Published on July 22nd, 2025 by Bob Ciura

The beauty of buy and hold forever dividend growth investing is that:

It takes very little work to maintain a portfolio.

Your passive income is likely to increase significantly over time.

High-quality dividend growth stocks tend to pay rising dividends year-after-year. This means a raise for investors every year. But the investor needs to do almost nothing to get their annual raise.

The only “work” required is to hold your dividend growth stocks so long as they continue to grow your income.

With the goal of annual dividend increases in mind, we created a list of over 130 Dividend Champions, each of which has increased its dividend for at least 25 consecutive years.

You can download your free copy of the Dividend Champions list, along with relevant financial metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the link below:

Annual dividend increases compound over time. The longer the time horizon, the greater your increased income for buying and holding.

Investors can expect many of the Dividend Champions to continue long-term dividend compounding far into the future.

This article will discuss the 10 Dividend Champions with the highest expected average annual dividend growth rates going forward.

Table of Contents

You can instantly jump to any specific section of the article by clicking on the links below:

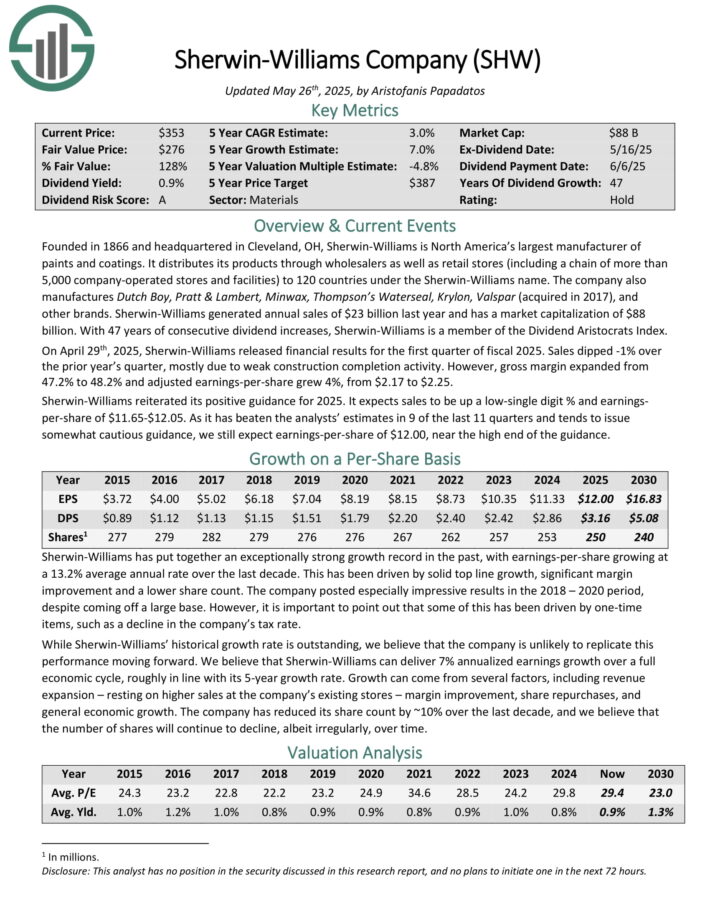

Long-Term Dividend Compounder #10: Sherwin-Williams Co. (SHW)

Annual Dividend Growth Rate: 10.0%

Sherwin-Williams is North America’s largest manufacturer of paints and coatings. It distributes its products through wholesalers as well as retail stores (including a chain of more than 5,000 company-operated stores and facilities) to 120 countries under the Sherwin-Williams name.

The company also manufactures Dutch Boy, Pratt & Lambert, Minwax, Thompson’s Waterseal, Krylon, Valspar (acquired in 2017), and other brands. Sherwin-Williams generated annual sales of $23 billion last year.

