Updated on July 9th, 2025 by Nathan Parsh

A company must have a long track record of generating steady dividend growth, even during recessions, to become a dividend king. This is far from an easy task, which makes it all the more impressive.

It should be no surprise that we consider the Dividend Kings to be among the highest-quality dividend stocks in the entire stock market.

With this in mind, we created a full list of all 55 Dividend Kings, along with important financial metrics such as dividend yields, payout ratios, and price-to-earnings ratios. You can download the full list by clicking on the link below:

Genuine Parts Company (GPC) has increased its dividend for 69 consecutive years, giving it one of the longest streaks of annual dividend raises in the entire stock market. It has achieved this growth with a top brand in an industry that has seen consistent growth over many years. A clear path remains ahead for continued growth, particularly as vehicles age.

Genuine Parts stock appears slightly undervalued at present, offering a yield above the market average and a high likelihood of continued dividend hikes for many years, in addition to a robust growth forecast.

Business Overview

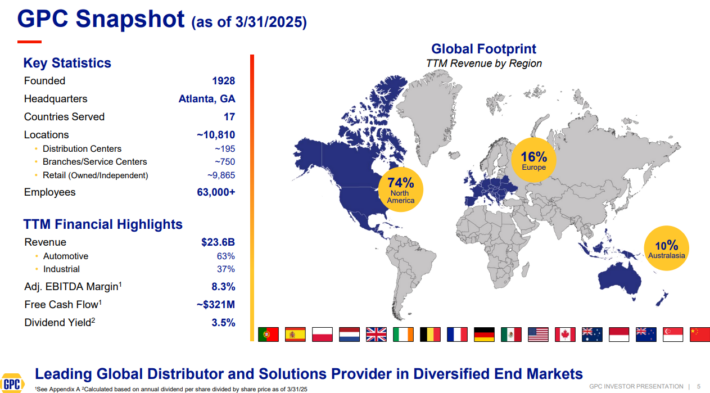

Genuine Parts traces its roots back to 1928, when Carlyle Fraser purchased Motor Parts Depot for $40,000. He renamed it, Genuine Parts Company. The original Genuine Parts store had annual sales of just $75,000 and employed only six people.

Today, Genuine Parts has the world’s largest global auto parts network, with more than 10,800 locations worldwide. As a major distributor of automotive and industrial parts, Genuine Parts generates annual revenue of nearly $24 billion.

Source: Investor Presentation

It operates two segments: automotive (which includes the NAPA brand) and the industrial parts group, which sells industrial replacement parts to MRO (maintenance, repair, and operations) and OEM (original equipment manufacturer) customers. Customers are derived from a wide range of segments, including food and beverage, metals and mining, oil and gas, and health care.

On April 22, 2025, the company reported its first-quarter 2025 results, with sales reaching $5.9 billion, a 1.7% increase from the same period in the previous year. However, net income fell to $194 million, or $1.40 per diluted share, down from $249 million, or $1.78 per diluted share, in Q1 2023. Adjusted diluted earnings per share (EPS) also decreased to $1.75 compared to $2.22 last year. Restructuring charges and the ongoing integration of acquired independent automotive stores drove this decline.

Growth Prospects

Genuine Parts is primed for success, as the environment for auto replacement parts is highly supportive of growth. Consumers are holding onto their cars longer and are increasingly making minor repairs to keep their cars on the road for longer, rather than buying new cars.

As the average cost of vehicle repair increases with a car’s age, this directly benefits Genuine Parts. As newer vehicles become increasingly expensive, customers are more likely to keep older cars for longer.

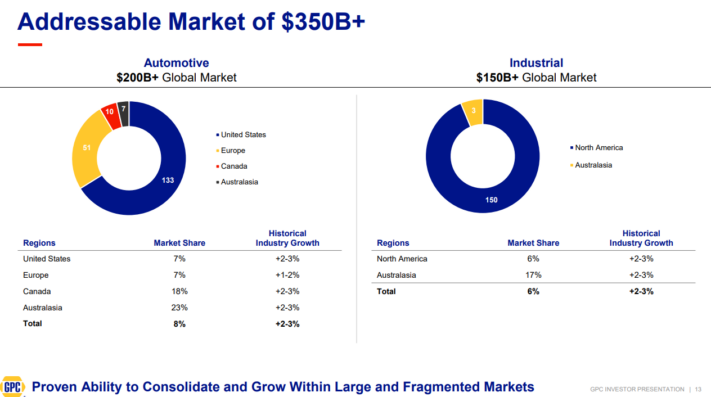

According to Genuine Parts, vehicles aged six years or older now represent the majority of cars on the road, which bodes very well for Genuine Parts. In addition, the total addressable market for automotive aftermarket products and services, as well as industry products, is huge and fragmented, leaving plenty of opportunity for expansion.

Source: Investor Presentation

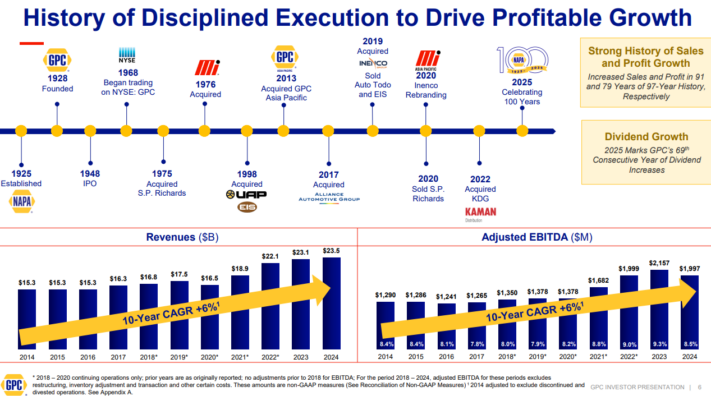

Source: Investor Presentation

Genuine Parts has a sizable portion of the $200 billion and growing automotive aftermarket business. One specific way Genuine Parts has captured market share in this space has historically been through acquisitions.

