the 47 cent per share profit in the prior year.

A large drop was expected given the sale of most of the company’s assets in the interim, that said the fall into outright loss-making territory was a disappointing surprise.

The company completed the first phase of its Alhambra Plant in July, ahead of schedule, and production volumes should ramp up in coming months.

It is planning on spending approximately C$560 million on development of oil and gas properties this year, primarily focused on its Willesden Green Duvernay operations.

This includes the drilling of approximately 22 wells along with the construction of its Alhambra processing plant.

Click here to download our most recent Sure Analysis report on PRMRF (preview of page 1 of 3 shown below):

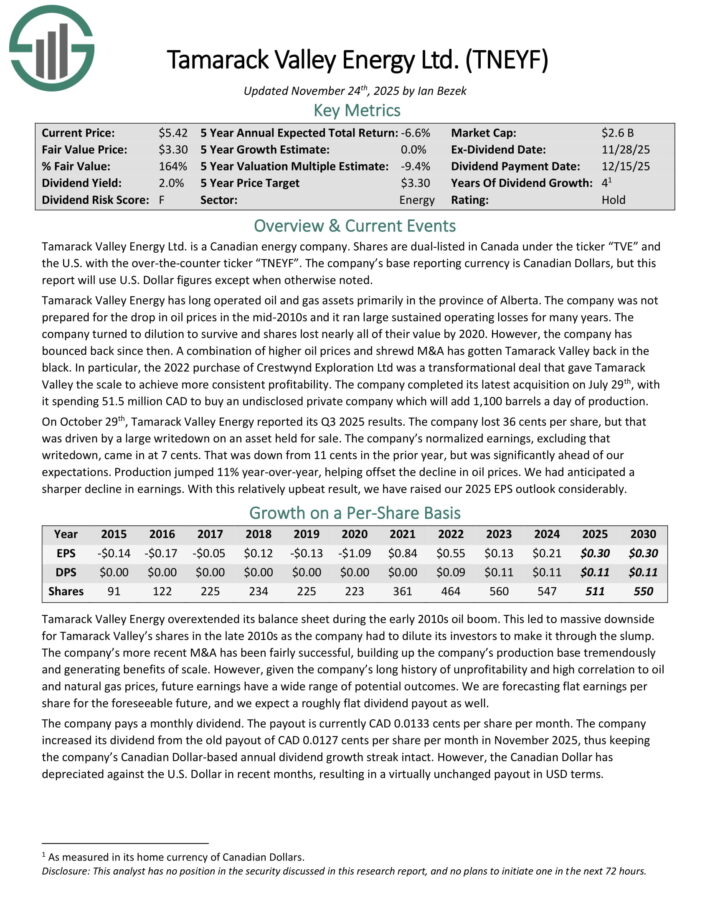

Canadian Oil Stock #8: Tamarack Valley Energy (TNEYF)

5-year expected returns: -7.1%

Tamarack Valley Energy Ltd. is a Canadian energy company. Shares are dual-listed in Canada under the ticker “TVE” and the U.S. with the over-the-counter ticker “TNEYF”.

The company’s base reporting currency is Canadian Dollars, but this report will use U.S. Dollar figures except when otherwise noted. Tamarack Valley Energy has long operated oil and gas assets primarily in the province of Alberta.

On October 29th, Tamarack Valley Energy reported its Q3 2025 results. The company lost 36 cents per share, but that was driven by a large write down on an asset held for sale.

The company’s normalized earnings, excluding that write down, came in at 7 cents.

That was down from 11 cents in the prior year, but was significantly ahead of our expectations. Production jumped 11% year-over-year, helping offset the decline in oil prices.

Click here to download our most recent Sure Analysis report on TNEYF (preview of page 1 of 3 shown below):

