Published on October 30th, 2025 by Felix Martinez

High-yield stocks pay out dividends that are significantly higher than the market average. For example, the S&P 500’s current yield is only ~1.2%.

High-yield stocks can be particularly beneficial in supplementing income after retirement. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

Bridgemarq Real Estate Services Inc. (BREUF) is part of our ‘High Dividend 50’ series, which covers the 50 highest-yielding stocks in the Sure Analysis Research Database.

We have created a spreadsheet of stocks (and closely related REITs, MLPs, etc.) with dividend yields of 5% or more.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Next on our list of high-dividend stocks to review is Bridgemarq Real Estate Services Inc. (BREUF).

Business Overview

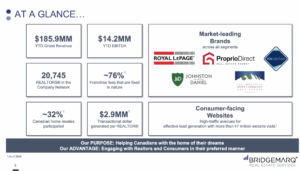

Bridgemarq Real Estate Services supports residential real estate brokers and REALTORS across Canada by providing information, tools, and services that enhance their operations. Operating under the Royal LePage, Via Capitale, Johnston, and Daniel brands, the company, formerly known as Brookfield Real Estate Services, rebranded as Bridgemarq in 2019. Founded in 2010, Bridgemarq is headquartered in Toronto.

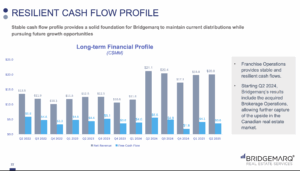

The company generates revenue through fixed and variable franchise fees from a network of nearly 21,000 REALTORS. Approximately 81% of these fees are fixed, providing stable, predictable cash flows that are further secured by long-term contracts. Bridgemarq maintains strong partner relationships, as reflected in its historically high renewal rate of 96%. Royal LePage franchise agreements, representing 96% of the company’s REALTORS, span 10 to 20 years, ensuring significant cash flow visibility.

Bridgemarq holds a leading position in the Canadian market, participating in over 70% of national home resales. Its brand reputation and technological advantages attract franchisees and reinforce its market dominance. However, the company was significantly impacted by the 2020 pandemic-induced recession, with earnings per share falling 47%, from $0.34 in 2019 to $0.18 in 2020.

Source: Investor Relations

The company reported Q2 2025 revenue of $108.0 million, slightly below last year’s, while year-to-date revenue rose to $186.0 million, driven by acquisitions and higher franchise fees. Adjusted Net Earnings were $2.2 million, with Free Cash Flow of $3.6 million. The company declared a monthly dividend of $0.1125 per share, maintaining its $1.35 annual target.

The company posted a net loss of $5.4 million ($0.57 per share), driven by a $4.9 million loss on Exchangeable Units, partially offset by lower interest and depreciation. Operating cash flow fell to $5.9 million due to higher interest costs and working capital changes, while Adjusted Net Earnings and Free Cash Flow edged down from 2024.

Bridgemarq added about 600 sales representatives to its Royal LePage network, strengthening its presence in key markets. Despite a 4% year-over-year decline in the Canadian housing market, activity improved in Quebec and some metro areas, supported by stable interest rates and controlled inflation.

Growth Prospects

Over the past decade, Bridgemarq has evolved from a pure franchise operator to a more integrated real estate platform. Historically, its revenue came from stable fixed and variable franchise fees, providing steady cash flow even during downturns like the COVID-19 pandemic. Recent moves, including the 2024 acquisition of brokerage operations and the internalization of management, have expanded the company into direct real estate sales and eliminated third-party fees, strengthening its operational control and cash-generating capabilities. Despite volatility in EPS, largely driven by non-cash items such as exchangeable unit revaluations, the underlying business has consistently supported its dividend.

Looking ahead, growth prospects are limited. Elevated operating costs, risks from integrating recent acquisitions, and uncertainty in the Canadian housing market make EPS and dividend growth unlikely. Bridgemarq has maintained a stable monthly dividend of CAD $0.1125 since 2017, reflecting consistency rather than growth. While the company remains cash-generative, investors should expect stability rather than significant near-term earnings or dividend growth.

Source: Investor Relations

Competitive Advantages & Recession Performance

Bridgemarq’s competitive edge comes from its large network of over 21,000 REALTORS, supported by strong brands like Royal LePage and Via Capitale. Its mix of franchise and corporately owned brokerages, long-term franchise agreements, and advanced technology tools ensures predictable cash flow, high agent loyalty, and market dominance.

The company has proven resilient during recessions, including the COVID-19 downturn. Its reliance on fixed franchise fees and cash-generative operations has allowed it to sustain dividends and maintain stability, even when earnings fluctuate due to non-cash accounting items.

Dividend Analysis

Bridgemarq offers a high dividend yield of 9.9%, far above the 1.2% S&P 500 yield, making it attractive for income-focused investors. U.S. investors should note that dividends are affected by the CAD/USD exchange rate.

However, the company’s payout ratio is high at 98%, and its net debt of $182 million exceeds its market cap, signaling a weak balance sheet. The dividend has been essentially flat over the past 9 years, so meaningful growth is unlikely.

Source: Investor Relations

Final Thoughts

Bridgemarq provides stable income through a resilient, fee-based real estate platform, but its limited growth potential and sensitivity to the housing market position it more as a yield-focused investment than a growth opportunity. We project annualized returns of 6.6%, driven largely by the current dividend yield but partially offset by potential valuation pressures.

Given the speculative nature of recent acquisitions and the internalization of management, combined with the absence of recent dividend increases, we maintain a sell rating on the stock.

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].