Genuine Parts frequently acquires smaller companies in the U.S. and international markets to boost market share in existing categories or expand into new areas. Throughout its history, Genuine Parts has made several acquisitions.

Source: Investor Presentation

These acquisitions have helped lead to earnings growth in each of the last 10 years. For example, Genuine Parts acquired Alliance Automotive Group for $2 billion. Alliance is a European distributor of vehicle parts, tools, and workshop equipment.

This was an attractive acquisition, as Alliance Automotive holds a top 3 market share position in Europe’s largest automotive aftermarkets: the U.K., France, and Germany. The deal added $1.7 billion of annual revenue to Genuine Parts, along with additional earnings growth potential from cost synergies.

In 2018, Genuine Parts agreed to acquire Hennig Fahrzeugteile, a Germany-based supplier of parts for light and commercial vehicles. The acquisition expanded Genuine Parts’ reach in Europe and also gave it further exposure to the commercial market. Genuine Parts expects the acquired company to boost its annual sales by $190 million.

More recently, Genuine Parts has made several acquisitions that are expected to strengthen the company’s leadership position in various markets. In 2019, Genuine Parts completed its acquisition of PartsPoint, a leading distributor of automotive aftermarket parts and accessories based in the Netherlands.

The company completed its purchase of leading industrial distributor Inenco in 2019. Inenco has operations in Australia, New Zealand, and Indonesia. Later that month, Genuine Parts announced it was adding Todd Group, a leader in the heavy-duty aftermarket segment in France.

In 2022, the company completed its $1.3 billion acquisition of Kaman Distribution Group, expanding its portfolio of replacement parts.

Genuine Parts divested its S.P. Richards US operations and its Safety Zone and Impact Products operations in 2020. It continues to optimize its portfolio, focusing on its core automotive and industrial parts businesses.

Overall, Genuine Parts’ multiple acquisitions have clearly contributed to the company’s long-term growth. The results of Genuine Parts’ growth strategy speak for themselves. We expect Genuine Parts to generate 8% annual earnings-per-share growth over the next five years.

Competitive Advantages & Recession Performance

The biggest challenge facing the economy continues to be supply chain issues stemming from the pandemic; however, as the economy recovers, Genuine Parts’ results are also improving. Thus far, Genuine Parts appears not to have been heavily impacted by these issues.

The other threat to physical retailers is e-commerce competition, but automotive parts retailers such as NAPA are not exposed to this risk. Automotive repairs are often complex, challenging tasks. NAPA is a leading brand, thanks in part to its reputation for quality products and service. It is valuable for customers to be able to ask questions to qualified staff, which gives Genuine Parts a competitive advantage.

Genuine Parts has a leadership position across its businesses. All of its operating segments represent the #1 or #2 brand in its respective category. This leads to a strong brand and steady demand from customers.

Genuine Parts’ earnings-per-share during the Great Recession are below:

2007 earnings-per-share of $2.98

2008 earnings-per-share of $2.92 (2.0% decline)

2009 earnings-per-share of $2.50 (14% decline)

2010 earnings-per-share of $3.00 (20% increase)

Earnings per share declined significantly in 2009, which should come as no surprise. Consumers tend to tighten their belts when the economy enters a downturn.

That said, Genuine Parts remained highly profitable throughout the recession and returned to growth in 2010 and beyond. The company also generated cash flow during the coronavirus pandemic, which allowed it to raise its dividend in 2020.

Given their consumable nature, there has always been a certain level of demand for automotive parts, which gives Genuine Parts’ earnings a high floor.

Valuation & Expected Returns

Based on our expected earnings per share of $7.75 for 2025, Genuine Parts has a price-to-earnings ratio of 16.4. Our fair value estimate for Genuine Parts is a price-to-earnings ratio of 15.0. As a result, Genuine Parts appears overvalued at the present time. Multiple contractions could reduce annual returns by 1.8% per year over the next five years.

Fortunately, Genuine Parts’ total returns will also include earnings growth and dividends.

We expect Genuine Parts to grow its earnings per share by 8% annually over the next five years. The stock has a 3.2% current yield, which is significantly higher than the average yield of the S&P 500 Index. Furthermore, Genuine Parts raises its dividend each year, including a 3% increase in 2025. Genuine Parts Company’s dividend growth streak now stands at 69 consecutive years.

Genuine Parts has a highly sustainable dividend. The company has paid a dividend every year since its initial public offering in 1948. The dividend is likely to continue growing for many years to come. That said, investors should also consider the impact of valuation when it comes to a stock’s total returns.

In total, Genuine Parts is expected to deliver an annual total return of 8.9% through 2030.

Final Thoughts

Genuine Parts has a long history of steady growth, benefiting from the rising demand for automotive parts. The aging vehicle fleet in the U.S. is expected to continue growing moving forward. In the meantime, shareholders should receive annual dividend increases as has been the case for nearly seven decades.

We find the stock to be slightly overvalued today, meaning that now may not be the ideal time to buy Genuine Parts. While the dividend yield remains solid and the company has a long history of dividend growth, we rate shares of Genuine Parts as a hold due to projected returns.

Additional Reading

The following databases of stocks contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].