With 47 years of consecutive dividend increases, Sherwin-Williams is a member of the Dividend Aristocrats Index. On April 29th, 2025, Sherwin-Williams released financial results for the first quarter of fiscal 2025. Sales dipped -1% over the prior year’s quarter, mostly due to weak construction completion activity.

However, gross margin expanded from 47.2% to 48.2% and adjusted earnings-per-share grew 4%, from $2.17 to $2.25.

Sherwin-Williams reiterated its positive guidance for 2025. It expects sales to be up a low-single digit percentage, and earnings-per-share of $11.65-$12.05.

Click here to download our most recent Sure Analysis report on SHW (preview of page 1 of 3 shown below):

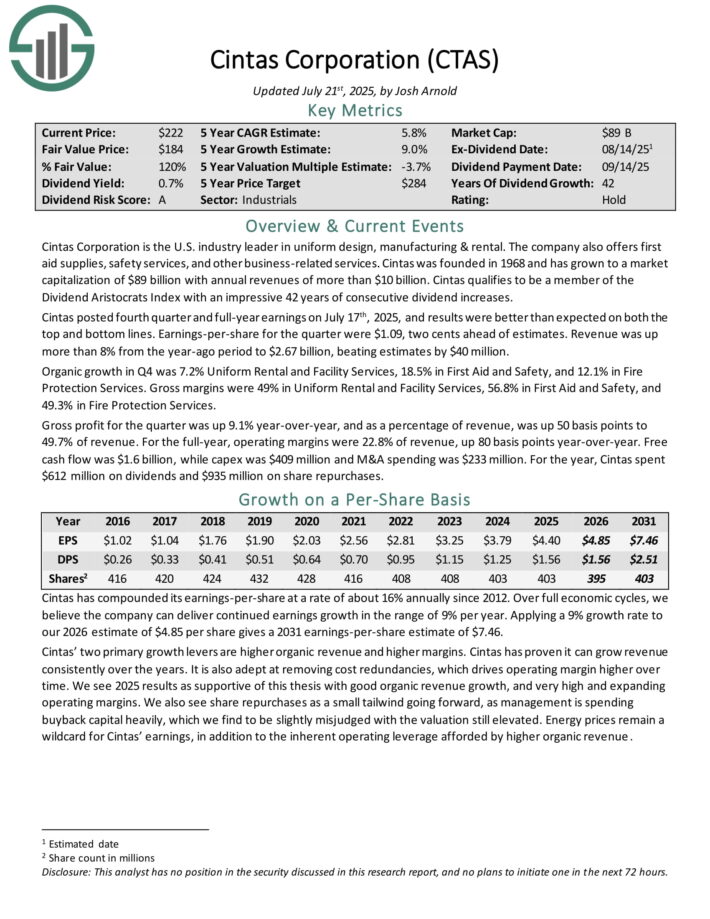

Long-Term Dividend Compounder #9: Cintas Corporation (CTAS)

Annual Dividend Growth Rate: 10.0%

Cintas Corporation is the U.S. industry leader in uniform design, manufacturing & rental. The company also offers first aid supplies, safety services, and other business-related services. Cintas was founded in 1968 and now generates annual revenues of more than $10 billion.

Cintas posted fourth quarter and full-year earnings on July 17th, 2025, and results were better than expected on both the top and bottom lines. Earnings-per-share for the quarter were $1.09, two cents ahead of estimates. Revenue was up more than 8% from the year-ago period to $2.67 billion, beating estimates by $40 million.

Organic growth in Q4 was 7.2% Uniform Rental and Facility Services, 18.5% in First Aid and Safety, and 12.1% in Fire Protection Services. Gross margins were 49% in Uniform Rental and Facility Services, 56.8% in First Aid and Safety, and 49.3% in Fire Protection Services.

Gross profit for the quarter was up 9.1% year-over-year, and as a percentage of revenue, was up 50 basis points to 49.7% of revenue. For the full-year, operating margins were 22.8% of revenue, up 80 basis points year-over-year. Free cash flow was $1.6 billion, while capex was $409 million and M&A spending was $233 million.

