Published on December 2nd, 2025 by Bob Ciura

Monthly dividend stocks have instant appeal for many income investors. Stocks that pay their dividends each month offer more frequent payouts than traditional quarterly or semi-annual dividend payers.

For this reason, we created a full list of 83 monthly dividend stocks.

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter like dividend yield and payout ratio) by clicking on the link below:

Investors in the US should not overlook Canadian stocks, many of which have higher dividend yields than their U.S.-based counterparts.

Note: Canada imposes a 15% dividend withholding tax on U.S. investors. In many cases, investing in Canadian stocks through a U.S. retirement account waives the dividend withholding tax from Canada, but check with your tax preparer or accountant for more on this issue.

With the average S&P 500 yield hovering around 1.3%, investors can generate much more income with high-yield stocks.

Screening for monthly dividend stocks that also have high dividend yields makes for an appealing combination.

This article will list the 10 highest-yielding Canadian monthly dividend stocks.

Table Of Contents

The following 10 Canadian monthly dividend stocks have high dividend yields above 5%. Stocks are listed by their dividend yields, from lowest to highest.

The list excludes oil and gas royalty trust, which have extreme fluctuations in their dividend payouts from one quarter to the next due to the underlying volatility of commodity prices. It also excludes REITs, BDCs, and MLPs, to focus only on common stocks.

You can instantly jump to an individual section of the article by utilizing the links below:

High-Yield Canadian Monthly Dividend Stock #10: Surge Energy (ZPTAF)

Surge Energy is a Calgary‑based independent oil and gas exploration, development and production company operating primarily in Alberta, Saskatchewan and Manitoba.

Surge holds a focused and operated portfolio of light and medium gravity crude oil assets, including large oil‑in‑place reservoirs with low recovery factors.

The company maintains a significant inventory of low-risk development drilling locations, including advancing water‑flood enhanced recovery projects, while retaining operator control and high working interests across its key plays.

On November 5th, 2025, Surge Energy reported its Q3 financial results for the period ending September 30th, 2025. Total revenue before hedging was approximately $101.7 million, based on average daily production of 23,622 boe/d, with crude oil representing about 88% of the mix.

Surge Energy generated about $49.7 million in adjusted funds flow, or $0.50 per share basic and $0.49 per share diluted, compared with about $51.6 million and $0.51 per share basic in the same quarter last year.

Click here to download our most recent Sure Analysis report on ZPTAF (preview of page 1 of 3 shown below):

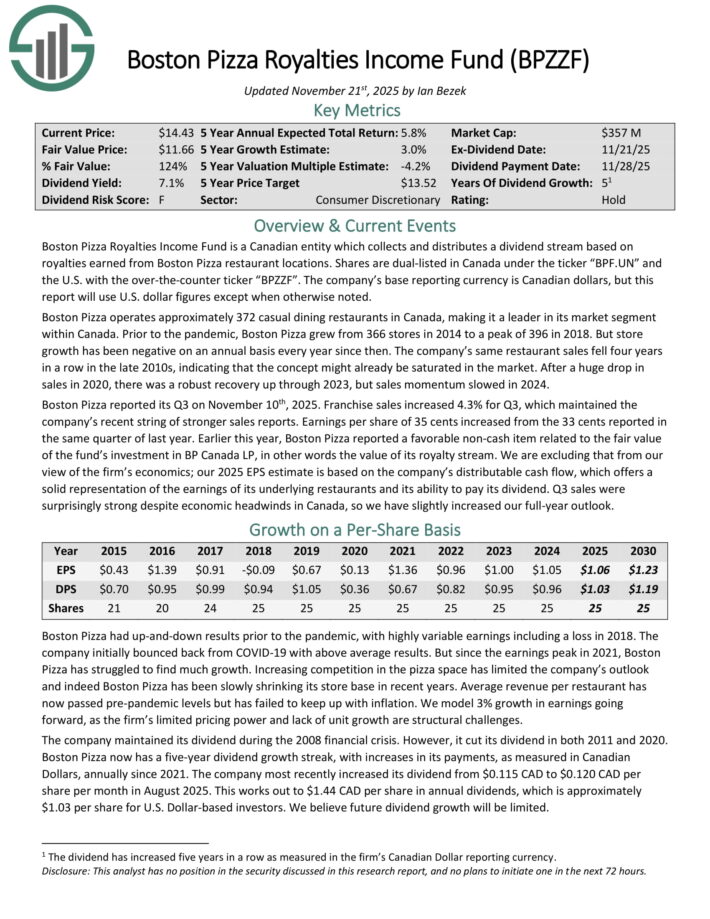

High-Yield Canadian Monthly Dividend Stock #9: Boston Pizza Royalties Income Fund (BPZZF)

