Published on December 15th, 2025 by Bob Ciura

The goal of rational investors is to maximize total return under a given set of constraints. Dividends contribute a significant portion of a stock’s total return.

In addition, stocks that raise their dividends each year, even during recessions, can provide high returns to shareholders over the long run.

This is why we believe that investors should focus on owning high-quality dividend-paying stocks such as the Dividend Aristocrats, which are those companies that have raised their dividends for at least 25 consecutive years.

Membership in this group is so exclusive that just 69 companies qualify as Dividend Aristocrat. We have compiled a list of all Dividend Aristocrats and relevant financial metrics like dividend yield and P/E ratios.

You can download the full list of Dividend Aristocrats by clicking on the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

While past performance is not a guarantee of future results, it can be useful to look back to see which Dividend Aristocrats performed the best.

Therefore, this article will discuss the 10 best-performing Dividend Aristocrats over the past 10 years.

Table of Contents

The table of contents below allows for easy navigation. The stocks are listed by annualized total returns over the past 10 years, in ascending order.

Best Performing Dividend Aristocrat #10: Linde plc (LIN)

10-year annualized total returns: 16.8%

Linde plc, which was created through the merger of Germany-based industrial gases company Linde AG and US-based industrial gases company Praxair, is the world’s largest industrial gas corporation.

The company produces, sells, and distributes atmospheric, process, and specialty gases, along with high-performance surface coatings. It is headquartered in Guildford, United Kingdom.

Linde plc released its third quarter earnings results in November. The company announced that its revenues totaled $8.6 billion during the quarter, which was up 2% versus the prior year’s quarter.

Linde was able to grow its margins over the last year, as its adjusted operating margin expanded by 10 basis points year-over-year.

Earnings-per-share during the third quarter totaled $4.21, which means that the company’s earnings-per-share growth came in at 7% versus the previous year’s quarter.

Management has a positive view regarding the foreseeable future, forecasting earnings-per-share in a range of $16.35 to $16.45 for fiscal 2025, which represents a solid growth rate of around 6% compared to 2024.

Click here to download our most recent Sure Analysis report on LIN (preview of page 1 of 3 shown below):

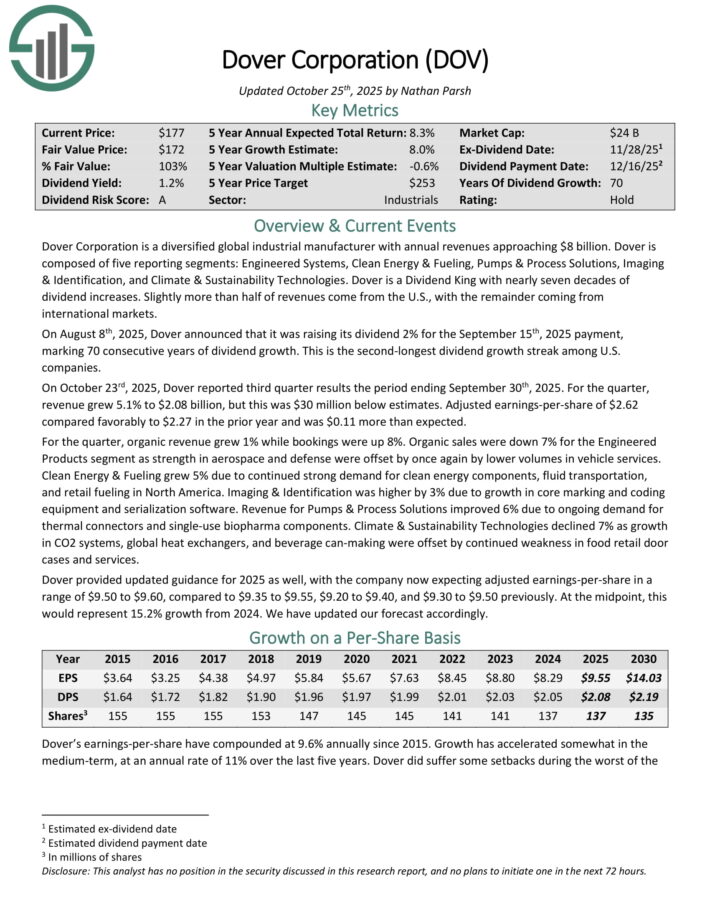

Best Performing Dividend Aristocrat #9: Dover Corp. (DOV)

10-year annualized total returns: 15.4%

Dover Corporation is a diversified global industrial manufacturer with annual revenue approaching $8 billion. Dover is composed of five reporting segments: Engineered Systems, Clean Energy & Fueling, Pumps & Process Solutions, Imaging & Identification, and Climate & Sustainability Technologies.

