Published on December 8th, 2025 by Bob Ciura

Usually, high dividend yields are a good thing. After all, the greater the dividend yield, the more income you are paid for your investment.

Income investing, and particular dividend reinvestment, allows investors to steadily grow their wealth over the long run.

With this in mind, we compiled a list of high dividend stocks with dividend yields above 5%. You can download your free copy of the high dividend stocks list by clicking on the link below:

High dividend stocks are naturally appealing on the surface, due to their high dividend yields.

But income investors need to make sure they do not fall into a dividend ‘trap’, meaning purchasing a stock solely due to its high yield, only to see the company cut or eliminate the dividend payout.

While there is never a guarantee a stock will not cut its dividend, focusing on stocks with strong underlying fundamentals and modest payout ratios can go a long way.

The stocks all have Dividend Risk Scores of ‘F’ (our lowest grades) in the Sure Analysis Research Database, with payout ratios above 100%, indicating their dividends are too high and unsustainable at the present levels.

As a result, all 10 stocks have sell ratings from Sure Dividend. The list is sorted by current yield, from lowest to highest.

Table of Contents

You can instantly jump to any specific section of the article by using the links below:

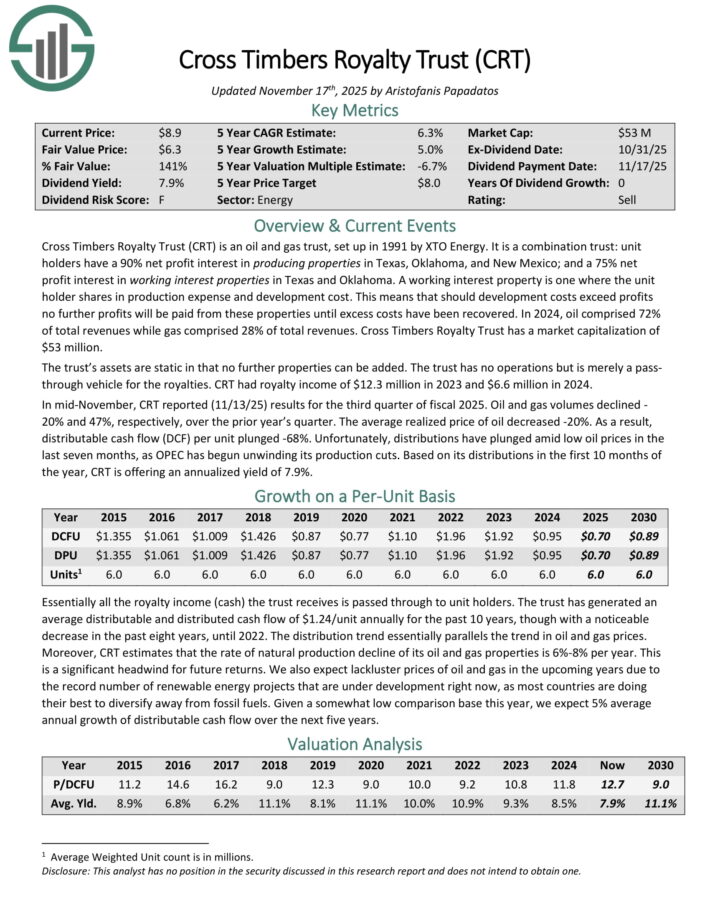

Too High Dividend Yield #10: Cross Timbers Royalty Trust (CRT)

Cross Timbers Royalty Trust (CRT) is an oil and gas trust, set up in 1991 by XTO Energy. It is a combination trust: unit holders have a 90% net profit interest in producing properties in Texas, Oklahoma, and New Mexico; and a 75% net profit interest in working interest properties in Texas and Oklahoma.

A working interest property is one where the unit holder shares in production expense and development cost. This means that should development costs exceed profits no further profits will be paid from these properties until excess costs have been recovered.

In 2024, oil comprised 72% of total revenues while gas comprised 28% of total revenues. The trust’s assets are static in that no further properties can be added.

The trust has no operations but is merely a pass-through vehicle for the royalties. CRT had royalty income of $12.3 million in 2023 and $6.6 million in 2024.

