Published on October 21st, 2025 by Bob Ciura

The average dividend yield in the S&P 500 Index remains low at just 1.2%. As a result, income investors should focus on higher-yielding securities.

High dividend stocks can contribute a significant portion of a stock’s total return.

With this in mind, we compiled a list of high dividend stocks with dividend yields above 5%. You can download your free copy of the high dividend stocks list by clicking on the link below:

Meanwhile, high dividend stocks could be even bigger bargains, when trading at rock bottom prices.

The following 10 high dividend stocks have yields above 5%, and are trading within 10% of their 52-week lows. The list is sorted by current dividend yield, in ascending order.

Table of Contents

You can instantly jump to any specific section of the article by using the links below:

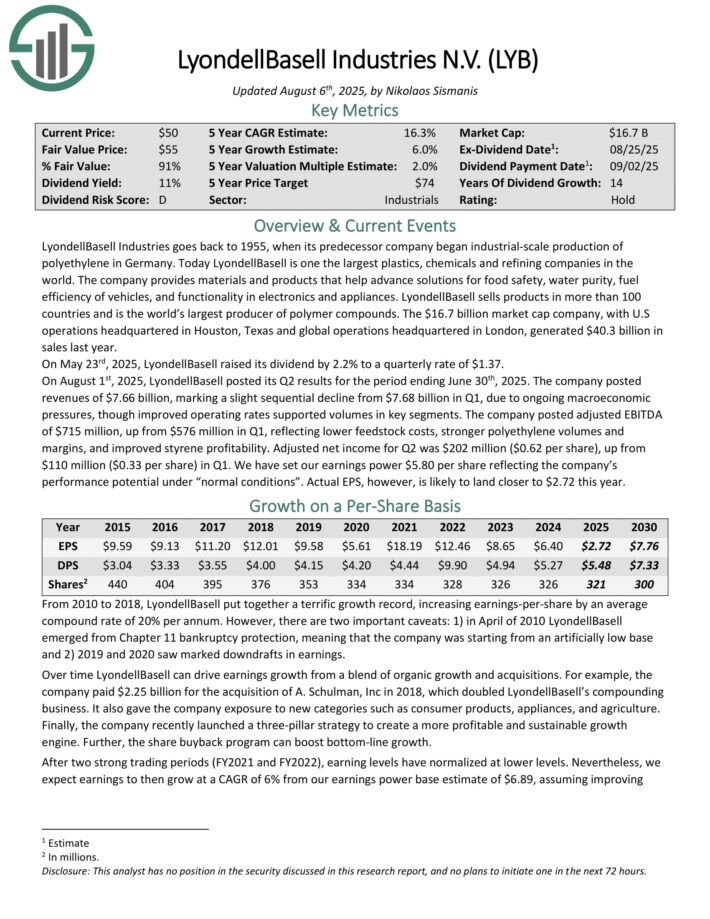

Beaten Down High Yielder #10: LyondellBasell Industries N.V. (LYB)

LyondellBasell is one the largest plastics, chemicals and refining companies in the world. The company provides materials and products that help advance solutions for food safety, water purity, fuel efficiency of vehicles, and functionality in electronics and appliances.

LyondellBasell sells products in more than 100 countries and is the world’s largest producer of polymer compounds. The company, with U.S operations headquartered in Houston, Texas and global operations headquartered in London, generated $40.3 billion in sales last year.

On August 1st, 2025, LyondellBasell posted its Q2 results. The company posted revenues of $7.66 billion, marking a slight sequential decline from $7.68 billion in Q1, due to ongoing macroeconomic pressures, though improved operating rates supported volumes in key segments.

The company posted adjusted EBITDA of $715 million, up from $576 million in Q1, reflecting lower feedstock costs, stronger polyethylene volumes and margins, and improved styrene profitability.

Adjusted net income for Q2 was $202 million ($0.62 per share), up from $110 million ($0.33 per share) in Q1.