On August 8th, 2025, Dover announced that it was raising its dividend 2% for the September 15th, 2025 payment, marking 70 consecutive years of dividend growth. This is the second-longest dividend growth streak among U.S. companies.

On October 23rd, 2025, Dover reported third quarter results the period ending September 30th, 2025. For the quarter, revenue grew 5.1% to $2.08 billion, but this was $30 million below estimates. Adjusted earnings-per-share of $2.62 compared favorably to $2.27 in the prior year and was $0.11 more than expected.

For the quarter, organic revenue grew 1% while bookings were up 8%. Organic sales were down 7% for the Engineered Products segment as strength in aerospace and defense were offset by once again by lower volumes in vehicle services.

Clean Energy & Fueling grew 5% due to continued strong demand for clean energy components, fluid transportation, and retail fueling in North America. Imaging & Identification was higher by 3% due to growth in core marking and coding equipment and serialization software.

Climate & Sustainability Technologies declined 7% as growth in CO2 systems, global heat exchangers, and beverage can-making were offset by continued weakness in food retail door cases and services.

Dover provided updated guidance for 2025 as well, with the company now expecting adjusted earnings-per-share in a range of $9.50 to $9.60. At the midpoint, this would represent 15.2% growth from 2024.

Click here to download our most recent Sure Analysis report on DOV (preview of page 1 of 3 shown below):

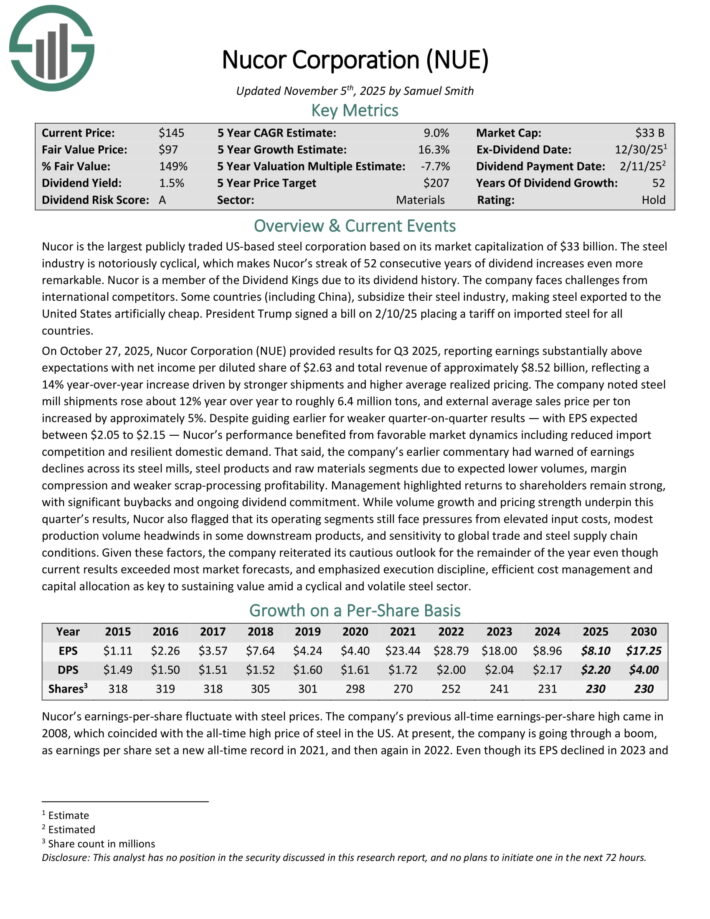

Best Performing Dividend Aristocrat #8: Nucor Corp. (NUE)

10-year annualized total returns: 16.8%

Nucor is the largest publicly traded US-based steel corporation based on its market capitalization. The steel industry is notoriously cyclical, which makes Nucor’s streak of 52 consecutive years of dividend increases even more remarkable. Nucor is a member of the Dividend Kings due to its dividend history.

