Published on September 23rd, 2025 by Bob Ciura

Dividend investing is ultimately about replacing your working income with a passive income stream for a secure retirement and financial freedom.

The reality of inflation means your income stream can’t just be static. It must be perpetually growing.

To build your perpetual dividend machine, you must invest in a reasonably diversified basket of income securities that have the following characteristics:

Pay dividends (create income), the higher the yield the better

Are likely to grow their payments, the faster the better

Have safe dividends, so you are likely to see stable or better income during a recession

Dividend investments should be safe, growing income securities with at least decent yields.

With this in mind, we created a downloadable list of over 130 Dividend Champions.

You can download your free copy of the Dividend Champions list, along with relevant financial metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the link below:

The Dividend Champions have raised their dividends for over 25 years in a row.

It’s no small feat to boost a dividend year-after-year for decades at a time, even through economic downturns.

For this reason, longer streaks are preferred because they show a company can increase dividends over a wide range of economic and competitive environments. They also show evidence of a durable competitive advantage.

The following 10 U.S.-based dividend stocks have increased their payouts for over 25 years, placing them on the Dividend Champions list. They also have high yields more than double current S&P 500 average yield of 1.15%.

Lastly, they have our top Dividend Risk Scores of ‘A’ or ‘B’, to focus on the stocks most likely to maintain their dividends, even in a recession.

As a result, they could be considered to be top stocks for building a perpetual income machine.

Table of Contents

The 10 stocks below are ranked by current dividend yield, from lowest to highest.

Perpetual Income Stock: Northwest Natural Holding (NWN)

NW Natural was founded in 1859 and has grown from just a handful of customers to serving more than 760,000 today. The utility’s mission is to deliver natural gas to its customers in the Pacific Northwest.

The company’s locations served are shown in the image below.

Source: Investor Presentation

On August 7, 2025, Northwest Natural Holding Company reported results for the second quarter ended June 30, 2025, showing steady growth in customer base and rate recovery despite seasonal weakness typical of warmer months.

The company recorded net income of $7.4 million, or $0.19 per diluted share, compared with $5.8 million, or $0.16 per share, in the same quarter last year. Operating revenue totaled $219.6 million, slightly down from $222.3 million in the prior year, as lower gas usage from mild weather offset the benefit of rate increases and customer growth.

Operating income was $28.9 million, up from $25.7 million, reflecting disciplined cost control and contributions from utility margin improvement. The gas distribution segment added nearly 11,000 new customers year-over-year, maintaining annual growth of about 1.4%, while infrastructure services contributed modestly to earnings.

Click here to download our most recent Sure Analysis report on NWN (preview of page 1 of 3 shown below):