Click here to download our most recent Sure Analysis report on LYB (preview of page 1 of 3 shown below):

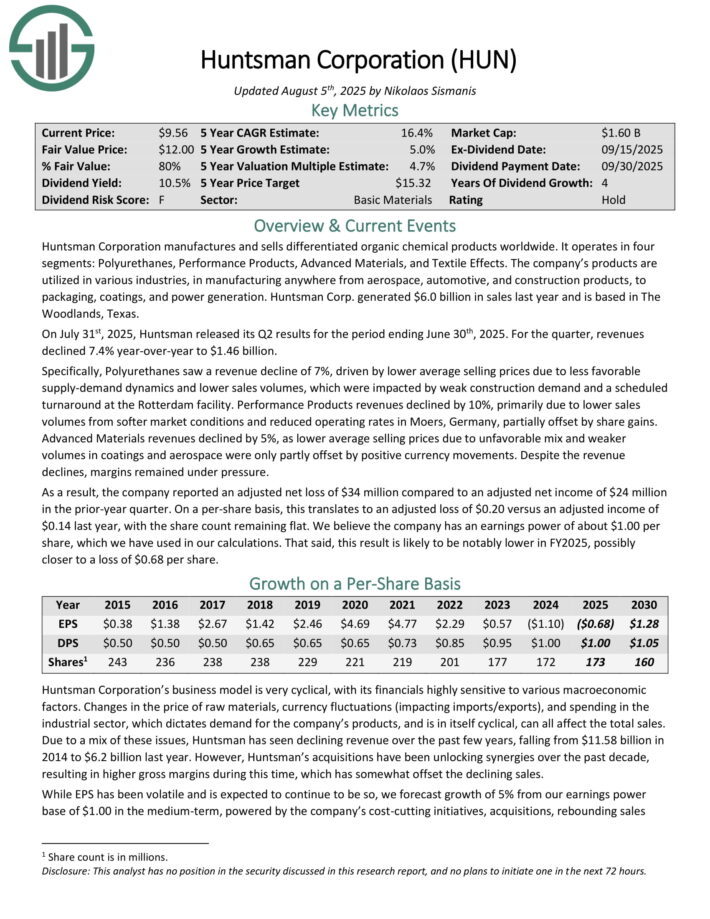

Beaten Down High Yielder #9: Huntsman Corporation (HUN)

Huntsman Corporation manufactures and sells differentiated organic chemical products worldwide. It operates in four segments: Polyurethanes, Performance Products, Advanced Materials, and Textile Effects.

The company’s products are utilized in various industries, in manufacturing anywhere from aerospace, automotive, and construction products, to packaging, coatings, and power generation. Huntsman Corp. generated $6.0 billion in sales last year and is based in The Woodlands, Texas.

On July 31st, 2025, Huntsman released its Q2 results for the period ending June 30th, 2025. For the quarter, revenues declined 7.4% year-over-year to $1.46 billion. Specifically, Polyurethanes saw a revenue decline of 7%, driven by lower average selling prices due to less favorable supply-demand dynamics and lower sales volumes.

Performance Products revenues declined by 10%, primarily due to lower sales volumes from softer market conditions and reduced operating rates in Moers, Germany, partially offset by share gains.

Advanced Materials revenues declined by 5%, as lower average selling prices due to unfavorable mix and weaker volumes in coatings and aerospace were only partly offset by positive currency movements. Despite the revenue declines, margins remained under pressure.

As a result, the company reported an adjusted net loss of $34 million compared to an adjusted net income of $24 million in the prior-year quarter. On a per-share basis, this translates to an adjusted loss of $0.20 versus an adjusted income of $0.14 last year.