On October 27, 2025, Nucor Corporation (NUE) provided results for Q3 2025, reporting earnings substantially above expectations with net income per diluted share of $2.63 and total revenue of approximately $8.52 billion, reflecting a 14% year-over-year increase driven by stronger shipments and higher average realized pricing.

The company noted steel mill shipments rose about 12% year over year to roughly 6.4 million tons, and external average sales price per ton increased by approximately 5%.

Despite guiding earlier for weaker quarter-on-quarter results — with EPS expected between $2.05 to $2.15 — Nucor’s performance benefited from favorable market dynamics including reduced import competition and resilient domestic demand.

Click here to download our most recent Sure Analysis report on NUE (preview of page 1 of 3 shown below):

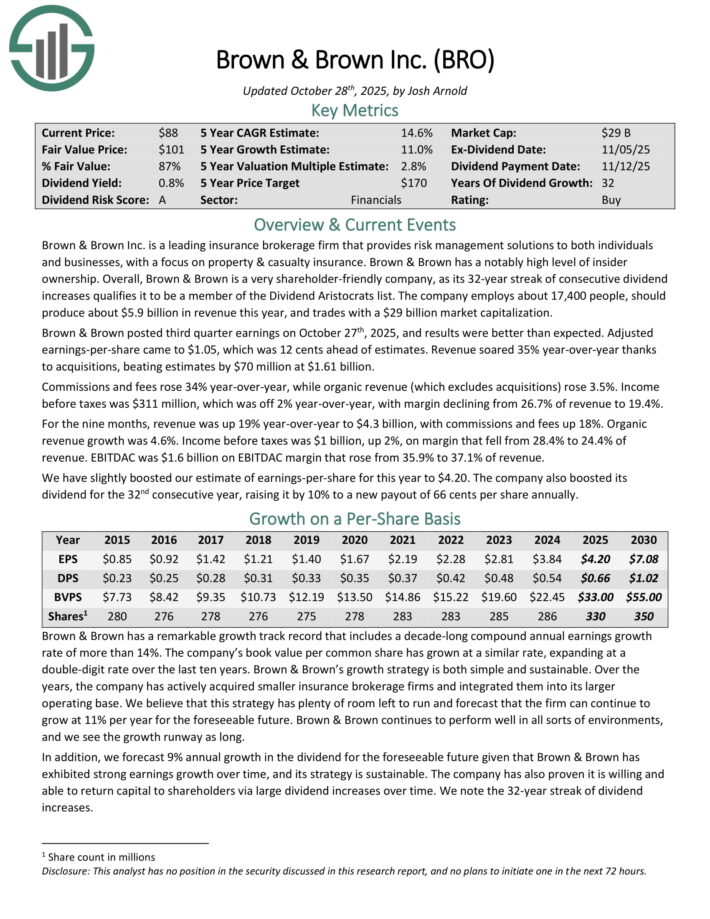

Best Performing Dividend Aristocrat #7: Brown & Brown (BRO)

10-year annualized total returns: 18.2%

Brown & Brown Inc. is a leading insurance brokerage firm that provides risk management solutions to both individuals and businesses, with a focus on property & casualty insurance. Brown & Brown has a notably high level of insider ownership.

Brown & Brown posted third quarter earnings on October 27th, 2025, and results were better than expected. Adjusted earnings-per-share came to $1.05, which was 12 cents ahead of estimates. Revenue soared 35% year-over-year thanks to acquisitions, beating estimates by $70 million at $1.61 billion.

Commissions and fees rose 34% year-over-year, while organic revenue (which excludes acquisitions) rose 3.5%. Income before taxes was $311 million, which was off 2% year-over-year, with margin declining from 26.7% of revenue to 19.4%.

For the nine months, revenue was up 19% year-over-year to $4.3 billion, with commissions and fees up 18%. Organic revenue growth was 4.6%. Income before taxes was $1 billion, up 2%, on margin that fell from 28.4% to 24.4% of revenue. EBITDAC was $1.6 billion on EBITDAC margin that rose from 35.9% to 37.1% of revenue.

