Data updated dailyArticle updated on September 26th, 2025 by Bob Ciura

The consumer staples sector is home to some of the most well-known dividend growth stocks in the world.

There is also a wide body of evidence that suggests that the consumer staples sector outperforms over long periods of time.

With that in mind, we’ve compiled a database of 61 consumer staples stocks, which you can access below:

The list of stocks was derived from a few major consumer staples ETFs:

Consumer Staples Select Sector SPDR ETF (XLP)

Invesco S&P Small Cap Consumer Staples ETF (PSCC)

Keep reading this article to learn more about the merits of investing in consumer staples stocks.

Table of Contents

This article provides our full list of all consumer staples stocks, a tutorial on how to use the spreadsheets to create screens of consumer staples stocks, and the top 7 consumer staples stocks now.

The top 7 list was derived from the expected returns of each stock. We calculate expected returns based on a projection of earnings-per-share growth, dividend yields, and changes in the valuation multiple.

The 7 consumer staples stocks are ranked by 5-year expected returns, from lowest to highest.

The table of contents below allows for easy navigation:

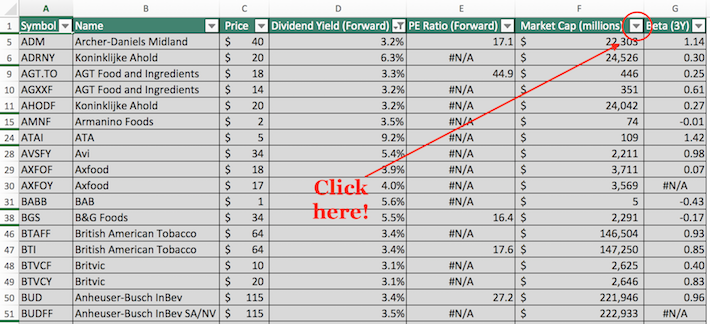

How To Use The Consumer Staples Stocks List To Find Investment Ideas

Having an Excel document containing each dividend-paying consumer staples stocks is very useful.

This tool becomes even more potent when combined with a solid, fundamental knowledge of how to manipulate data with Microsoft Excel. Quantitative investing screeners allow investors to remove many of the cognitive biases that impair long-term investing returns.

With that in mind, this section will provide a step-by-step explanation of how to use the dividend-paying consumer staples stocks list to find the best consumer staples investment ideas by using simple screening techniques.

The first screen that we will implement is for stocks with price-to-earnings ratios below 25,

Screen 1: Avoiding Overvalued Stocks

Step 1: Download your free spreadsheet of all 71 consumer staples stocks here.

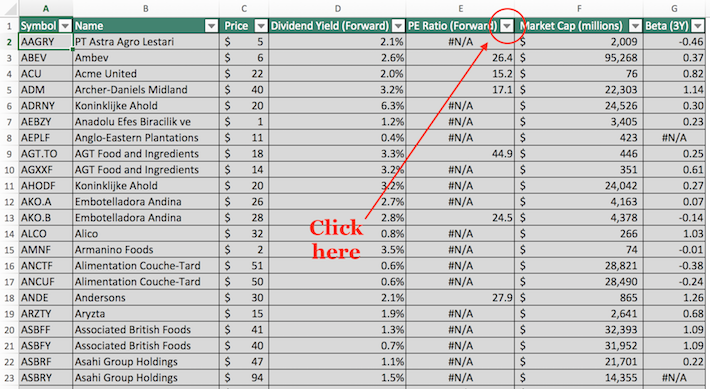

Step 2: Click on the filter icon at the top of the price-to-earnings ratio column, as shown below.

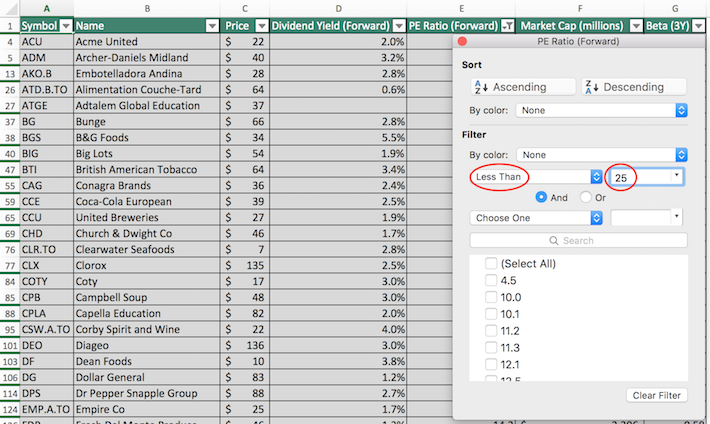

Step 3: Change the filter setting to “Less Than” and input 25 into the field beside it, as shown below.