Click here to download our most recent Sure Analysis report on HUN (preview of page 1 of 3 shown below):

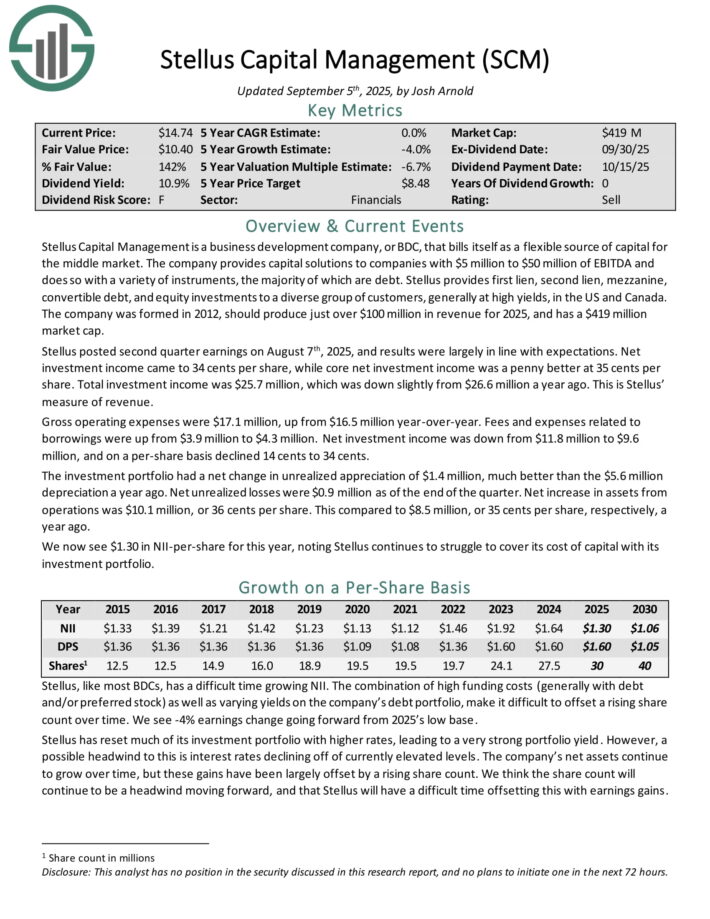

Beaten Down High Yielder #8: Stellus Capital (SCM)

Stellus Capital Management provides capital solutions to companies with $5 million to $50 million of EBITDA and does so with a variety of instruments, the majority of which are debt.

Stellus provides first lien, second lien, mezzanine, convertible debt, and equity investments to a diverse group of customers, generally at high yields, in the US and Canada.

Stellus posted second quarter earnings on August 7th, 2025, and results were largely in line with expectations. Net investment income came to 34 cents per share, while core net investment income was a penny better at 35 cents per share.

Total investment income was $25.7 million, which was down slightly from $26.6 million a year ago. This is Stellus’ measure of revenue.

Gross operating expenses were $17.1 million, up from $16.5 million year-over-year. Fees and expenses related to borrowings were up from $3.9 million to $4.3 million. Net investment income was down from $11.8 million to $9.6 million, and on a per-share basis declined 14 cents to 34 cents.

The investment portfolio had a net change in unrealized appreciation of $1.4 million, much better than the $5.6 million depreciation a year ago.

Click here to download our most recent Sure Analysis report on SCM (preview of page 1 of 3 shown below):