We have slightly boosted our estimate of earnings-per-share for this year to $4.20. The company also boosted its dividend for the 32nd consecutive year, raising it by 10% to a new payout of 66 cents per share annually.

Click here to download our most recent Sure Analysis report on BRO (preview of page 1 of 3 shown below):

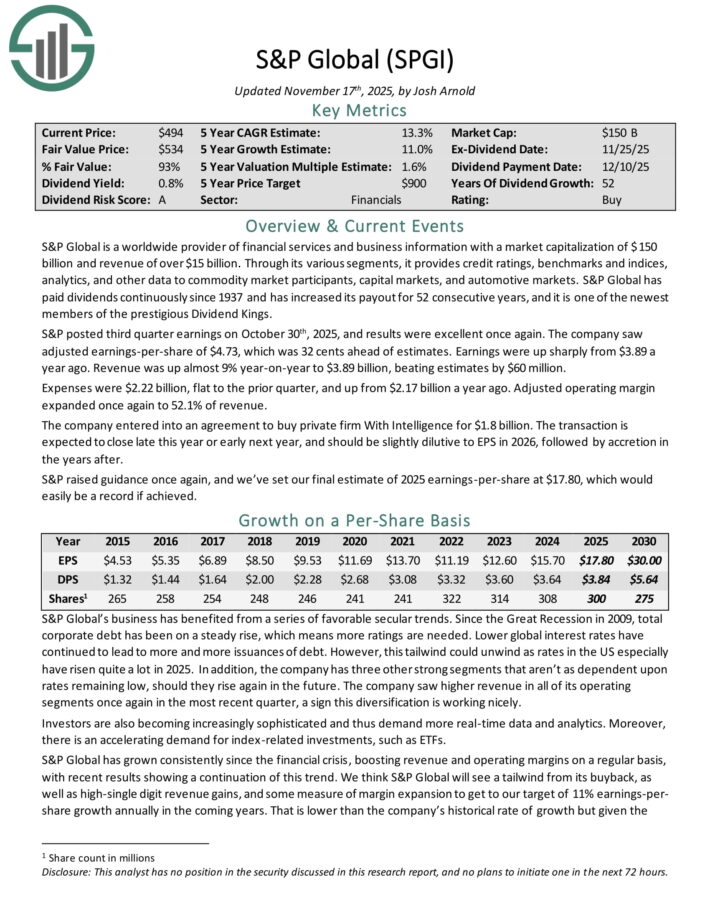

Best Performing Dividend Aristocrat #6: S&P Global (SPGI)

10-year annualized total returns: 19.5%

S&P Global is a worldwide provider of financial services and business information with revenue of over $15 billion. Through its various segments, it provides credit ratings, benchmarks and indices, analytics, and other data to commodity market participants, capital markets, and automotive markets.

S&P Global has paid dividends continuously since 1937 and has increased its payout for 52 consecutive years, and it is one of the newest members of the prestigious Dividend Kings.

S&P posted third quarter earnings on October 30th, 2025. The company saw adjusted earnings-per-share of $4.73, which was 32 cents ahead of estimates.

Earnings were up sharply from $3.89 a year ago. Revenue was up almost 9% year-on-year to $3.89 billion, beating estimates by $60 million.

Expenses were $2.22 billion, flat to the prior quarter, and up from $2.17 billion a year ago. Adjusted operating margin expanded once again to 52.1% of revenue.

The company entered into an agreement to buy private firm With Intelligence for $1.8 billion. The transaction is expected to close late this year or early next year, and should be slightly dilutive to EPS in 2026, followed by accretion in the years after.