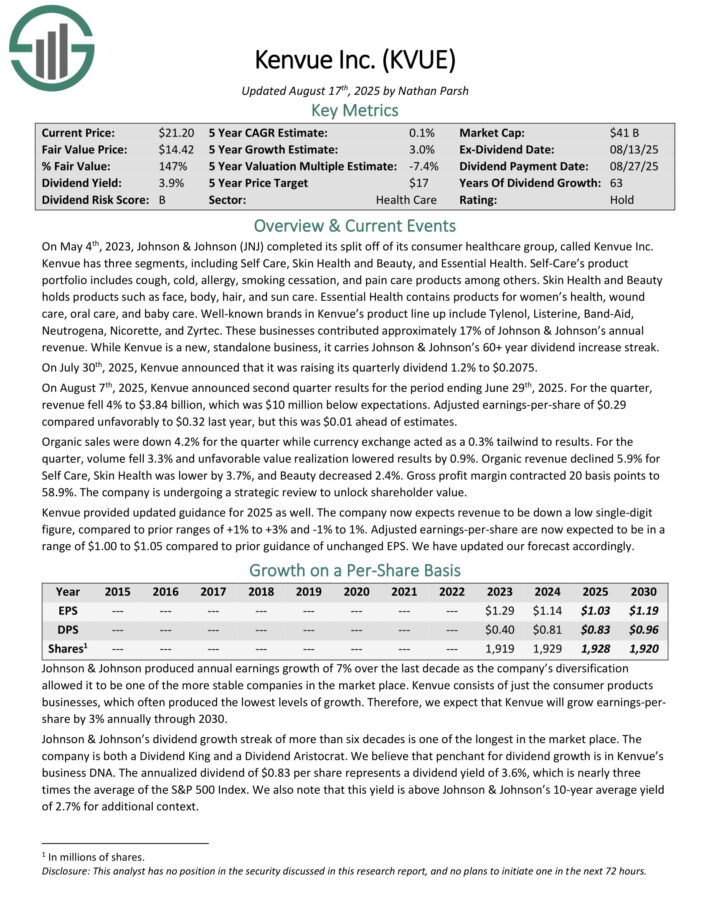

Perpetual Income Stock: Kenvue Inc. (KVUE)

Kenvue was spun off from Johnson & Johnson (JNJ) in 2023. It has three segments, including Self Care, Skin Health and Beauty, and Essential Health.

Self-Care’s product portfolio includes cough, cold, allergy, smoking cessation, and pain care products among others. Skin Health and Beauty holds products such as face, body, hair, and sun care. Essential Health contains products for women’s health, wound care, oral care, and baby care.

Well-known brands in Kenvue’s product line up include Tylenol, Listerine, Band-Aid, Neutrogena, Nicorette, and Zyrtec. These businesses contributed approximately 17% of Johnson & Johnson’s annual revenue.

On August 7th, 2025, Kenvue announced second quarter results for the period ending June 29th, 2025. For the quarter, revenue fell 4% to $3.84 billion, which was $10 million below expectations. Adjusted earnings-per-share of $0.29 compared unfavorably to $0.32 last year, but this was $0.01 ahead of estimates.

Organic sales were down 4.2% for the quarter while currency exchange acted as a 0.3% tailwind to results. For the quarter, volume fell 3.3% and unfavorable value realization lowered results by 0.9%.

Organic revenue declined 5.9% for Self Care, Skin Health was lower by 3.7%, and Beauty decreased 2.4%. Gross profit margin contracted 20 basis points to 58.9%. The company is undergoing a strategic review to unlock shareholder value.

Click here to download our most recent Sure Analysis report on KVUE (preview of page 1 of 3 shown below):

Perpetual Income Stock: Sonoco Products (SON)

Sonoco Products provides packaging, industrial products and supply chain services to its customers. The markets that use the company’s products include those in the appliances, electronics, beverage, construction and food industries.

The company generates over $5 billion in annual sales. Sonoco Products is now composed of 2 major segments, Consumer Packaging, and Industrial Packaging, with all other businesses listed as “All Other”.

On April 16th, 2025, Sonoco Products raised its quarterly dividend 1.9% to $0.53, extending the company’s dividend growth streak to 49 consecutive years.

On July 23rd, 2025, Sonoco Products announced second quarter results for the period ending June 29th, 2025. For the quarter, revenue grew 17.9% to $1.91 billion, which was in-line with estimates. Adjusted earnings-per-share of $1.37 compared to $1.28 in the prior year, but was $0.08 less than expected.

Revenues and earnings benefited from the addition of Eviosys. For the quarter, Consumer Packaging revenues surged 110% to $1.23 billion, mostly due to contributions from Eviosys.

Volume growth was strong and favorable currency exchange rates also aided results. Industrial Paper Packing sales fell 2% to $588 million due to the impact of foreign currency exchange rates and lower volume following two plant divestitures in China last year.

