Updated on February 20th, 2026 by Nathan Parsh

The Dividend Aristocrats are a group of stocks in the S&P 500 Index with 25+ years of consecutive dividend increases. These companies have high-quality business models that have stood the test of time and have shown a remarkable ability to raise dividends every year regardless of the economy.

We believe the Dividend Aristocrats are some of the highest-quality stocks to buy and hold for the long term. With that in mind, we created a full list of all 69 Dividend Aristocrats.

You can download the full Dividend Aristocrats list, along with important metrics like dividend yields and price-to-earnings ratios, by clicking on the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

The list of Dividend Aristocrats is diversified across multiple sectors, including consumer goods, financials, industrials, and healthcare.

One group that is surprisingly underrepresented is the utility sector. Only three utility stocks, including Consolidated Edison (ED), are on the list of Dividend Aristocrats.

The fact that just three utilities are on the Dividend Aristocrats list may come as a surprise, especially since utilities are widely regarded as steady dividend stocks. The two other utilities on the list are Atmos Energy (ATO) and NextEra Energy (NEE).

Consolidated Edison is about as consistent a dividend stock as they come. The company has over 100+ years of steady dividends and more than 50 years of annual dividend increases. This article will discuss what makes Consolidated Edison appealing for income investors.

Business Overview

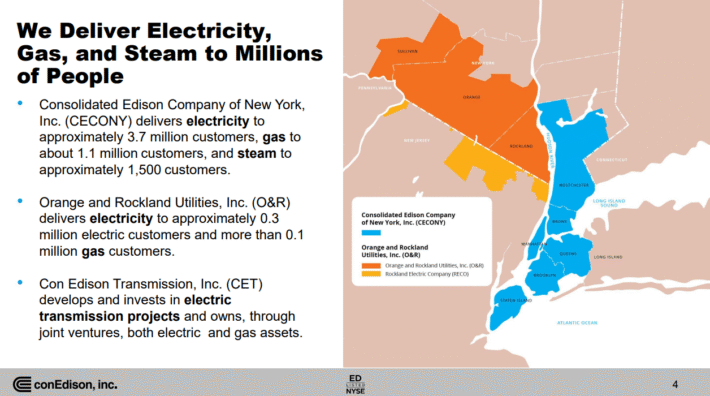

Consolidated Edison is a large-cap utility stock. The company generates nearly $17 billion in annual revenue. The company serves almost 4 million electric customers, and another 1.1 million gas customers, in New York.

It operates electric, gas, and steam transmission businesses.

Source: Investor Presentation

On January 27th, 2026, Consolidated Edison announced that it was raising its quarterly dividend 4.4% to $0.8875. This was the company’s 52nd annual increase, qualifying Consolidated Edison as a Dividend King.

On February 20th, 2026, Consolidated Edison announced its fourth-quarter and full-year results. For the quarter, revenue grew 9.0% to $4.0 billion, beating estimates by $284 million. Adjusted earnings of $320 billion, or $0.89 per share, compared to adjusted earnings of $340 million, or $0.98 per share, in the previous year. Adjusted earnings-per-share were $0.03 ahead of expectations.

For the year, revenue of $16.9 billion was a 10.9% improvement year-over-year. Adjusted earnings of $2.04 billion, or $5.70 per share, compared to adjusted earnings of $1.87 billion, or $5.40 per share, in 2024.

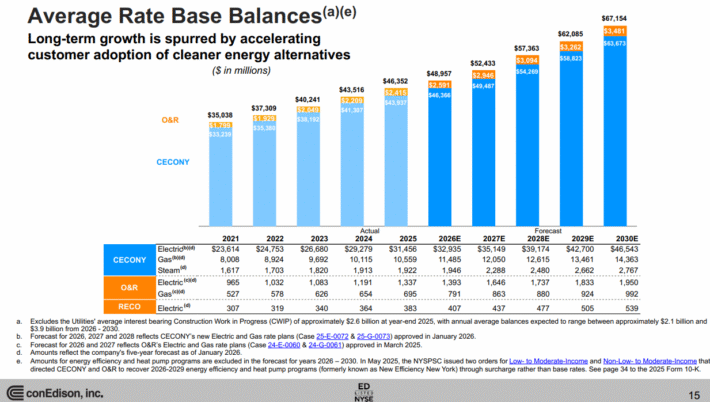

As with prior quarters, higher rate bases for gas and electric customers were the primary contributors to results in the CECONY business, which accounts for the vast majority of the company’s assets. Average rate base balances are expected to grow by 8.6% annually through 2030 off of 2026 levels. This is up from the company’s prior forecast for growth of 8.2%.