The remaining stocks in the spreadsheet are consumer staples with price-to-earnings ratio less than 25.

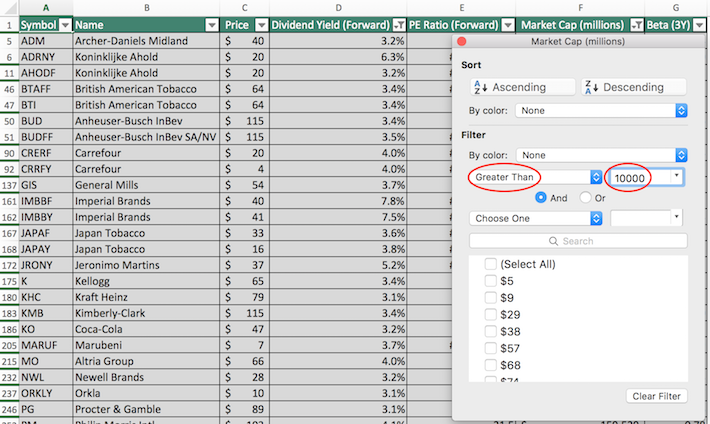

The next screen that we’ll implement is for ‘blue chip stocks’ – those with dividend yields above 3% and market capitalizations above $10 billion.

Screen 2: Blue Chip Stocks

Step 1:Download your free spreadsheet of all 71 consumer staples stocks here.

Step 2: We’ll first filter by dividend yield and then by market capitalization. Importantly, order doesn’t matter – you could also filter by market capitalization and then dividend yield and the screen would output the same results.

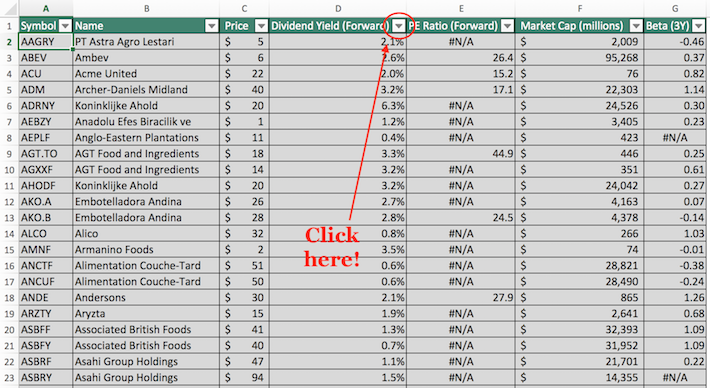

To filter by dividend yield, click the filter icon at the top of the dividend yield icon, as shown above.

\

\

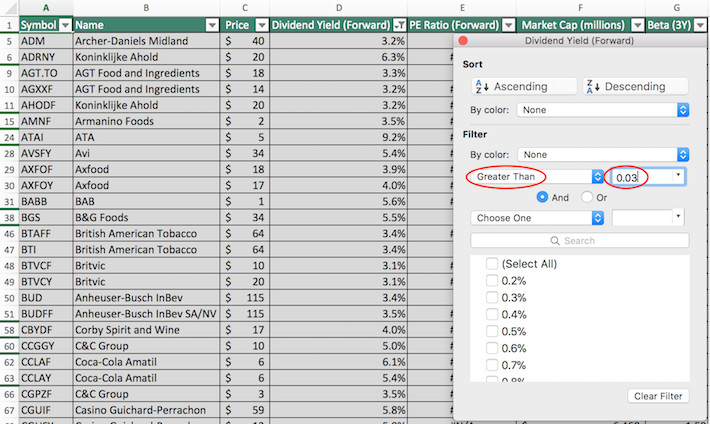

Step 3: To filter for dividend yields greater than 3%, change the filter setting to ‘Greater Than’, and input 0.03 into the field beside it.