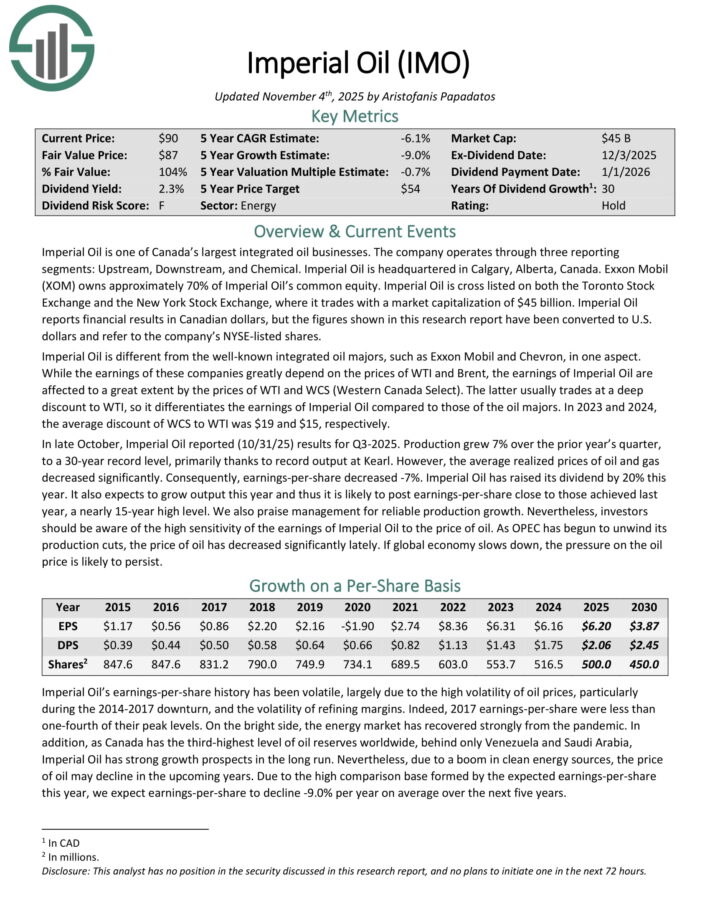

Canadian Oil Stock #7: Imperial Oil (IMO)

5-year expected returns: -6.6%

Imperial Oil is one of Canada’s largest integrated oil businesses. The company operates through three reporting segments: Upstream, Downstream, and Chemical. Imperial Oil is headquartered in Calgary, Alberta, Canada.

Exxon Mobil (XOM) owns approximately 70% of Imperial Oil’s common equity. Imperial Oil is cross listed on both the Toronto Stock Exchange and the New York Stock Exchange.

Imperial Oil reports financial results in Canadian dollars, but the figures shown in this research report have been converted to U.S. dollars and refer to the company’s NYSE-listed shares.

In late October, Imperial Oil reported (10/31/25) results for Q3-2025. Production grew 7% over the prior year’s quarter, to a 30-year record level, primarily thanks to record output at Kearl.

However, the average realized prices of oil and gas decreased significantly. Consequently, earnings-per-share decreased -7%.

Imperial Oil has raised its dividend by 20% this year. It also expects to grow output this year and is likely to post earnings-per-share close to those achieved last year, a nearly 15-year high level.

Click here to download our most recent Sure Analysis report on IMO (preview of page 1 of 3 shown below):

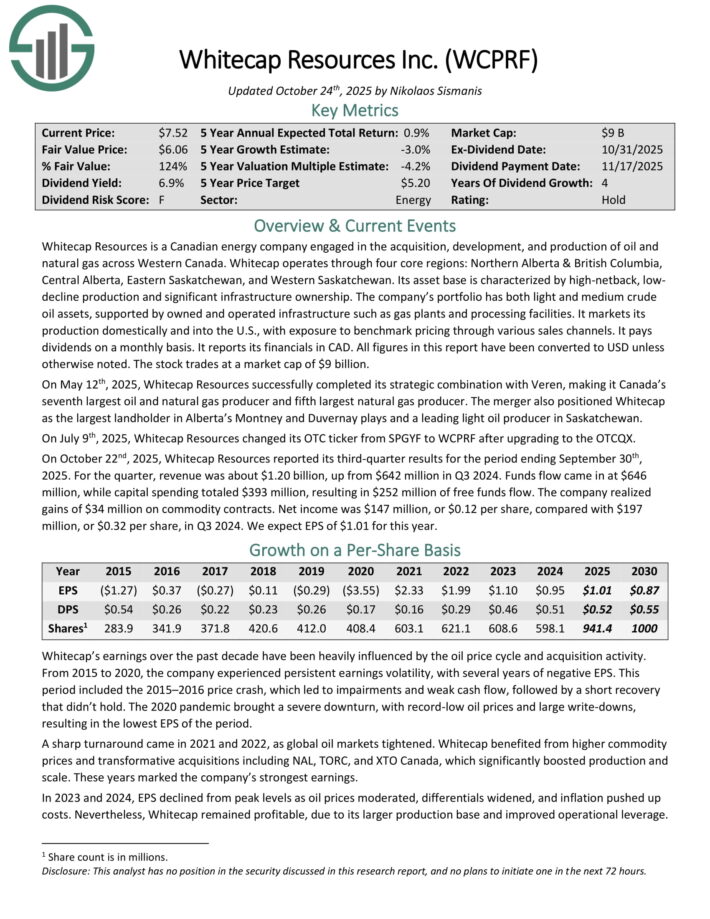

Canadian Oil Stock #6: Whitecap Resources (WCPRF)