Click here to download our most recent Sure Analysis report on Sonoco (SON) (preview of page 1 of 3 shown below):

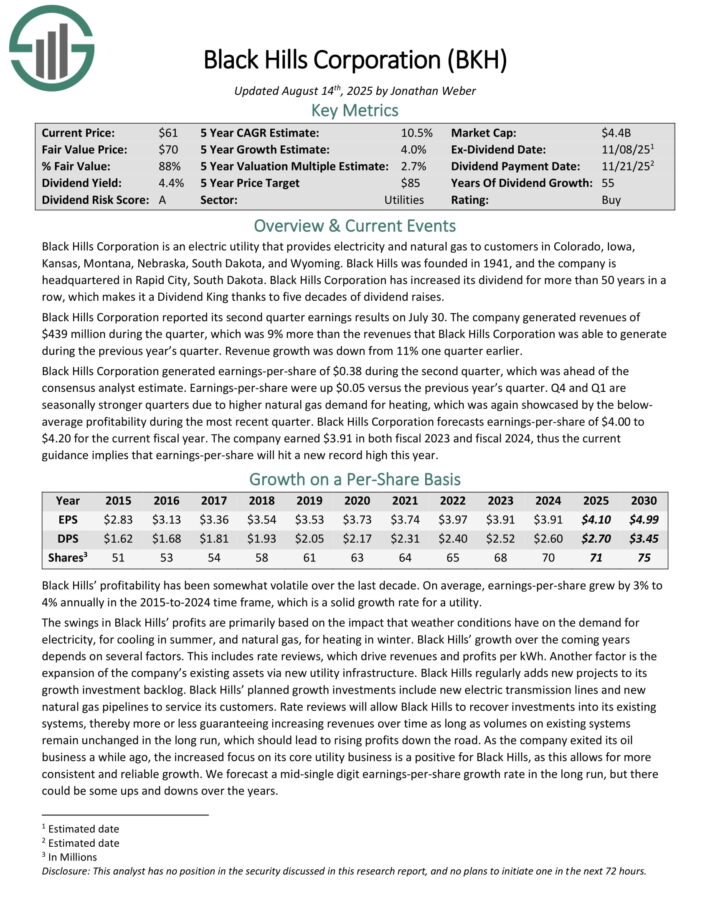

Perpetual Income Stock: Black Hills Corp (BKH)

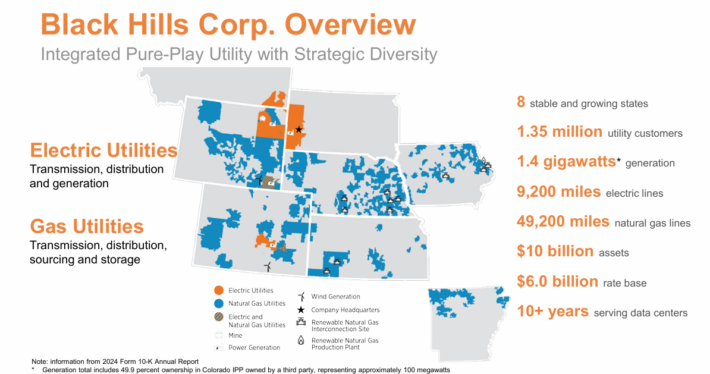

Black Hills Corporation is an electric utility that provides electricity and natural gas to customers in Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, and Wyoming.

The company has 1.35 million utility customers in eight states. Its natural gas assets include 49,200 miles of natural gas lines. Separately, it has ~9,200 miles of electric lines and 1.4 gigawatts of electric generation capacity.

Source: Investor Presentation

Black Hills Corporation reported its second quarter earnings results on July 30. The company generated revenues of $439 million during the quarter, up 9% year-over-year.

Black Hills Corporation generated earnings-per-share of $0.38 during the second quarter, which was ahead of the consensus analyst estimate.

Earnings-per-share were up $0.05 versus the previous year’s quarter. Q4 and Q1 are seasonally stronger quarters due to higher natural gas demand for heating.