Click here to download our most recent Sure Analysis report on SPGI (preview of page 1 of 3 shown below):

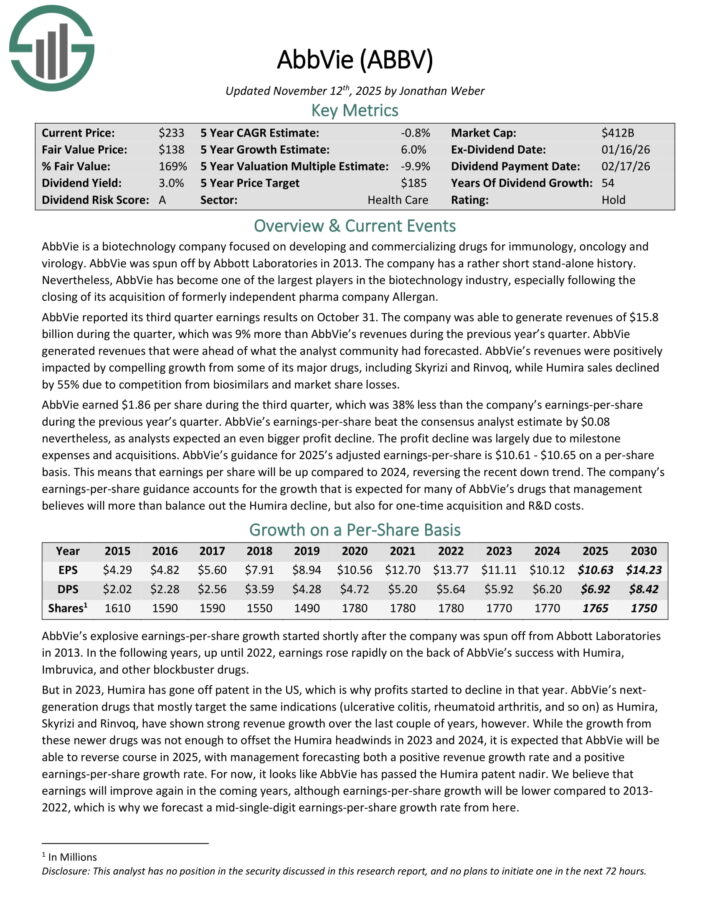

Best Performing Dividend Aristocrat #5: AbbVie Inc. (ABBV)

10-year annualized total returns: 20.1%

AbbVie is a biotechnology company focused on developing and commercializing drugs for immunology, oncology and virology. It was spun off by Abbott Laboratories in 2013 and has become one of the largest players in the biotechnology industry.

AbbVie reported its third quarter earnings results on October 31. The company was able to generate revenues of $15.8 billion during the quarter, which was 9% year-over-year growth.

Revenue was positively impacted by compelling growth from some of its major drugs, including Skyrizi and Rinvoq, while Humira sales declined by 55% due to competition from biosimilars and market share losses.

AbbVie earned $1.86 per share during the third quarter, which was 38% less than the company’s earnings-per-share during the previous year’s quarter.

Earnings-per-share beat the consensus analyst estimate by $0.08. Guidance for 2025 adjusted earnings-per-share is $10.61 – $10.65.

Click here to download our most recent Sure Analysis report on ABBV (preview of page 1 of 3 shown below):