For the year, Cintas spent $612 million on dividends and $935 million on share repurchases.

Click here to download our most recent Sure Analysis report on CTAS (preview of page 1 of 3 shown below):

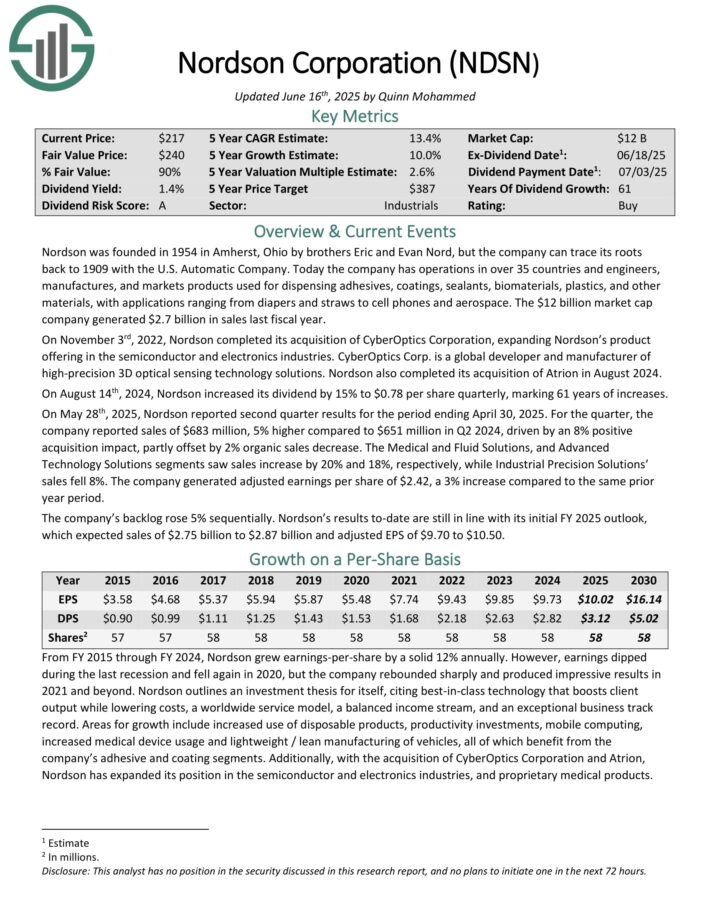

Long-Term Dividend Compounder #8: Nordson Corp. (NDSN)

Annual Dividend Growth Rate: 10.0%

Nordson was founded in 1954. Today the company has operations in over 35 countries and engineers, manufactures, and markets products used for dispensing adhesives, coatings, sealants, biomaterials, plastics, and other materials, with applications ranging from diapers and straws to cell phones and aerospace.

The company generated $2.7 billion in sales last fiscal year.

On May 28th, 2025, Nordson reported second quarter results for the period ending April 30, 2025. For the quarter, the company reported sales of $683 million, 5% higher compared to $651 million in Q2 2024, driven by an 8% positive acquisition impact, partly offset by 2% organic sales decrease.

The Medical and Fluid Solutions, and Advanced Technology Solutions segments saw sales increase by 20% and 18%, respectively, while Industrial Precision Solutions sales fell 8%. The company generated adjusted earnings per share of $2.42, a 3% increase compared to the same prior year period.

The company’s backlog rose 5% sequentially.