Black Hills Corporation forecasts earnings-per-share of $4.00 to $4.20 for the current fiscal year.

Click here to download our most recent Sure Analysis report on BKH (preview of page 1 of 3 shown below):

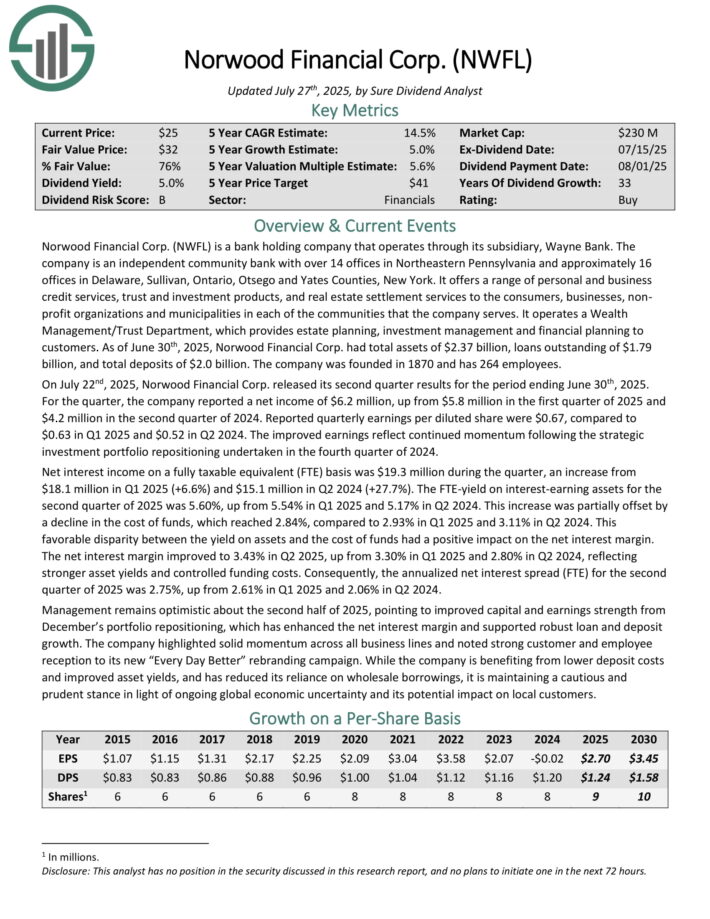

Perpetual Income Stock: Norwood Financial (NWL)

Norwood Financial Corp. (NWFL) is a bank holding company that operates through its subsidiary, Wayne Bank. The company is an independent community bank with over 14 offices in Northeastern Pennsylvania and approximately 16 offices in Delaware, Sullivan, Ontario, Otsego and Yates Counties, New York.

It offers a range of personal and business credit services, trust and investment products, and real estate settlement services to the consumers, businesses, nonprofit organizations and municipalities in each of the communities that the company serves. It operates a Wealth Management/Trust Department, which provides estate planning, investment management and financial planning to customers.

As of June 30th, 2025, Norwood Financial Corp. had total assets of $2.37 billion, loans outstanding of $1.79 billion, and total deposits of $2.0 billion. The company was founded in 1870 and has 264 employees.

On July 22nd, 2025, Norwood Financial Corp. released its second quarter results for the period ending June 30th, 2025. For the quarter, the company reported a net income of $6.2 million, up from $5.8 million in the first quarter of 2025 and $4.2 million in the second quarter of 2024.

Reported quarterly earnings per diluted share were $0.67, compared to $0.63 in Q1 2025 and $0.52 in Q2 2024. The improved earnings reflect continued momentum following the strategic investment portfolio repositioning undertaken in the fourth quarter of 2024.

Net interest income on a fully taxable equivalent (FTE) basis was $19.3 million during the quarter, an increase from $18.1 million in Q1 2025 (+6.6%) and $15.1 million in Q2 2024 (+27.7%). The FTE-yield on interest-earning assets for the second quarter of 2025 was 5.60%, up from 5.54% in Q1 2025 and 5.17% in Q2 2024.