Boston Pizza Royalties Income Fund is a Canadian entity which collects and distributes a dividend stream based on royalties earned from Boston Pizza restaurant locations.

Boston Pizza operates approximately 372 casual dining restaurants in Canada, making it a leader in its market segment within Canada. Prior to the pandemic, Boston Pizza grew from 366 stores in 2014 to a peak of 396 in 2018.

But store growth has been negative on an annual basis every year since then. The company’s same restaurant sales fell four years in a row in the late 2010s, indicating that the concept might already be saturated in the market.

After a huge drop in sales in 2020, there was a robust recovery up through 2023, but sales momentum slowed in 2024.

Boston Pizza reported its Q3 on November 10th, 2025. Franchise sales increased 4.3% for Q3, which maintained the company’s recent string of stronger sales reports.

Earnings per share of 35 cents increased from the 33 cents reported in the same quarter of last year.

Earlier this year, Boston Pizza reported a favorable non-cash item related to the fair value of the fund’s investment in BP Canada LP, in other words the value of its royalty stream.

Click here to download our most recent Sure Analysis report on BPZZF (preview of page 1 of 3 shown below):

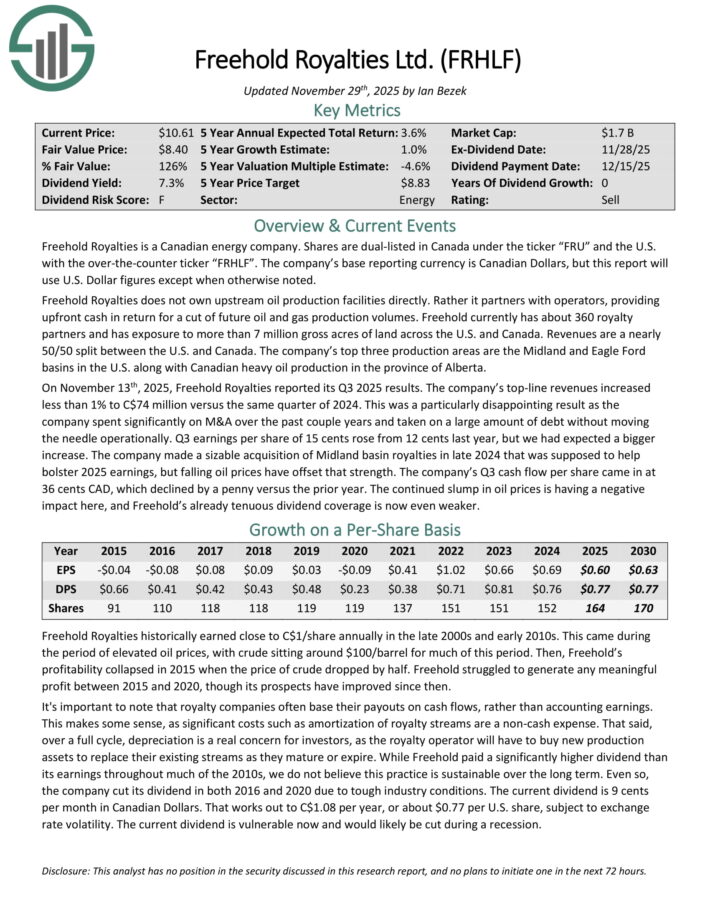

High-Yield Canadian Monthly Dividend Stock #8: Freehold Royalties (FRHLF)

Freehold Royalties is a Canadian energy company. It does not own upstream oil production facilities directly. Rather it partners with operators, providing upfront cash in return for a cut of future oil and gas production volumes.