Click here to download our most recent Sure Analysis report on NDSN (preview of page 1 of 3 shown below):

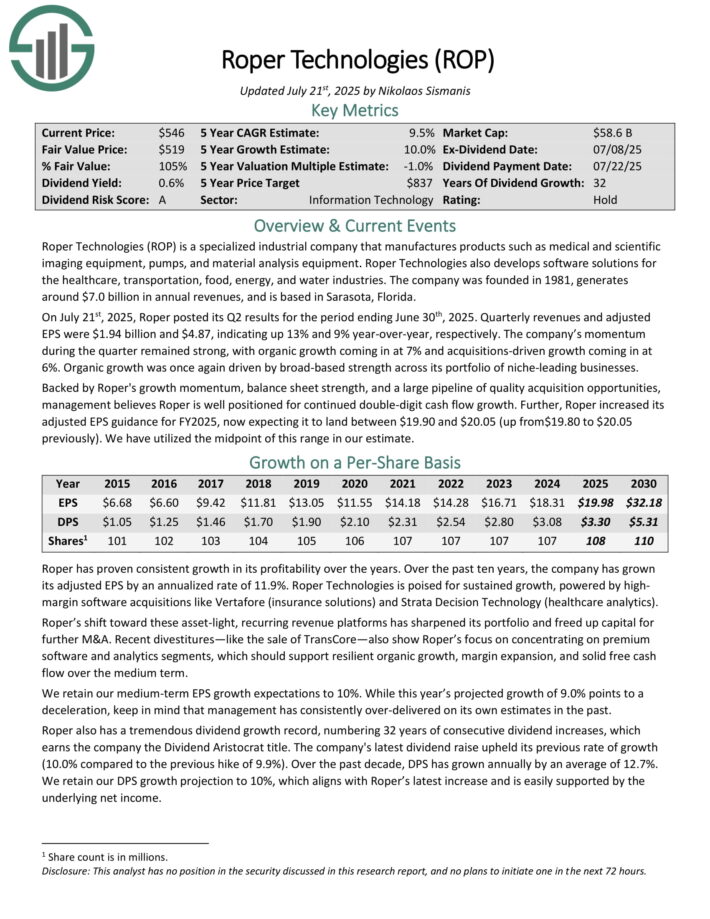

Long-Term Dividend Compounder #7: Roper Technologies (ROP)

Annual Dividend Growth Rate: 10.0%

Roper Technologies is a specialized industrial company that manufactures products such as medical and scientific imaging equipment, pumps, and material analysis equipment.

Roper Technologies also develops software solutions for the healthcare, transportation, food, energy, and water industries. The company was founded in 1981, generates around $7.0 billion in annual revenues, and is based in Sarasota, Florida.

On July 21st, 2025, Roper posted its Q2 results for the period ending June 30th, 2025. Quarterly revenues and adjusted EPS were $1.94 billion and $4.87, indicating up 13% and 9% year-over-year, respectively.

The company’s momentum during the quarter remained strong, with organic growth coming in at 7% and acquisitions-driven growth coming in at 6%. Organic growth was once again driven by broad-based strength across its portfolio of niche-leading businesses.

Backed by Roper’s growth momentum, balance sheet strength, and a large pipeline of quality acquisition opportunities, management believes Roper is well positioned for continued double-digit cash flow growth.

Further, Roper increased its adjusted EPS guidance for FY2025, now expecting it to land between $19.90 and $20.05.

Click here to download our most recent Sure Analysis report on ROP (preview of page 1 of 3 shown below):