Click here to download our most recent Sure Analysis report on NWFL (preview of page 1 of 3 shown below):

Perpetual Income Stock: Hormel Foods (HRL)

Hormel Foods was founded in 1891 in Minnesota. Since that time, the company has grown into a juggernaut in the food products industry with about $12 billion in annual revenue.

Hormel has kept its core competency as a processor of meat products for well over a hundred years but has also grown into other business lines through acquisitions.

The company sells its products in 80 countries worldwide, and its brands include Skippy, SPAM, Applegate, Justin’s, and more than 30 others.

Hormel posted third quarter earnings on August 28th, 2025, and results were very weak, including disappointing guidance for the fourth quarter.

Adjusted earnings-per-share came to 35 cents, which was six cents light of estimates. Revenue was up 4.5% year-over-year to $3.03 billion, beating estimates by $50 million. Organic net sales were up 6% year-over-year on volume gains of 4%, with price and mix comprising the other 2%.

The company also noted its cost savings program is working and helping save about $125 million annually. Gross profit was flat year-on-year, with inflationary headwinds offset by top line gains. The company noted 400 basis points of raw material cost inflation, a massive headwind to margins.

Cash flow from operations were $157 million, while capex was $72 million, and dividends paid were $159 million. Guidance for Q4 was for net sales of ~$3.2 billion, about $50 million light of consensus. Earnings are expected at ~39 cents.

Click here to download our most recent Sure Analysis report on HRL (preview of page 1 of 3 shown below):

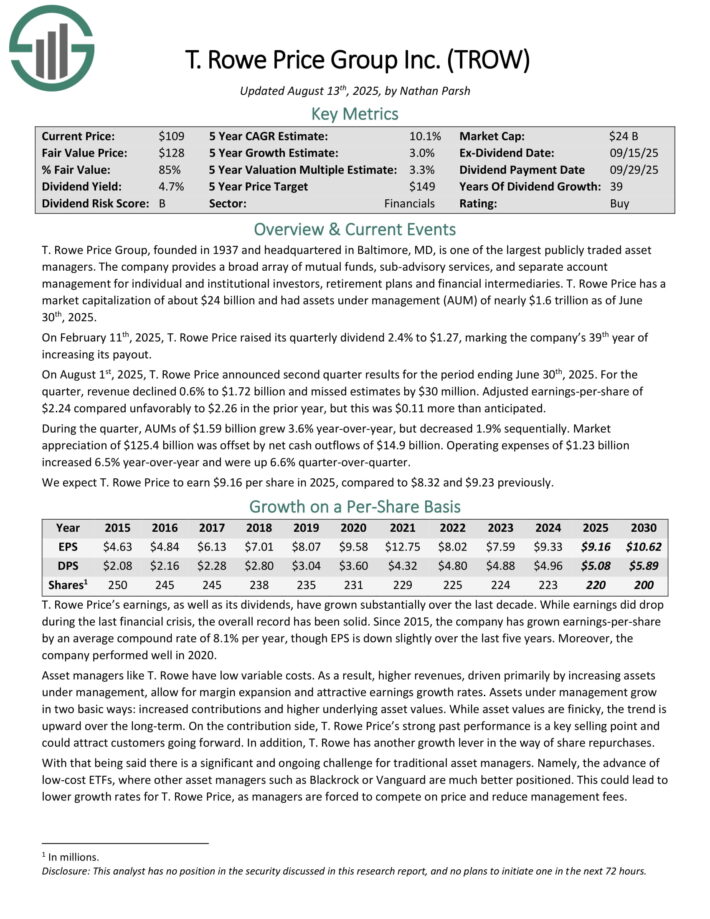

Perpetual Income Stock: T. Rowe Price Group (TROW)

T. Rowe Price Group is one of the largest publicly traded asset managers. The company provides a broad array of mutual funds, sub-advisory services, and separate account management for individual and institutional investors, retirement plans and financial intermediaries.

