Updated on October 21st, 2025 by Bob Ciura

Investing in defense stocks has been a big win for shareholders. As of this writing, the iShares Dow Jones U.S. Aerospace & Defense ETF (ITA) generated annualized total returns of approximately 12.7% per year over the past 10 years.

With this in mind, we created a downloadable spreadsheet that focuses on defense stocks.

The list was derived from two major defense industry-focused exchange traded funds, ITA and the SPDR S&P Aerospace & Defense ETF (XAR).

You can download an Excel spreadsheet of all defense stocks (with metrics that matter such as dividend yields and price-to-earnings ratios) by clicking the link below:

Is there more room for these stocks to run going forward?

This article will look at the top 5 defense stocks according to the Sure Analysis Research Database.

We rank these defense stocks by our expected 5-year expected returns, which includes a combination of current dividend yield, expected annual EPS growth, and any change in the valuation multiple.

Table of Contents

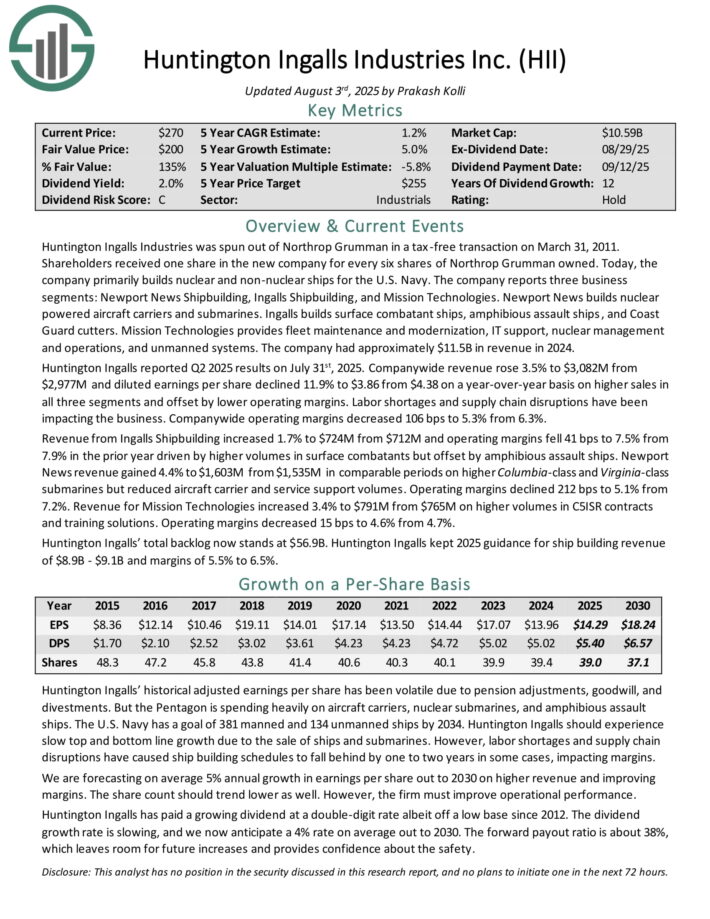

Defense Stock #5: Huntington Ingalls Industries Inc. (HII)

Estimated Annual Returns: 0.0%

Huntington Ingalls Industries primarily builds nuclear and non-nuclear ships for the U.S. Navy. The company reports three business segments: Newport News Shipbuilding, Ingalls Shipbuilding, and Mission Technologies. Newport News builds nuclear powered aircraft carriers and submarines.

Ingalls builds surface combatant ships, amphibious assault ships, and Coast Guard cutters. Mission Technologies provides fleet maintenance and modernization, IT support, nuclear management and operations, and unmanned systems. The company had approximately $11.5B in revenue in 2024.

Huntington Ingalls reported Q2 2025 results on July 31st, 2025. Company-wide revenue rose 3.5% and diluted earnings per share declined 11.9% to $3.86 from $4.38 on a year-over-year basis on higher sales in all three segments and offset by lower operating margins.

Labor shortages and supply chain disruptions have been impacting the business. Companywide operating margins decreased 106 bps to 5.3% from 6.3%.

Revenue from Ingalls Shipbuilding increased 1.7% to $724M from $712M and operating margins fell 41 bps to 7.5% from 7.9% in the prior year driven by higher volumes in surface combatants but offset by amphibious assault ships.