Consolidated Edison is expected to produce earnings-per-share of $6.02 in 2026. The company expects 6% to 7% earnings growth from 2026 to 2030. This is up from the prior forecast of 5% to 7% growth.

Growth Prospects

Earnings growth across the utility industry typically mimics GDP growth, plus a couple of points. Over the next five years, we expect Consolidated Edison to increase earnings-per-share by more than 6% per year, which is in line with the company’s guidance.

New customers and rate increases are Consolidated Edison’s growth drivers. ConEd forecasts 8.6% annual rate base growth through 2030.

Source: Investor Presentation

One potential threat to future growth is high interest rates, which could increase the cost of capital for companies that utilize debt, such as utilities. Fortunately, the Federal Reserve cut interest rates several times in 2025, with the added potential for rate cuts in the future that would lower the company’s cost of capital. Lowering rates helps companies that rely heavily on debt financing, such as utilities.

Consolidated Edison is in strong financial condition. It has an investment-grade credit rating of A-, and a modest capital structure with balanced debt maturities over the next several years.

Competitive Advantages & Recession Performance

Consolidated Edison’s main competitive advantage is the high regulatory hurdles of the utility industry. Electricity and gas services are necessary and vital to society.

As a result, the industry is highly regulated, making it virtually impossible for a new competitor to enter the market. This provides a wide moat for Consolidated Edison.

In addition, the utility business model is highly recession-resistant. While many companies experienced significant earnings declines in 2008 and 2009, Consolidated Edison held up relatively well. Earnings-per-share during the Great Recession are shown below:

2007 earnings-per-share of $3.48

2008 earnings-per-share of $3.36 (3% decline)

2009 earnings-per-share of $3.14 (7% decline)

2010 earnings-per-share of $3.47 (11% increase)

Consolidated Edison’s earnings fell in 2008 and 2009, but recovered in 2010. The company still generated healthy profits, even during the worst of the economic downturn. This resilience allowed Consolidated Edison to continue increasing its dividend each year.

The same pattern held up in 2020 when the U.S. economy entered a recession due to the coronavirus pandemic. Last year, ConEd remained highly profitable, which allowed the company to raise its dividend again.

Valuation & Expected Returns

Using the current share price of ~$110 and EPS estimates for 2026, the stock has a price-to-earnings ratio of 18.3. This is just ahead of our fair value estimate of 18.0, which is in line with the 10-year average price-to-earnings ratio for the stock.

As a result, Consolidated Edison shares appear to be slightly overvalued. If the stock valuation retraces to the fair value estimate, the corresponding multiple contractions would reduce annualized returns by 0.3% over the next five years.

Fortunately, the stock could still provide positive returns to shareholders, through earnings growth and dividends. We expect the company to grow earnings by 6% per year over the next five years. In addition, the stock has a current dividend yield of 3.2%.

Utilities like ConEd are prized for their stable dividends and safe payouts. The company’s expected payout ratio for 2026 is 59%, below the 10-year average payout ratio of 67%.

Putting it all together, Consolidated Edison’s total expected returns could look like the following:

6% earnings growth

-0.3% multiple reversion

3.2% dividend yield

Consolidated Edison is expected to return 8.3% annually over the next five years. This is a modest rate of return, but not high enough to warrant a buy recommendation at this time.

Income investors may find the yield attractive, as it is meaningfully higher than the yield of the S&P 500 Index.

Final Thoughts

Consolidated Edison can be a valuable holding for income investors, such as retirees, due to its 3%+ dividend yield. The stock offers secure dividend income, and is also a Dividend Aristocrat, meaning it should raise its dividend each year.

Overall, with expected returns of 8.3%, we rate the stock as a hold at today’s current price.

Additionally, the following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

If you’re looking for stocks with unique dividend characteristics, consider the following Sure Dividend databases:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].