T. Rowe Price had assets under management (AUM) of nearly $1.6 trillion as of June 30th, 2025.

On February 11th, 2025, T. Rowe Price raised its quarterly dividend 2.4% to $1.27, marking the company’s 39th year of increasing its payout.

On August 1st, 2025, T. Rowe Price announced second quarter results for the period ending June 30th, 2025. For the quarter, revenue declined 0.6% to $1.72 billion and missed estimates by $30 million. Adjusted earnings-per-share of $2.24 compared unfavorably to $2.26 in the prior year, but this was $0.11 more than anticipated.

During the quarter, AUMs of $1.59 billion grew 3.6% year-over-year, but decreased 1.9% sequentially. Market appreciation of $125.4 billion was offset by net cash outflows of $14.9 billion. Operating expenses of $1.23 billion increased 6.5% year-over-year and were up 6.6% quarter-over-quarter.

Click here to download our most recent Sure Analysis report on TROW (preview of page 1 of 3 shown below):

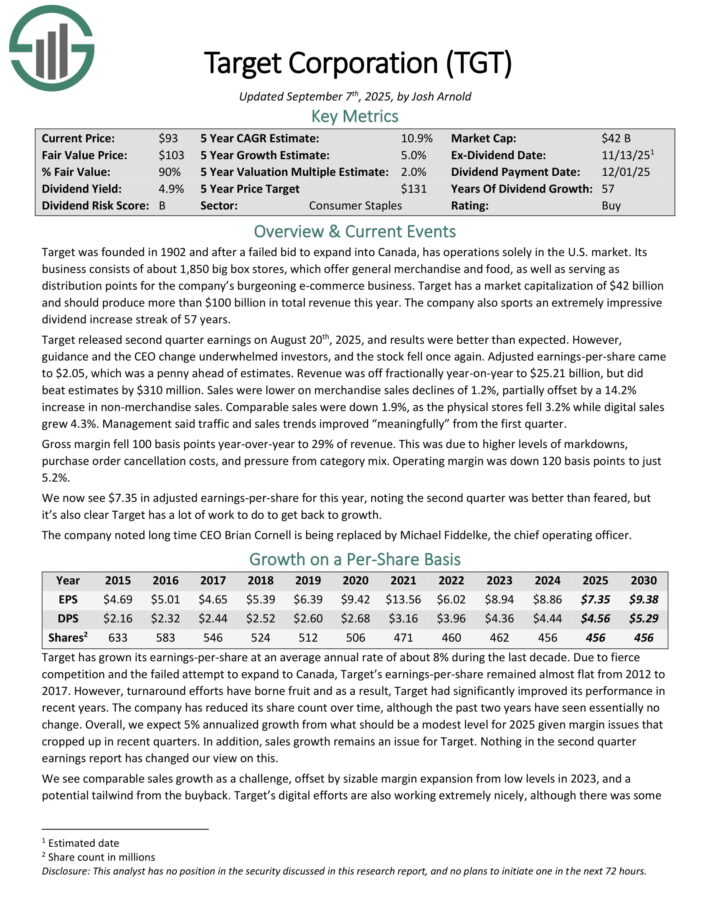

Perpetual Income Stock: Target Corporation (TGT)

Target was founded in 1902 and now operates about 1,850 big box stores, which offer general merchandise and food, as well as serving as distribution points for the company’s e-commerce business.

Target released second quarter earnings on August 20th, 2025, and results were better than expected. However, guidance and the CEO change underwhelmed investors, and the stock fell once again.

Adjusted earnings-per-share came to $2.05, which was a penny ahead of estimates. Revenue was off fractionally year-on-year to $25.21 billion, but did beat estimates by $310 million. Sales were lower on merchandise sales declines of 1.2%, partially offset by a 14.2% increase in non-merchandise sales.