5-year expected returns: -1.4%

Whitecap Resources is a Canadian energy company engaged in the acquisition, development, and production of oil and natural gas across Western Canada.

Whitecap operates through four core regions: Northern Alberta & British Columbia, Central Alberta, Eastern Saskatchewan, and Western Saskatchewan.

It markets its production domestically and into the U.S., with exposure to benchmark pricing through various sales channels. It pays dividends on a monthly basis.

On May 12th, 2025, Whitecap Resources successfully completed its strategic combination with Veren, making it Canada’s seventh largest oil and natural gas producer and fifth largest natural gas producer.

The merger also positioned Whitecap as the largest landholder in Alberta’s Montney and Duvernay plays and a leading light oil producer in Saskatchewan. On July 9th, 2025, Whitecap Resources changed its OTC ticker from SPGYF to WCPRF after upgrading to the OTCQX.

On October 22nd, 2025, Whitecap Resources reported its third-quarter results for the period ending September 30th, 2025. For the quarter, revenue was about $1.20 billion, up from $642 million in Q3 2024.

Funds flow came in at $646 million, while capital spending totaled $393 million, resulting in $252 million of free funds flow. The company realized gains of $34 million on commodity contracts.

Net income was $147 million, or $0.12 per share, compared with $197 million, or $0.32 per share, in Q3 2024.

Click here to download our most recent Sure Analysis report on WCPRF (preview of page 1 of 3 shown below):

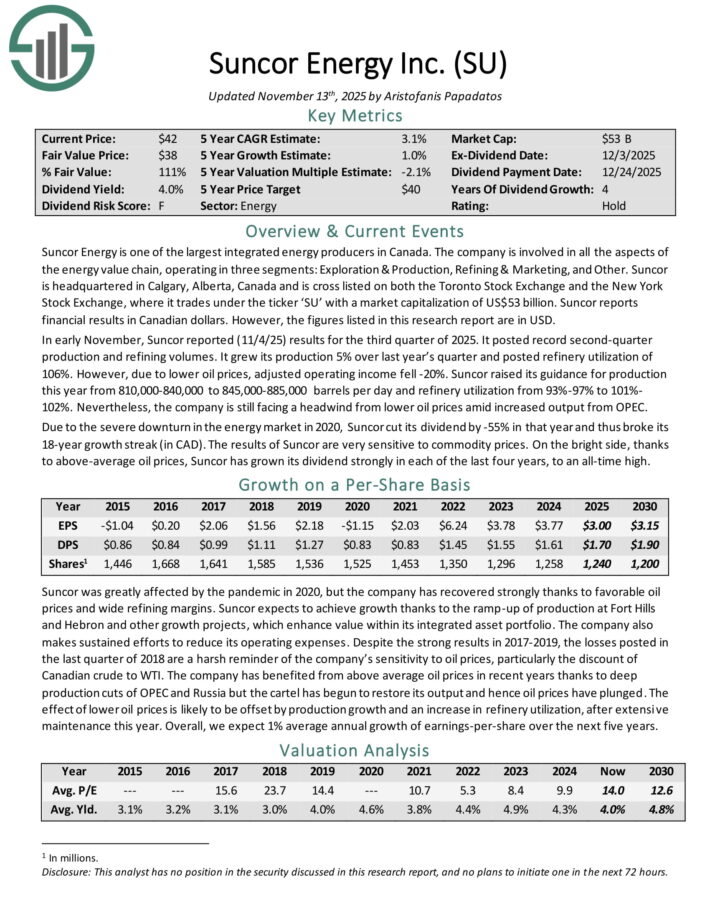

Canadian Oil Stock #5: Suncor Energy (SU)

5-year expected annual returns: 2.0%

Suncor Energy is one of the largest integrated energy producers in Canada. The company is involved in all the aspects of the energy value chain, operating in three segments: Exploration & Production, Refining & Marketing, and Other.