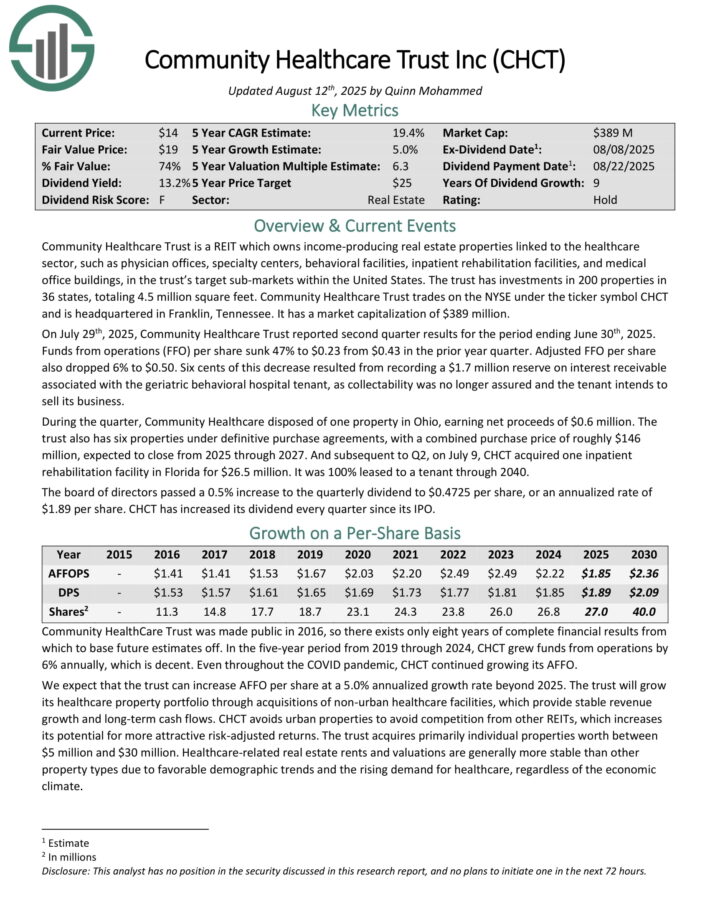

Beaten Down High Yielder #7: Community Healthcare Trust (CHCT)

Community Healthcare Trust owns income-producing real estate properties linked to the healthcare sector, such as physician offices, specialty centers, behavioral facilities, inpatient rehabilitation facilities, and medical office buildings, in the trust’s target sub-markets within the United States.

The trust has investments in 200 properties in 36 states, totaling 4.5 million square feet.

On July 29th, 2025, Community Healthcare Trust reported second quarter results for the period ending June 30th, 2025.

Funds from operations per share sank 47% to $0.23 from $0.43 in the prior year quarter. Adjusted FFO per share also dropped 6% to $0.50.

Six cents of this decrease resulted from recording a $1.7 million reserve on interest receivable associated with the geriatric behavioral hospital tenant, as collectability was no longer assured and the tenant intends to sell its business.

During the quarter, Community Healthcare disposed of one property in Ohio, earning net proceeds of $0.6 million. The trust also has six properties under definitive purchase agreements, with a combined purchase price of roughly $146 million, expected to close from 2025 through 2027.

And subsequent to Q2, on July 9, CHCT acquired one inpatient rehabilitation facility in Florida for $26.5 million. It was 100% leased to a tenant through 2040.

Click here to download our most recent Sure Analysis report on CHCT (preview of page 1 of 3 shown below):