Freehold currently has about 360 royalty partners and has exposure to more than 7 million gross acres of land across the U.S. and Canada. Revenues are a nearly 50/50 split between the U.S. and Canada.

The company’s top three production areas are the Midland and Eagle Ford basins in the U.S. along with Canadian heavy oil production in the province of Alberta.

On November 13th, 2025, Freehold Royalties reported its Q3 2025 results. The company’s top-line revenues increased less than 1% to C$74 million versus the same quarter of 2024.

This was a particularly disappointing result as the company spent significantly on M&A over the past couple years and taken on a large amount of debt without moving the needle operationally. Earnings per share of 15 cents rose from 12 cents last year, but we had expected a bigger increase.

The company made a sizable acquisition of Midland basin royalties in late 2024 that was supposed to help bolster 2025 earnings, but falling oil prices have offset that strength.

Cash flow per share came in at 36 cents CAD, which declined by a penny versus the prior year.

Click here to download our most recent Sure Analysis report on FRHLF (preview of page 1 of 3 shown below):

High-Yield Canadian Monthly Dividend Stock #7: Diversified Royalties Corp. (BEVFF)

Cardinal Energy is a Canadian oil and gas producer operating primarily in Alberta and Saskatchewan, with a strong focus on conventional light and medium oil.

Its operations are centered on mature, low-decline fields where enhanced oil recovery methods, like waterflooding and CO₂ injection, are actively used to maintain stable production.

The company manages a large inventory of vertical and horizontal wells tied into company-owned infrastructure, which supports efficient field operations and cost control.

With over 90% of production weighted to oil and NGLs, Cardinal’s day-to-day operations are heavily oil-driven, with ongoing maintenance, recompletions, and targeted infill drilling forming the backbone of its development activity.

On July 30th, 2025, Cardinal Energy reported its Q2 results for the period ending June 30th, 2025. Total revenue for the quarter was about $94.0 million, down 25% from the same period in 2024, primarily due to lower commodity prices.

Production averaged 21,184 boe/d, down 5% year-over-year, with oil and NGLs continuing to make up over 90% of the mix.

Operating income came in at $36.07 million, reflecting weaker pricing but partially offset by lower operating expenses. Diluted EPS was $0.073, down from $0.183 in the prior year.

Click here to download our most recent Sure Analysis report on CRLFF (preview of page 1 of 3 shown below):

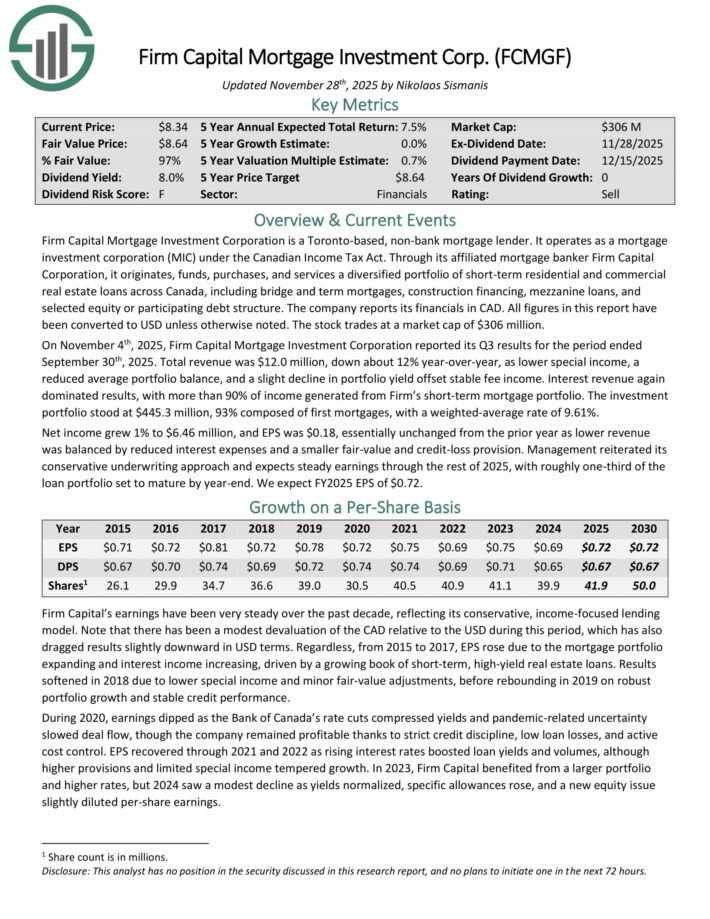

High-Yield Canadian Monthly Dividend Stock #6: Firm Capital Mortgage Investment (FCMGF)

