Published on November 12th, 2025 by Felix Martinez

High-yield stocks pay out dividends that are significantly higher than the market average. For example, the S&P 500’s current yield is only ~1.2%.

High-yield stocks can be particularly beneficial in supplementing income after retirement. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

Energy Transfer LP (ET) is part of our ‘High Dividend 50’ series, which covers the 50 highest-yielding stocks in the Sure Analysis Research Database.

We have created a spreadsheet of stocks (and closely related REITs, MLPs, etc.) with dividend yields of 5% or more.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Next on our list of high-dividend stocks to review is Energy Transfer LP (ET).

Business Overview

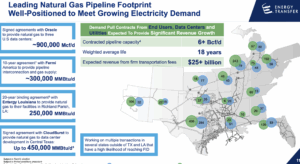

Energy Transfer LP is one of the largest and most diversified energy infrastructure companies in the United States, operating approximately 140,000 miles of pipelines and associated energy assets across 44 states. Its operations span natural gas midstream, intrastate and interstate transportation and storage, crude oil, refined product, and natural gas liquids (NGL) transportation and terminaling, as well as NGL fractionation.

The company also holds interests in Sunoco LP and USA Compression Partners, LP, enhancing its integrated energy network and providing a broad base of fee-based revenue with limited exposure to commodity price fluctuations.

The partnership focuses on strategic growth through infrastructure expansion, operational efficiency, and long-term supply agreements. Recent initiatives include new processing plants, storage expansions, and power generation facilities, as well as long-term natural gas supply contracts with major corporate customers.

ET’s diverse portfolio and geographic reach allow it to generate balanced earnings across multiple segments, with a significant portion of cash flow derived from natural gas-related assets. This positions the company to sustain distributions to partners while investing in growth projects across key U.S. energy markets.

Source: Investor Relations

The company reported Q3 2025 net income of $1.02 billion, or $0.28 per common unit, with revenue of $6.03 billion, up 4.9% year-over-year. Adjusted EBITDA was $3.84 billion, and distributable cash flow totaled $1.90 billion, slightly below last year due to one-time items. Growth and maintenance capital expenditures were $1.14 billion and $293 million, respectively.

Operational volumes set new records across NGL terminals (+10%), NGL transportation (+11%), and exports (+13%), while natural gas transportation and midstream volumes also increased. Key projects include the Mustang Draw II processing plant, Price River Terminal expansion, and new West Texas power facilities.

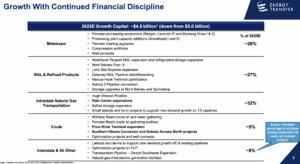

Strategically, the company signed long-term gas supply agreements with Oracle and Entergy, and is expanding storage at Bethel to 12 Bcf by 2028. Quarterly distributions rose 3% to $0.3325 per common unit. With a diversified, fee-based portfolio, Energy Transfer plans $5 billion in 2026 growth capital, focusing on natural gas infrastructure.

Source: Investor Relations

Growth Prospects

Energy Transfer LP’s growth prospects are anchored in the strategic expansion of its midstream and natural gas infrastructure across the United States. The company continues to invest in large-scale projects, including new processing plants, storage facilities, and pipeline expansions, which are designed to support rising demand for natural gas and NGL transportation.

Its ongoing projects, such as the Mustang Draw II processing plant and Bethel storage expansion, enhance capacity and operational efficiency, positioning ET to capture long-term growth opportunities in key energy markets.

In addition, Energy Transfer is leveraging long-term supply agreements with major corporate customers, including Oracle and Entergy, to secure stable, fee-based revenue streams. The company’s diversified portfolio, spanning multiple energy segments and geographic regions, reduces commodity price risk while providing consistent cash flow for reinvestment.

With planned growth capital expenditures of approximately $5 billion in 2026, primarily in natural gas-related assets, ET is well-positioned to expand its infrastructure leadership, increase volumes, and sustain distributions to partners over the long term.

Source: Investor Relations

Competitive Advantages & Recession Performance

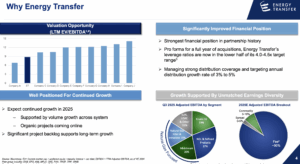

Energy Transfer LP’s competitive edge comes from its scale, diversification, and largely fee-based operations. With 140,000 miles of pipelines and extensive terminals across 44 states, no single segment drives more than one-third of EBITDA, reducing commodity risk.

Partnerships with Sunoco LP and USA Compression strengthen its infrastructure and operational reach.

The company performs well during recessions due to predictable, fee-driven cash flows and essential energy infrastructure. Even in market downturns, ET maintains stable distributions while investing in growth projects, leveraging its diversified portfolio to generate reliable revenue and sustain long-term financial stability.

Dividend Analysis

The company’s annual dividend is $1.33 per share. At its recent share price, the stock has a high yield of 7.9%.

Given the company’s 2025 earnings outlook, CF/S is expected to be $2.70 per share. As a result, the company is expected to pay out roughly 49% of its CF/S to shareholders in dividends.

Final Thoughts

Energy Transfer carries an elevated risk due to a weak balance sheet and a modest rally over the past 18 months. Over the next five years, the stock could deliver an average annual return of 7.9%, driven by its 7.9% distribution yield and 5% cash flow per share growth, partially offset by a -5.0% valuation drag.

The stock retains a hold rating and is appropriate only for investors willing to tolerate significant volatility.

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].