In mid-November, CRT reported (11/13/25) results for the third quarter of fiscal 2025. Oil and gas volumes declined 20% and 47%, respectively, over the prior year’s quarter. The average realized price of oil decreased -20%.

As a result, distributable cash flow (DCF) per unit plunged -68%. Unfortunately, distributions have plunged amid low oil prices in the last seven months, as OPEC has begun unwinding its production cuts.

Click here to download our most recent Sure Analysis report on CRT (preview of page 1 of 3 shown below):

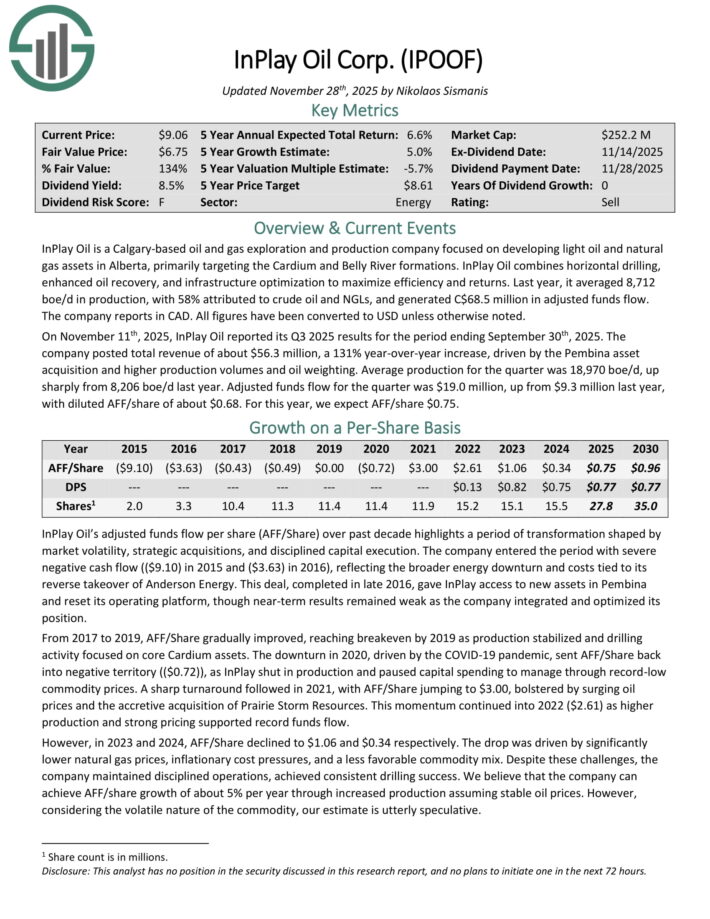

Too High Dividend Yield #9: InPlay Oil Corp. (IPOOF)

InPlay Oil is a Calgary-based oil and gas exploration and production company focused on developing light oil and natural gas assets in Alberta, primarily targeting the Cardium and Belly River formations. InPlay Oil combines horizontal drilling, enhanced oil recovery, and infrastructure optimization to maximize efficiency and returns.

Last year, it averaged 8,712 boe/d in production, with 58% attributed to crude oil and NGLs, and generated C$68.5 million in adjusted funds flow.

InPlay Oil is a Calgary-based oil and gas exploration and production company focused on developing light oil and natural gas assets in Alberta, primarily targeting the Cardium and Belly River formations.

InPlay Oil combines horizontal drilling, enhanced oil recovery, and infrastructure optimization to maximize efficiency and returns. Last year, it averaged 8,712 boe/d in production, with 58% attributed to crude oil and NGLs, and generated C$68.5 million in adjusted funds flow.

On November 11th, 2025, InPlay Oil reported its Q3 2025 results. The company posted total revenue of about $56.3 million, a 131% year-over-year increase, driven by the Pembina asset acquisition and higher production volumes and oil weighting.

Average production for the quarter was 18,970 boe/d, up sharply from 8,206 boe/d last year. Adjusted funds flow for the quarter was $19.0 million, up from $9.3 million last year, with diluted AFF/share of about $0.68.

