Published on January 20th, 2026 by Bob Ciura

Utility stocks have great appeal for income investors. They typically generate steady earnings year after year, and many utility stocks have recession-proof dividend payouts.

After all, people will always need water, heat, and electricity, even during periods of steep economic downturns.

As a result, utility stocks tend to have high dividend yields, with consistent dividend growth over time.

You can download the list of high dividend stocks (along with important financial ratios such as dividend yields and payout ratios) by clicking on the link below:

So why do these businesses make for attractive investments?

Utilities usually conduct business in highly regulated markets, meaning their profits (and dividends) are more certain and predictable than many other market sectors.

Canadian utility stocks could be even more attractive, as many have higher yields and/or lower valuations than their U.S. based counterparts.

This article will list the 6 highest-yielding Canadian utility stocks in the Sure Analysis Research Database.

Table Of Contents

The following table of contents provides for easy navigation:

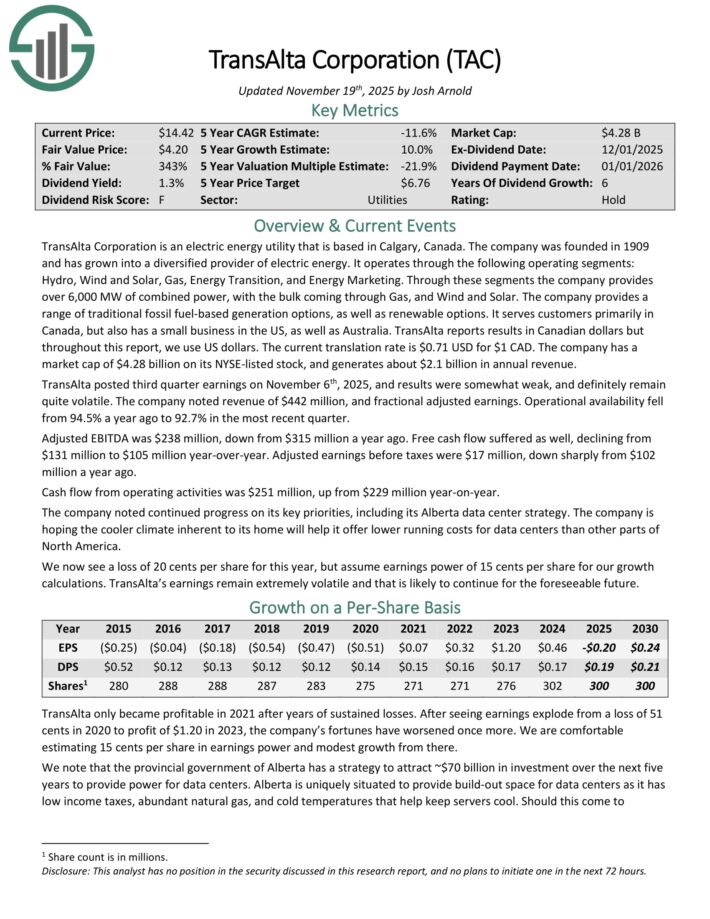

Highest-Yielding Canadian Utility Stock #6: TransAlta Corporation (TAC)

TransAlta Corporation is an electric energy utility that is based in Calgary, Canada. It operates through the following operating segments: Hydro, Wind and Solar, Gas, Energy Transition, and Energy Marketing.

Through these segments the company provides over 6,000 MW of combined power, with the bulk coming through Gas, and Wind and Solar. The company provides a range of traditional fossil fuel-based generation options, as well as renewable options.

It serves customers primarily in Canada, but also has a small business in the US, as well as Australia. TransAlta reports results in Canadian dollars but throughout this report, we use US dollars. The current translation rate is $0.71 USD for $1 CAD. The company generates about $2.1 billion in annual revenue.

TransAlta posted third quarter earnings on November 6th, 2025, and results were somewhat weak, and definitely remain quite volatile. The company noted revenue of $442 million, and fractional adjusted earnings.

Operational availability fell from 94.5% a year ago to 92.7% in the most recent quarter. Adjusted EBITDA was $238 million, down from $315 million a year ago.

Free cash flow suffered as well, declining from $131 million to $105 million year-over-year. Adjusted earnings before taxes were $17 million, down sharply from $102 million a year ago.

Cash flow from operating activities was $251 million, up from $229 million year-on-year.

