Published on August 5th, 2025 by Bob Ciura

High dividend stocks are stocks with a dividend yield well in excess of the market average dividend yield of ~1.3%.

High-yield stocks can be very helpful to shore up income after retirement. With that in mind, we have created a free list of over 200 high dividend stocks with dividend yields above 5%.

You can download your copy of the high dividend stocks list below:

However, not all high dividend stocks are equally safe.

There are many examples of high dividend stocks reducing or eliminating their dividends. Overall, despite the positive attributes attached to high dividend stocks, their risk profile can be elevated.

As a result, income investors should try to find dividend stocks that not just have high yields, but also have sustainable payouts backed by strong underlying fundamentals.

In this article, we have analyzed the 6 high dividend stocks from our Sure Analysis Research Database with the safest dividends based on our Dividend Risk Score rating system.

The 6 high dividend stocks below have current yields above 4% and Dividend Risk Scores of ‘A’, our highest ranking.

The stocks are listed below according to their current yield, in ascending order.

Table of Contents

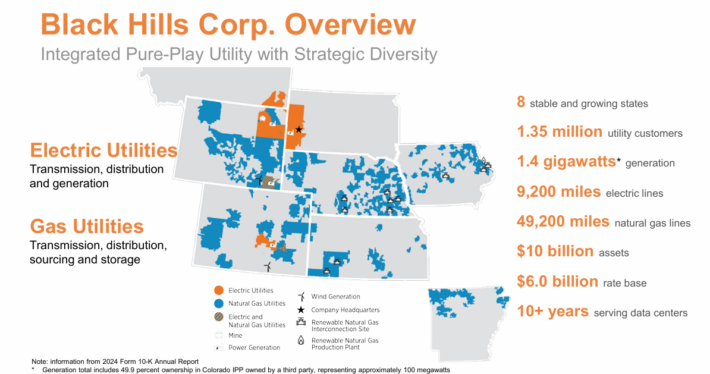

Ultra-Safe High Yielder #6: PepsiCo Inc. (PEP)

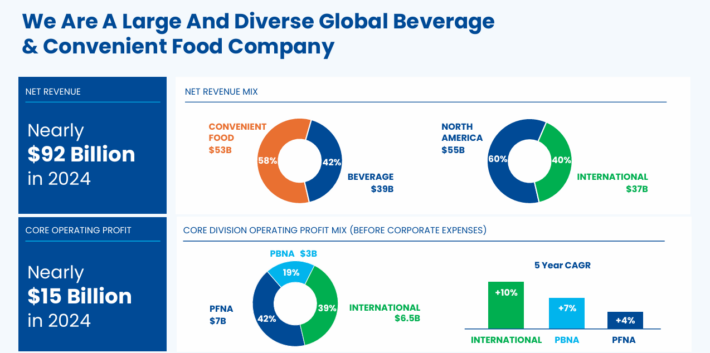

PepsiCo is a global food and beverage company. Its products include Pepsi, Mountain Dew, Frito-Lay chips, Gatorade, Tropicana orange juice and Quaker foods.

Its business is split roughly 60-40 in terms of food and beverage revenue. It is also balanced geographically between the U.S. and the rest of the world.

Source: Investor Presentation

On July 18th, 2025, PepsiCo announced second quarter earnings results for the period ending June 30th, 2025. For the quarter, revenue grew 1.0% to $22.7 billion, which topped estimates by $430 million.

Adjusted earnings-per-share of $2.12 compared unfavorably to $2.28 the prior year, but this was $0.09 ahead of expectations. Currency exchange reduced revenue by 1.5% and adjusted earnings-per-share by 5%.

Organic sales grew 2.1% for the second quarter. For the period, volume for beverages was once again unchanged while food fell 1.5%.

Click here to download our most recent Sure Analysis report on PEP (preview of page 1 of 3 shown below):