Click here to download our most recent Sure Analysis report on IPOOF (preview of page 1 of 3 shown below):

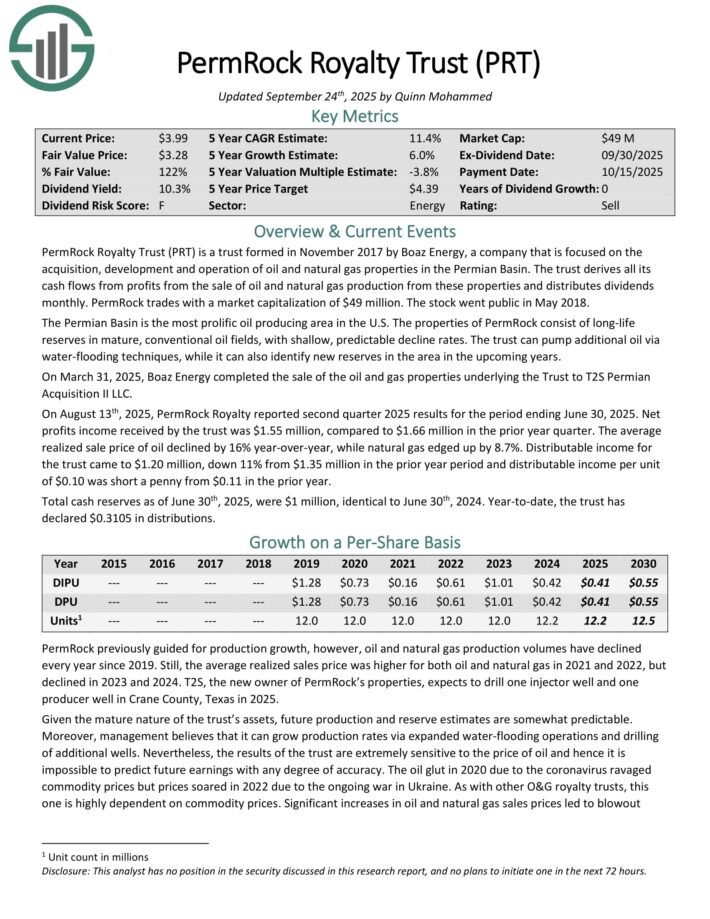

Too High Dividend Yield #8: PermRock Royalty Trust (PRT)

PermRock Royalty Trust is a trust formed in November 2017 by Boaz Energy, a company that is focused on the acquisition, development and operation of oil and natural gas properties in the Permian Basin.

The trust derives all its cash flows from profits from the sale of oil and natural gas production from these properties and distributes dividends monthly.

The Permian Basin is the most prolific oil producing area in the U.S. The properties of PermRock consist of long-life reserves in mature, conventional oil fields, with shallow, predictable decline rates.

The trust can pump additional oil via water-flooding techniques, while it can also identify new reserves in the area in the upcoming years.

On March 31, 2025, Boaz Energy completed the sale of the oil and gas properties underlying the Trust to T2S Permian Acquisition II LLC.

On August 13th, 2025, PermRock Royalty reported second quarter 2025 results for the period ending June 30, 2025. Net profits income received by the trust was $1.55 million, compared to $1.66 million in the prior year quarter.

The average realized sale price of oil declined by 16% year-over-year, while natural gas edged up by 8.7%.

Distributable income for the trust came to $1.20 million, down 11% from $1.35 million in the prior year period and distributable income per unit of $0.10 was short a penny from $0.11 in the prior year.

Total cash reserves as of June 30th, 2025, were $1 million, identical to June 30th, 2024. Year-to-date, the trust has declared $0.3105 in distributions.

Click here to download our most recent Sure Analysis report on PRT (preview of page 1 of 3 shown below):