Step 4: Next we’ll execute the screen for market capitalization. Close of out of the previous window (by clicking exit, not by clicking ‘clear filter’ at the bottom of the filter window). Then, click the filter icon at the top of the market capitalization column, as shown below.

Step 5: Change the filter setting to ‘Greater Than’ and input 10000 into the field beside it. Notice that since market capitalization is measured in millions of dollars in this spreadsheet, then filtering for stocks with market capitalizations above ‘$10,000 million’ is equivalent for screening for securities with market capitalizations above $10 billion.

The remaining stocks in this spreadsheet are those with dividend yields above 3% and market capitalizations above $10 billion.

You now have a solid understanding of how to use the dividend-paying consumer staples stocks spreadsheet to find compelling investment ideas. The next section will provide a summary of why the consumer staples sector merits an allocation in your investment portfolio.

Why Invest In Consumer Staples Stocks?

Consumer staples stocks are an appealing investment category for a number of reasons.

First of all, consumer staples stocks are very recession-resistant by definition. Consumer staples companies make products or deliver services that are considered to be ‘staples’ – in other words, consumers can’t do without them.

Food stocks within the consumer staples sector are an excellent example of this. Consumers are likely to buy more food products during recessions as they cut back on dining out to conserve funds during difficult economic times.

Alcohol stocks are another example. People tend to drink at least the same amount (if not more) when times get tough.

This means that consumer staples stocks tend to hold up very well during periods of economic turmoil. This can be seen by studying the sector’s performance during the 2007-2009 financial crisis.

During 2008, for example, the consumer staples sector returned -15%. While this seems bad on the surface, it is actually very good on a relative basis. Here’s the performance of some other sectors during the same calendar year:

Financials: -55%

Materials: -44%

Technology: -41%

Clearly, the performance of the consumer staples sector beat these other industries by a wide margin despite being negative itself. In fact, consumer staples was the single best performing sector during calendar year 2008.

The consumer staples sector stands up well during times of recessions, implying that the sector presents less risk than many of its counterparts.

Amazingly, the sector’s long-term performance has also been one of the best. The sector has demonstrated a remarkable ability to generate consistently high returns on invested capital, avoiding the mean reversion experienced by many other highly profitable industries.

While traditional academic theory tells us that investors must assume extra risk to generate incremental returns, the out-performance of the recession-resistant consumer staples sector tells us that this isn’t true in practice.

The sector’s combination of high returns and low risk make it a uniquely appealing sector for conservative total return investors.

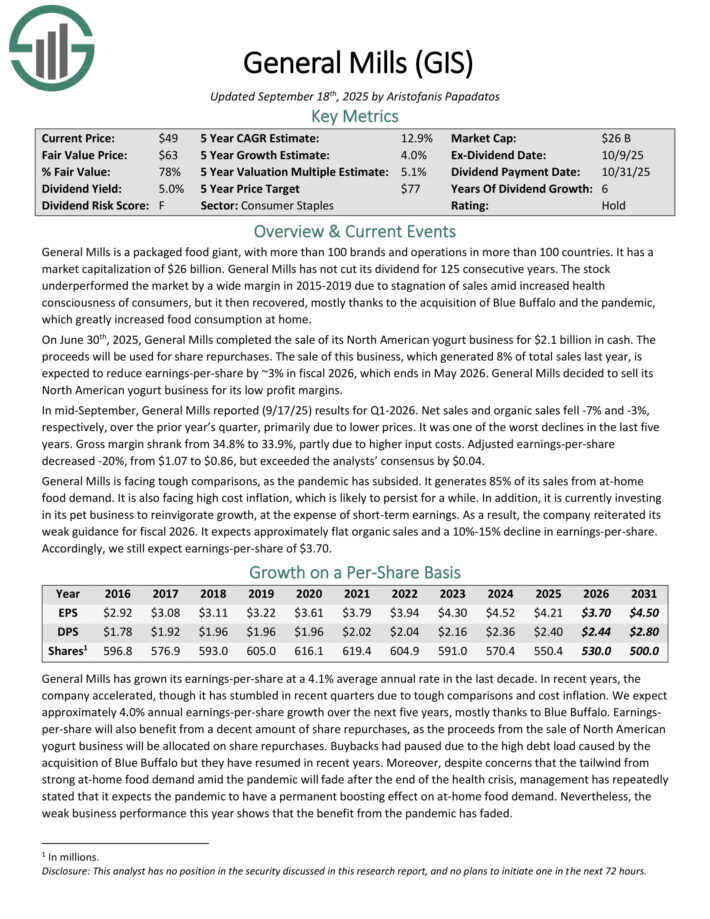

Consumer Staples Stock #7: General Mills (GIS)

Expected Annual Returns: 12.7%

General Mills is a packaged food giant, with more than 100 brands and operations in more than 100 countries. It has a market capitalization of $26 billion. General Mills has not cut its dividend for 125 consecutive years.

