Updated on January 22nd, 2026 by Bob Ciura

Oil and gas royalty trusts are now offering exceptionally high distributions to their investors, resulting in much higher yields than the ~1.2% average dividend yield of the S&P 500.

We have created a spreadsheet of high dividend stocks with dividend yields of 5% or more…

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

In this article, we will discuss the prospects of the highest-yielding royalty trusts in the Sure Analysis Research Database.

Table of Contents

You can instantly jump to any specific section of the article by using the links below:

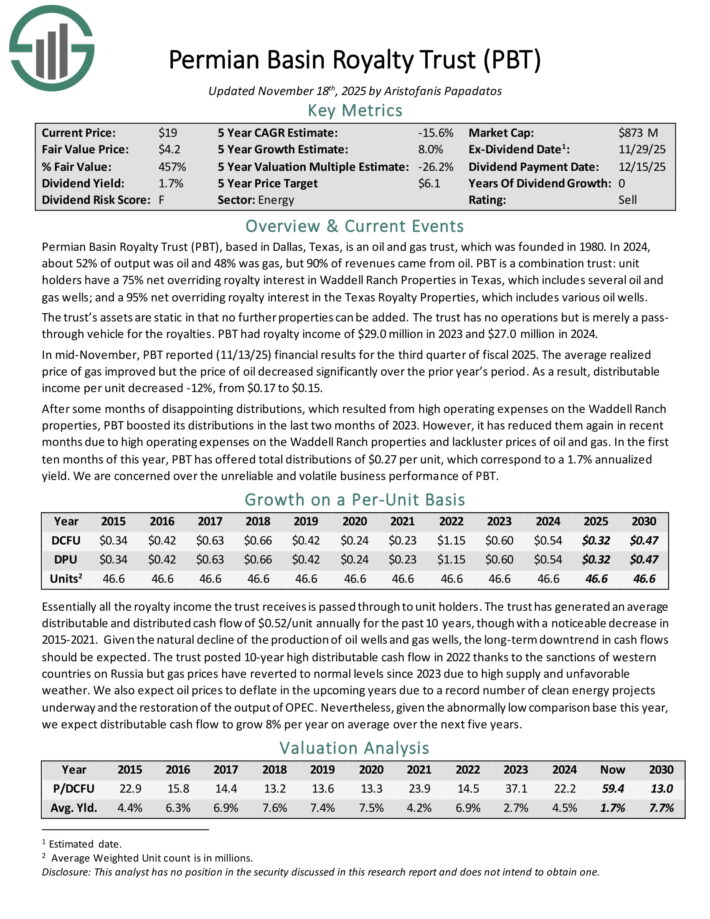

High-Yield Royalty Trust No. 7: Permian Basin Royalty Trust (PBT)

Permian Basin Royalty Trust is an oil and gas trust, which was founded in 1980. In 2023, about 55% of output was oil and 45% was gas, but 85% of revenues came from oil.

PBT is a combination trust: unit holders have a 75% net overriding royalty interest in Waddell Ranch Properties in Texas, which includes several oil and gas wells; and a 95% net overriding royalty interest in the Texas Royalty Properties, which includes various oil wells.

The trust’s assets are static in that no further properties can be added. The trust has no operations but is merely a pass through vehicle for the royalties. PBT had royalty income of $54.4 million in 2022 and $29.0 million in 2023.

In mid-November, PBT reported (11/13/25) financial results for the third quarter of fiscal 2025. The average realized price of gas improved but the price of oil decreased significantly over the prior year’s period. As a result, distributable income per unit decreased -12%, from $0.17 to $0.15.