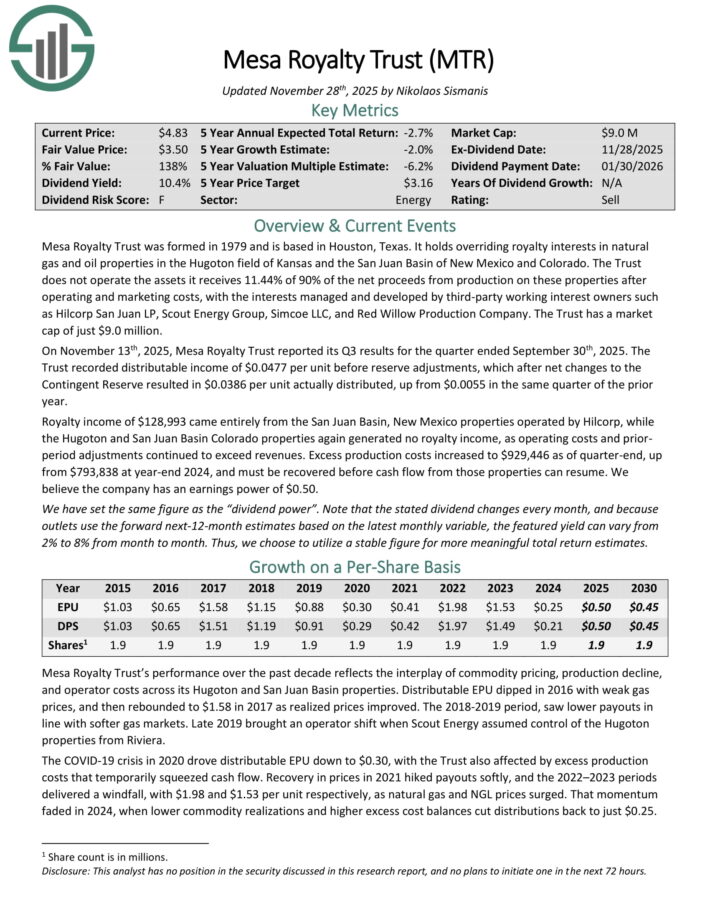

Too High Dividend Yield #7: Mesa Royalty Trust (MTR)

Mesa Royalty Trust was formed in 1979 and is based in Houston, Texas. It holds overriding royalty interests in natural gas and oil properties in the Hugoton field of Kansas and the San Juan Basin of New Mexico and Colorado.

The Trust does not operate the assets it receives 11.44% of 90% of the net proceeds from production on these properties after operating and marketing costs, with the interests managed and developed by third-party working interest owners such as Hilcorp San Juan LP, Scout Energy Group, Simcoe LLC, and Red Willow Production Company.

On November 13th, 2025, Mesa Royalty Trust reported its Q3 results for the quarter ended September 30th, 2025. The Trust recorded distributable income of $0.0477 per unit before reserve adjustments, which after net changes to the Contingent Reserve resulted in $0.0386 per unit actually distributed, up from $0.0055 in the same quarter of the prior year.

Royalty income of $128,993 came entirely from the San Juan Basin, New Mexico properties operated by Hilcorp, while the Hugoton and San Juan Basin Colorado properties again generated no royalty income, as operating costs and prior period adjustments continued to exceed revenues.

Excess production costs increased to $929,446 as of quarter-end, up from $793,838 at year-end 2024, and must be recovered before cash flow from those properties can resume. We believe the company has an earnings power of $0.50.

Click here to download our most recent Sure Analysis report on MTR (preview of page 1 of 3 shown below):

Too High Dividend Yield #6: Stellus Capital (SCM)