Firm Capital Mortgage Investment Corporation is a Toronto-based, non-bank mortgage lender. It operates as a mortgage investment corporation (MIC) under the Canadian Income Tax Act.

Through its affiliated mortgage banker Firm Capital Corporation, it originates, funds, purchases, and services a diversified portfolio of short-term residential and commercial real estate loans across Canada, including bridge and term mortgages, construction financing, mezzanine loans, and selected equity or participating debt structure.

On November 4th, 2025, Firm Capital Mortgage Investment Corporation reported its Q3 results. Total revenue was $12.0 million, down about 12% year-over-year, as lower special income, a reduced average portfolio balance, and a slight decline in portfolio yield offset stable fee income.

Interest revenue again dominated results, with more than 90% of income generated from Firm’s short-term mortgage portfolio. The investment portfolio stood at $445.3 million, 93% composed of first mortgages, with a weighted-average rate of 9.61%.

Net income grew 1% to $6.46 million, and EPS was $0.18, essentially unchanged from the prior year as lower revenue was balanced by reduced interest expenses and a smaller fair-value and credit-loss provision.

Management reiterated its conservative underwriting approach and expects steady earnings through the rest of 2025, with roughly one-third of the loan portfolio set to mature by year-end.

Click here to download our most recent Sure Analysis report on FCMGF (preview of page 1 of 3 shown below):

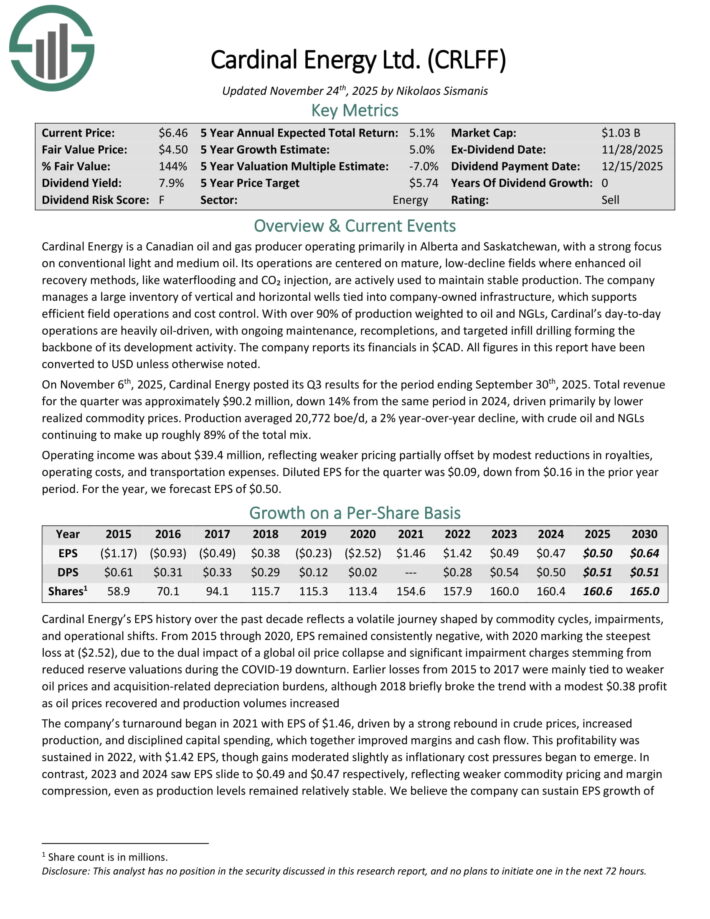

High-Yield Canadian Monthly Dividend Stock #5: Cardinal Energy Ltd. (CRLFF)

Cardinal Energy is a Canadian oil and gas producer operating primarily in Alberta and Saskatchewan, with a strong focus on conventional light and medium oil.