Suncor is headquartered in Calgary, Alberta, Canada and is cross listed on both the Toronto Stock Exchange and the New York Stock Exchange.

In early November, Suncor reported (11/4/25) results for the third quarter of 2025. It posted record second-quarter production and refining volumes.

It grew its production 5% over last year’s quarter and posted refinery utilization of 106%. However, due to lower oil prices, adjusted operating income fell -20%.

Suncor raised its guidance for production this year from 810,000-840,000 to 845,000-885,000 barrels per day and refinery utilization from 93%-97% to 101% 102%.

Click here to download our most recent Sure Analysis report on SU (preview of page 1 of 3 shown below):

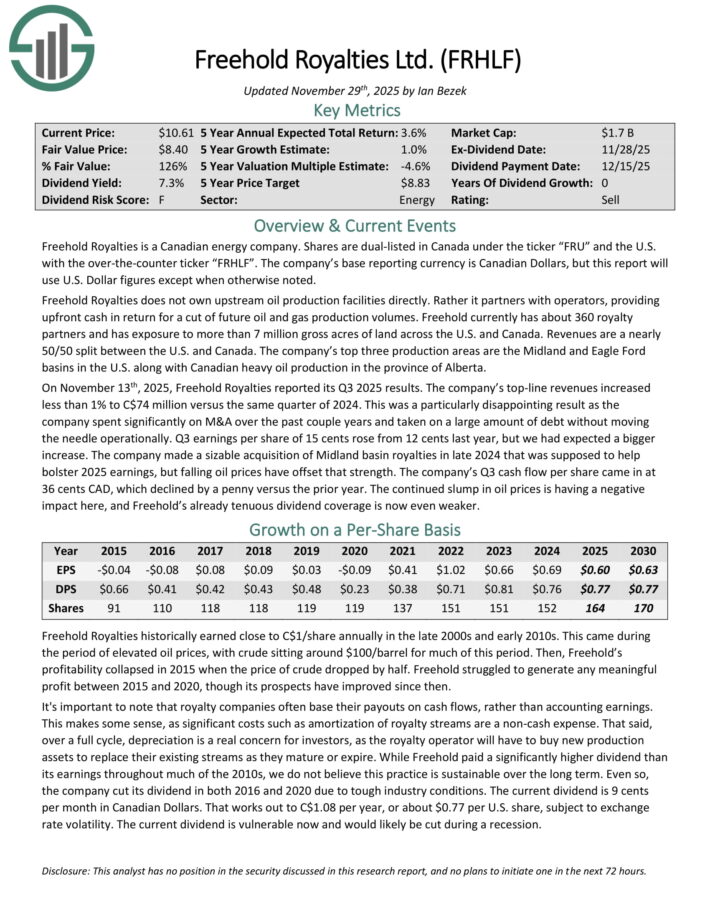

Canadian Oil Stock #4: Freehold Royalties Ltd. (FRHLF)

5-year expected annual returns: 2.8%

Freehold Royalties is a Canadian energy company. Shares are dual-listed in Canada under the ticker “FRU” and the U.S. with the over-the-counter ticker “FRHLF”. The company’s base reporting currency is Canadian Dollars, but this report will use U.S. Dollar figures except when otherwise noted.

Freehold Royalties does not own upstream oil production facilities directly. Rather it partners with operators, providing upfront cash in return for a cut of future oil and gas production volumes. Freehold currently has about 360 royalty partners and has exposure to more than 7 million gross acres of land across the U.S. and Canada.

The company’s top three production areas are the Midland and Eagle Ford basins in the U.S. along with Canadian heavy oil production in the province of Alberta.

On November 13th, 2025, Freehold Royalties reported its Q3 2025 results. The company’s top-line revenues increased less than 1% to C$74 million versus the same quarter of 2024.

This was a particularly disappointing result as the company spent significantly on M&A over the past couple years and taken on a large amount of debt without moving the needle operationally. Earnings per share of 15 cents rose from 12 cents last year, but we had expected a bigger increase.

The company made a sizable acquisition of Midland basin royalties in late 2024 that was supposed to help bolster 2025 earnings, but falling oil prices have offset that strength.

Cash flow per share came in at 36 cents CAD, which declined by a penny versus the prior year.

