Updated on February 12th, 2026 by Nathan Parsh

Investing in high-quality dividend growth stocks can lead to outstanding long-term returns. Investors looking for dividend income and sustainable growth should start with the Dividend Aristocrats, an exclusive group of companies that have raised their dividends for 25+ consecutive years.

With this in mind, we created a full list of all 69 Dividend Aristocrats and essential financial metrics like dividend yields and price-to-earnings ratios.

You can download an Excel spreadsheet with the full list of Dividend Aristocrats by using the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

There are only 69 Dividend Aristocrats. This article will review diversified industrial manufacturer Stanley Black & Decker (SWK).

Stanley Black & Decker has an amazing track record of dividend payments. The company has paid dividends for nearly 150 years and has increased its dividend yearly for 58 consecutive years. Today, the company’s dividend appears safe relative to its underlying fundamentals.

This article will discuss the qualities that have made Stanley Black & Decker a time-tested dividend growth stock.

Business Overview

Stanley Black & Decker is the result of Stanley Works’ $3.5 billion acquisition of Black & Decker in 2009. Stanley Works and Black & Decker were both named after their respective founders. Stanley Works was formed in 1843 when Frederick Stanley started a small shop in New Britain, Connecticut, where he manufactured bolts, hinges, and other hardware. His products developed a reputation for their quality.

Meanwhile, Black & Decker was started by Duncan Black and Alonzo Decker in 1910. Like Stanley, they opened a small hardware shop. In 1916, they obtained a patent to manufacture the world’s first portable power tool.

Over the past 180 years, Stanley Black & Decker has steadily grown into one of the world’s largest industrial product manufacturers.

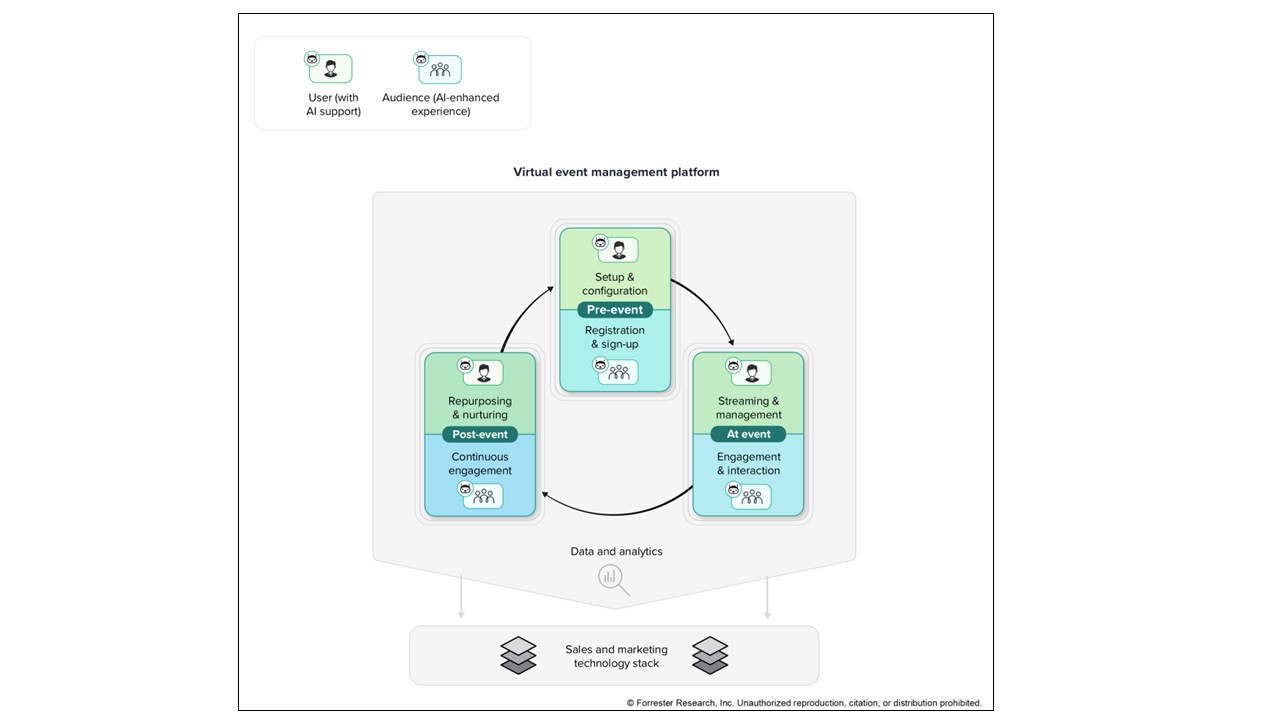

Source: Investor Presentation

Its main products include hand tools, power tools, and related accessories. It also produces electronic security solutions, healthcare solutions, engineered fastening systems, and more.

The company has annual sales of more than $15 billion. It operates two business segments: Tools & Outdoors and Engineered Fastening.

The company has produced weak growth rates in recent years due to high levels of inventory, weaker demand, and the negative impact from tariffs.

Growth Prospects

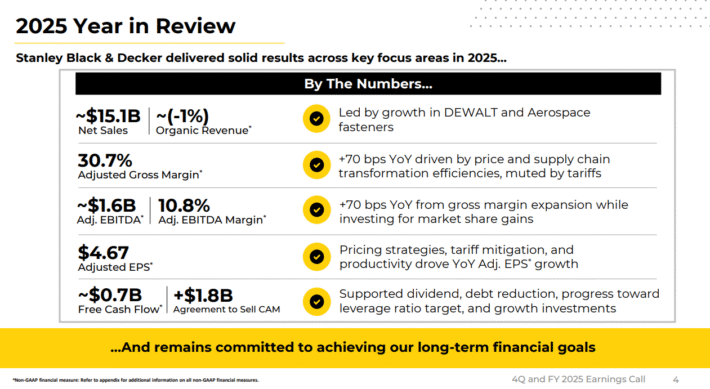

On February 4th, 2026, Stanley Black & Decker announced fourth quarter and full-year results for the period ending December 31st, 2025.