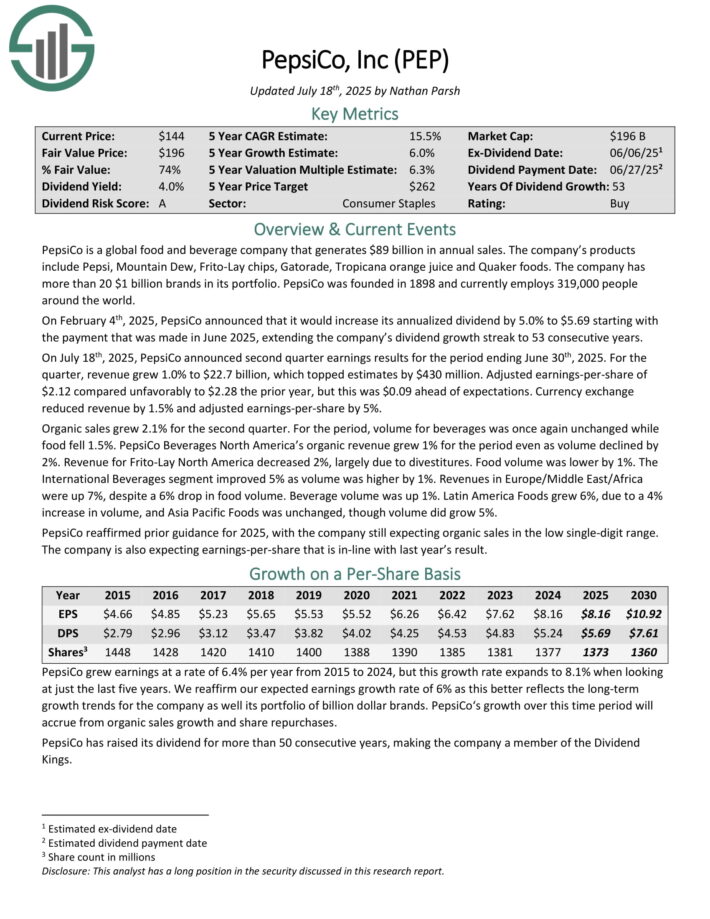

Ultra-Safe High Yielder #5: Hormel Foods (HRL)

Hormel Foods was founded back in 1891 in Minnesota. Since that time, the company has grown into a juggernaut in the food products industry with nearly $10 billion in annual revenue.

Hormel has kept with its core competency as a processor of meat products for well over a hundred years, but has also grown into other business lines through acquisitions.

Hormel has a large portfolio of category-leading brands. Just a few of its top brands include include Skippy, SPAM, Applegate, Justin’s, and more than 30 others.

The company has increased its dividend for 59 consecutive years.

Source: Investor Presentation

Hormel posted second quarter earnings on May 29th, 2025, and results were largely in line with expectations. Adjusted earnings-per-share came to 35 cents, which was a penny ahead of estimates.

Revenue was up fractionally to $2.9 billion, meeting expectations. The company saw a 7% decline in volume and flat sales in both retail and foodservice. Pricing increases helped to offset that.

Click here to download our most recent Sure Analysis report on HRL (preview of page 1 of 3 shown below):

Ultra-Safe High Yielder #4: Target Corp. (TGT)

Target was founded in 1902 and now operates about 1,850 big box stores, which offer general merchandise and food, as well as serving as distribution points for the company’s e-commerce business.

Target posted first quarter earnings on May 21st, 2025, and results were weak. Earnings came to $1.30 per share, which missed estimates by 35 cents. Revenue was also 3% lower from the prior year at $23.8 billion, missing estimates by $550 million. Merchandise sales were off 3.1% year-over-year, partially offset by a 13.5% increase in other revenue.

Digital comparable sales were up 4.7%, with same-day delivery growth of 35%. Strength in Drive Up continues to drive those results. Total comparable sales fell 3.8%, and management noted Target held or gained market share in just 15 of its 35 categories.

The company is investing heavily in its business in order to navigate through the changing landscape in the retail sector. The payout is now 61% of earnings for this year, which is elevated from historical levels, but the dividend remains well-covered.

Target’s competitive advantage comes from its everyday low prices on attractive merchandise in its guest-friendly stores.

Click here to download our most recent Sure Analysis report on TGT (preview of page 1 of 3 shown below):