Click here to download our most recent Sure Analysis report on FRHLF (preview of page 1 of 3 shown below):

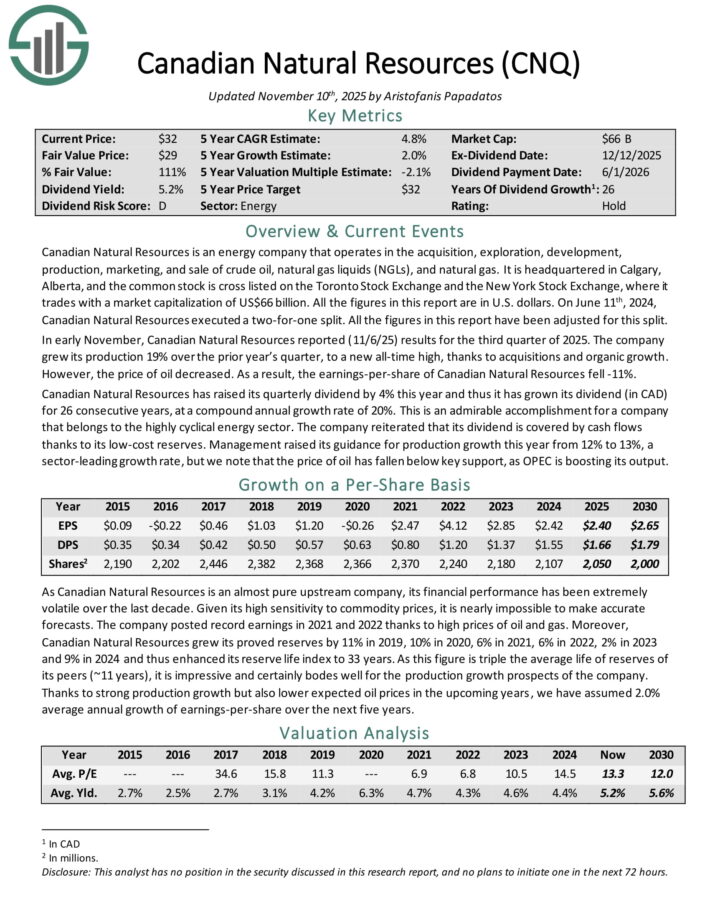

Canadian Oil Stock #3: Canadian Natural Resources (CNQ)

5-year expected returns: 4.5%

Canadian Natural Resources is an energy company that operates in the acquisition, exploration, development, production, marketing, and sale of crude oil, natural gas liquids (NGLs), and natural gas.

It is headquartered in Calgary, Alberta. All the figures in this report are in U.S. dollars. In addition to trading on the New York Stock Exchange, CNQ stock trades on the Toronto Stock Exchange.

In early November, Canadian Natural Resources reported (11/6/25) results for the third quarter of 2025. The company grew its production 19% over the prior year’s quarter, to a new all-time high, thanks to acquisitions and organic growth.

However, the price of oil decreased. As a result, the earnings-per-share of Canadian Natural Resources fell -11%.

Click here to download our most recent Sure Analysis report on CNQ (preview of page 1 of 3 shown below):

