Updated on February 12th, 2026 by Nathan Parsh

At Sure Dividend, we are huge proponents of investing in high-quality dividend growth stocks. We believe companies with long history of raising their dividends will most likely reward their shareholders with superior long-term returns.

This is why we focus so intently on the Dividend Aristocrats.

Our review of each of the 69 Dividend Aristocrats, a group of companies in the S&P 500 Index with 25+ consecutive years of dividend increases, continues with medical supply company Becton Dickinson (BDX).

You can download an Excel spreadsheet with the full list of all 69 Dividend Aristocrats (plus important metrics like dividend yields and price-to-earnings ratios) by using the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

Becton Dickinson has grown into a global giant. In 2017, it completed its $24 billion acquisition of C.R. Bard, its largest acquisition ever, bringing together two huge companies in the medical supply industry. More recently, in September 2024, it completed its $4.2 billion purchase of Edward Lifesciences’ (EW) Critical Care segment.

The industry’s fundamentals remain very healthy. Aging global populations, growing healthcare spending, and expansion in emerging markets are attractive growth catalysts. In this article, we examine Becton Dickinson’s investment prospects.

Business Overview

Both Becton Dickinson and C.R. Bard have long operating histories. C.R. Bard was founded in 1907 by Charles Russell Bard, an American importer of French silks, after he began importing Gomenol to New York City. At the time, Gomenol was commonly used in Europe, and Mr. Bard used it to treat his discomfort from tuberculosis.

By 1923, C.R. Bard was incorporated. Later, it developed the first balloon catheter, and slowly expanded its product portfolio.

Meanwhile, Becton Dickinson has been in business for more than 120 years. Today, the company employs more than 75,000 employees in over 50 countries. It generates approximately $22 billion in annual revenue.

Effective October 1st, 2025, Becton Dickinson reorganized its businesses into five distinct, separately managed segments. These include Medical Essentials, Connected Care, BioPharma Systems, Interventional, and Life Science.

Becton Dickinson has undergone recent changes to its business model. On February 9th, 2026, the company reported that it had completed its previously announced spinoff of its Biosciences and Diagnostics Solutions businesses. These businesses were then combined with Waters Corporation (WAT).

Becton Dickinson received $4 billon in cash for the transaction, $2 billion of which will be used to pay down debt and $2 billion will be used for share repurchases.

Also on February 9th, 2026, BD released earnings results for the first quarter of fiscal year 2026, which ended on December 31st, 2025.

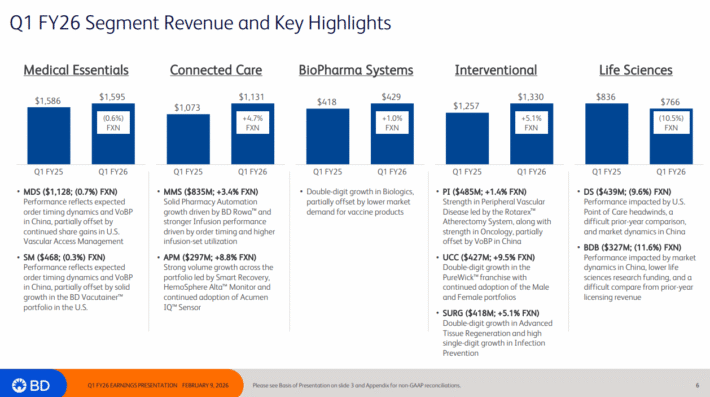

Source: Investor Presentation

For the quarter, revenue grew 1.5% to $5.25 billion, which beat estimates by $100 million. Adjusted earnings-per-share of $2.91 compared unfavorably to $3.43 in the prior year, but this was $0.10 more than expected.

Interventional, Connected Care, and BioPharma Systems grew 5.1%, 4.7%, and 1.0%, respectively. Medical Essentials fell 0.6% while Life Sciences was lower by 10.5%

BD provided an updated outlook for fiscal year 2026 as well. The company still expects revenue to grow by a low single-digit rate. Adjusted earnings-per-share is now projected to be in a range of $12.35 to $12.65 for the fiscal year, down from a range of $14.75 to $15.05 previously. The change in forecast reflects the separation of the Biosciences and Diagnostic Solutions businesses.

Growth Prospects

Becton Dickinson has several avenues for future growth. For starters, the company is a leader in many of the areas that it competes.