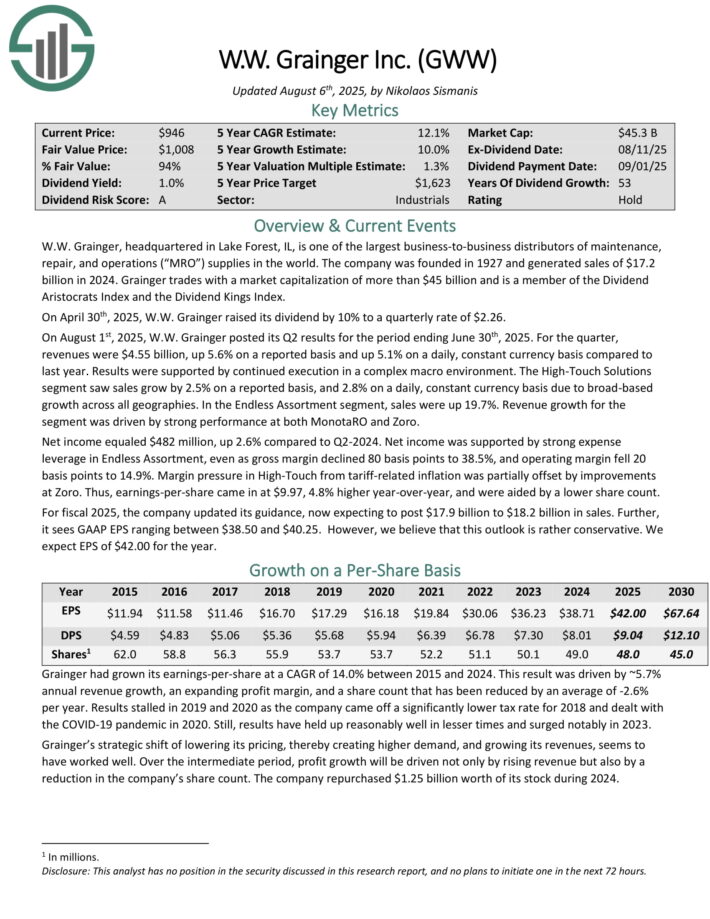

Best Performing Dividend Aristocrat #4: W.W. Grainger (GWW)

10-year annualized total returns: 20.2%

W.W. Grainger, headquartered in Lake Forest, IL, is one of the largest business-to-business distributors of maintenance, repair, and operations (“MRO”) supplies in the world. The company was founded in 1927 and generated sales of $17.2 billion in 2024.

On August 1st, 2025, W.W. Grainger posted its Q2 results for the period ending June 30th, 2025. For the quarter, revenues were $4.55 billion, up 5.6% on a reported basis and up 5.1% on a daily, constant currency basis compared to last year.

The High-Touch Solutions segment saw sales grow by 2.5% on a reported basis, and 2.8% on a daily, constant currency basis due to broad-based growth across all geographies.

In the Endless Assortment segment, sales were up 19.7%. Revenue growth for the segment was driven by strong performance at both MonotaRO and Zoro.

Net income equaled $482 million, up 2.6% compared to Q2-2024. Net income was supported by strong expense leverage in Endless Assortment, even as gross margin declined 80 basis points to 38.5%, and operating margin fell 20 basis points to 14.9%.

Margin pressure in High-Touch from tariff-related inflation was partially offset by improvements at Zoro. Earnings-per-share came in at $9.97, 4.8% higher year-over-year, and were aided by a lower share count.

Click here to download our most recent Sure Analysis report on GWW (preview of page 1 of 3 shown below):

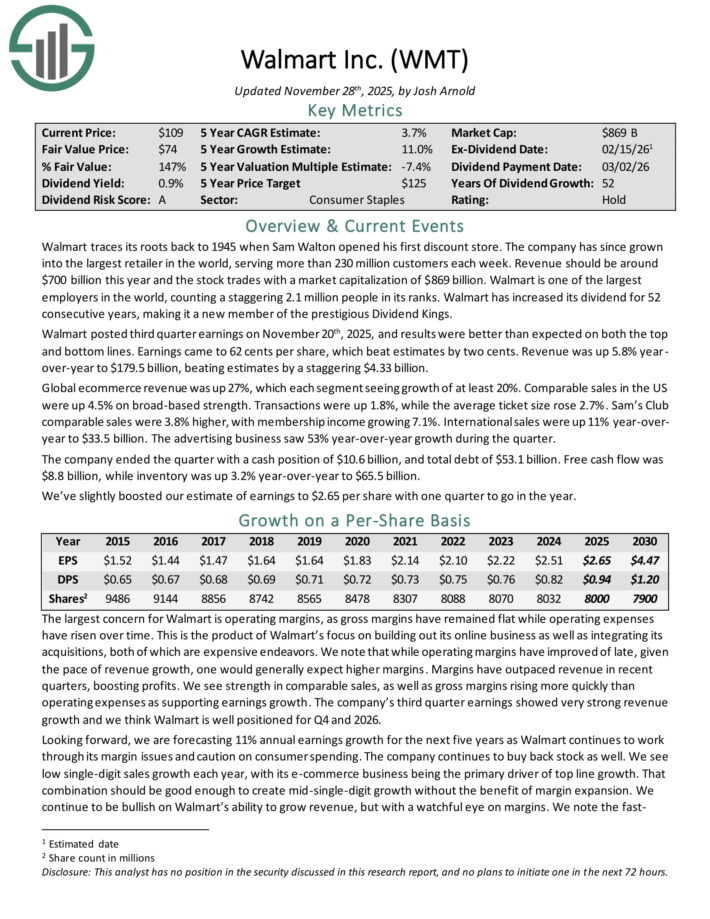

Best Performing Dividend Aristocrat #3: Walmart Inc. (WMT)

10-year annualized total returns: 21.6%

Walmart traces its roots back to 1945 when Sam Walton opened his first discount store.