Click here to download our most recent Sure Analysis report on Permian Basin Royalty Trust (PBT) (preview of page 1 of 3 shown below):

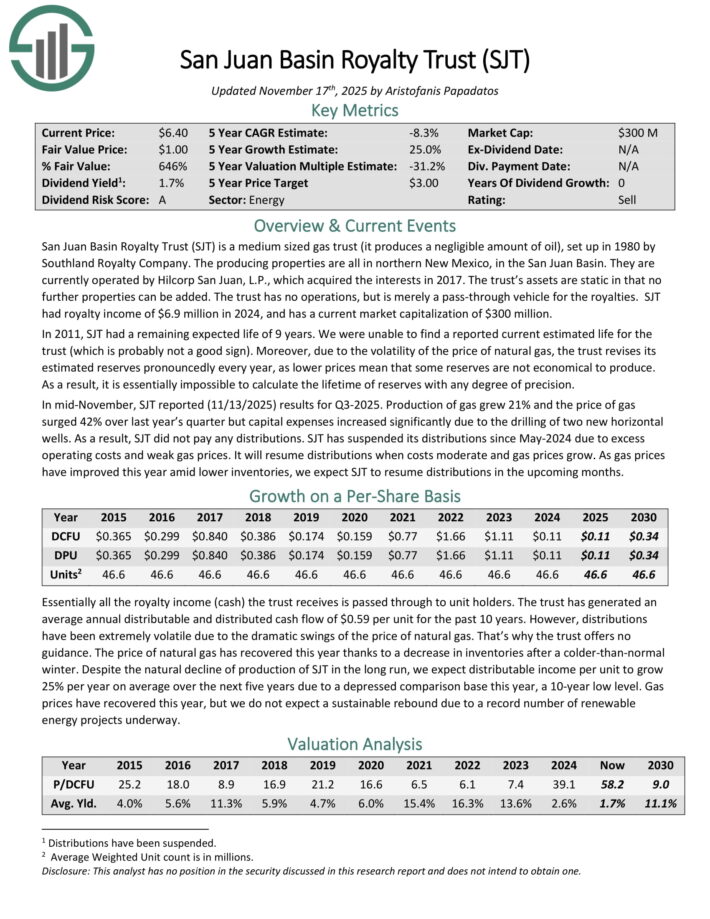

High-Yield Royalty Trust No. 6: San Juan Basin Royalty Trust (SJT)

San Juan Basin Royalty Trust (SJT) is a medium sized gas trust (it produces a negligible amount of oil), set up in 1980 by Southland Royalty Company. The producing properties are all in northern New Mexico, in the San Juan Basin.

They are currently operated by Hilcorp San Juan, L.P., which acquired the interests in 2017. The trust’s assets are static in that no further properties can be added. It had royalty income of $6.9 million in 2024.

In mid-November, SJT reported (11/13/2025) results for Q3-2025. Production of gas grew 21% and the price of gas surged 42% over last year’s quarter but capital expenses increased significantly due to the drilling of two new horizontal wells. As a result, SJT did not pay any distributions.

Click here to download our most recent Sure Analysis report on SJT (preview of page 1 of 3 shown below):