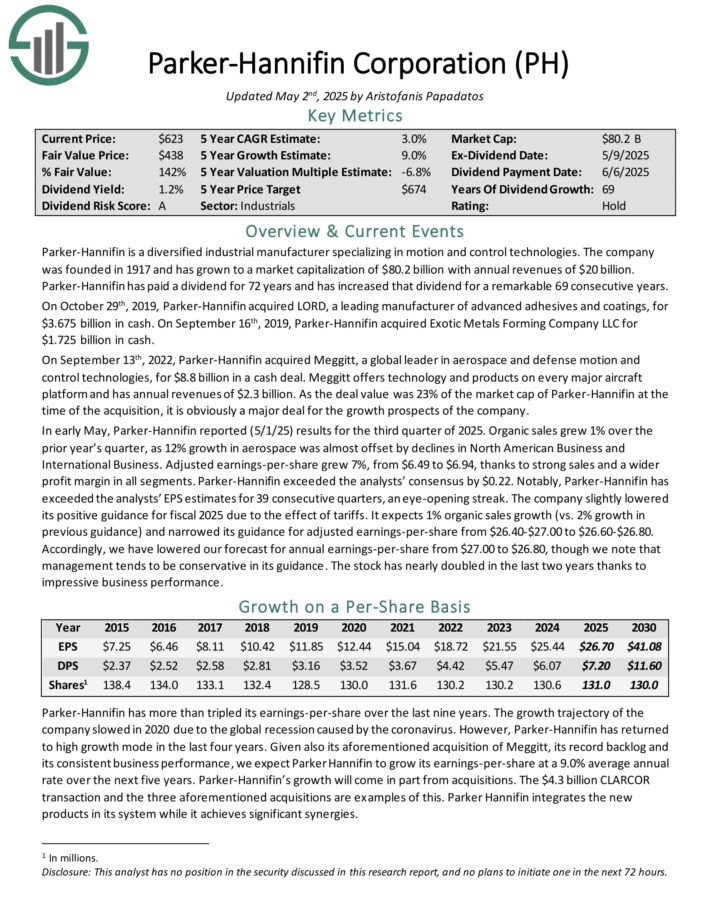

Long-Term Dividend Compounder #6: Parker-Hannifin Corp. (PH)

Annual Dividend Growth Rate: 10.0%

Parker-Hannifin is a diversified industrial manufacturer specializing in motion and control technologies. The company generates annual revenues of $20 billion.

Parker-Hannifin has increased the dividend for 69 consecutive years.

Source: Investor Presentation

In early May, Parker-Hannifin reported (5/1/25) results for the third quarter of 2025. Organic sales grew 1% over the prior year’s quarter, as 12% growth in aerospace was almost offset by declines in North American Business and International Business.

Adjusted earnings-per-share grew 7%, from $6.49 to $6.94, thanks to strong sales and a wider profit margin in all segments.

Parker-Hannifin exceeded the analysts’ consensus by $0.22. Notably, Parker-Hannifin has exceeded the analysts’ EPS estimates for 39 consecutive quarters.

Click here to download our most recent Sure Analysis report on Parker-Hannifin (preview of page 1 of 3 shown below):