Click here to download our most recent Sure Analysis report on TAC (preview of page 1 of 3 shown below):

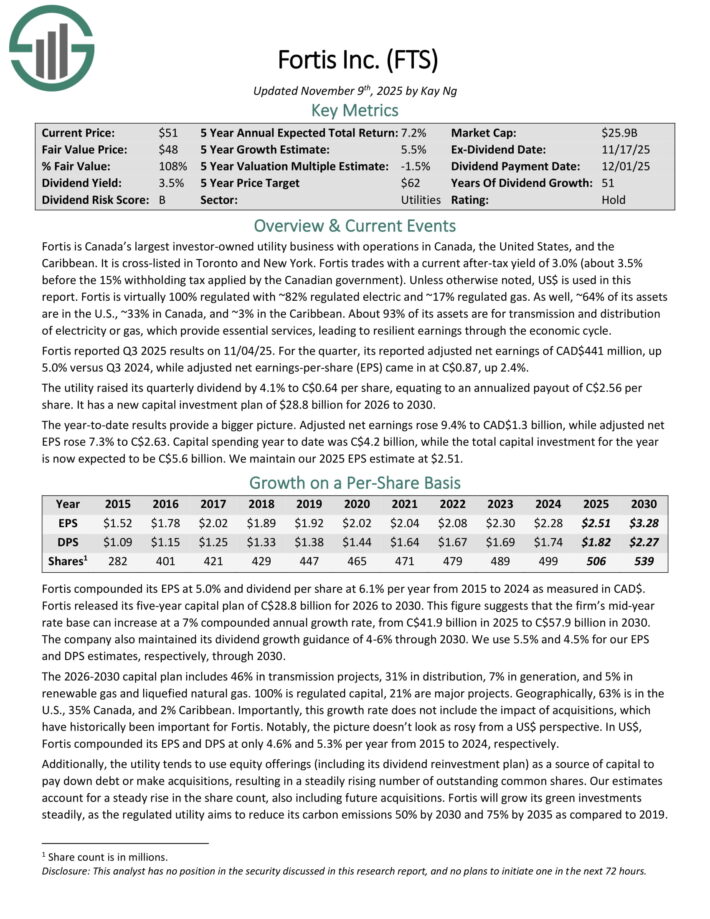

Highest-Yielding Canadian Utility Stock #5: Fortis Inc. (FTS)

Fortis is Canada’s largest investor-owned utility business with operations in Canada, the United States, and the Caribbean. It is cross-listed in Toronto and New York.

Fortis trades with a current after-tax yield of 3.0% (about 3.5% before the 15% withholding tax applied by the Canadian government).

Fortis is virtually 100% regulated with ~82% regulated electric and ~17% regulated gas. As well, ~64% of its assets are in the U.S., ~33% in Canada, and ~3% in the Caribbean.

About 93% of its assets are for transmission and distribution of electricity or gas, which provide essential services, leading to resilient earnings through the economic cycle.

Fortis reported Q3 2025 results on 11/04/25. For the quarter, its reported adjusted net earnings of CAD$441 million, up 5.0% versus Q3 2024, while adjusted net earnings-per-share (EPS) came in at C$0.87, up 2.4%.

The utility raised its quarterly dividend by 4.1% to C$0.64 per share, equating to an annualized payout of C$2.56 per share. It has a new capital investment plan of $28.8 billion for 2026 to 2030.

The year-to-date results provide a bigger picture. Adjusted net earnings rose 9.4% to CAD$1.3 billion, while adjusted net EPS rose 7.3% to C$2.63. Capital spending year to date was C$4.2 billion, while the total capital investment for the year is now expected to be C$5.6 billion.

Click here to download our most recent Sure Analysis report on FTS (preview of page 1 of 3 shown below):

Highest-Yielding Canadian Utility Stock #4: Canadian Utilities (CDUAF)

Canadian Utilities is a $8.14 billion company with approximately 5,000 employees. ATCO owns 53% of Canadian Utilities.

Based in Alberta, Canadian Utilities is a diversified global energy infrastructure corporation delivering solutions in Electricity, Pipelines & Liquid, and Retail Energy.

The company prides itself on having Canada’s longest consecutive years of dividend increases, with a 53-year streak. Unless otherwise noted, US dollars are used in this research report.