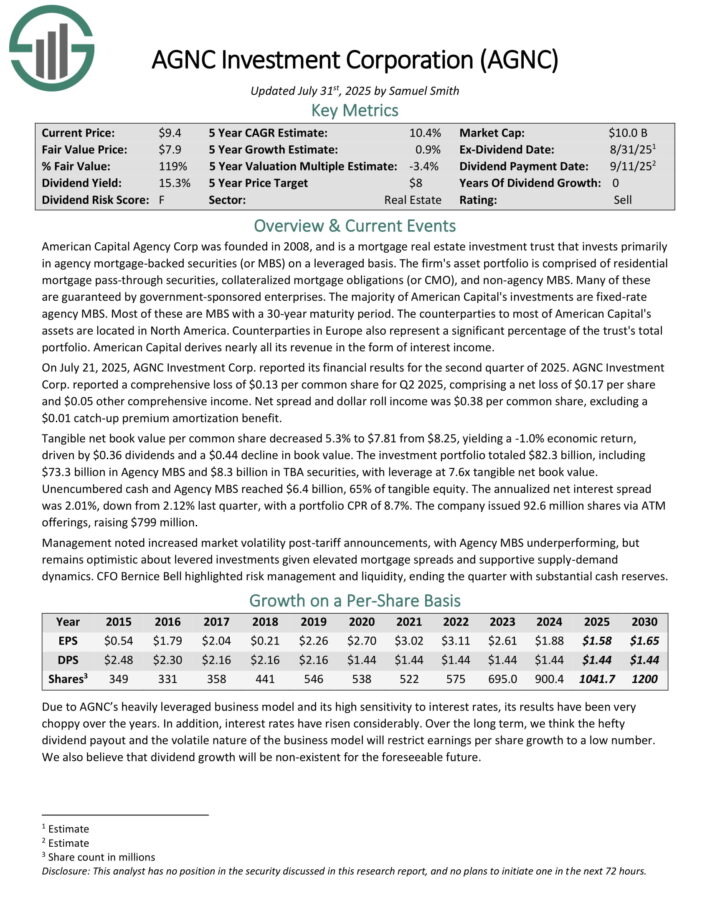

Beaten Down High Yielder #6: AGNC Investment Corporation (AGNC)

American Capital Agency Corp is a mortgage real estate investment trust that invests primarily in agency mortgage–backed securities (or MBS) on a leveraged basis.

The firm’s asset portfolio is comprised of residential mortgage pass–through securities, collateralized mortgage obligations (or CMO), and non–agency MBS. Many of these are guaranteed by government–sponsored enterprises.

On July 21, 2025, AGNC Investment Corp. reported its financial results for the second quarter of 2025. AGNC Investment Corp. reported a comprehensive loss of $0.13 per common share for Q2 2025, comprising a net loss of $0.17 per share and $0.05 other comprehensive income.

Net spread and dollar roll income was $0.38 per common share, excluding a $0.01 catch-up premium amortization benefit.

Tangible net book value per common share decreased 5.3% to $7.81 from $8.25, yielding a -1.0% economic return, driven by $0.36 dividends and a $0.44 decline in book value. The investment portfolio totaled $82.3 billion, including $73.3 billion in Agency MBS and $8.3 billion in TBA securities, with leverage at 7.6x tangible net book value.

Unencumbered cash and Agency MBS reached $6.4 billion, 65% of tangible equity. The annualized net interest spread was 2.01%, down from 2.12% last quarter, with a portfolio CPR of 8.7%. The company issued 92.6 million shares via ATM offerings, raising $799 million.

Click here to download our most recent Sure Analysis report on AGNC Investment Corp (AGNC) (preview of page 1 of 3 shown below):