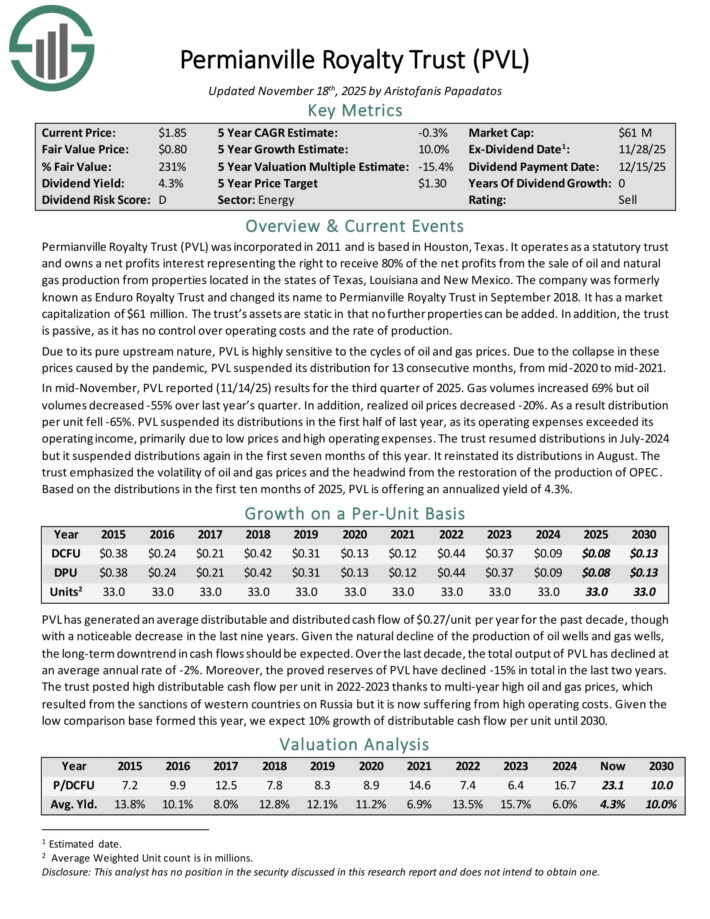

High-Yield Royalty Trust No. 5: Permianville Royalty Trust (PVL)

Permianville Royalty Trust (PVL) was incorporated in 2011 and is based in Houston, Texas.

It operates as a statutory trust and owns a net profits interest representing the right to receive 80% of the net profits from the sale of oil and natural gas production from properties located in the states of Texas, Louisiana and New Mexico.

The trust’s assets are static in that no further properties can be added. In addition, the trust is passive, as it has no control over operating costs and the rate of production.

In mid-November, PVL reported (11/14/25) results for the third quarter of 2025. Gas volumes increased 69% but oil volumes decreased -55% over last year’s quarter. In addition, realized oil prices decreased -20%.

As a result distribution per unit fell -65%. PVL suspended its distributions in the first half of last year, as its operating expenses exceeded its operating income, primarily due to low prices and high operating expenses.

The trust suspended distributions in the first seven months of this year but reinstated its distributions in August.

Click here to download our most recent Sure Analysis report on PVL (preview of page 1 of 3 shown below):

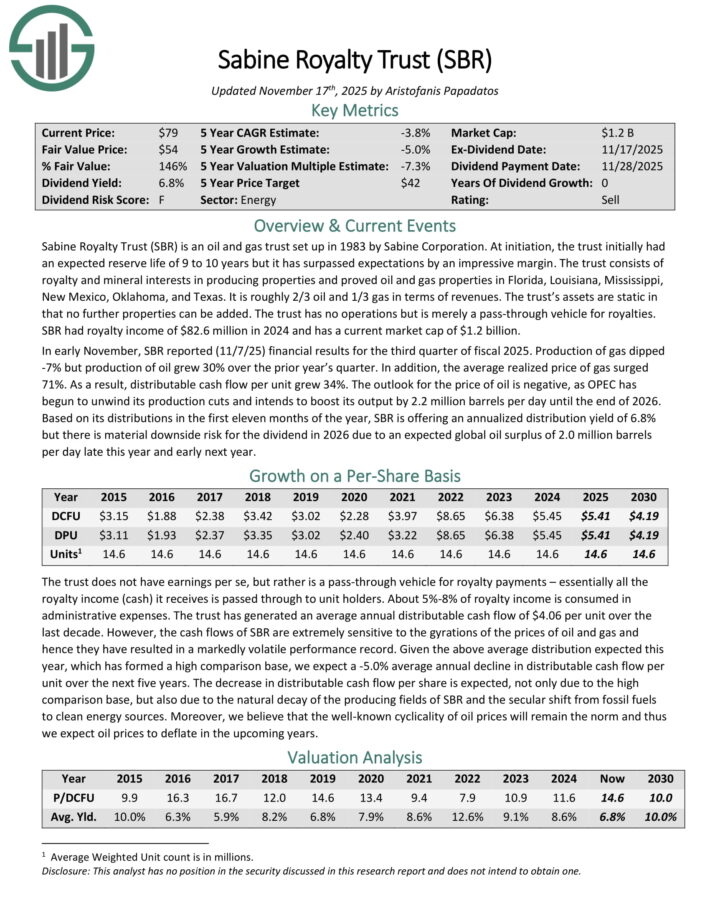

High-Yield Royalty Trust No. 4: Sabine Royalty Trust (SBR)