Source: Investor Presentation

For the quarter, revenue was unchanged at $3.7 billion, but this was $80 million less than expected. Adjusted earnings-per-share of $1.41 was down from $1.49 in the prior year, but this was $0.13 better than expected.

For the year, revenue declined 2% to $15.1 billion while adjusted earnings-per-share of $4.67 was up from $4.36 in 2024.

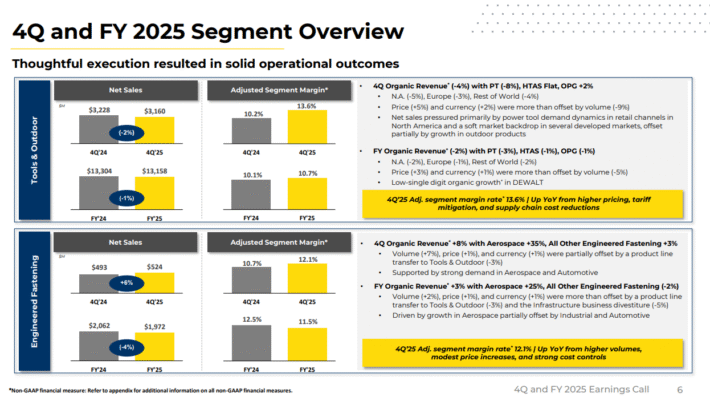

Companywide organic growth declined 3% for the quarter and was lower by 1% for the year. Organic sales for Tools & Outdoor, the largest segment within the company, was lower by 4% for the quarter.

The Engineered Fastening segment grew 8% as volume was up 2% and pricing and currency translation both added 1%. Aerospace was very strong with sales up 35%.

The company has taken sizeable steps to reduce costs within its business as it generated ~$120 million of pre-tax run-rate cost savings during the quarter. Stanley Black & Decker has achieved $2.1 billion of cost savings since starting the program.

Finally, Stanley Black & Decker announced in December that it had agreed to sell its Consolidated Aerospace Manufacturing business to Howmet Aerospace (HWM) for $1.8 billion in cash. Proceeds will be used to pay down debt.

Competitive Advantages & Recession Performance

Stanley Black & Decker’s brand portfolio and global scale are its main competitive advantages. Innovation and scalability are at the core of the company’s growth strategy. It has a leadership position in its three product categories, and its brand strength gives the company pricing power, leading to high-profit margins.

Furthermore, it is relatively easy for the company to scale up its brands, thanks to distribution efficiencies.

Stanley Black & Decker constantly invests in product innovation to retain these competitive advantages. That said, Stanley Black & Decker is not immune from recessions. Earnings declined significantly in 2008 and 2009. As an industrial manufacturer, Stanley Black & Decker is reliant on a strong economy and a financially-healthy consumer.

Stanley Black & Decker’s earnings-per-share during the Great Recession are below:

2007 earnings-per-share of $4.00

2008 earnings-per-share of $3.41 (15% decline)

2009 earnings-per-share of $2.72 (20% decline)

2010 earnings-per-share of $3.96 (46% increase)

Despite the steep decline in earnings from 2007-2009, Stanley Black & Decker recovered just as quickly. Earnings-per-share increased another 32% in 2011 and reached a new high. Earnings continued to grow at a high rate up until 2021, but faced a steep decline the following year.

Results since have been weak, but the company is expected to post its third consecutive year of growth in 2026.

Valuation & Expected Returns

Using the current share price of ~$90 and expected earnings-per-share for 2025 of ~$5.30, Stanley Black & Decker has a price-to-earnings ratio of 17.0. Excluding the extremely high multiple that the stock averaged in 2023, shares of the company have a long-term average of 17.3.

Stanley Black & Decker stock appears to be overvalued, given that its price-to-earnings ratio is higher than its historical norm, which is also above our fair value estimate for the stock of 15 times earnings. If the stock’s valuation were to compress to meet its historical average by 2031, investors would experience a -2.5% headwind to annualized total returns over this time.

Therefore, returns will likely be comprised of earnings growth, dividends, and valuation multiple compression. Due to organic growth and acquisitions, we feel that an expected EPS growth rate of 8% per year is sustainable.

The stock has a current dividend yield of 3.7%. Based on this, total returns would reach approximately 8.4% annually, consisting of 8% earnings growth, the starting dividend, and a low single-digit headwind from multiple compression. This is a solid expected rate of return, meaning Stanley Black & Decker stock has a hold recommendation.

Final Thoughts

Stanley Black & Decker is not a high-yield stock, but it has all of the qualities of a strong dividend growth stock. It has a top position in its industry, strong cash flow, and durable competitive advantages.

The company’s positive growth outlook bodes well for the dividend. The stock appears overvalued today. Additionally, Stanley Black & Decker will likely continue to hike its dividend each year for the foreseeable future.

While the stock is expected to produce high single-digit annualized total returns over the next five years and has a solid dividend risk score of “B”, we believe that Stanley Black & Decker is a hold as it trades ahead of our fair value valuation.

Additionally, the following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

If you’re looking for stocks with unique dividend characteristics, consider the following Sure Dividend databases:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].