Published on November 14th, 2025 by Bob Ciura

Dividend growth is a powerful signal of a company’s financial health, management’s confidence, and commitment to long-term value creation.

Dividend growth stocks have historically generated superior returns with less volatility relative to stocks with flat dividends, stocks that reduce their dividend, and stocks that don’t pay dividends

It’s especially rare to find an investing factor that has historically offered – and I believe is likely to continue offering – both superior returns and lower volatility.

And it stands to reason that dividend growth stocks would provide both stronger returns and lower volatility versus non-dividend growth stocks.

Rising dividends are a positive signal of underlying business growth on a per share basis and consistent cash flow generation ability.

Dividend growth is measured in years of consecutive increases, and percentage or compound increase over a number of years.

All other things being equal, longer streaks and greater percentage increases are preferred.

Longer streaks are preferred because they show a company can increase dividends over a wide range of economic and competitive environments. They show evidence of a durable competitive advantage.

It’s no small feat to boost a dividend year-after-year for decades at a time, through recessions, wars, and epidemics.

And since dividends are paid with actual cash, they can’t be faked. A company cannot pay dividends for any meaningful length of time without generating cash flows to support the dividend.

Of course, not all dividend growth stocks make equally good investments…

This is why we recommend stocks with at least 10+ consecutive years of dividend increases, which we call ‘blue chip’ stocks.

You can download our free blue chip stocks list with important financial metrics, such as dividend yields and price-to-earnings ratios, by clicking on the link below:

Blue-chip stocks are established, financially strong, and consistently profitable publicly traded companies.

By investing in blue-chip stocks with long histories of increasing dividends each year, regardless of the state of the global economy, investors can unleash the power of dividend growth.

This article will discuss 10 blue-chip stocks with the highest expected future dividend growth in the Sure Analysis Research Database.

The 10 blue chip stocks below are sorted by estimated dividend growth rate, from lowest to highest.

Table of Contents

The table of contents below allows for easy navigation.

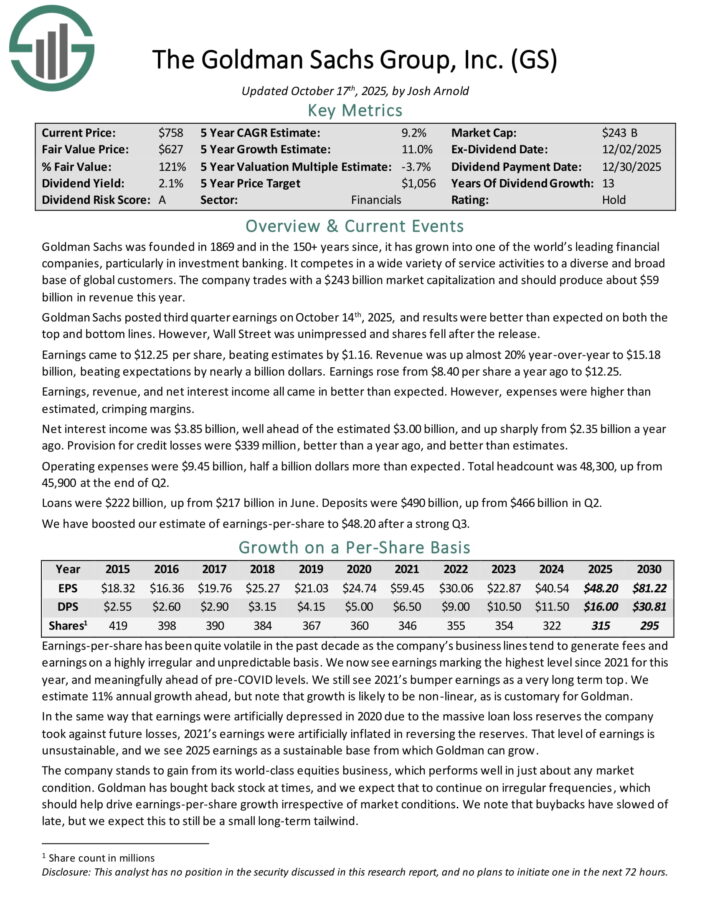

Dividend Growth Stock: Goldman Sachs Group (GS)

Goldman Sachs was founded in 1869 and in the 150+ years since, it has grown into one of the world’s leading financial companies, particularly in investment banking.