On November 7th, 2025, Canadian Utilities posted its Q3 results for the period ending September 30th, 2025. Adjusted earnings were $76.7 million ($0.28 per share), up $4.3 million ($0.01 per share) year-over-year.

Growth in adjusted earnings was driven primarily by continued rate base expansion in ATCO Energy Systems and higher approved rates in ATCO Gas Australia under the new AA6 regulatory period.

These positive factors were partially offset by the lower 2025 ROE, the completion of ECM funding recorded in the prior year, lower interest income, the timing of certain expenses, and the reduced earnings contribution from ATCO Energy following its transfer to ATCO in 2024.

Click here to download our most recent Sure Analysis report on CDUAF (preview of page 1 of 3 shown below):

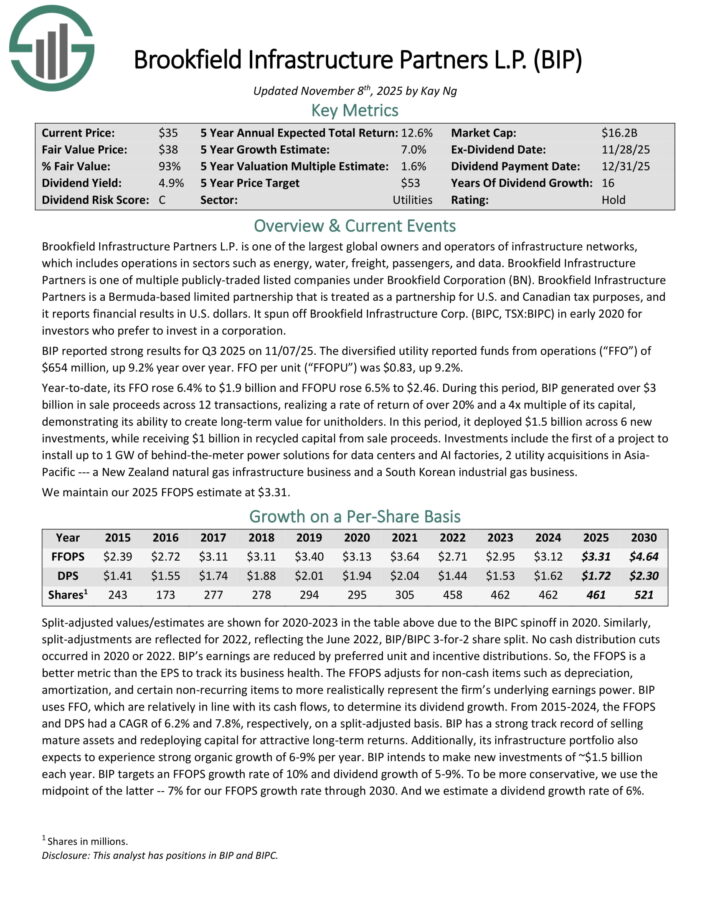

Highest-Yielding Canadian Utility Stock #3: Brookfield Infrastructure Partners LP (BIP)

Brookfield Infrastructure Partners L.P. is one of the largest global owners and operators of infrastructure networks, which includes operations in sectors such as energy, water, freight, passengers, and data.

Brookfield Infrastructure Partners is one of multiple publicly-traded listed companies under Brookfield Corporation (BN).

Brookfield Infrastructure Partners is a Bermuda-based limited partnership that is treated as a partnership for U.S. and Canadian tax purposes, and it reports financial results in U.S. dollars.

BIP reported strong results for Q3 2025 on 11/07/25. The diversified utility reported funds from operations (“FFO”) of $654 million, up 9.2% year over year. FFO per unit (“FFOPU”) was $0.83, up 9.2%.

Year-to-date, its FFO rose 6.4% to $1.9 billion and FFOPU rose 6.5% to $2.46. During this period, BIP generated over $3 billion in sale proceeds across 12 transactions, realizing a rate of return of over 20% and a 4x multiple of its capital, demonstrating its ability to create long-term value for unitholders.

In this period, it deployed $1.5 billion across 6 new investments, while receiving $1 billion in recycled capital from sale proceeds.

Click here to download our most recent Sure Analysis report on BIP (preview of page 1 of 3 shown below):

Highest-Yielding Canadian Utility Stock #2: Brookfield Renewable Partners LP (BEP)

Brookfield Renewable Partners L.P. operates one of the world’s largest portfolios of publicly traded renewable power assets.