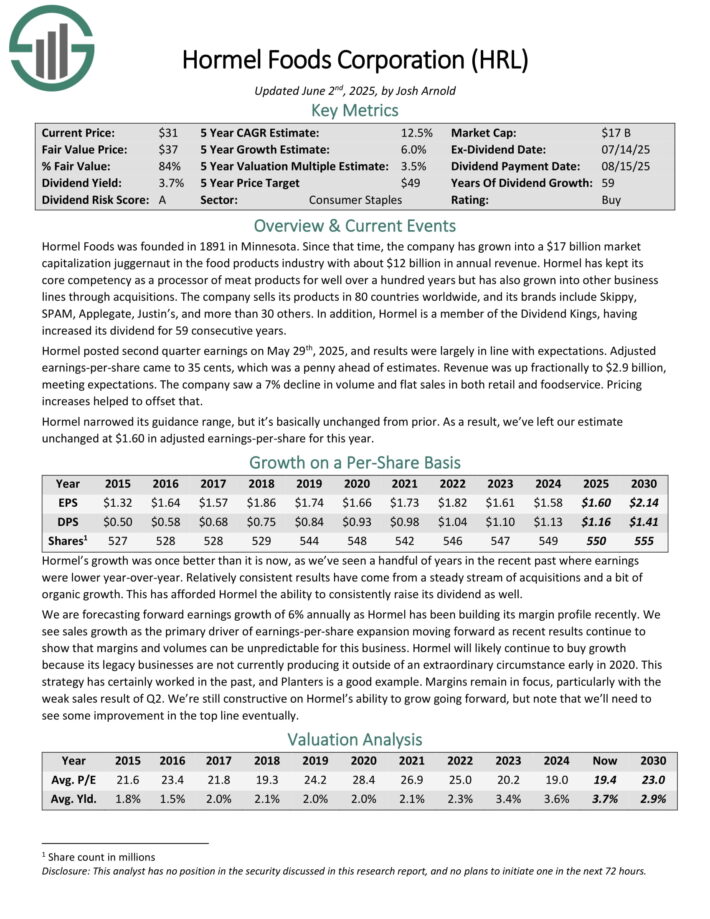

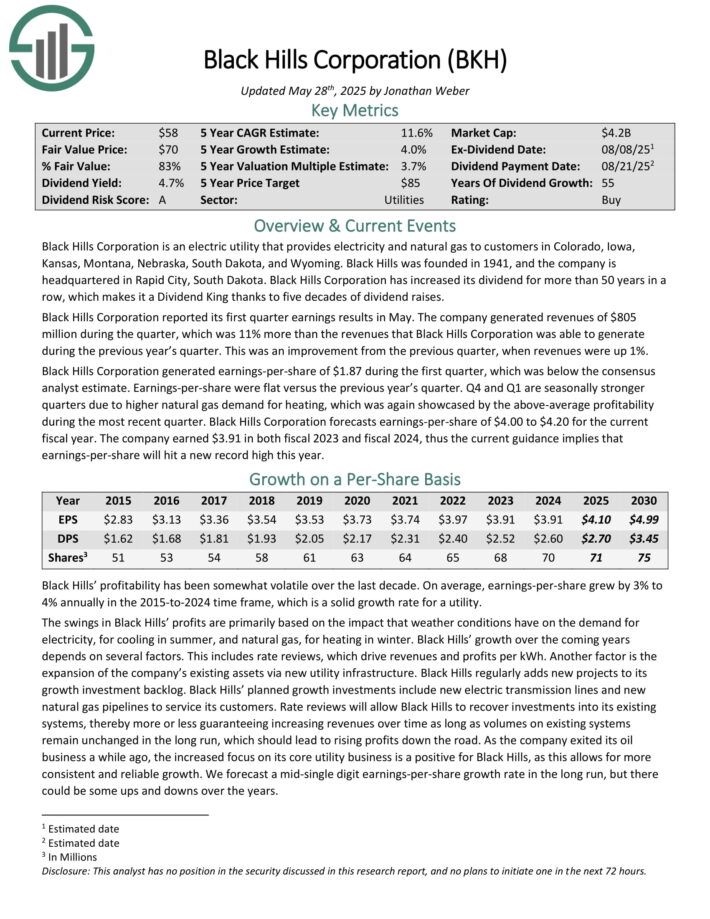

Ultra-Safe High Yielder #3: Black Hills Corporation (BKH)

Black Hills Corporation is an electric utility that provides electricity and natural gas to customers in Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, and Wyoming.

The company has 1.35 million utility customers in eight states. Its natural gas assets include 49,200 miles of natural gas lines. Separately, it has ~9,200 miles of electric lines and 1.4 gigawatts of electric generation capacity.

Source: Investor Presentation

Black Hills Corporation reported its first quarter earnings results in May. The company generated revenues of $805 million during the quarter, which was 11% year-over-year growth.

Black Hills Corporation generated earnings-per-share of $1.87 during the first quarter, which was below the consensus analyst estimate. Earnings-per-share were flat versus the previous year’s quarter.

Q4 and Q1 are seasonally stronger quarters due to higher natural gas demand for heating, which was again showcased by the above-average profitability during the most recent quarter.

Black Hills Corporation forecasts earnings-per-share of $4.00 to $4.20 for the current fiscal year.

Click here to download our most recent Sure Analysis report on BKH (preview of page 1 of 3 shown below):

Ultra-Safe High Yielder #2: Sonoco Products Co. (SON)

Sonoco Products provides packaging, industrial products and supply chain services to its customers. The markets that use the company’s products include those in the appliances, electronics, beverage, construction and food industries.

The company generates over $5 billion in annual sales. Sonoco Products is now composed of 2 major segments, Consumer Packaging, and Industrial Packaging, with all other businesses listed as “All Other”.

On April 16th, 2025, Sonoco Products raised its quarterly dividend 1.9% to $0.53, extending the company’s dividend growth streak to 49 consecutive years.