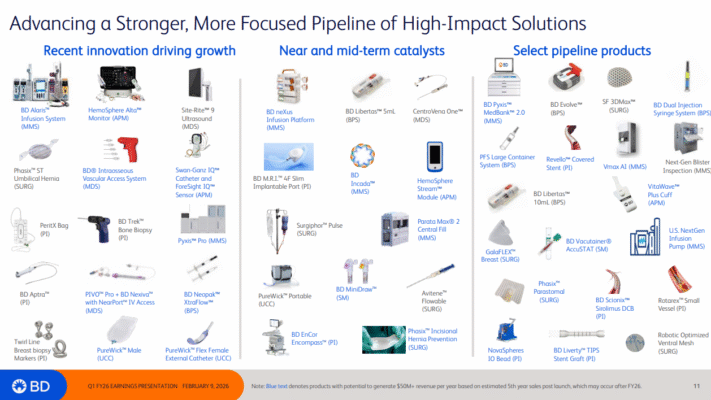

Source: Investor Presentation

The company’s products and services are trusted by customers, making them a key component throughout the sector.

Second, aging demographics should provide tailwinds to the sector in general and the company in particular. Last year, the percentage of the global population that was at least 65 years old reached 10%, this is double what it was in the 1970s. This age group is projected to reach 1.6 billion, or 16% of the world’s population, by 2050. As people age, their need for healthcare services increases.

Becton Dickinson has been fairly active in acquisitions, with Bard being one of it largest purchases ever. The company benefits from a size and scale that makes it likely that it will continue to be able to add to its core businesses through bolt on acquisitions.

Becton Dickinson is also about to undergo a transformation to its business model. The separation of its Biosciences and Diagnostic Solutions businesses will help the core company become a more pureplay medical device company. This could earn the stock a higher multiple from the market as these are much higher margin businesses and the ones likely to see sustained growth in the future.

BDX has increased earnings-per-share by approximately 6% per year over the past 10 years, and has grown earnings in 7 out of the last 10 years. We feel the company can grow earnings-per-share at a rate of 5% per year through fiscal 2031.

Competitive Advantages & Recession Performance

Becton Dickinson has significant competitive advantages, including scale and a vast patent portfolio, due to its high investment spending.

Becton Dickinson spends over $1 billion per year on research and development. This spending has certainly paid off, with strong revenue and earnings growth over the past several years. The company has obtained leadership positions in their respective categories because of product innovation, a direct result of R&D investments.

These competitive advantages provide the company with consistent growth, even during economic downturns. Becton Dickinson steadily grew earnings during the Great Recession. Becton Dickinson’s earnings-per-share during the recession are as follows:

2007 earnings-per-share of $3.84

2008 earnings-per-share of $4.46 (16% increase)

2009 earnings-per-share of $4.95 (11% increase)

2010 earnings-per-share of $4.94 (0.2% decline)

Becton Dickinson generated double-digit earnings growth in 2008 and 2009, during the worst years of the recession. It took a small step back in 2010, but continued to grow in the years since, along with the economic recovery.

The ability to consistently grow earnings each year of the Great Recession, which was arguably the worst economic downturn in decades, is extremely impressive.

Becton Dickinson also performed well during the worst of the COVID-19 pandemic as the company benefited from the increased demand for healthcare equipment.

The reason for its strong financial performance, is that health care patients need medical supplies. Patients cannot choose to forego necessary healthcare supplies. This keeps demand steady from year to year, regardless of the condition of the economy.

Becton Dickinson has a unique ability to withstand recessions, which explains its 54-year history of consecutive dividend increases. Becton Dickinson’s dividend is also very safe based on its fundamentals.

Valuation & Expected Returns

Using the midpoint for estimated earnings-per-share of $12.50 for the fiscal year 2026, the stock has a price-to-earnings ratio of 14.2. Our fair value estimate for BDX stock is a P/E ratio of 19x, meaning shares appear undervalued. Multiple expansion to the fair value P/E could increase annual returns by 5.9% per year over the next five years.

But valuation isn’t the only factor in estimating total returns. The stock will also generate returns from earnings growth and dividends.

As far as dividends go, Becton Dickinson remains a quality dividend growth stock. It has a very secure payout and room for growth. Based on fiscal 2026 earnings guidance, Becton Dickinson will likely have a dividend payout of 34%.

This is a very low payout ratio. It leaves plenty of room for sustained dividend growth moving forward, particularly since earnings will continue to grow.

We project annual returns of 13.0% through fiscal year 2031, stemming from 5% earnings growth, the current dividend yield of 2.4%, and the 5.9% yearly boost from P/E expansion. The expected annual return and the strong dividend risk score of “A” earns the stock a buy recommendation.

Final Thoughts

Becton Dickinson’s business continues to perform very well. Given the positive growth outlook for the healthcare industry, we feel that Becton Dickinson has room for strong earnings growth.

In addition, Becton Dickinson is highly likely to increase its annual dividend for many years. Becton Dickinson is an attractive stock for dividend growth investors with expected total returns of 13% per year and a safe and growing dividend.

Additionally, the following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

If you’re looking for stocks with unique dividend characteristics, consider the following Sure Dividend databases:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].