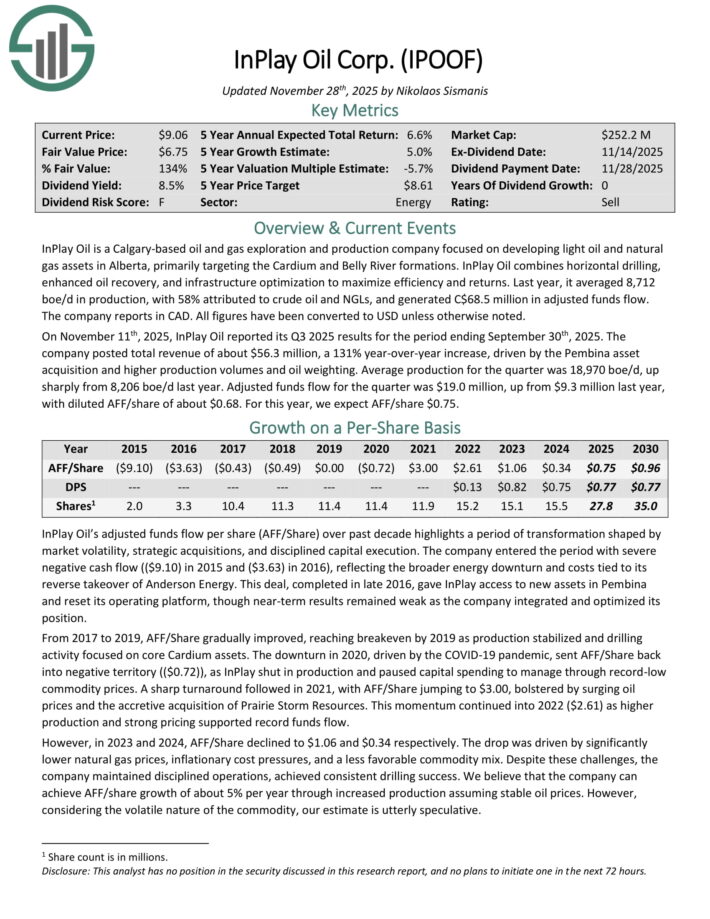

Canadian Oil Stock #2: InPlay Oil Corp. (IPOOF)

5-year expected annual returns: 5.9%

InPlay Oil is a Calgary-based oil and gas exploration and production company focused on developing light oil and natural gas assets in Alberta, primarily targeting the Cardium and Belly River formations. InPlay Oil combines horizontal drilling, enhanced oil recovery, and infrastructure optimization to maximize efficiency and returns.

Last year, it averaged 8,712 boe/d in production, with 58% attributed to crude oil and NGLs, and generated C$68.5 million in adjusted funds flow.

InPlay Oil is a Calgary-based oil and gas exploration and production company focused on developing light oil and natural gas assets in Alberta, primarily targeting the Cardium and Belly River formations.

InPlay Oil combines horizontal drilling, enhanced oil recovery, and infrastructure optimization to maximize efficiency and returns. Last year, it averaged 8,712 boe/d in production, with 58% attributed to crude oil and NGLs, and generated C$68.5 million in adjusted funds flow.

On November 11th, 2025, InPlay Oil reported its Q3 2025 results. The company posted total revenue of about $56.3 million, a 131% year-over-year increase, driven by the Pembina asset acquisition and higher production volumes and oil weighting.

Average production for the quarter was 18,970 boe/d, up sharply from 8,206 boe/d last year. Adjusted funds flow for the quarter was $19.0 million, up from $9.3 million last year, with diluted AFF/share of about $0.68.

Click here to download our most recent Sure Analysis report on IPOOF (preview of page 1 of 3 shown below):

Canadian Oil Stock #1: Enbridge Inc. (ENB)

5-year expected annual returns: 7.2%

Enbridge is an oil & gas company that operates the following segments: Liquids Pipelines, Gas Distributions, Energy Services, Gas Transmission & Midstream, and Green Power & Transmission. Enbridge bought Spectra Energy for $28 billion in 2016 and has become one of the largest midstream companies in North America.

Enbridge was founded in 1949 and is headquartered in Calgary, Canada.

Enbridge reported its third quarter earnings results in November. The company generated revenues of CAD$14.6 billion during the period, which was down 2% compared to the previous year’s quarter, and which pencils out to US$10.5 billion.

During the quarter, Enbridge grew its adjusted EBITDA by 2% year over year, to CAD$4.3 billion, up from CAD$4.2 billion during the previous year’s quarter.

During the third quarter, Enbridge was able to generate distributable cash flows of CAD$2.6 billion, which equates to US$1.9 billion, or US$0.87 on a per-share basis.

While distributable cash flows in 2024 were down in US Dollars, that was due to currency rate movements – results were higher in Canadian Dollars. The same holds true for Enbridge’s dividend, which was increased by 3% in Canadian Dollars, to CAD$0.9424 at the beginning of the current year.

Enbridge is forecasting distributable cash flows in a range of CAD$5.50 – CAD$5.90 per share for the current year. Using current exchange rates, this equates to USD$4.08 at the midpoint of the guidance range, which would be up 6% versus 2024.

Click here to download our most recent Sure Analysis report on ENB (preview of page 1 of 3 shown below):

Final Thoughts

Canadian oil stocks do not get nearly as much coverage as the major U.S. oil stocks. However, income and value investors should pay attention to the big Canadian oil stocks.

All 9 Canadian oil stocks have dividend yields that are well above most of the U.S. oil stocks.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].