The Market is down and yields are up.

A lot of people turn to guaranteed income when the markets are volatile or moving sideways. A popular choice is Schwab’s SCHD etf, but if we take income investing to the extreme we find companies like Yield Max that are high risk high income machines. Some funds are boasting distribution rates exceeding 100%, it’s no surprise they’ve attracted yield-hungry investors seeking to maximize returns in a volatile market. However, these sky-high payouts come with a caveat: potential NAV erosion, elevated risk, and a cap on upside potential.

The YieldMax suite includes ETFs like the MSTR Option Income Strategy ETF (MSTY), TSLA Option Income Strategy ETF (TSLY), COIN Option Income Strategy ETF (CONY), and NVDA Option Income Strategy ETF (NVDY). These funds generate income by selling covered call options on single stocks, effectively trading away potential upside in exchange for cash premiums.

Among them, MSTY has delivered the most staggering returns. A $10,000 investment in MSTY one year ago would now be worth $24,891 — a 148.91% total return fueled by Bitcoin’s rebound and MicroStrategy’s leveraged exposure. Yet, such dramatic gains highlight the speculative nature of these ETFs. TSLY and NVDY also performed well, turning $10,000 into $12,355 and $12,169 respectively. In contrast, CONY’s Coinbase exposure dragged it down, leaving a $10,000 investment worth just $8,753.

While these returns are eye-catching, they underscore the inherent risk of YieldMax ETFs. Covered call strategies cap potential gains, and reliance on volatile assets like Bitcoin and Coinbase exposes investors to significant price swings. Additionally, NAV erosion is a real concern. A consistent payout of over 100% annually is unlikely to be sustainable long-term, especially if the underlying stocks underperform.