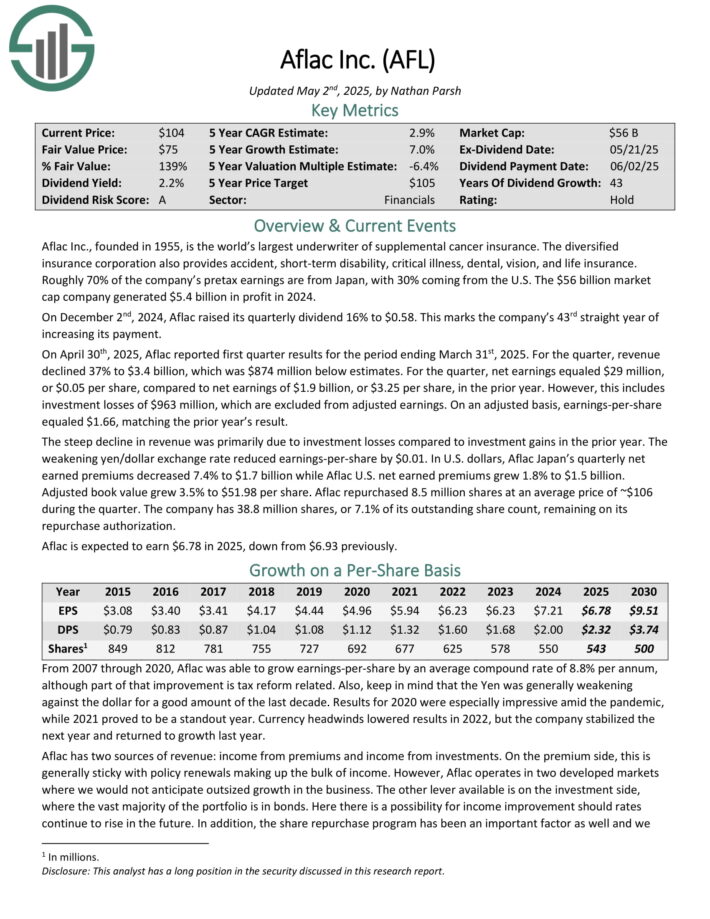

Long-Term Dividend Compounder #5: Aflac Inc. (AFL)

Annual Dividend Growth Rate: 10.0%

Aflac Inc., founded in 1955, is the world’s largest underwriter of supplemental cancer insurance. The diversified insurance corporation also provides accident, short-term disability, critical illness, dental, vision, and life insurance.

Roughly 70% of the company’s pretax earnings are from Japan, with 30% coming from the U.S. The company generated $5.4 billion in profit in 2024.

On April 30th, 2025, Aflac reported first quarter results for the period ending March 31st, 2025. For the quarter, revenue declined 37% to $3.4 billion, which was $874 million below estimates. For the quarter, net earnings equaled $29 million, or $0.05 per share, compared to net earnings of $1.9 billion, or $3.25 per share, in the prior year.

However, this includes investment losses of $963 million, which are excluded from adjusted earnings. On an adjusted basis, earnings-per-share equaled $1.66, matching the prior year’s result.

The steep decline in revenue was primarily due to investment losses compared to investment gains in the prior year. The weakening yen/dollar exchange rate reduced earnings-per-share by $0.01. In U.S. dollars, Aflac Japan’s quarterly net earned premiums decreased 7.4% to $1.7 billion while Aflac U.S. net earned premiums grew 1.8% to $1.5 billion.

Adjusted book value grew 3.5% to $51.98 per share.

Click here to download our most recent Sure Analysis report on AFL (preview of page 1 of 3 shown below):

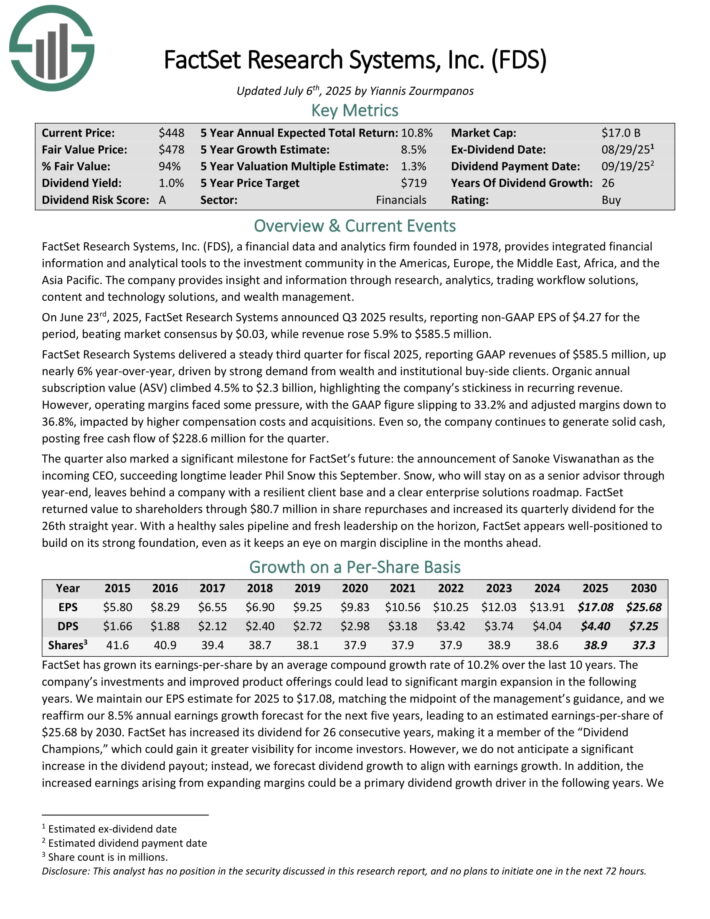

Long-Term Dividend Compounder #4: Factset Research Systems (FDS)