On July 23rd, 2025, Sonoco Products announced second quarter results for the period ending June 29th, 2025. For the quarter, revenue grew 17.9% to $1.91 billion, which was in-line with estimates. Adjusted earnings-per-share of $1.37 compared to $1.28 in the prior year, but was $0.08 less than expected.

Revenues and earnings benefited from the addition of Eviosys. For the quarter, Consumer Packaging revenues surged 110% to $1.23 billion, mostly due to contributions from Eviosys.

Volume growth was strong and favorable currency exchange rates also aided results. Industrial Paper Packing sales fell 2% to $588 million due to the impact of foreign currency exchange rates and lower volume following two plant divestitures in China last year.

Click here to download our most recent Sure Analysis report on Sonoco (SON) (preview of page 1 of 3 shown below):

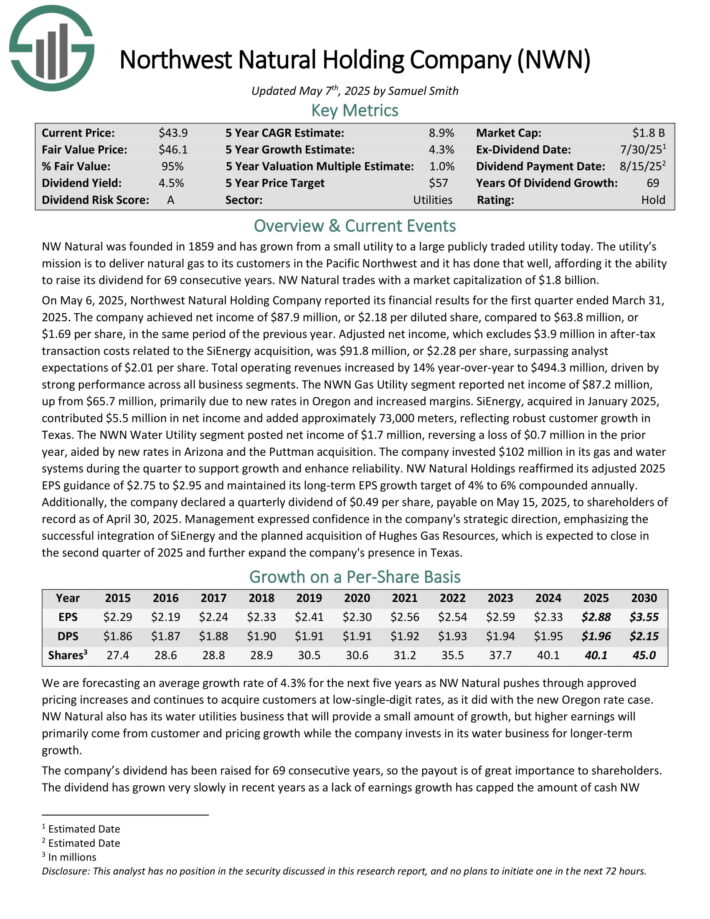

Ultra-Safe High Yielder #1: Northwest Natural Holding (NWN)

Northwest was founded over 160 years ago as a natural gas utility in Portland, Oregon.

It has grown from a very small, local utility that provided gas service to a handful of customers to a very successful regional utility with interests that now include water and wastewater, which were purchased in recent acquisitions.

The company’s operations are shown in the image below.

Source: Investor Presentation

Northwest provides gas service to 2.5 million customers in ~140 communities in Oregon and Washington, serving more than 795,000 connections. It also owns and operates ~35 billion cubic feet of underground gas storage capacity.

On May 6, 2025, Northwest Natural Holding Company reported its financial results for the first quarter ended March 31, 2025. The company achieved net income of $87.9 million, or $2.18 per diluted share, compared to $63.8 million, or $1.69 per share, in the same period of the previous year.

Adjusted net income, which excludes $3.9 million in after-tax transaction costs related to the SiEnergy acquisition, was $91.8 million, or $2.28 per share, surpassing analyst expectations of $2.01 per share.

Total operating revenues increased by 14% year-over-year to $494.3 million, driven by strong performance across all business segments.

NW Natural Holdings reaffirmed its adjusted 2025 EPS guidance of $2.75 to $2.95.

Click here to download our most recent Sure Analysis report on NWN (preview of page 1 of 3 shown below):

Final Thoughts

High dividend stocks can be an attractive option for investors seeking a greater level of income from their investment portfolios.

While no investment comes without risk, some high dividend stocks have demonstrated a history of financial stability, consistent earnings, and reliable dividend payments.

These 6 high-yielding dividend stocks have attractive payouts above 4%, and carry our highest Dividend Risk score.

Additional Reading

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

And see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].