On June 30th, 2025, General Mills completed the sale of its North American yogurt business for $2.1 billion in cash. The proceeds will be used for share repurchases.

The sale of this business, which generated 8% of total sales last year, is expected to reduce earnings-per-share by ~3% in fiscal 2026, which ends in May 2026. General Mills decided to sell its North American yogurt business for its low profit margins.

In mid-September, General Mills reported (9/17/25) results for Q1-2026. Net sales and organic sales fell -7% and -3%, respectively, over the prior year’s quarter, primarily due to lower prices.

It was one of the worst declines in the last five years. Gross margin shrank from 34.8% to 33.9%, partly due to higher input costs.

Adjusted earnings-per-share decreased -20%, from $1.07 to $0.86, but exceeded the analysts’ consensus by $0.04. General Mills is facing tough comparisons, as the pandemic has subsided.

It generates 85% of its sales from at-home food demand. It is also facing high cost inflation, which is likely to persist for a while.

In addition, it is currently investing in its pet business to reinvigorate growth, at the expense of short-term earnings. As a result, the company reiterated its weak guidance for fiscal 2026.

It expects approximately flat organic sales and a 10%-15% decline in earnings-per-share.

Click here to download our most recent Sure Analysis report on GIS (preview of page 1 of 3 shown below):

Consumer Staples Stock #6: McCormick & Co. (MKC)

Expected Annual Returns: 13.0%

McCormick & Company produces, markets, and distributes seasoning mixes, spices, condiments and other products to customers in the food industry. McCormick was founded in 1889 by Willoughby M. McCormick and controls ~20% of the global seasoning and spice market.

On June 26th, 2025, McCormick announced second quarter results for the period ending May 31st, 2025. For the quarter, revenue improved 1.2% to $1.6. billion, which matched estimates. Adjusted earnings-per-share of $0.69 was unchanged from the prior year, but was $0.04 better than expected.

For the quarter, volume and mix grew 1.3% while pricing was up 0.3%. The Consumer segment was higher by 3.0% for the period. Gains in volume and mix (+3.3) were only partially offset by weaker pricing (-0.3%).

Organic growth for the Americas, EMEA, and Asia/Pacific regions was 2.8%, 3.3%, and 3.7%, respectively. All regions saw volume growth while pricing was only down in the Americas.

McCormick provided updated guidance for 2025 as well. The company still expects revenue to be in a range of flat to up 2% compared to 2024.

Adjusted earnings-per-share are now projected to be in a range of $3.03 to $3.08, up from $2.99 to $3.04 previously.

Click here to download our most recent Sure Analysis report on MKC (preview of page 1 of 3 shown below):

Consumer Staples Stock #5: Conagra Brands (CAG)

Expected Annual Returns: 13.3%

Conagra traces its roots back to Gilbert Van Camp’s new canned product – pork and beans – in 1861.

The company was incorporated as Nebraska Consolidated Mills in 1919, changed to ConAgra in 1971, ConAgra Foods in 1993, and has now become Conagra Brands, moving its headquarters from Omaha to Chicago and spinning off its Lamb Weston business in 2016. In 2018 Conagra acquired Pinnacle Foods.

The company has well-known brands like Slim Jim, Healthy Choice, Marie Callender’s, Orville Redenbacher’s, Reddi Whip, Birds Eye, Vlasic, Hunt’s, and PAM.

After paying the same $0.2125 quarterly payout for 13 consecutive quarters, Conagra increased its dividend 29.4% in 2020, 13.6% in 2021, 5.6% in 2022, and 6.1% in 2023 to $0.35 per quarter.

On July 10th, 2025, Conagra reported fourth quarter results for the period ending May 25, 2025. (Conagra’s fiscal year ends the last Sunday in May). For the quarter, net sales declined 4.3% year-over-year to $2.8 billion, the result of a 3.5% reduction in organic net sales, a 0.6% decline due to currency exchange, and a negative impact of -0.2% due to M&A.