Annual Dividend Growth Rate: 10.5%

FactSet Research Systems, a financial data and analytics firm founded in 1978, provides integrated financial information and analytical tools to the investment community in the Americas, Europe, the Middle East, Africa, and Asia-Pacific.

The company provides insight and information through research, analytics, trading workflow solutions, content and technology solutions, and wealth management.

On June 23rd, 2025, FactSet Research Systems announced Q3 2025 results, reporting non-GAAP EPS of $4.27 for the period, beating market consensus by $0.03, while revenue rose 5.9% to $585.5 million.

It delivered a steady third quarter for fiscal 2025, reporting GAAP revenues of $585.5 million, up nearly 6% year-over-year, driven by strong demand from wealth and institutional buy-side clients.

Organic annual subscription value (ASV) climbed 4.5% to $2.3 billion, highlighting the company’s stickiness in recurring revenue.

However, operating margins faced some pressure, with the GAAP figure slipping to 33.2% and adjusted margins down to 36.8%, impacted by higher compensation costs and acquisitions.

Even so, the company continues to generate solid cash, posting free cash flow of $228.6 million for the quarter.

FactSet returned value to shareholders through $80.7 million in share repurchases and increased its quarterly dividend for the 26th straight year.

Click here to download our most recent Sure Analysis report on FDS (preview of page 1 of 3 shown below):

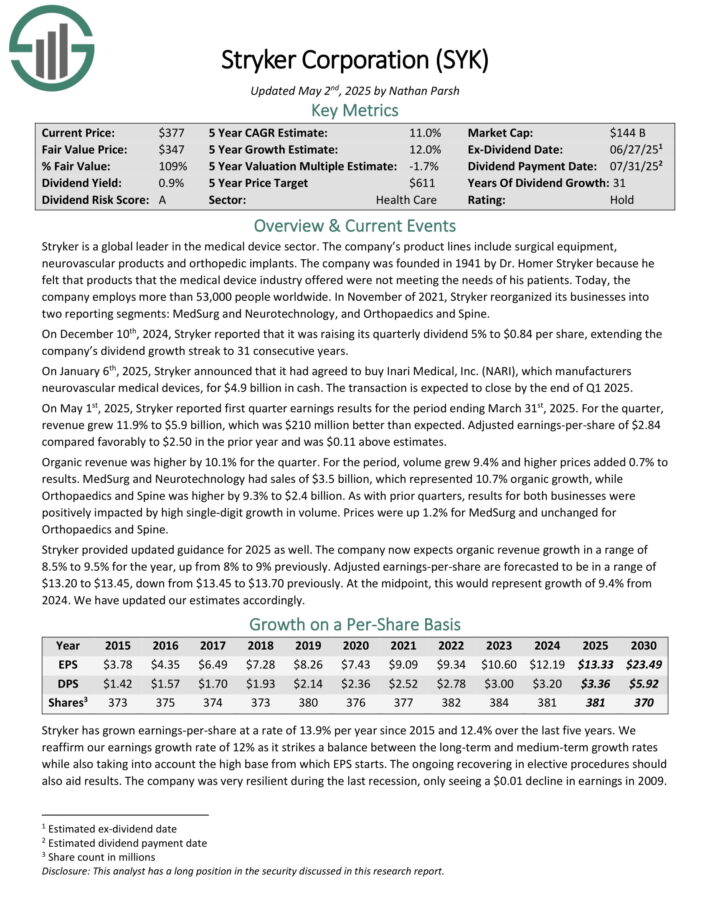

Long-Term Dividend Compounder #3: Stryker Corp. (SYK)

Annual Dividend Growth Rate: 12.0%

Stryker is a global leader in the medical device sector. The company’s product lines include surgical equipment, neurovascular products and orthopedic implants.