Its operations are centered on mature, low-decline fields where enhanced oil recovery methods, like waterflooding and CO₂ injection, are actively used to maintain stable production.

The company manages a large inventory of vertical and horizontal wells tied into company-owned infrastructure, which supports efficient field operations and cost control.

With over 90% of production weighted to oil and NGLs, Cardinal’s day-to-day operations are heavily oil-driven, with ongoing maintenance, recompletions, and targeted infill drilling forming the backbone of its development activity.

On November 6th, 2025, Cardinal Energy posted its Q3 results. Total revenue for the quarter was approximately $90.2 million, down 14% from the same period in 2024, driven primarily by lower realized commodity prices.

Production averaged 20,772 boe/d, a 2% year-over-year decline, with crude oil and NGLs continuing to make up roughly 89% of the total mix.

Operating income was about $39.4 million, reflecting weaker pricing partially offset by modest reductions in royalties, operating costs, and transportation expenses. Diluted EPS for the quarter was $0.09, down from $0.16 in the prior year period.

Click here to download our most recent Sure Analysis report on CRLFF (preview of page 1 of 3 shown below):

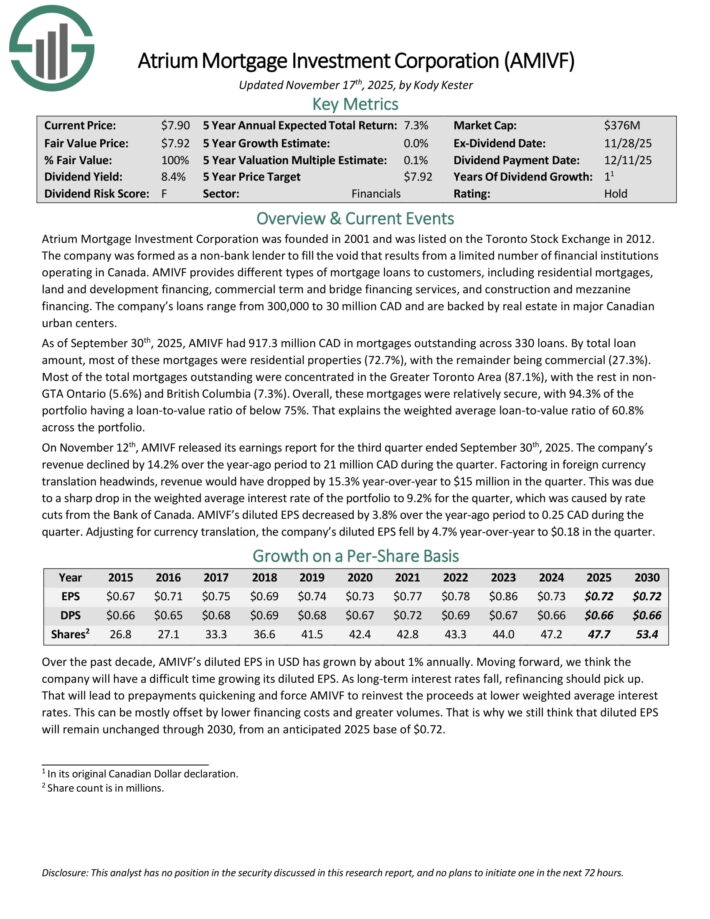

High-Yield Canadian Monthly Dividend Stock #4: Atrium Mortgage Investment Corp. (AMIVF)

Atrium Mortgage Investment Corporation was founded in 2001 and was listed on the Toronto Stock Exchange in 2012. AMIVF provides different types of mortgage loans to customers, including residential mortgages, land and development financing, commercial term and bridge financing services, and construction and mezzanine financing.

The company’s loans range from 300,000 to 30 million CAD and are backed by real estate in major Canadian urban centers.

As of September 30th, 2025, AMIVF had 917.3 million CAD in mortgages outstanding across 330 loans. By total loan amount, most of these mortgages were residential properties (72.7%), with the remainder being commercial (27.3%).