Sabine Royalty Trust (SBR) is an oil and gas trust set up in 1983 by Sabine Corporation. At initiation, the trust initially had an expected reserve life of 9 to 10 years but it has surpassed expectations by an impressive margin.

The trust consists of royalty and mineral interests in producing properties and proved oil and gas properties in Florida, Louisiana, Mississippi, New Mexico, Oklahoma, and Texas. It is roughly 2/3 oil and 1/3 gas in terms of revenues.

The trust’s assets are static in that no further properties can be added. The trust has no operations but is merely a pass through vehicle for royalties. SBR had royalty income of $82.6 million in 2024 and has a current market cap of $965 million.

In early November, SBR reported (11/7/25) financial results for the third quarter of fiscal 2025. Production of gas dipped -7% but production of oil grew 30% over the prior year’s quarter.

In addition, the average realized price of gas surged 71%. As a result, distributable cash flow per unit grew 34%.

The outlook for the price of oil is negative, as OPEC has begun to unwind its production cuts and intends to boost its output by 2.2 million barrels per day until the end of 2026.

Click here to download our most recent Sure Analysis report on SBR (preview of page 1 of 3 shown below):

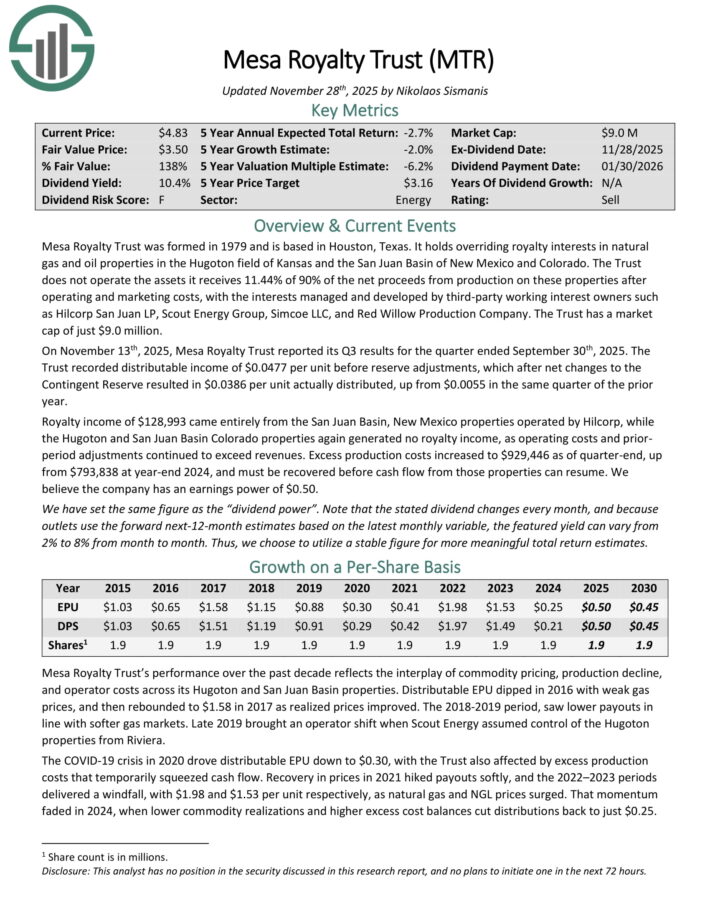

High-Yield Royalty Trust No. 3: Mesa Royalty Trust (MTR)

Mesa Royalty Trust was formed in 1979 and is based in Houston, Texas. It holds overriding royalty interests in natural gas and oil properties in the Hugoton field of Kansas and the San Juan Basin of New Mexico and Colorado.