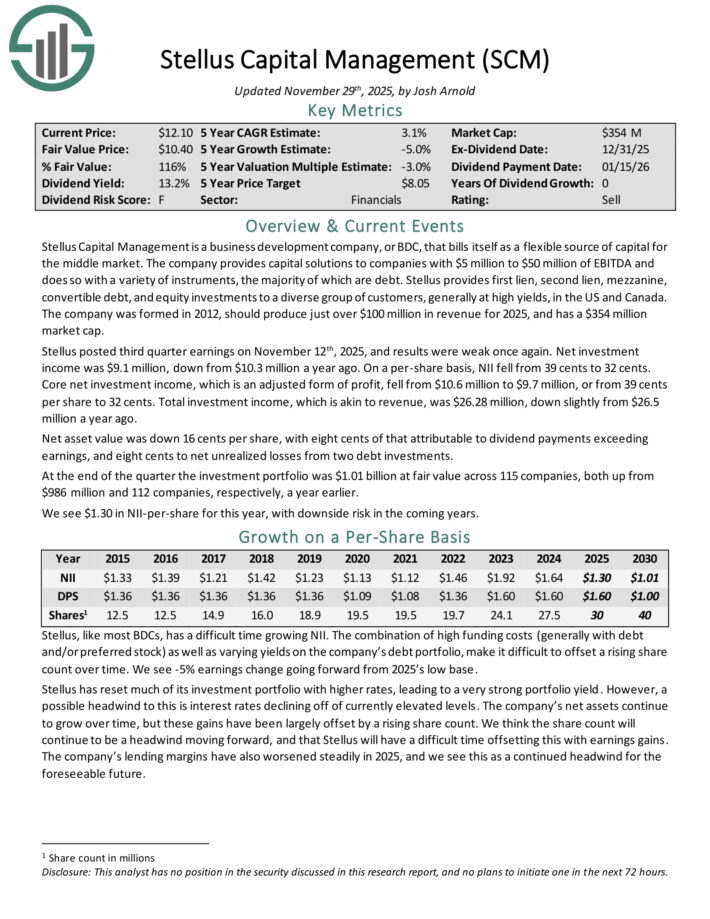

Stellus Capital Management is a business development company, or BDC, that bills itself as a flexible source of capital for the middle market.

The company provides capital solutions to companies with $5 million to $50 million of EBITDA and does so with a variety of instruments, the majority of which are debt.

Stellus provides first lien, second lien, mezzanine, convertible debt, and equity investments to a diverse group of customers, generally at high yields, in the US and Canada.

Stellus posted third quarter earnings on November 12th, 2025, and results were weak once again. Net investment income was $9.1 million, down from $10.3 million a year ago. On a per-share basis, NII fell from 39 cents to 32 cents.

Core net investment income, which is an adjusted form of profit, fell from $10.6 million to $9.7 million, or from 39 cents per share to 32 cents. Total investment income, which is akin to revenue, was $26.28 million, down slightly from $26.5 million a year ago.

Net asset value was down 16 cents per share, with eight cents of that attributable to dividend payments exceeding earnings, and eight cents to net unrealized losses from two debt investments.

At the end of the quarter the investment portfolio was $1.01 billion at fair value across 115 companies, both up from $986 million and 112 companies, respectively, a year earlier.

Click here to download our most recent Sure Analysis report on SCM (preview of page 1 of 3 shown below):

Too High Dividend Yield #5: Ellington Credit Co. (EARN)

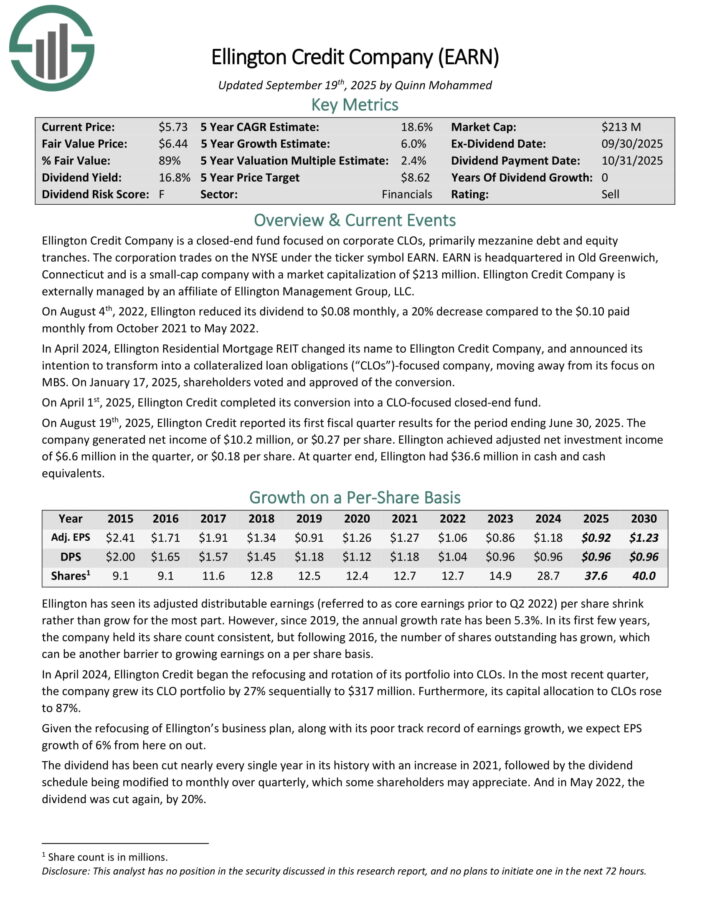

Ellington Credit Co. acquires, invests in, and manages residential mortgage and real estate related assets. Ellington focuses primarily on residential mortgage-backed securities, specifically those backed by a U.S. Government agency or U.S. government–sponsored enterprise.