Comparable sales were down 1.9%, as the physical stores fell 3.2% while digital sales grew 4.3%. Management said traffic and sales trends improved “meaningfully” from the first quarter.

The company is investing heavily in its business in order to navigate through the changing landscape in the retail sector. The payout is now 62% of earnings for this year, which is elevated from historical levels, but the dividend remains well-covered.

Click here to download our most recent Sure Analysis report on TGT (preview of page 1 of 3 shown below):

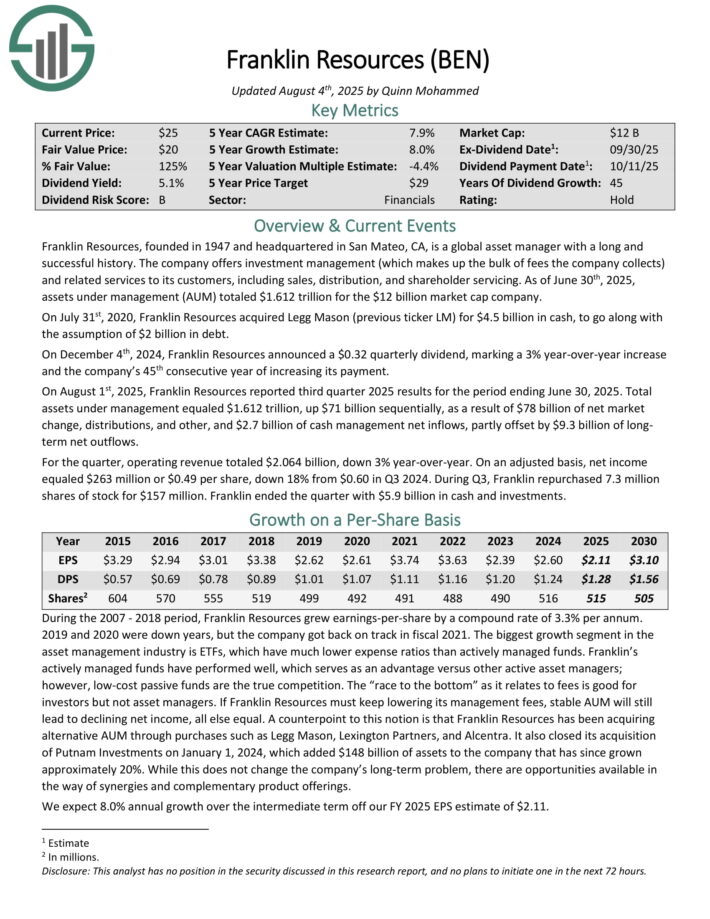

Perpetual Income Stock: Franklin Resources (BEN)

Franklin Resources, founded in 1947 and headquartered in San Mateo, CA, is a global asset manager with a long and successful history. The company offers investment management (which makes up the bulk of fees the company collects) and related services to its customers, including sales, distribution, and shareholder servicing.

As of June 30th, 2025, assets under management (AUM) totaled $1.612 trillion for the $12 billion market cap company.

On July 31st, 2020, Franklin Resources acquired Legg Mason (previous ticker LM) for $4.5 billion in cash, to go along with the assumption of $2 billion in debt.

On August 1st, 2025, Franklin Resources reported third-quarter 2025 results for the period ending June 30, 2025. Total assets under management equaled $1.612 trillion, up $71 billion sequentially, as a result of $78 billion of net market change, distributions, and other, and $2.7 billion of cash management net inflows, partly offset by $9.3 billion of long-term net outflows.

For the quarter, operating revenue totaled $2.064 billion, down 3% year-over-year. On an adjusted basis, net income equaled $263 million or $0.49 per share, down 18% from $0.60 in Q3 2024. During Q3, Franklin repurchased 7.3 million shares of stock for $157 million. Franklin ended the quarter with $5.9 billion in cash and investments.