Volume declined 2.5%. Adjusted EPS decreased 8% to $0.56, missing analyst estimates by $0.05. At fiscal year-end, the company had net debt of $8.0 billion, and a net leverage ratio of 3.6x.

Conagra provided its fiscal 2026 guidance, expecting organic net sales growth of (1)% to 1% compared to FY 2025. Adjusted operating margin is likely to come in between 11.0% to 11.5%, and adjusted EPS is expected to decline sharply from FY 2025 to $1.70 to $1.85.

Capex is expected to be $450 million, and interest expense is expected to equal $400 million. Furthermore, it expects its net leverage ratio to degrade further to 3.85x.

Click here to download our most recent Sure Analysis report on CAG (preview of page 1 of 3 shown below):

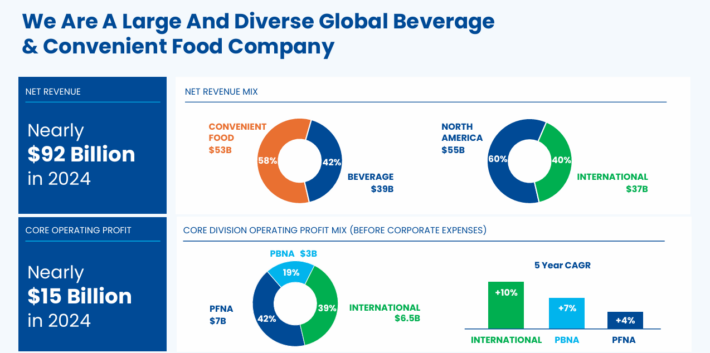

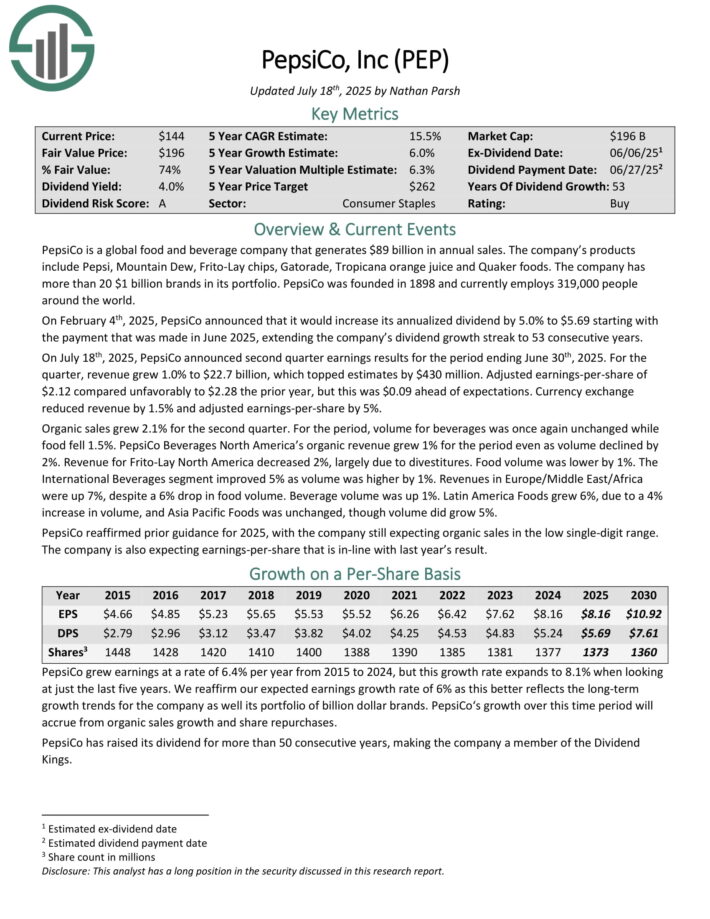

Consumer Staples Stock #4: PepsiCo Inc. (PEP))

Expected Annual Returns: 16.1%

PepsiCo is a global food and beverage company. Its products include Pepsi, Mountain Dew, Frito-Lay chips, Gatorade, Tropicana orange juice and Quaker foods.

Its business is split roughly 60-40 in terms of food and beverage revenue. It is also balanced geographically between the U.S. and the rest of the world.

