Published on October 14, 2025, by Felix Martinez

High-yield stocks pay out dividends that are significantly higher than the market average. For example, the S&P 500’s current yield is only ~1.1%, a product of record highs in stock indices so far in 2025.

High-yield stocks can be particularly helpful in shoring up income after retirement. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

We have created a spreadsheet of stocks (and closely related REITs and MLPs, etc.) with dividend yields of 5% or more…

You can download your free full list of all high dividend stocks with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Next on our list of high dividend stocks to review is Horizon Bancorp, Inc. (HBNC).

Business Overview

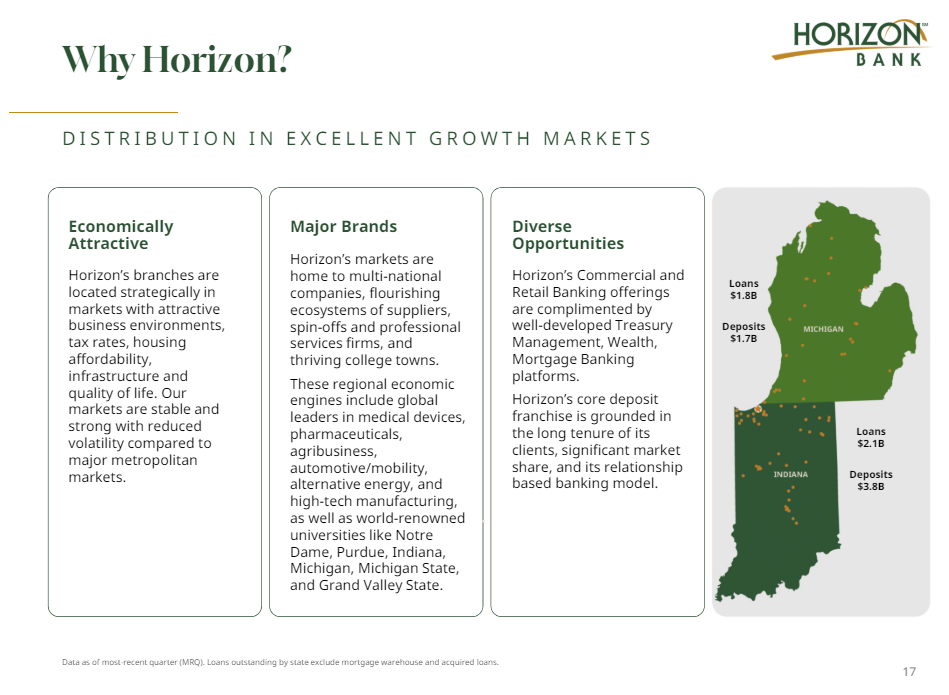

Horizon is a bank holding company for Horizon Bank, which offers a diverse range of commercial and retail banking services and products.

It offers checking, savings, money market accounts, certificates of deposit, retirement accounts, various types of consumer and commercial loans, insurance, and more.

Horizon operates in Indiana and Michigan and was founded in 1873.

Source: Investor presentation

The bank reported its second-quarter earnings on July 23, 2025, and the results were significantly improved from the prior quarter.

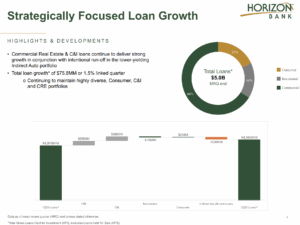

Source: Investor presentation

The company reported strong second-quarter 2025 results, with net income of $20.6 million, or $0.47 per diluted share, up 26% year-over-year and $0.03 above estimates. Revenue rose 26% to $70.3 million, driven by higher-yielding loans and effective deposit cost management. The net interest margin expanded to 3.23%, marking the seventh straight quarterly increase, while loan growth rose 6.2% annualized, led by commercial lending. Credit quality remained excellent with minimal charge-offs at 0.02%, and the efficiency ratio held steady at 59.5%. Deposits declined 1.1% as the bank continued to manage out higher-cost time deposits.

As of June 30, 2025, Horizon’s total assets stood at $7.7 billion, with tangible book value per share climbing to $14.32. Capital levels remained strong, with a Tier 1 ratio of 12.52% and total capital ratio of 14.48%. CEO Thomas Prame highlighted continued operational strength and margin expansion, noting a 58% year-over-year increase in EPS for the first half of 2025. Looking ahead, Horizon expects sustained earnings growth supported by prudent expense control, steady loan demand, and improved funding costs, positioning the bank to deliver consistent shareholder returns through the remainder of 2025.

Growth Prospects

Horizon’s earnings growth has been choppy to say the least. The bank has managed to boost its earnings over time; however, in the past decade, there have been three years of declining earnings, including last year.

We expect to see 8% growth from this year’s base of $1.42.

Source: Investor presentation

If this is to happen, Horizon is likely to rely on loan growth, which it has been concentrating on in recent quarters.

In Q2, the bank expanded its loan portfolio by $76 million, driven by growth in commercial real estate and commercial and industrial (C&I) loans.

Competitive Advantages & Recession Performance

Like other banks, Horizon really doesn’t have any competitive advantages. We note that all banks generally offer the same set of products and services, so small banks like Horizon rely upon brand loyalty and office location convenience for customer retention. However, we note that these are loose advantages at best, similar to those of other banks.

Additionally, like other banks, Horizon is susceptible to recessionary periods, and we anticipate that Horizon’s earnings will likely suffer during the next period of economic weakness.

To its credit, the company performed relatively strongly during the previous major economic downturn, the Great Recession of 2008-2009:

2008 earnings-per-share: $0.54

2009 earnings-per-share: $0.47

2010 earnings-per-share: $0.54

Horizon’s excellent credit quality will serve it well during the next recession, but the fact remains that no bank has control over loan demand during recessions, or indeed borrowers that are unable to pay.

With Horizon struggling in recent years to grow earnings during a period of strong economic growth, we are cautious about the bank during the next recession.

Dividend Analysis

Horizon has managed to boost its dividend by an average of almost 11% annually in the past decade, which is extremely strong by the standards of the banking group. However, it has not increased its dividend over the past two years. We are not expecting a dividend increase this year either. Although the company has a low payout ratio of 34%,

The current dividend of 64 cents per share annually is less than half of earnings, so we believe it’s safe for the foreseeable future. We believe that Horizon’s ability to raise the dividend is somewhat limited, but we also think that small increases are likely in the cards for the coming years.

The yield is very strong at more than 4%, a result of the strong dividend growth, but also a relatively stagnant share price. Overall, we appreciate the yield and the relative safety of the payout, but we see the likelihood of large increases being muted.

Final Thoughts

We view Horizon as a strong income stock, offering a relatively safe dividend and room for small increases going forward. We note the lack of competitive advantages and susceptibility to recession, but the latter is not currently an issue.

We encourage investors to watch the net interest margin, as it’s a weak point for Horizon at the moment in terms of earnings, which has a direct impact on its ability to raise the dividend.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].