On December 10th, 2024, Stryker reported that it was raising its quarterly dividend 5% to $0.84 per share, extending the company’s dividend growth streak to 31 consecutive years.

On January 6th, 2025, Stryker announced that it had agreed to buy Inari Medical, Inc. (NARI), which manufacturers neurovascular medical devices, for $4.9 billion in cash. The transaction is expected to close by the end of Q1 2025.

On May 1st, 2025, Stryker reported first quarter earnings results for the period ending March 31st, 2025. For the quarter, revenue grew 11.9% to $5.9 billion, which was $210 million better than expected.

Adjusted earnings-per-share of $2.84 compared favorably to $2.50 in the prior year and was $0.11 above estimates.

Organic revenue was higher by 10.1% for the quarter. For the period, volume grew 9.4% and higher prices added 0.7% to results.

MedSurg and Neurotechnology had sales of $3.5 billion, which represented 10.7% organic growth, while Orthopaedics and Spine was higher by 9.3% to $2.4 billion.

Click here to download our most recent Sure Analysis report on SYK (preview of page 1 of 3 shown below):

Long-Term Dividend Compounder #2: Nucor Corp. (NUE)

Annual Dividend Growth Rate: 12.7%

Nucor is the largest publicly traded US-based steel corporation based on its market capitalization. The steel industry is notoriously cyclical, which makes Nucor’s streak of 52 consecutive years of dividend increases even more remarkable.

On April 28, 2025, Nucor Corporation reported its financial results for the first quarter of 2025. The company posted net earnings attributable to stockholders of $156 million, or $0.67 per diluted share, a significant decrease from $845 million, or $3.46 per share, in the same quarter of the previous year.

Adjusted net earnings, excluding one-time charges related to facility closures and repurposing, were $179 million, or $0.77 per share, surpassing analyst expectations of $0.64 per share.

Net sales for the quarter were $7.83 billion, down 4% year-over-year but up 11% sequentially, driven by a 10% increase in total shipments to 6.83 million tons, despite a 12% decline in average sales price per ton compared to the first quarter of 2024.

Click here to download our most recent Sure Analysis report on NUE (preview of page 1 of 3 shown below):

Long-Term Dividend Compounder #1: Badger Meter (BMI)

Annual Dividend Growth Rate: 15.0%

Badger Meter was founded in 1905 in Milwaukee, WI. The company’s first product was a “frost proof” water meter. Today, Badger Meter manufactures and markets meters and valves that are used to measure and control the flow of liquids, such as water, oil and various chemicals.

The company’s products are also used to control the flow of air and other gases. Badger Meter generates ~$925 million in annual revenues.

On April 17th, 2025, Badger Meter reported first quarter earnings results for the period ending March 31st, 2025. For the quarter, revenue grew 13.25% to $222.2 million, which beat estimates by $1.44 million. Earnings-per-share of $1.30 compared favorably to earnings-per-share of $0.99 in the prior year and was $0.27 better than expected.

The utility water business grew 16% for the quarter, partially due to an acquisition. Excluding this, sales were up 12%. As with prior periods, this growth was led by higher demand for ORION Cellular endpoint, E-Series Ultrasonic meters, and BEACON Software as a Service.

Revenue for flow instrumentation products grew 5% year-over-year as gains in the water-focused end markets were once again offset by deemphasized applications globally.

Click here to download our most recent Sure Analysis report on BMI (preview of page 1 of 3 shown below):

Additional Reading

The Dividend Champions list is not the only way to quickly screen for stocks that regularly pay rising dividends.

The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 55 stocks with 50+ years of consecutive dividend increases.

The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].