Most of the total mortgages outstanding were concentrated in the Greater Toronto Area (87.1%), with the rest in non-GTA Ontario (5.6%) and British Columbia (7.3%).

Overall, these mortgages were relatively secure, with 94.3% of the portfolio having a loan-to-value ratio of below 75%. That explains the weighted average loan-to-value ratio of 60.8% across the portfolio.

On November 12th, AMIVF released its earnings report for the third quarter ended September 30th, 2025. The company’s revenue declined by 14.2% over the year-ago period to 21 million CAD during the quarter.

Factoring in foreign currency translation headwinds, revenue would have dropped by 15.3% year-over-year to $15 million in the quarter. This was due to a sharp drop in the weighted average interest rate of the portfolio to 9.2% for the quarter, which was caused by rate cuts from the Bank of Canada.

AMIVF’s diluted EPS decreased by 3.8% over the year-ago period to 0.25 CAD during the quarter. Adjusting for currency translation, the company’s diluted EPS fell by 4.7% year-over-year to $0.18 in the quarter.

Click here to download our most recent Sure Analysis report on AMIVF (preview of page 1 of 3 shown below):

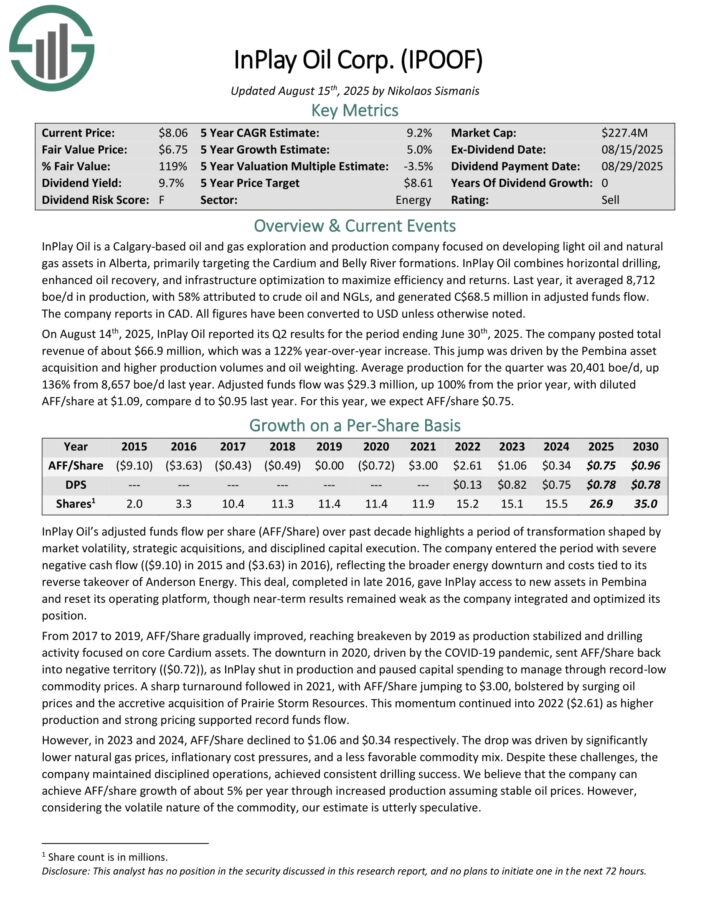

High-Yield Canadian Monthly Dividend Stock #3: InPlay Oil Corp. (IPOOF)

InPlay Oil is a Calgary-based oil and gas exploration and production company focused on developing light oil and natural gas assets in Alberta, primarily targeting the Cardium and Belly River formations. InPlay Oil combines horizontal drilling, enhanced oil recovery, and infrastructure optimization to maximize efficiency and returns.

Last year, it averaged 8,712 boe/d in production, with 58% attributed to crude oil and NGLs, and generated C$68.5 million in adjusted funds flow.

InPlay Oil is a Calgary-based oil and gas exploration and production company focused on developing light oil and natural gas assets in Alberta, primarily targeting the Cardium and Belly River formations.

InPlay Oil combines horizontal drilling, enhanced oil recovery, and infrastructure optimization to maximize efficiency and returns. Last year, it averaged 8,712 boe/d in production, with 58% attributed to crude oil and NGLs, and generated C$68.5 million in adjusted funds flow.