Newport News revenue gained 4.4% to $1,603M from $1,535M in comparable periods on higher Columbia-class and Virginia-class submarines but reduced aircraft carrier and service support volumes.

Huntington Ingalls’ total backlog now stands at $56.9B. Huntington Ingalls kept 2025 guidance for ship building revenue of $8.9B – $9.1B and margins of 5.5% to 6.5%.

Click here to download our most recent Sure Analysis report on HII (preview of page 1 of 3 shown below):

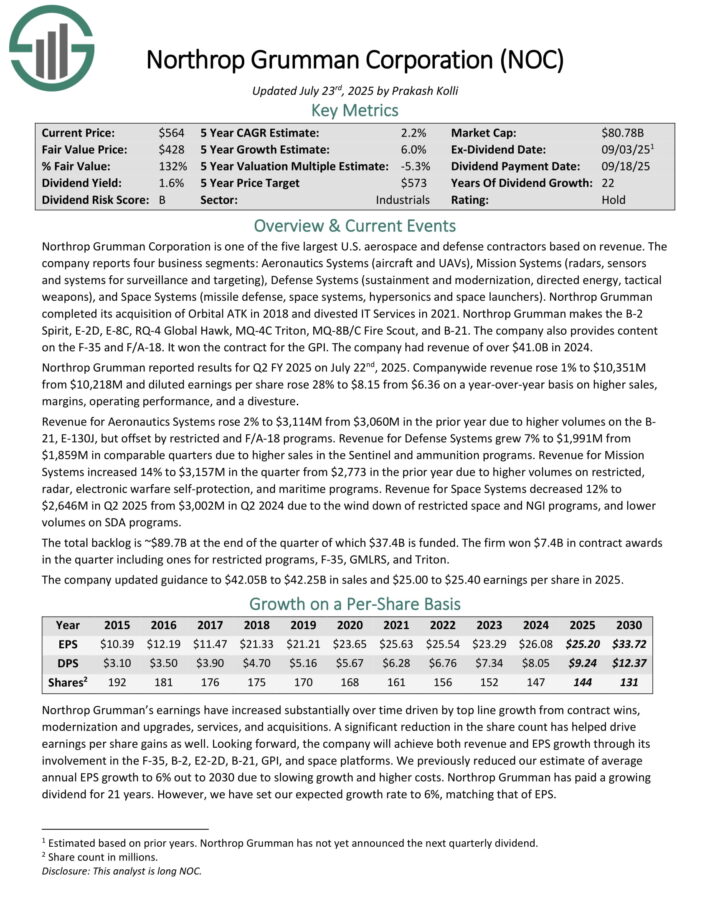

Defense Stock #4: Northrop Grumman (NOC)

Estimated Total Returns: 0.9%

Northrop Grumman Corporation reports four business segments: Aeronautics Systems (aircraft and UAVs), Mission Systems (radars, sensors and systems for surveillance and targeting), Defense Systems (sustainment and modernization, directed energy, tactical weapons), and Space Systems (missile defense, space systems, hypersonics and space launchers).

Northrop Grumman makes the B-2 Spirit, E-2D, E-8C, RQ-4 Global Hawk, MQ-4C Triton, and MQ-8B/C Fire Scout.

Northrop Grumman reported results for Q2 FY 2025 on July 22nd, 2025. Company-wide revenue rose 1% and diluted earnings per share rose 28% to $8.15 from $6.36 on a year-over-year basis on higher sales, margins, operating performance, and a divestiture.

The total backlog is ~$89.7B at the end of the quarter of which $37.4B is funded. The firm won $7.4B in contract awards in the quarter including ones for restricted programs, F-35, GMLRS, and Triton.

The company updated guidance to $42.05B to $42.25B in sales and $25.00 to $25.40 earnings per share in 2025.