The Trust does not operate the assets it receives 11.44% of 90% of the net proceeds from production on these properties after operating and marketing costs, with the interests managed and developed by third-party working interest owners such as Hilcorp San Juan LP, Scout Energy Group, Simcoe LLC, and Red Willow Production Company.

On November 13th, 2025, Mesa Royalty Trust reported its Q3 results for the quarter ended September 30th, 2025. The Trust recorded distributable income of $0.0477 per unit before reserve adjustments, which after net changes to the Contingent Reserve resulted in $0.0386 per unit actually distributed, up from $0.0055 in the same quarter of the prior year.

Royalty income of $128,993 came entirely from the San Juan Basin, New Mexico properties operated by Hilcorp, while the Hugoton and San Juan Basin Colorado properties again generated no royalty income, as operating costs and prior period adjustments continued to exceed revenues.

Excess production costs increased to $929,446 as of quarter-end, up from $793,838 at year-end 2024, and must be recovered before cash flow from those properties can resume. We believe the company has an earnings power of $0.50.

Click here to download our most recent Sure Analysis report on MTR (preview of page 1 of 3 shown below):

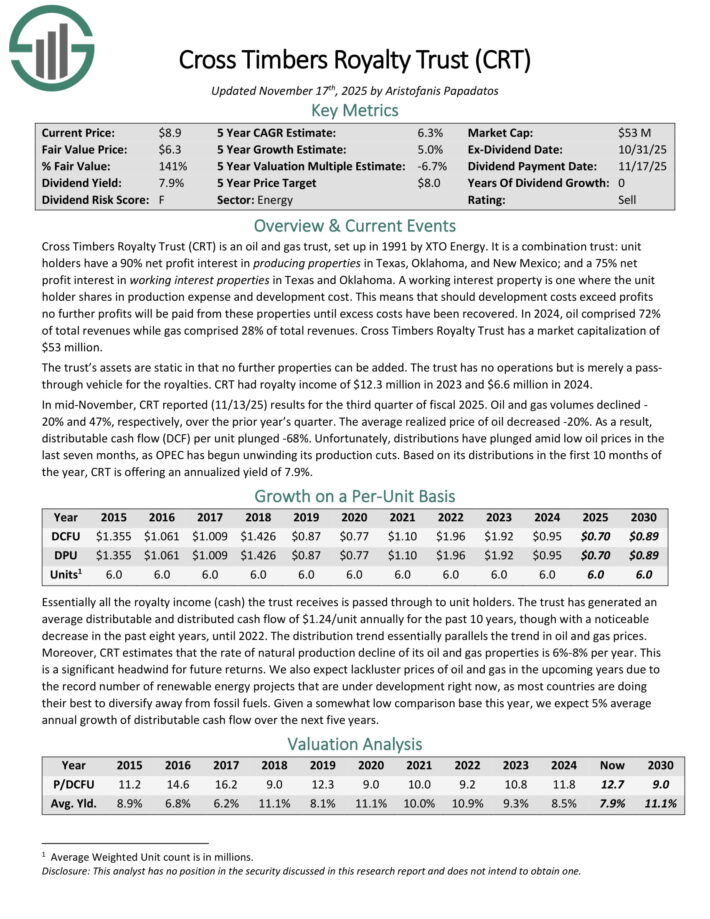

High-Yield Royalty Trust No. 2: Cross Timbers Royalty Trust (CRT)

Cross Timbers Royalty Trust is an oil and gas trust (about 50/50), set up in 1991 by XTO Energy.

Its unitholders have a 90% net profit interest in producing properties in Texas, Oklahoma, and New Mexico; and a 75% net profit interest in working interest properties in Texas and Oklahoma.

In mid-November, CRT reported (11/13/25) results for the third quarter of fiscal 2025. Oil and gas volumes declined 20% and 47%, respectively, over the prior year’s quarter. The average realized price of oil decreased -20%.