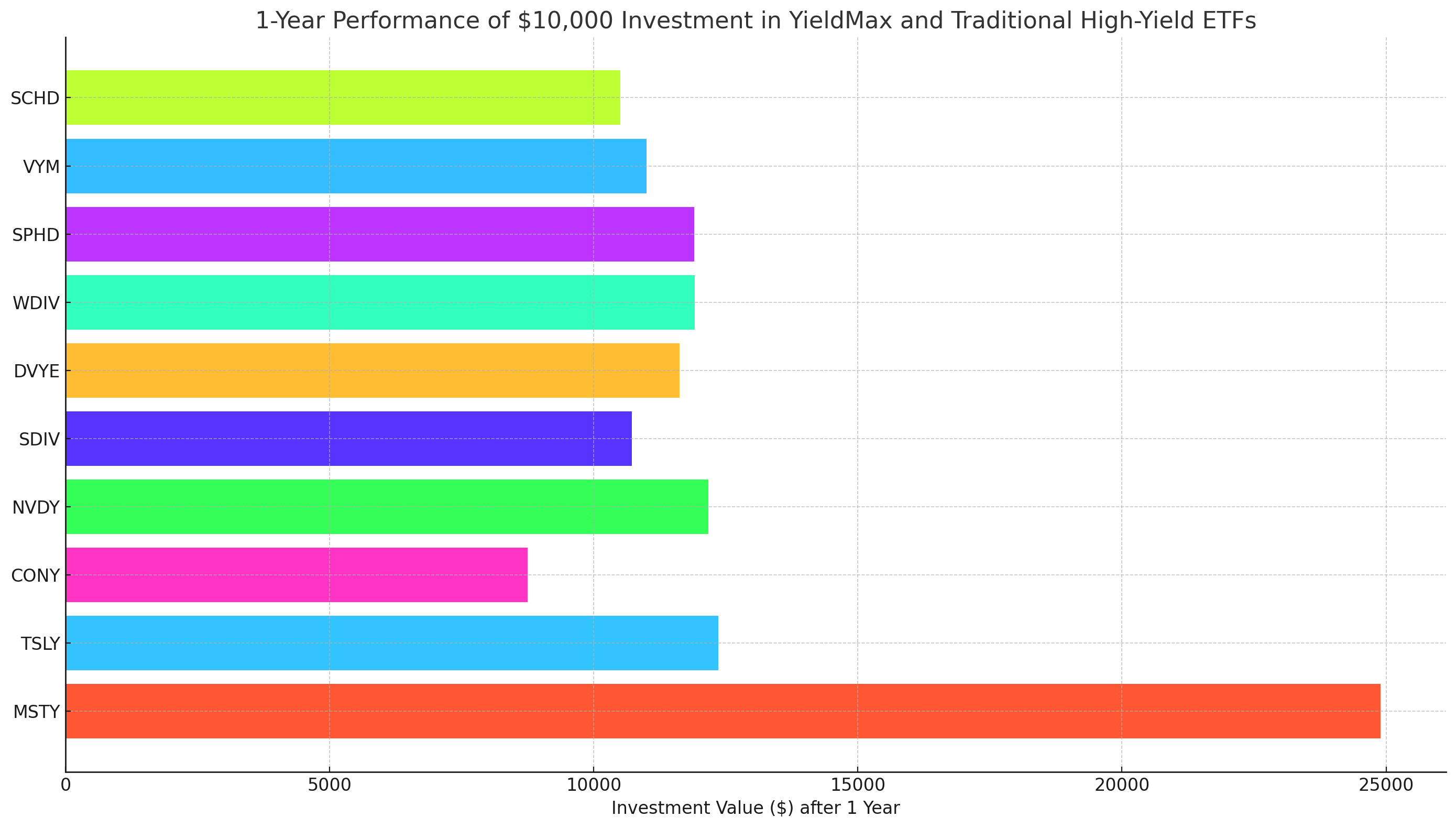

Investment Simulation: $10,000 Invested in YieldMax ETFs and Traditional ETFs

To illustrate the risk/reward profile, the chart below consolidates the performance of $10,000 investments in both YieldMax ETFs and traditional high-yield ETFs over the past year.

The data reveals a striking contrast between the speculative nature of YieldMax ETFs and the steadier returns of more conventional high-yield funds.

MSTY emerges as the top performer with a 148.91% return, driven by MicroStrategy’s aggressive Bitcoin acquisition strategy.

TSLY and NVDY also generated solid returns, though far below MSTY’s outsized gains.

CONY, however, serves as a cautionary tale, losing over 12% due to Coinbase’s stock performance.

On the other hand, traditional ETFs like SPHD and WDIV offered more stable returns of around 19%, while SCHD and VYM provided moderate, lower-risk gains.

Traditional High-Yield ETFs: Income with Stability

For income-seeking investors unwilling to accept the risk profile of YieldMax ETFs, more traditional high-yield ETFs present a compelling alternative. Funds like the Schwab U.S. Dividend Equity ETF (SCHD), Vanguard High Dividend Yield ETF (VYM), and SPDR S&P Global Dividend ETF (WDIV) offer lower but more stable yields.

SCHD, for instance, combines a 3.99% dividend yield with a focus on quality U.S. dividend-paying stocks. Its one-year total return of 5.06% is modest but reflects a more balanced approach between income and growth. VYM, another reliable dividend play, has delivered a 10.03% total return over the past year.

More aggressive options include SDIV and DVYE, which yield 11% and 11.36% respectively. These funds target high-yielding global stocks, but with elevated exposure to emerging markets, they carry higher volatility. Meanwhile, SPHD and WDIV have offered strong returns, with SPHD gaining 19.06% and WDIV up 19.14% over the past year.

Consolidated Performance Analysis

To provide a broader context, here’s how a $10,000 investment in each fund would have performed over the past year:

MSTY: $24,891 — 148.91% return

TSLY: $12,355 — 23.55% return

CONY: $8,753 — –12.47% return

NVDY: $12,169 — 21.69% return

SDIV: $10,725 — 7.25% return

DVYE: $11,628 — 16.28% return

WDIV: $11,914 — 19.14% return

SPHD: $11,906 — 19.06% return

VYM: $11,003 — 10.03% return

SCHD: $10,506 — 5.06% return

Traditional high-yield ETFs provide more stability and less extreme swings in value. While they lack the outsized returns of MSTY or TSLY, they also avoid the dramatic losses seen in CONY. This balance can be crucial for income investors focused on preserving capital while generating consistent cash flow.

Weighing Risks and Opportunities

YieldMax ETFs present an intriguing yet speculative approach to income investing. Their triple-digit yields are hard to ignore, but the risks — NAV erosion, capped upside, and exposure to volatile assets — are equally pronounced. MSTY and TSLY are clear winners for aggressive investors betting on Bitcoin and Tesla, while NVDY offers a middle ground with NVIDIA exposure. However, CONY’s decline serves as a cautionary tale for those investing in high-risk sectors.

Meanwhile, traditional ETFs like SCHD, VYM, and SPHD offer more predictable returns, albeit with lower yields. DVYE and SDIV cater to those seeking higher income but come with increased emerging market risk. For conservative investors, SCHD remains a standout for its balance of quality holdings, income generation, and relatively low volatility.

Final Takeaway: Balancing Income and Risk

The choice between YieldMax ETFs and traditional high-yield funds ultimately comes down to an investor’s risk tolerance. Those seeking outsized income potential and willing to stomach significant volatility may find value in MSTY and TSLY. However, for more conservative income strategies, SCHD, VYM, and SPHD provide a safer path with less downside risk.