Agency MBS are created and backed by government agencies or enterprises, while non-agency MBS are not guaranteed by the government.

On August 19th, 2025, Ellington Credit reported its first fiscal quarter results for the period ending June 30, 2025. The company generated net income of $10.2 million, or $0.27 per share.

Ellington achieved adjusted net investment income of $6.6 million in the quarter, or $0.18 per share. At quarter end, Ellington had $36.6 million in cash and cash equivalents.

Click here to download our most recent Sure Analysis report on EARN (preview of page 1 of 3 shown below):

Too High Dividend Yield #4: Horizon Technology Finance (HRZN)

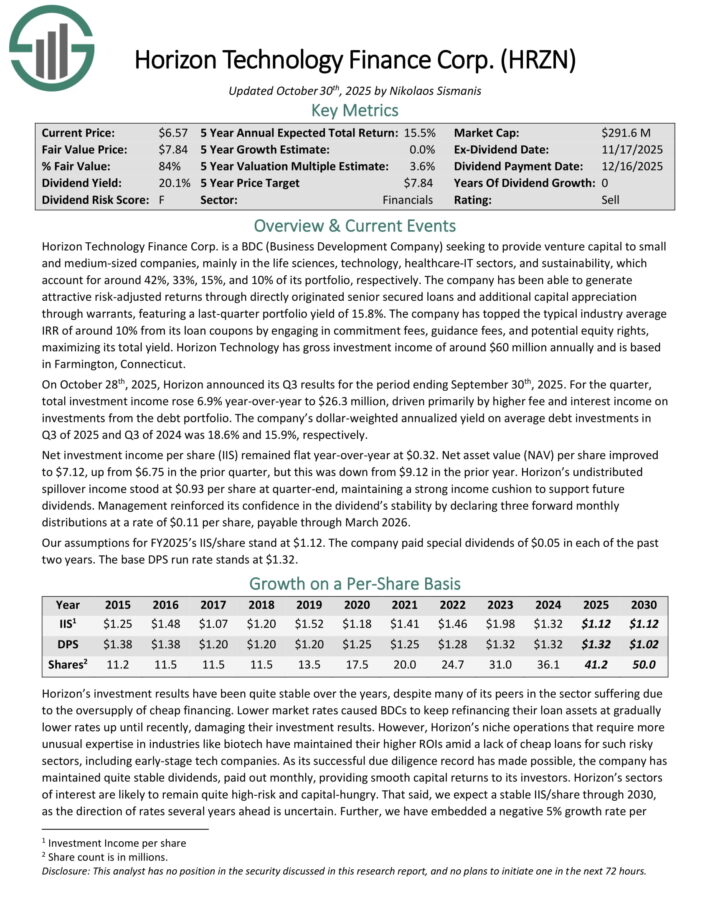

Horizon Technology Finance Corp. is a BDC that provides venture capital to small and medium–sized companies in the technology, life sciences, and healthcare–IT sectors.

The company has generated attractive risk–adjusted returns through directly originated senior secured loans and additional capital appreciation through warrants.

Horizon Technology Finance Corp. is a BDC that provides venture capital to small and medium–sized companies in the technology, life sciences, and healthcare–IT sectors.

On October 28th, 2025, Horizon announced its Q3 results. For the quarter, total investment income rose 6.9% year-over-year to $26.3 million, driven primarily by higher fee and interest income on investments from the debt portfolio.

The company’s dollar-weighted annualized yield on average debt investments in Q3 of 2025 and Q3 of 2024 was 18.6% and 15.9%, respectively.

Net investment income per share (IIS) remained flat year-over-year at $0.32. Net asset value (NAV) per share improved to $7.12, up from $6.75 in the prior quarter, but this was down from $9.12 in the prior year.