On August 14th, 2025, InPlay Oil reported its Q2 results for the period ending June 30th, 2025. The company posted total revenue of about $66.9 million, which was a 122% year-over-year increase. This jump was driven by the Pembina asset acquisition and higher production volumes and oil weighting.

Average production for the quarter was 20,401 boe/d, up 136% from 8,657 boe/d last year. Adjusted funds flow was $29.3 million, up 100% from the prior year, with diluted AFF/share at $1.09, compare d to $0.95 last year.

Click here to download our most recent Sure Analysis report on IPOOF (preview of page 1 of 3 shown below):

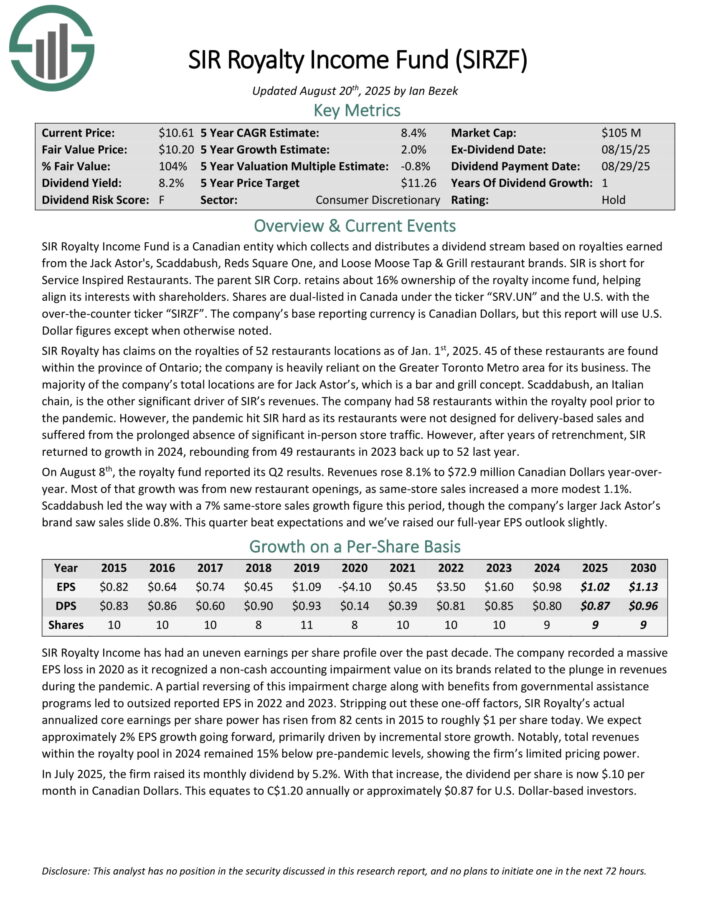

High-Yield Canadian Monthly Dividend Stock #2: SIR Royalty Income Fund (SIRZF)

SIR Royalty Income Fund is a Canadian entity which collects and distributes a dividend stream based on royalties earned from the Jack Astor’s, Scaddabush, Reds Square One, and Loose Moose Tap & Grill restaurant brands.

The parent SIR Corp. retains about 16% ownership of the royalty income fund, helping align its interests with shareholders.

SIR Royalty has claims on the royalties of 52 restaurants locations as of Jan. 1st, 2025. 45 of these restaurants are found within the province of Ontario; the company is heavily reliant on the Greater Toronto Metro area for its business.

The majority of the company’s total locations are for Jack Astor’s, which is a bar and grill concept. Scaddabush, an Italian chain, is the other significant driver of SIR’s revenues.

On August 8th, the royalty fund reported its Q2 results. Revenues rose 8.1% to $72.9 million Canadian Dollars year-over-year. Most of that growth was from new restaurant openings, as same-store sales increased a more modest 1.1%.

Scaddabush led the way with a 7% same-store sales growth figure this period, though the company’s larger Jack Astor’s brand saw sales slide 0.8%.