Source: Investor Presentation

On July 18th, 2025, PepsiCo announced second quarter earnings results for the period ending June 30th, 2025. For the quarter, revenue grew 1.0% to $22.7 billion, which topped estimates by $430 million.

Adjusted earnings-per-share of $2.12 compared unfavorably to $2.28 the prior year, but this was $0.09 ahead of expectations. Currency exchange reduced revenue by 1.5% and adjusted earnings-per-share by 5%.

Organic sales grew 2.1% for the second quarter. For the period, volume for beverages was once again unchanged while food fell 1.5%.

Click here to download our most recent Sure Analysis report on PEP (preview of page 1 of 3 shown below):

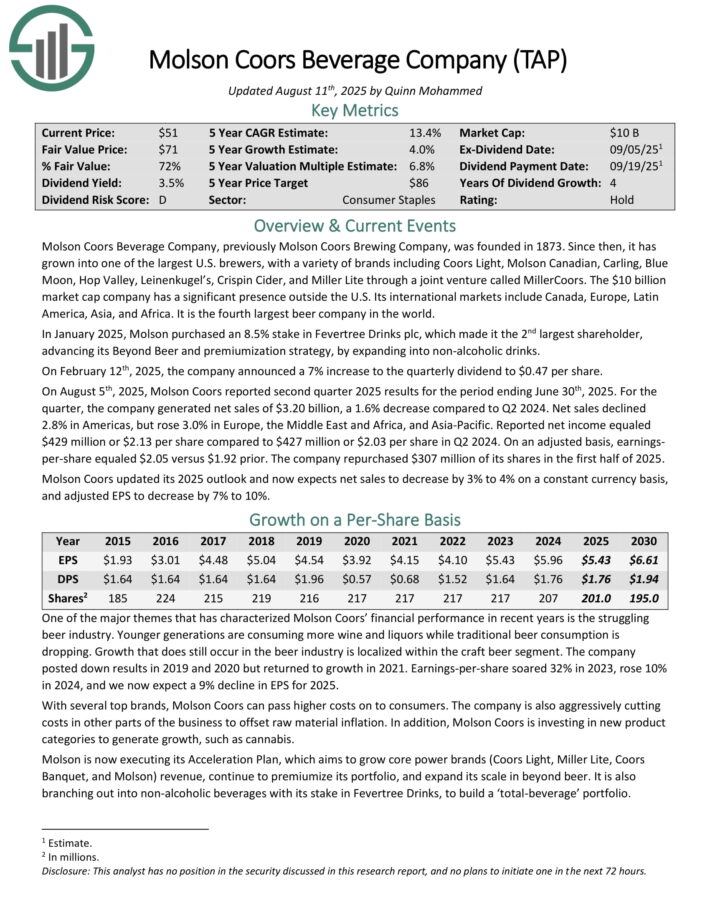

Consumer Staples Stock #3: Molson Coors (TAP)

Expected Annual Returns: 16.5%

Molson Coors Beverage Company was founded in 1873. Since then, it has grown into one of the largest U.S. brewers, with a variety of brands including Coors Light, Molson Canadian, Carling, Blue Moon, Hop Valley, Leinenkugel’s, Crispin Cider, and Miller Lite through a joint venture called MillerCoors.

The company has a significant presence outside the U.S. Its international markets include Canada, Europe, Latin America, Asia, and Africa. It is the fourth largest beer company in the world.

In January 2025, Molson purchased an 8.5% stake in Fevertree Drinks plc, which made it the 2nd largest shareholder, advancing its Beyond Beer and premiumization strategy, by expanding into non-alcoholic drinks.

On February 12th, 2025, the company announced a 7% increase to the quarterly dividend to $0.47 per share.

On August 5th, 2025, Molson Coors reported second quarter 2025 results for the period ending June 30th, 2025. For the quarter, the company generated net sales of $3.20 billion, a 1.6% decrease compared to Q2 2024.

Net sales declined 2.8% in Americas, but rose 3.0% in Europe, the Middle East and Africa, and Asia-Pacific. Reported net income equaled $429 million or $2.13 per share compared to $427 million or $2.03 per share in Q2 2024.

On an adjusted basis, earnings-per-share equaled $2.05 versus $1.92 prior. The company repurchased $307 million of its shares in the first half of 2025.