The company has since grown into the largest retailer in the world, serving more than 230 million customers each week. Revenue should be around $700 billion this year.

Walmart posted third-quarter earnings on November 20th, 2025, and results were better than expected on both the top and bottom lines. Earnings came to 62 cents per share, which beat estimates by two cents.

Revenue was up 5.8% year-over-year to $179.5 billion, beating estimates by $4.33 billion. Global e-commerce revenue was up 27%, which each segment seeing growth of at least 20%.

Comparable sales in the US were up 4.5% on broad-based strength. Transactions were up 1.8%, while the average ticket size rose 2.7%. Sam’s Club comparable sales were 3.8% higher, with membership income growing 7.1%.

International sales were up 11% year-over-year to $33.5 billion. The advertising business saw 53% year-over-year growth during the quarter.

Click here to download our most recent Sure Analysis report on WMT (preview of page 1 of 3 shown below):

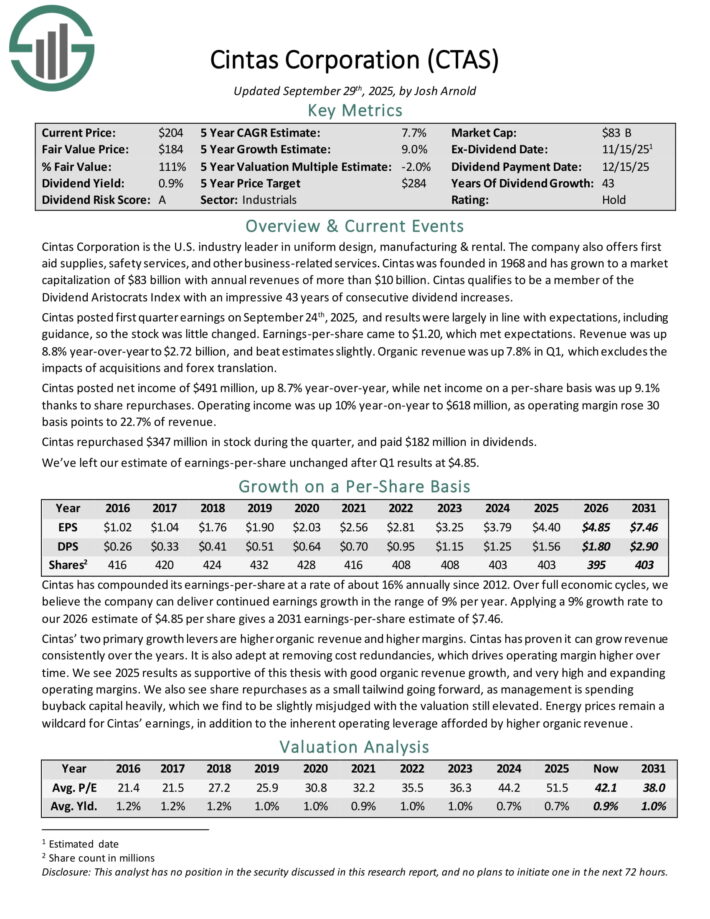

Best Performing Dividend Aristocrat #2: Cintas Corp. (CTAS)

10-year annualized total returns: 24.9%

Cintas Corporation is the U.S. industry leader in uniform design, manufacturing & rental. The company also offers first aid supplies, safety services, and other business-related services.

Cintas was founded in 1968 and has grown to generate annual revenues of more than $10 billion. It qualifies to be a member of the Dividend Aristocrats Index with 43 years of consecutive dividend increases.

Cintas posted first quarter earnings on September 24th, 2025, and results were largely in line with expectations, including guidance, so the stock was little changed. Earnings-per-share came to $1.20, which met expectations.