It competes in a wide variety of service activities to a diverse and broad base of global customers. The company should produce about $55 billion in revenue this year.

Goldman Sachs posted third quarter earnings on October 14th, 2025, and results were better than expected on both the top and bottom lines. Earnings came to $12.25 per share, beating estimates by $1.16.

Revenue was up almost 20% year-over-year to $15.18 billion, beating expectations by nearly a billion dollars. Earnings rose from $8.40 per share a year ago to $12.25.

Net interest income was $3.85 billion, well ahead of the estimated $3.00 billion, and up sharply from $2.35 billion a year ago. Provision for credit losses were $339 million, better than a year ago, and better than estimates.

Operating expenses were $9.45 billion, half a billion dollars more than expected. Total headcount was 48,300, up from 45,900 at the end of Q2. Loans were $222 billion, up from $217 billion in June. Deposits were $490 billion, up from $466 billion in Q2.

Click here to download our most recent Sure Analysis report on GS (preview of page 1 of 3 shown below):

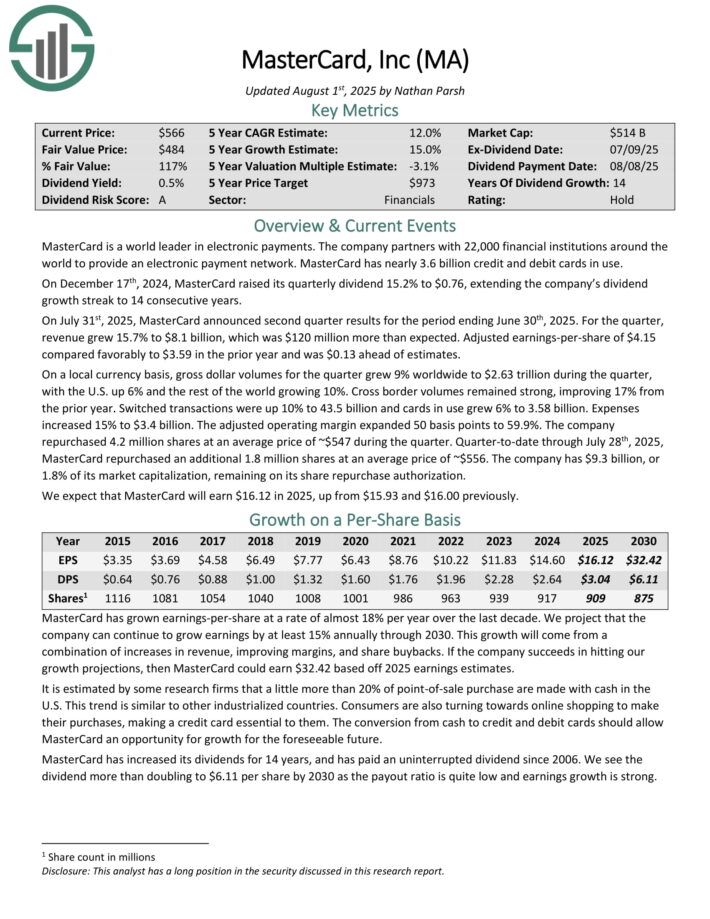

Dividend Growth Stock: Mastercard Inc. (MA)

MasterCard is a world leader in electronic payments. The company partners with 25,000 financial institutions around the world to provide an electronic payment network. MasterCard has more than 3.1 billion credit and debit cards in use.