Horizon’s undistributed spillover income stood at $0.93 per share at quarter-end, maintaining a strong income cushion to support future dividends.

Click here to download our most recent Sure Analysis report on HRZN (preview of page 1 of 3 shown below):

Too High Dividend Yield #3: Orchid Island Capital (ORC)

Orchid Island Capital is a mortgage REIT that is externally managed by Bimini Advisors LLC and focuses on investing in residential mortgage-backed securities (RMBS), including pass-through and structured agency RMBSs.

These financial instruments generate cash flow based on residential loans such as mortgages, subprime, and home-equity loans.

On October 23, 2025, Orchid Island Capital, Inc. reported estimated net income of $0.53 per common share for Q3 2025, with book value per share estimated at $7.33 as of September 30, 2025.

The company declared a monthly dividend of $0.12 per share for October, keeping consistent with its monthly payout strategy.

The RMBS portfolio and derivatives portfolio evolved as the company remained focused on agency residential mortgage-backed securities paired with hedging strategies.

Orchid Island highlighted that the investment backdrop remains attractive with improving spreads and prepayment risk manageable given the portfolio’s coupon distribution and hedges.

Prepayment activity remained a focal point, with management noting the need for continued vigilance given higher coupon pools and refinancing dynamics.

Click here to download our most recent Sure Analysis report on Orchid Island Capital, Inc. (ORC) (preview of page 1 of 3 shown below):

Too High Dividend Yield #2: Prospect Capital (PSEC)

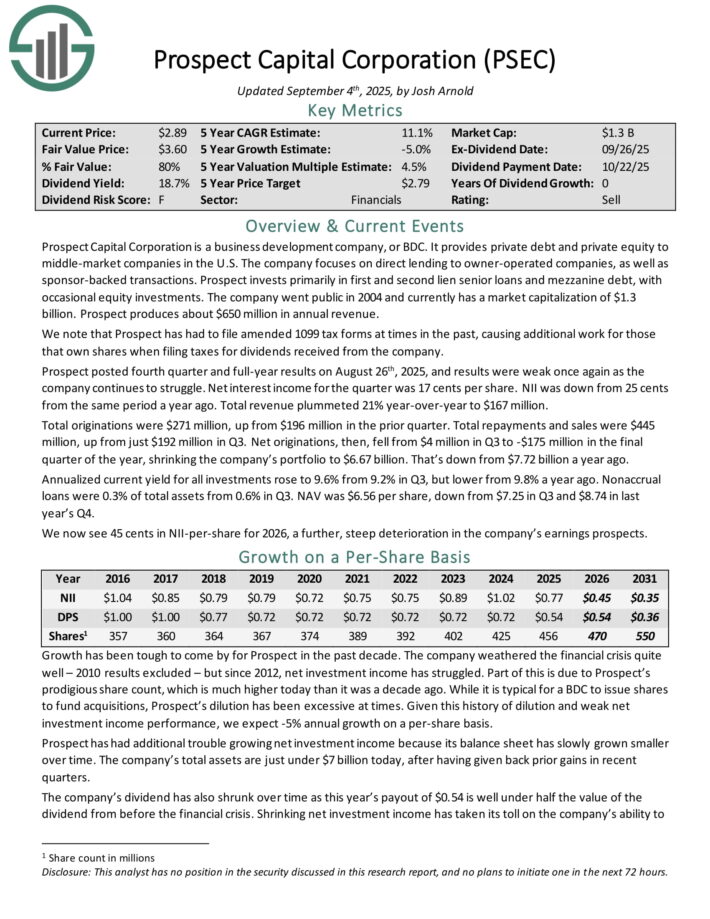

Prospect Capital Corporation is a Business Development Company, or BDC, that provides private debt and private equity to middle–market companies in the U.S.

The company focuses on direct lending to owner–operated companies, as well as sponsor–backed transactions. Prospect invests primarily in first and second lien senior loans and mezzanine debt, with occasional equity investments.

Prospect posted fourth quarter and full-year results on August 26th, 2025, and results were weak once again as the company continues to struggle. Net interest income for the quarter was 17 cents per share. NII was down from 25 cents from the same period a year ago. Total revenue plummeted 21% year-over-year to $167 million.