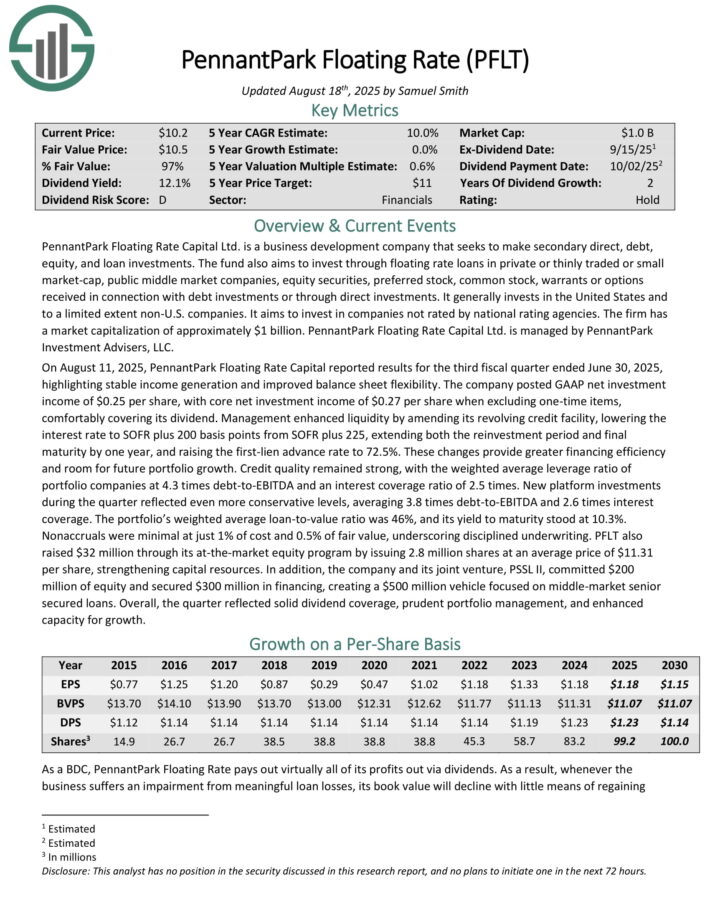

Beaten Down High Yielder #5: PennantPark Floating Rate Capital (PFLT)

PennantPark Floating Rate Capital Ltd. is a business development company that seeks to make secondary direct, debt, equity, and loan investments.

The fund also aims to invest through floating rate loans in private or thinly traded or small market-cap, public middle market companies, equity securities, preferred stock, common stock, warrants or options received in connection with debt investments or through direct investments.

On August 11, 2025, PennantPark Floating Rate Capital reported results for the third fiscal quarter ended June 30, 2025, highlighting stable income generation and improved balance sheet flexibility.

The company posted GAAP net investment income of $0.25 per share, with core net investment income of $0.27 per share when excluding one-time items, comfortably covering its dividend.

Management enhanced liquidity by amending its revolving credit facility, lowering the interest rate to SOFR plus 200 basis points from SOFR plus 225, extending both the reinvestment period and final maturity by one year, and raising the first-lien advance rate to 72.5%.

These changes provide greater financing efficiency and room for future portfolio growth. Credit quality remained strong, with the weighted average leverage ratio of portfolio companies at 4.3 times debt-to-EBITDA and an interest coverage ratio of 2.5 times.

New platform investments during the quarter reflected even more conservative levels, averaging 3.8 times debt-to-EBITDA and 2.6 times interest coverage. The portfolio’s weighted average loan-to-value ratio was 46%, and its yield to maturity stood at 10.3%.

Nonaccruals were minimal at just 1% of cost and 0.5% of fair value, underscoring disciplined underwriting. PFLT also raised $32 million through its at-the-market equity program by issuing 2.8 million shares at an average price of $11.31 per share, strengthening capital resources.

In addition, the company and its joint venture, PSSL II, committed $200 million of equity and secured $300 million in financing, creating a $500 million vehicle focused on middle-market senior secured loans.

Click here to download our most recent Sure Analysis report on PFLT (preview of page 1 of 3 shown below):