Click here to download our most recent Sure Analysis report on NOC (preview of page 1 of 3 shown below):

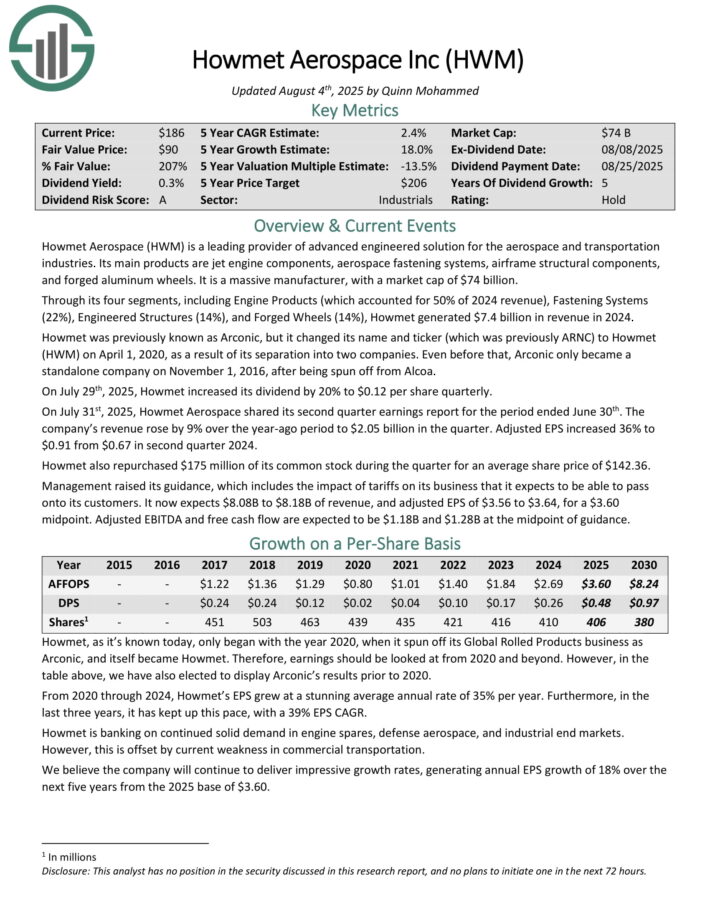

Defense Stock #3: Howmet Aerospace (HWM)

Estimated Annual Returns: 1.8%

Howmet Aerospace is a leading provider of advanced engineered solution for the aerospace and transportation industries. Its main products are jet engine components, aerospace fastening systems, airframe structural components, and forged aluminum wheels.

Through its four segments, including Engine Products (which accounted for 50% of 2024 revenue), Fastening Systems (22%), Engineered Structures (14%), and Forged Wheels (14%), Howmet generated $7.4 billion in revenue in 2024.

On July 29th, 2025, Howmet increased its dividend by 20% to $0.12 per share quarterly.

On July 31st, 2025, Howmet Aerospace shared its second quarter earnings report for the period ended June 30th. The company’s revenue rose by 9% over the year-ago period to $2.05 billion in the quarter. Adjusted EPS increased 36% to $0.91 from $0.67 in second quarter 2024.

Howmet also repurchased $175 million of its common stock during the quarter for an average share price of $142.36. Management raised its guidance, which includes the impact of tariffs on its business that it expects to be able to pass onto its customers.

It now expects $8.08B to $8.18B of revenue, and adjusted EPS of $3.56 to $3.64.

Click here to download our most recent Sure Analysis report on HWM (preview of page 1 of 3 shown below):

