Updated on May 16th, 2025 by Bob Ciura

Choosing the right asset class is one of the biggest questions for investors. The dividend stocks-versus-bonds debate continues, as these are the largest two asset classes.

We believe the goal of any investor should be either:

Maximize returns given a fixed level of risk

Minimize risk given a fixed level of desired returns

Incorporating both return and risk into an investment strategy can be difficult. While performance is easy to measure, risk can be more difficult to quantify.

Volatility is a common measure of risk. Volatility is a stock’s tendency to ‘bounce around’. Low volatility stocks will produce consistent returns, while high volatility stocks have more unpredictable return sequences.

With this in mind, dividend stocks have historically produced superior total returns compared to their fixed income counterparts.

This is because established dividend stocks like the Dividend Aristocrats – stocks with 25+ years of consecutive dividend increases – have generated superior performance that more than offsets their higher volatility relative to bonds.

You can download the full list of all 69 Dividend Aristocrats (along with metrics that matter such as price-to-earnings ratios and payout ratios) by clicking on the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

For this reason, we believe dividend stocks are a compelling investment opportunity when compared to bonds – their biggest ‘competitor’ as an investment.

This article will compare the risk-adjusted returns of dividend stocks and bonds in detail.

The article will conclude by detailing a few actionable ways that investors can improve the risk-adjusted returns of their portfolio.

Measuring Risk-Adjusted Returns

The most common metric to measure risk-adjusted returns is the Sharpe Ratio. By understanding the Sharpe Ratio of the two major asset classes, investors can come a little closer to settling the dividend stocks vs. bonds debate.

Related: The Highest Sharpe Ratio Stocks Within The S&P 500

The Sharpe Ratio measures how much additional return is generated for each unit of risk. It is calculated with the following equation:

One of the tricky elements of performing a Sharpe Ratio analysis is determining what to use for the risk-free rate of return.

When analyzing stocks, the 10-year U.S. government bond yield is often used, as the probability of a default from the U.S. Government is generally assumed to be zero.

However, this article will be analyzing both stocks and bonds, so using a 10-year bond yield as the risk-free rate would be inappropriate (as it will assign a Sharpe Ratio of zero to fixed-income instruments).

Accordingly, the yield on the 3-month U.S. Treasury Bill will be used as the risk-free rate of return throughout this article.

For reference, the 3-month Treasury Bill yield is 4.35% right now.

Next, we need to pick appropriate benchmarks by which to measure the performance of dividend stocks and bonds.

As a proxy for dividend stocks, this analysis will use the iShares Select Dividend ETF (DVY). This ETF is benchmarked to the Dow Jones U.S. Select Dividend Index.

Normally, I would prefer to use a dividend ETF that tracks the performance of the Dividend Aristocrats, which is our favorite universe for identifying high-quality dividend stocks.

Unfortunately, the ETF which best tracks the performance of the Dividend Aristocrats index is the ProShare S&P 500 Dividend Aristocrats ETF (NOBL).

This ETF has only been trading since 2013 and thus is not a good proxy for long-term investment returns. DVY has been trading since 2003 and has a much longer track record for which to make comparisons.

As such, DVY will be used to represent dividend stocks during this analysis.

For bonds, we’ll be using the iShares Core U.S. Aggregate Bond ETF, which trades on the New York Stock Exchange under the ticker AGG. The fund is benchmarked to the Bloomberg Barclays U.S. Aggregate Bond Index.

The next section of this article compares the performance of these two asset classes in detail.

Dividend Stocks vs. Bonds: Comparing Risk-Adjusted Returns

The trailing 1-year Sharpe Ratio for dividend stocks and bonds can be seen below.

Source: YCharts

When it comes to dividend stocks vs. bonds, bonds have a higher 1-year Sharpe Ratio.

While it appears that dividend stocks tend to have a higher Sharpe Ratio than a diversified basket of bonds during most time periods, there are notable stretches (including the 2007-2009 financial crisis) where this did not hold true.

Indeed, dividend stocks have outperformed bonds over the past decade. This trend is better illustrated below.

Source: YCharts

In the past 10 years, DVY has generated a total annualized return of 9.1%, nearly eight percentage points higher than AGG.

As a result, the dividend stocks vs. bonds battle seems to have a clear winner, at least as far as the past decade goes.