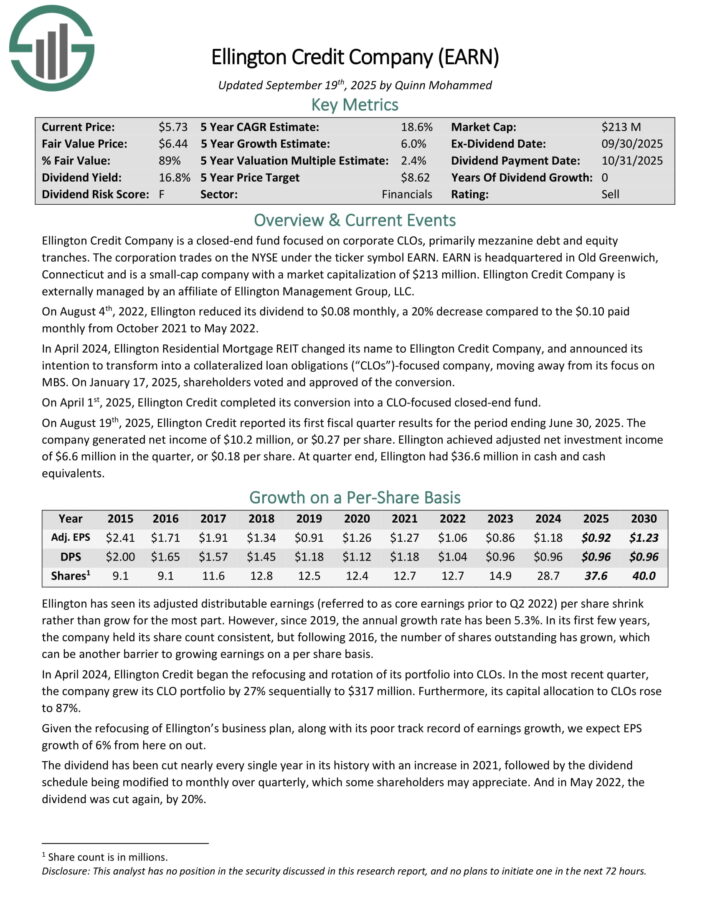

Beaten Down High Yielder #4: Ellington Credit Co. (EARN)

Ellington Credit Co. acquires, invests in, and manages residential mortgage and real estate related assets. Ellington focuses primarily on residential mortgage-backed securities, specifically those backed by a U.S. Government agency or U.S. government–sponsored enterprise.

Agency MBS are created and backed by government agencies or enterprises, while non-agency MBS are not guaranteed by the government.

On August 19th, 2025, Ellington Credit reported its first fiscal quarter results for the period ending June 30, 2025. The company generated net income of $10.2 million, or $0.27 per share.

Ellington achieved adjusted net investment income of $6.6 million in the quarter, or $0.18 per share. At quarter end, Ellington had $36.6 million in cash and cash equivalents.

Click here to download our most recent Sure Analysis report on EARN (preview of page 1 of 3 shown below):

Beaten Down High Yielder #3: Orchid Island Capital (ORC)

Orchid Island Capital, Inc. is an mREIT that is externally managed by Bimini Advisors LLC and focuses on investing in residential mortgage-backed securities (RMBS), including pass-through and structured agency RMBSs.

These financial instruments generate cash flow based on residential loans such as mortgages, subprime, and home-equity loans.

On July 24, 2025, Orchid Island Capital, Inc. reported its financial results for the second quarter of 2025. The company recorded a net loss of $33.6 million, or $0.29 per common share, driven by net interest income of $23.2 million, total expenses of $5.0 million, and net realized and unrealized losses of $51.7 million on RMBS and derivatives.

Dividends declared and paid were $0.36 per common share, with book value per share at $7.21 by June 30, 2025, reflecting a total return of (4.66)%.

Liquidity remained strong at $492.5 million, comprising cash and unpledged securities, representing 54% of stockholders’ equity, with borrowing capacity exceeding $6.7 billion across 24 lenders.

Click here to download our most recent Sure Analysis report on Orchid Island Capital, Inc. (ORC) (preview of page 1 of 3 shown below):