Molson Coors updated its 2025 outlook and now expects net sales to decrease by 3% to 4% on a constant currency basis, and adjusted EPS to decrease by 7% to 10%.

Click here to download our most recent Sure Analysis report on TAP (preview of page 1 of 3 shown below):

Consumer Staples Stock #2: Keurig Dr. Pepper (KDP)

Expected Annual Returns: 19.6%

Keurig Dr. Pepper is the result of a ~$20B merger between Dr. Pepper Snapple and Keurig Green Mountain completed in mid-2018. The new company started trading on July 10, 2018.

KDP is now the third largest non-alcoholic beverage company in terms of revenue in the U.S. behind Coca-Cola (KO) and Pepsi (PEP). KDP now reports three business segments: U.S. Refreshment Beverages, U.S. Coffee, and International.

Major brands include Core, Dr. Pepper, Sunkist, Canada Dry, Bai, 7UP, Snapple, and Keurig. JAB Holdings controls ~4.4% of the common stock. Net sales were about $15.35B in fiscal 2024. Keurig Dr. Pepper reported Q2 2025 results on July 25th, 2025.

Company-wide adjusted net sales climbed 7.2% year-over-year. Adjusted diluted earnings per share increased 11.1% to $0.49 in the quarter, compared to $0.45 in the year-ago period. Sales rose 10.5% in the U.S.

Refreshment Beverage segment on 1.0% higher prices and 9.5% greater volume/mix drive by the GHOST acquisition. The U.S. Coffee segment saw (-0.2%) lower sales on 3.6% higher prices and -3.8% volume/mix decline. Rising competition and input costs are affecting results of this segment.

Keurig Dr. Pepper continues to acquire or partner with brands to expand its reach. The most recent deal was a partnership with Grupo PiSA for Electrolit.

The firm acquired GHOST, an energy drink with about 3% market share and $500M in sales. Keurig will acquire 60% now and the remaining 40% in 2028.

Click here to download our most recent Sure Analysis report on KDP (preview of page 1 of 3 shown below):

Consumer Staples Stock #1: Constellation Brands Inc. (STZ)

Expected Annual Returns: 22.3%

Constellation Brands was founded in 1945. The company produces and distributes alcoholic beverages including beer, wine, and spirits. It is the third largest beer company in the U.S., and imports and sells beer brands such as Corona, Modelo Especial (the #1 Beer in U.S.), Modelo Negra, and Pacifico.

In addition, Constellation has many wine brands including Robert Mondavi and Kim Crawford, as well as spirits brands including Casa Noble Tequila, and High West Whiskey. The company also has a stake in cannabis company Canopy Growth.

In June 2025, Constellation completed its divestiture of some of its wine and spirits brands to The Wine Group. The brands divested include Woodbridge, Meiomi, Robert Mondavi Private Selection, Cook’s, SIMI, and J. Roget sparkling wine, as well as its inventory, facilities, and vineyards. Constellation retained its high-end wine and spirits brands.

On July 1st, 2025, Constellation Brands reported first quarter fiscal 2026 results for the period ending May 31, 2025. For the quarter, the company recorded $2.52 billion in net sales, down 6% compared to the same prior year period. Beer sales fell 2% year-over-year, while wine and spirits sales plunged 28%.

Comparable earnings-per-share equaled $3.22 for the quarter, which was 10% lower compared to Q1 2025, and $0.07 behind analyst estimates.

In the first quarter, Constellation Brands repurchased $306 million of its shares and paid $182 million in dividends.

Click here to download our most recent Sure Analysis report on STZ (preview of page 1 of 3 shown below):

Final Thoughts

The consumer staples sector is an intriguing place to looks for high-quality dividend investment ideas.

If you’re willing to look outside of this sector while hunting for investment opportunities, the following stock databases are highly useful:

Investing is a unique craft because we have the ability to ‘cheat’ off the moves of the world’s greatest investors.

Large, institutional investment managers with more than $100 million in assets under management are required to disclose their portfolio holdings on a quarterly basis through a regulatory filing called a 13F.

With this in mind, there is no better investor than Berkshire Hathaway’s Warren Buffett. We provide a detailed quarterly analysis on Warren Buffett’s stock portfolio, which you can access below:

If you’re looking for other sector-specific dividend stocks, the following Sure Dividend databases will be useful:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].