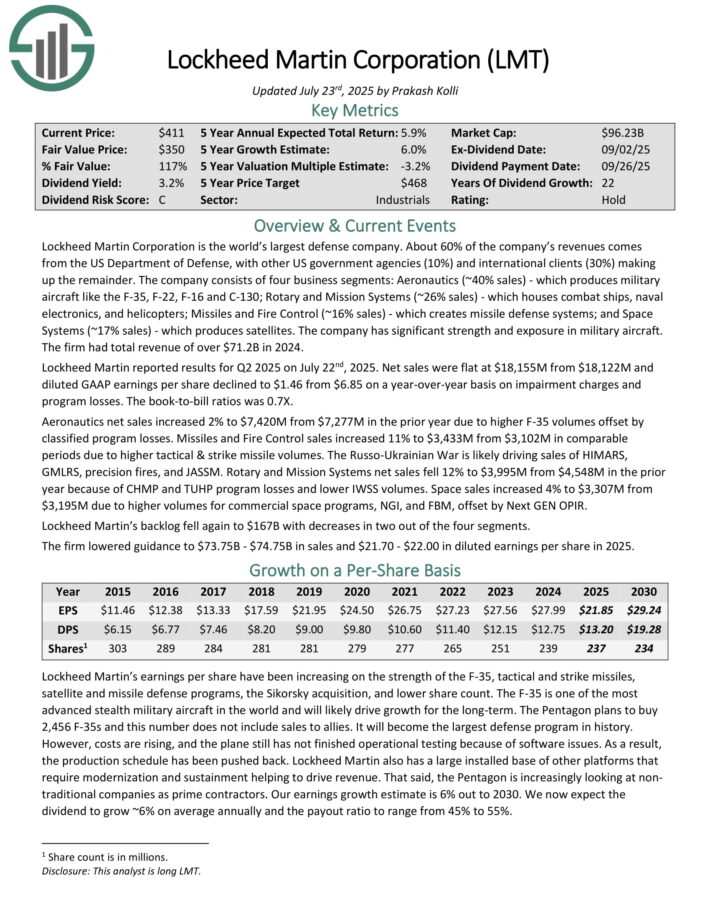

Defense Stock #2: Lockheed Martin (LMT)

Estimated Annual Returns: 1.8%

Lockheed Martin Corporation is the world’s largest defense company. About 60% of the company’s revenues comes from the US Department of Defense, with other US government agencies (10%) and international clients (30%) making up the remainder.

The company consists of four business segments: Aeronautics (~40% sales) – which produces military aircraft like the F-35, F-22, F-16 and C-130; Rotary and Mission Systems (~26% sales) – which houses combat ships, naval electronics, and helicopters; Missiles and Fire Control (~16% sales) – which creates missile defense systems; and Space Systems (~17% sales) – which produces satellites.

The company has significant strength and exposure in military aircraft. The firm had total revenue of over $71.2B in 2024.

Lockheed Martin reported results for Q2 2025 on July 22nd, 2025. Net sales were flat and diluted GAAP earnings per share declined to $1.46 from $6.85 on a year-over-year basis on impairment charges and program losses. The book-to-bill ratios was 0.7X.

Aeronautics net sales increased 2% to $7,420M from $7,277M in the prior year due to higher F-35 volumes offset by classified program losses. Missiles and Fire Control sales increased 11% in comparable periods due to higher tactical & strike missile volumes.

The Russo-Ukrainian War is likely driving sales of HIMARS, GMLRS, precision fires, and JASSM. Rotary and Mission Systems net sales fell 12% to $3,995M from $4,548M in the prior year because of CHMP and TUHP program losses and lower IWSS volumes.

Space sales increased 4% to $3,307M from $3,195M due to higher volumes for commercial space programs, NGI, and FBM, offset by Next GEN OPIR.

Lockheed Martin’s backlog fell again to $167B with decreases in two out of the four segments.

Click here to download our most recent Sure Analysis report on LMT (preview of page 1 of 3 shown below):

Defense Stock #1: General Dynamics (GD)

Estimated Annual Returns: 2.4%

General Dynamics has increased its dividend for over 30 years in a row. As a result, it is on the exclusive Dividend Aristocrats list.

General Dynamics operates four business divisions. Aerospace produces the high-end Gulf Stream private jet. Combat Systems makes combat vehicles like the Abrams battle tank.

The company’s Aerospace segment is focused on business jets and services while the remainder of the company is defense.

General Dynamics reported solid Q2 2025 results on July 23rd, 2025, beating estimates on more revenue in three of the four segments and better margins. Company-wide revenue rose 8.9% and diluted earnings per share increased 14.7% to $3.74 from $3.26 on a year-over-year basis.

Aerospace revenue rose 4.1% to $3,062M from $2,940M in the prior year. The total backlog is $18,903M, increasing for the first time in a year. Gulfstream’s book-to-bill ratio was 1.3X.

Revenue for Marine Systems increased 22.2% on the strength of the Columbia and Virginia-class submarine programs. The total segment backlog was down to $52,972M. Combat Systems revenue fell -0.2% to $2,283M from $2,288M. The total backlog fell to $16,577M because production exceeded orders.

International customers, M1 upgrade, and ammunition demand are increasing revenue. Technologies revenue increased 5.5%.

Click here to download our most recent Sure Analysis report on GD (preview of page 1 of 3 shown below):

Final Thoughts

Defense stocks have been among the hottest stocks in the market in the past decade. This has caused many stocks in this sector to reach valuations well above their historical average.

While defense stocks could continue to perform well, we encourage investors to wait for a pullback in several of these defense stocks due to valuation concerns.

Additional Reading

The following databases of stocks contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors.

The Dividend Achievers List is comprised of ~400 stocks with 10+ years of consecutive dividend increases.

The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].