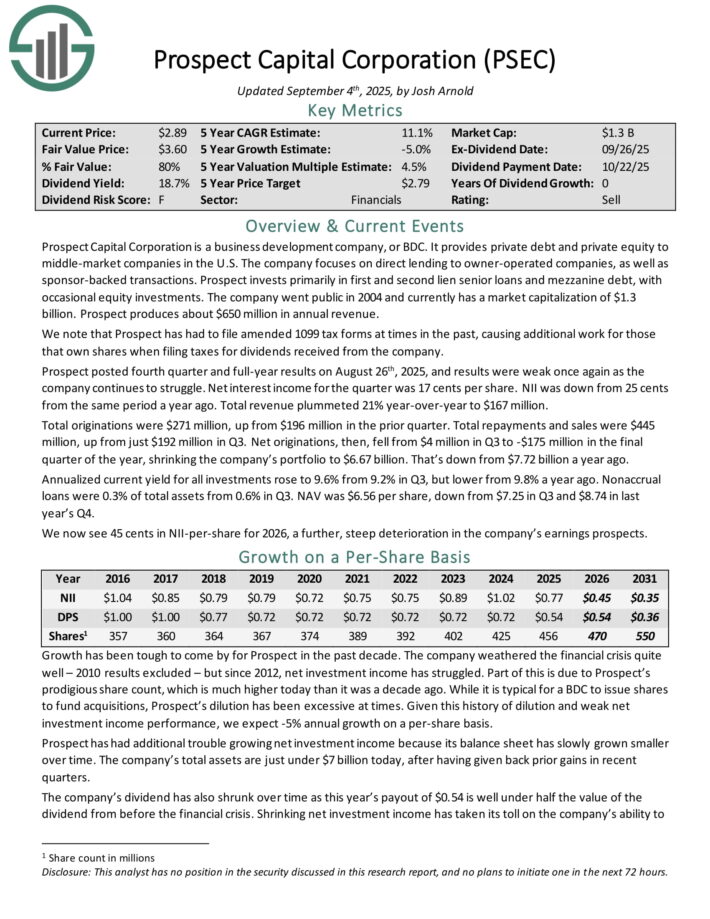

Beaten Down High Yielder #2: Prospect Capital (PSEC)

Prospect Capital Corporation is a Business Development Company, or BDC, that provides private debt and private equity to middle–market companies in the U.S.

The company focuses on direct lending to owner–operated companies, as well as sponsor–backed transactions. Prospect invests primarily in first and second lien senior loans and mezzanine debt, with occasional equity investments.

Prospect posted fourth quarter and full-year results on August 26th, 2025, and results were weak once again as the company continues to struggle. Net interest income for the quarter was 17 cents per share. NII was down from 25 cents from the same period a year ago. Total revenue plummeted 21% year-over-year to $167 million.

Total originations were $271 million, up from $196 million in the prior quarter. Total repayments and sales were $445 million, up from just $192 million in Q3. Net originations, then, fell from $4 million in Q3 to -$175 million in the final quarter of the year, shrinking the company’s portfolio to $6.67 billion. That’s down from $7.72 billion a year ago.

Annualized current yield for all investments rose to 9.6% from 9.2% in Q3, but lower from 9.8% a year ago.

Click here to download our most recent Sure Analysis report on PSEC (preview of page 1 of 3 shown below):

Beaten Down High Yielder #1: Horizon Technology Finance (HRZN)

Horizon Technology Finance Corp. is a BDC that provides venture capital to small and medium–sized companies in the technology, life sciences, and healthcare–IT sectors.

The company has generated attractive risk–adjusted returns through directly originated senior secured loans and additional capital appreciation through warrants.

On August 7th, 2025, Horizon announced its Q2 results for the period ending June 30th, 2025. For the quarter, total investment income fell 4.5% year-over-year to $24.5 million, primarily due to lower interest income on investments from the debt investment portfolio.

More specifically, the company’s dollar-weighted annualized yield on average debt investments in Q2 of 2025 and Q2 of 2024 was 15.8% and 15.9%, respectively.

Net investment income per share (IIS) fell to $0.28, down from $0.36 compared to Q2-2024. Net asset value (NAV) per share landed at $6.75, down from $9.12 year-over-year and $8.43 sequentially.

After paying its monthly distributions, Horizon’s undistributed spillover income as of the end of the quarter was $0.94 per share, indicating a considerable cash cushion.

Management assured investors of the dividend’s stability by declaring three forward monthly dividends at a rate of $0.11.

Click here to download our most recent Sure Analysis report on HRZN (preview of page 1 of 3 shown below):

Additional Reading

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].