On July 31st, 2025, MasterCard announced second quarter results for the period ending June 30th, 2025. For the quarter, revenue grew 15.7% to $8.1 billion, which was $120 million more than expected. Adjusted earnings-per-share of $4.15 compared favorably to $3.59 in the prior year and was $0.13 ahead of estimates.

On a local currency basis, gross dollar volumes for the quarter grew 9% worldwide to $2.63 trillion during the quarter, with the U.S. up 6% and the rest of the world growing 10%. Cross border volumes remained strong, improving 17% from the prior year.

Switched transactions were up 10% to 43.5 billion and cards in use grew 6% to 3.58 billion. Expenses increased 15% to $3.4 billion. The adjusted operating margin expanded 50 basis points to 59.9%.

The company repurchased 4.2 million shares at an average price of ~$547 during the quarter. Quarter-to-date through July 28th, 2025, MasterCard repurchased an additional 1.8 million shares at an average price of ~$556.

Click here to download our most recent Sure Analysis report on Mastercard (preview of page 1 of 3 shown below):

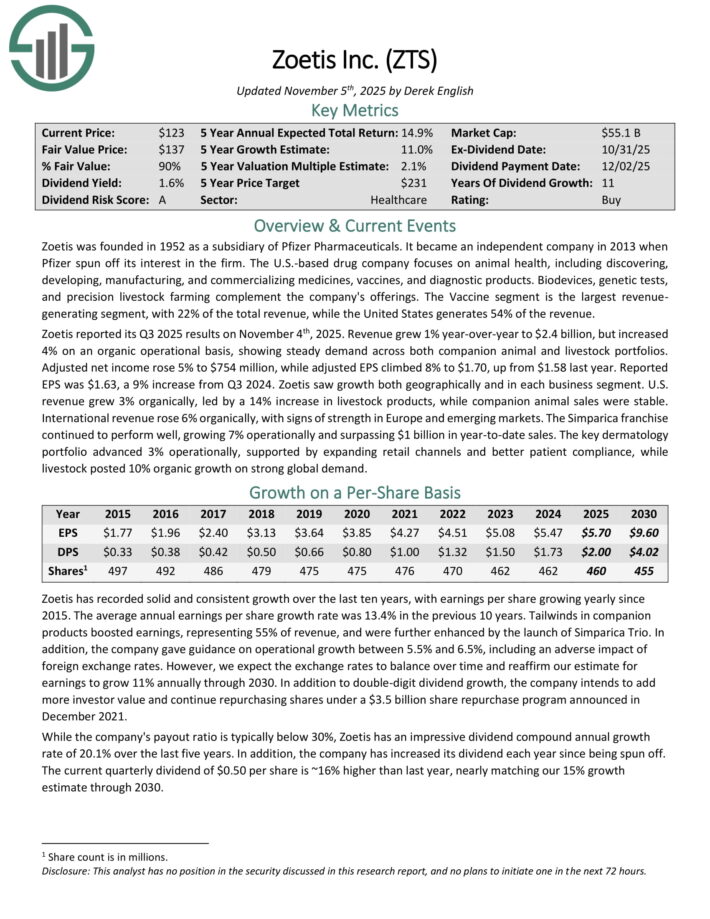

Dividend Growth Stock: Zoetis Inc. (ZTS)

Zoetis was founded in 1952 as a subsidiary of Pfizer Pharmaceuticals. It became an independent company in 2013 when Pfizer spun off its interest in the firm.

The U.S.-based drug company focuses on animal health, including discovering, developing, manufacturing, and commercializing medicines, vaccines, and diagnostic products.

Biodevices, genetic tests, and precision livestock farming complement the company’s offerings. The Vaccine segment is the largest revenue generating segment, with 22% of the total revenue, while the United States generates 54% of the revenue.

Zoetis reported its Q3 2025 results on November 4th, 2025. Revenue grew 1% year-over-year to $2.4 billion, but increased 4% on an organic operational basis, showing steady demand across both companion animal and livestock portfolios.