There are two reasons why we remain far more bullish on dividend stocks than on bonds:

Dividend stocks have delivered higher absolute returns than bonds during all meaningful time periods. Sometimes, ‘risk-adjusted returns’ aren’t the most important metric if they expose you to the risk of compounding your wealth at rates that are highly inadequate. As an example, the 10-year U.S. Treasury bond yields about 4.48% while many dividend stocks have higher dividend yields.

We are coming to the end of a multi-decade bull market in bonds. Bond prices fall while interest rates rise.

Altogether, we remain convinced that dividend growth investing is one of the best ways to compound individual wealth. With that said, there are counter-arguments to stocks versus bonds.

The next section of this article will describe actionable methods that investors can use to improve the risk-adjusted returns of their investment portfolios.

Improving Risk-Adjusted Returns

Looking back to the formula for the Sharpe Ratio, there are mathematically three ways to increase this metric:

Improve investment returns

Reduce the risk-free rate of return

Reduce portfolio volatility

While these three factors are mathematical variables, investors actually have no control over the risk-free rate of return. Accordingly, this section will focus on increasing investment performance and reducing portfolio volatility.

Many investors mistakenly believe that they have no control over the performance of their investments and resort to index investing (more specifically, ETF investing) to match the performance of some benchmark.

This is not necessarily the case. There are many trends that investors can take advantage of to increase portfolio returns.

One example is the observation that stocks with steadily rising dividends tend to outperform the market. Companies that are able to increase their annual dividend payments for years (or even decades) clearly have a durable competitive advantage which allows them to remain highly profitable through various market cycles.

Accordingly, we view a long dividend history as a sign of a high-quality business.

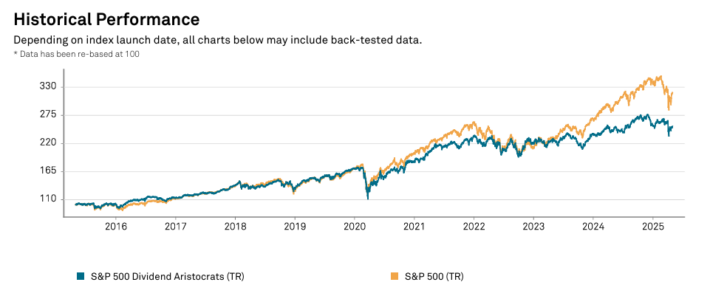

There is no better example of this than the aforementioned Dividend Aristocrats, which have nearly matched the performance of the S&P 500 while generating less volatility – a trend which is shown below.

Source: S&P Fact Sheet

Investors could also consider investing in the even more exclusive Dividend Kings. To be a Dividend King, a company must have 50+ years of consecutive dividend increases – twice the requirement to be a Dividend Aristocrat.

You can see the full list of all Dividend Kings here.

For a more broad universe of stocks, the Dividend Achievers List contains roughly ~400 stocks with 10+ years of consecutive dividend increases.

Aside from investing in high-quality businesses, investors can also boost returns by investing in stocks that are cheap compared to both the rest of the market and the stock’s historical average.

The typical metric that is used to measure valuation is the price-to-earnings ratio, but dividend yields also are indicative of a company’s current valuation.

If a stock is trading above its long-term average dividend yield, its valuation is more attractive.

This is why the Sure Dividend Newsletter ranks stocks by dividend yield according to The 8 Rules of Dividend Investing.

Finally, investors can also boost risk-adjusted returns by reducing portfolio volatility. The easiest way to reduce portfolio volatility is to smartly diversify across industries and sectors.

Mathematically, the best way to reduce portfolio volatility is by investing in pairs of stocks that have the lowest correlation.

Portfolio volatility can also be decreased by investing in companies with low stock price volatility.

Stocks with strong total return potential but low stock price volatility include Johnson & Johnson (JNJ), Hormel Foods (HRL), and The Coca-Cola Company (KO).

Final Thoughts

The dividend stocks vs. bonds debate will likely rage for some time. At Sure Dividend, we believe dividend growth stocks are the best way to invest for long-term wealth creation.

Dividend growth investing is an attractive investment strategy on both an absolute basis and a risk-adjusted basis. This can help the beginner investor get started building their dividend growth portfolio.

In addition, the following Sure Dividend lists contain many more quality dividend stocks to consider:

The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

The Blue Chip Stocks List: stocks with 10+ consecutive years of dividend increases.

The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].