As a result, distributable cash flow (DCF) per unit plunged -68%. Distributions have plunged amid low oil prices in the last seven months.

Click here to download our most recent Sure Analysis report on Cross Timbers Royalty Trust (CRT) (preview of page 1 of 3 shown below):

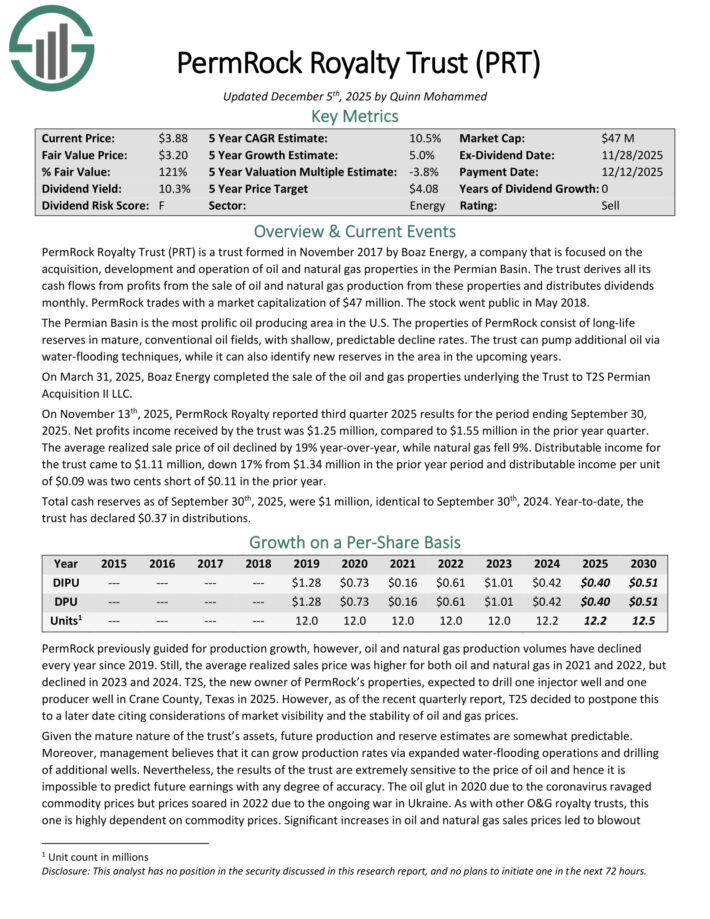

High-Yield Royalty Trust No. 1: PermRock Royalty Trust (PRT)

PermRock Royalty Trust is a trust formed in late 2017 by Boaz Energy, a company that is focused on the acquisition, development and operation of oil and natural gas properties in the Permian Basin.

The Trust benefits from the unique characteristics of the Permian Basin, which is the most prolific oil-producing area in the U.S.

On November 13th, 2025, PermRock Royalty reported third quarter 2025 results for the period ending September 30, 2025. Net profits income received by the trust was $1.25 million, compared to $1.55 million in the prior year quarter.

The average realized sale price of oil declined by 19% year-over-year, while natural gas fell 9%. Distributable income for the trust came to $1.11 million, down 17% from $1.34 million in the prior year period and distributable income per unit of $0.09 was two cents short of $0.11 in the prior year.

Click here to download our most recent Sure Analysis report on PRT (preview of page 1 of 3 shown below):

Final Thoughts

On the surface, oil and gas royalty trusts are attractive as they widely offer higher yields than the S&P 500 average.

However, oil and gas prices are infamous for their dramatic swings. Investors should also be aware of the excessive risk of all these trusts near the peak of their cycle.

The ideal time to buy these trusts is during a severe downturn of the energy sector, when these stocks plunge and may become undervalued.

As mentioned above, all the oil and gas trusts are highly risky due to the natural decline of their production and their sensitivity to the prices of oil and gas.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].