Total originations were $271 million, up from $196 million in the prior quarter. Total repayments and sales were $445 million, up from just $192 million in Q3. Net originations, then, fell from $4 million in Q3 to -$175 million in the final quarter of the year, shrinking the company’s portfolio to $6.67 billion. That’s down from $7.72 billion a year ago.

Annualized current yield for all investments rose to 9.6% from 9.2% in Q3, but lower from 9.8% a year ago.

Click here to download our most recent Sure Analysis report on PSEC (preview of page 1 of 3 shown below):

Too High Dividend Yield #1: Oxford Square Capital (OXSQ)

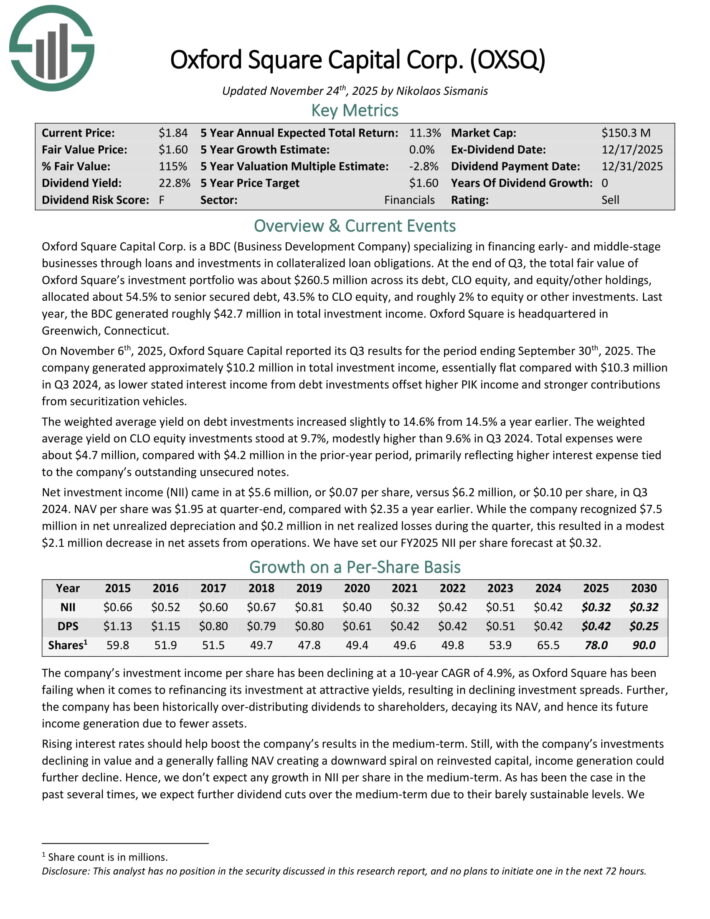

Oxford Square Capital Corp. is a BDC (Business Development Company) specializing in financing early- and middle-stage businesses through loans and investments in collateralized loan obligations.

At the end of Q3, the total fair value of Oxford Square’s investment portfolio was about $260.5 million across its debt, CLO equity, and equity/other holdings, allocated about 54.5% to senior secured debt, 43.5% to CLO equity, and roughly 2% to equity or other investments. Last year, the BDC generated roughly $42.7 million in total investment income.

On November 6th, 2025, Oxford Square Capital reported its Q3. The company generated approximately $10.2 million in total investment income, essentially flat compared with $10.3 million in Q3 2024, as lower stated interest income from debt investments offset higher PIK income and stronger contributions from securitization vehicles.

The weighted average yield on debt investments increased slightly to 14.6% from 14.5% a year earlier. The weighted average yield on CLO equity investments stood at 9.7%, modestly higher than 9.6% in Q3 2024.

Total expenses were about $4.7 million, compared with $4.2 million in the prior-year period, primarily reflecting higher interest expense tied to the company’s outstanding unsecured notes.

Net investment income (NII) came in at $5.6 million, or $0.07 per share, versus $6.2 million, or $0.10 per share, in Q3 2024.

Click here to download our most recent Sure Analysis report on OXSQ (preview of page 1 of 3 shown below):

Additional Reading

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].