Click here to download our most recent Sure Analysis report on BEN (preview of page 1 of 3 shown below):

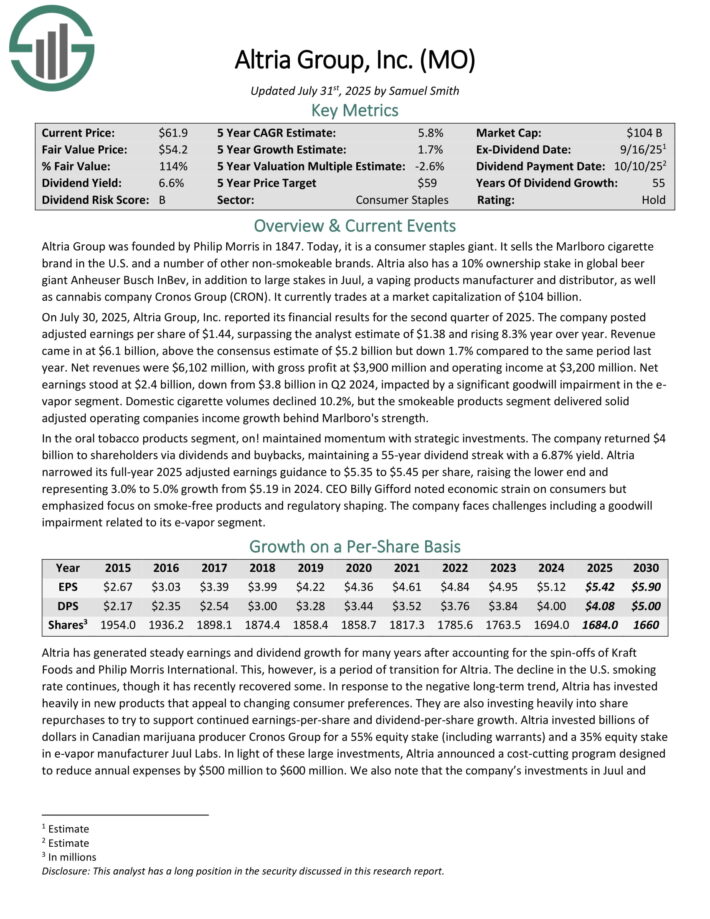

Perpetual Income Stock: Altria Group (MO)

Altria is a tobacco stock that sells cigarettes, chewing tobacco, cigars, e-cigarettes, and more under a variety of brands, including Marlboro, Skoal, and Copenhagen, among others.

This is a period of transition for Altria. The decline in the U.S. smoking rate continues. In response, Altria has invested heavily in new products that appeal to changing consumer preferences, as the smoke-free category continues to grow.

The company also has a 35% investment stake in e-cigarette maker JUUL, and a 45% stake in the Canadian cannabis producer Cronos Group (CRON).

On July 30, 2025, Altria Group, Inc. reported its financial results for the second quarter of 2025. The company posted adjusted earnings per share of $1.44, surpassing the analyst estimate of $1.38 and rising 8.3% year over year.

Revenue came in at $6.1 billion, above the consensus estimate of $5.2 billion but down 1.7% compared to the same period last year. Net revenues were $6,102 million, with gross profit at $3,900 million and operating income at $3,200 million.

Net earnings stood at $2.4 billion, down from $3.8 billion in Q2 2024, impacted by a significant goodwill impairment in the e-vapor segment.

Domestic cigarette volumes declined 10.2%, but the smokeable products segment delivered solid adjusted operating companies income growth behind Marlboro’s strength.

Click here to download our most recent Sure Analysis report on Altria (preview of page 1 of 3 shown below):

Additional Reading

The Dividend Champions list is not the only way to quickly screen for stocks that regularly pay rising dividends.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].