Click here to download our most recent Sure Analysis report on SIRZF (preview of page 1 of 3 shown below):

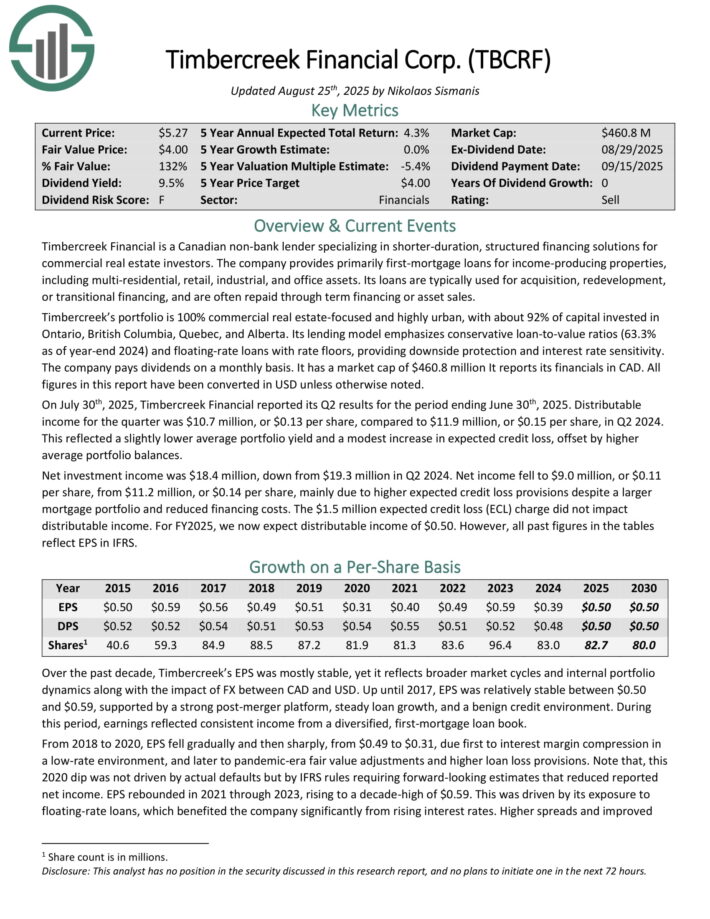

High-Yield Canadian Monthly Dividend Stock #1: Timbercreek Financial Corp. (TBCRF)

Timbercreek Financial is a Canadian non-bank lender specializing in shorter-duration, structured financing solutions for commercial real estate investors.

The company provides primarily first-mortgage loans for income-producing properties, including multi-residential, retail, industrial, and office assets. Its loans are typically used for acquisition, redevelopment, or transitional financing, and are often repaid through term financing or asset sales.

Timbercreek’s portfolio is 100% commercial real estate-focused and highly urban, with about 92% of capital invested in Ontario, British Columbia, Quebec, and Alberta.

On July 30th, 2025, Timbercreek Financial reported its Q2 results. Distributable income for the quarter was $10.7 million, or $0.13 per share, compared to $11.9 million, or $0.15 per share, in Q2 2024.

This reflected a slightly lower average portfolio yield and a modest increase in expected credit loss, offset by higher average portfolio balances.

Net investment income was $18.4 million, down from $19.3 million in Q2 2024. Net income fell to $9.0 million, or $0.11 per share, from $11.2 million, or $0.14 per share, mainly due to higher expected credit loss provisions despite a larger mortgage portfolio and reduced financing costs.

Click here to download our most recent Sure Analysis report on TBCRF (preview of page 1 of 3 shown below):

Final Thoughts

Monthly dividend stocks could be more appealing to income investors than quarterly or semi-annual dividend stocks. This is because monthly dividend stocks make 12 dividend payments per year, instead of the usual 4 or 2.

Furthermore, monthly dividend stocks with high yields above 5% are even more attractive for income investors.

The 10 stocks on this list have not been vetted for dividend safety, meaning each investor should understand the unique risk factors of each company.

That said, these 10 Canadian dividend stocks make monthly payments to shareholders, and all have high dividend yields.

Further Reading

If you are interested in finding high-yield Canadian stocks and/or monthly dividend stocks, the following Sure Dividend resources will be useful:

Monthly Dividend Stock Individual Security Research

Other Canadian Dividend Stocks Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].