Its portfolio consists of about 46,000 megawatts of capacity in North America, South America, Europe, and Asia.

In early November, BEP reported (11/5/25) results for the third quarter of 2025. Its funds from operations (FFO) per unit grew 9.5%, from $0.42 to $0.46, thanks to asset development and acquisitions.

Management stated that it expects the exceptionally strong performance of this segment to remain in place for at least the remainder of this year. BEP is resilient to high inflation, as about 70% of its contracts are indexed to inflation and most of its costs are fixed.

The objective of BEP as a publicly traded partnership is “to deliver long-term annualized total returns of 12%-15%, including annual distribution increases of 5%-9% from organic cash flow growth and project development”.

Click here to download our most recent Sure Analysis report on BEP (preview of page 1 of 3 shown below):

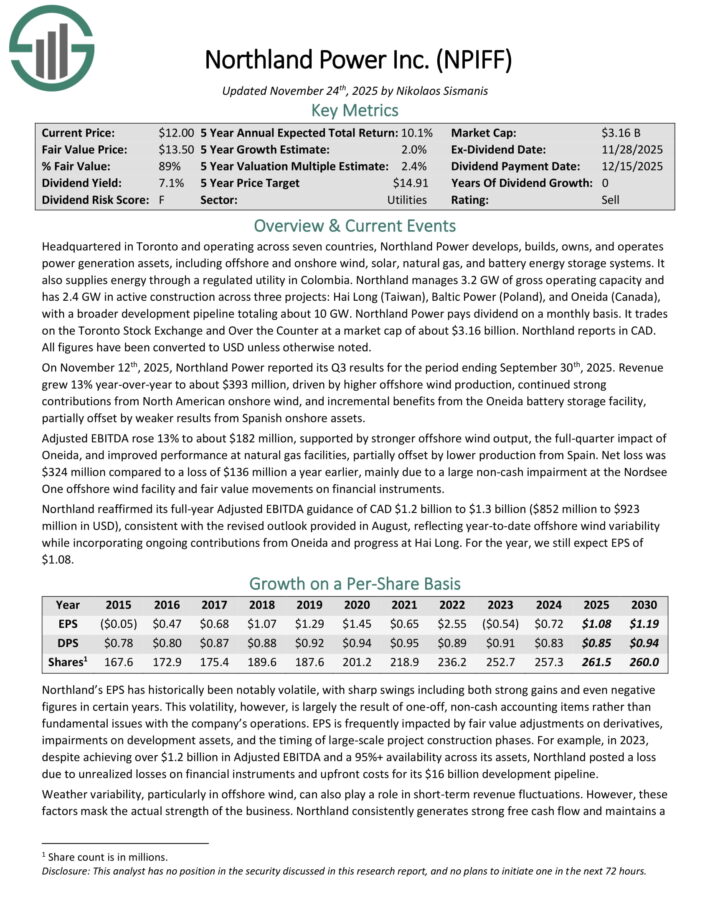

Highest-Yielding Canadian Utility Stock #1: Northland Power (NPIFF)

Northland Power develops, builds, owns, and operates power generation assets, including offshore and onshore wind, solar, natural gas, and battery energy storage systems. It also supplies energy through a regulated utility in Colombia.

Northland manages 3.2 GW of gross operating capacity and has 2.4 GW in active construction across three projects: Hai Long (Taiwan), Baltic Power (Poland), and Oneida (Canada), with a broader development pipeline totaling about 10 GW.

On November 12th, 2025, Northland Power reported its Q3 results for the period ending September 30th, 2025. Revenue grew 13% year-over-year to about $393 million, driven by higher offshore wind production, continued strong contributions from North American onshore wind, and incremental benefits from the Oneida battery storage facility, partially offset by weaker results from Spanish onshore assets.

Adjusted EBITDA rose 13% to about $182 million, supported by stronger offshore wind output, the full-quarter impact of Oneida, and improved performance at natural gas facilities, partially offset by lower production from Spain.

Net loss was $324 million compared to a loss of $136 million a year earlier, mainly due to a large non-cash impairment at the Nordsee One offshore wind facility and fair value movements on financial instruments.

Northland reaffirmed its full-year Adjusted EBITDA guidance of CAD $1.2 billion to $1.3 billion ($852 million to $923 million in USD).

Click here to download our most recent Sure Analysis report on NPIFF (preview of page 1 of 3 shown below):

Final Thoughts

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].