Revenue was up 8.8% year-over-year to $2.72 billion, and beat estimates slightly. Organic revenue was up 7.8% in Q1, which excludes the impacts of acquisitions and forex translation.

Cintas posted net income of $491 million, up 8.7% year-over-year, while net income on a per-share basis was up 9.1% thanks to share repurchases. Operating income was up 10% year-on-year to $618 million, as operating margin rose 30 basis points to 22.7% of revenue.

Cintas repurchased $347 million in stock during the quarter, and paid $182 million in dividends.

Click here to download our most recent Sure Analysis report on Cintas (preview of page 1 of 3 shown below):

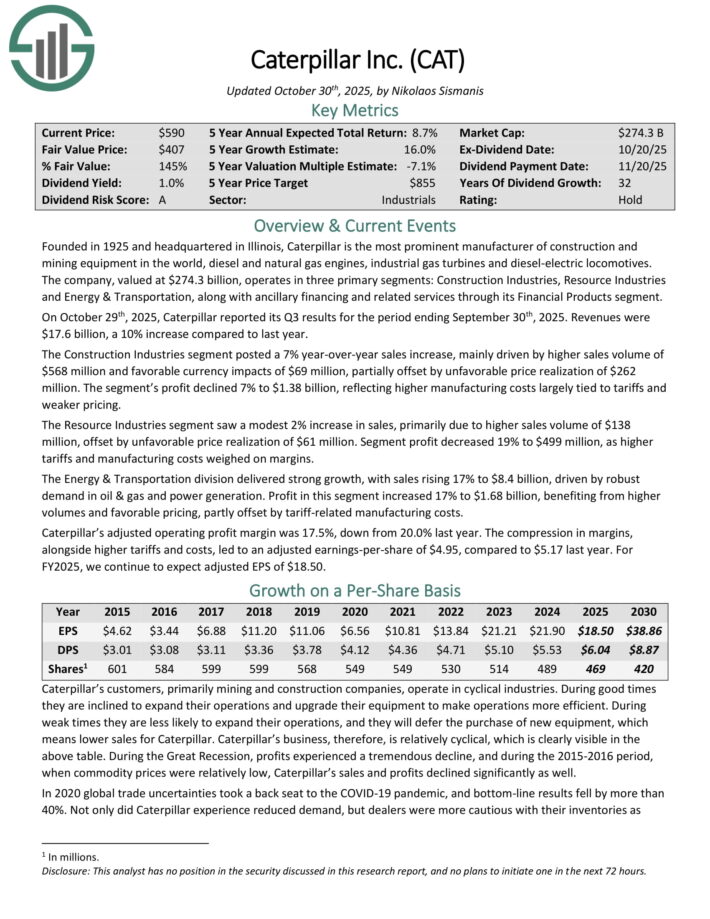

Best Performing Dividend Aristocrat #1: Caterpillar Inc. (CAT)

10-year annualized total returns: 27.9%

Caterpillar is the most prominent manufacturer of construction and mining equipment in the world, diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives.

It operates in three primary segments: Construction Industries, Resource Industries and Energy & Transportation, along with ancillary financing and related services through its Financial Products segment.

On October 29th, 2025, Caterpillar reported its Q3 results for the period ending September 30th, 2025. Revenue was $17.6 billion, a 10% increase compared to last year.

The Construction Industries segment posted a 7% year-over-year sales increase, mainly driven by higher sales volume of $568 million and favorable currency impacts of $69 million, partially offset by unfavorable price realization of $262million.

The Resource Industries segment saw a modest 2% increase in sales, primarily due to higher sales volume of $138 million, offset by unfavorable price realization of $61 million.

The Energy & Transportation division delivered strong growth, with sales rising 17% to $8.4 billion, driven by robust demand in oil & gas and power generation.

Profit in this segment increased 17% to $1.68 billion, benefiting from higher volumes and favorable pricing, partly offset by tariff-related manufacturing costs.

Caterpillar’s adjusted operating profit margin was 17.5%, down from 20.0% last year. The compression in margins, alongside higher tariffs and costs, led to an adjusted earnings-per-share of $4.95, compared to $5.17 last year.

Click here to download our most recent Sure Analysis report on CAT (preview of page 1 of 3 shown below):

Additional Reading

The following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].