Adjusted net income rose 5% to $754 million, while adjusted EPS climbed 8% to $1.70, up from $1.58 last year. Reported EPS was $1.63, a 9% increase from Q3 2024. Zoetis saw growth both geographically and in each business segment.

U.S. revenue grew 3% organically, led by a 14% increase in livestock products, while companion animal sales were stable.

International revenue rose 6% organically, with signs of strength in Europe and emerging markets. The Simparica franchise continued to perform well, growing 7% operationally and surpassing $1 billion in year-to-date sales.

Click here to download our most recent Sure Analysis report on ZTS (preview of page 1 of 3 shown below):

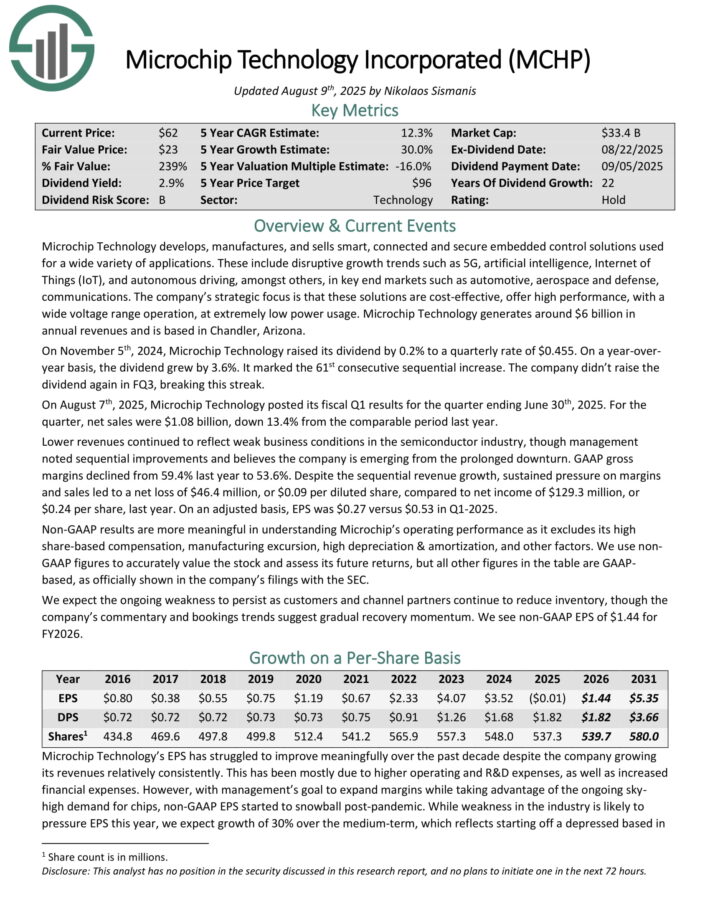

Dividend Growth Stock: Microchip Technology (MCHP)

Microchip Technology develops, manufactures, and sells smart, connected and secure embedded control solutions used for a wide variety of applications.

These include disruptive growth trends such as 5G, artificial intelligence, Internet of Things (IoT), and autonomous driving, amongst others, in key end markets such as automotive, aerospace and defense, communications.

Microchip Technology generates around $6 billion in annual revenues and is based in Chandler, Arizona.

On August 7th, 2025, Microchip Technology posted its fiscal Q1 results for the quarter ending June 30th, 2025. For the quarter, net sales were $1.08 billion, down 13.4% from the comparable period last year.

Lower revenues continued to reflect weak business conditions in the semiconductor industry, though management noted sequential improvements and believes the company is emerging from the prolonged downturn.

GAAP gross margins declined from 59.4% last year to 53.6%. Despite the sequential revenue growth, sustained pressure on margins and sales led to a net loss of $46.4 million, or $0.09 per diluted share, compared to net income of $129.3 million, or $0.24 per share, last year.

On an adjusted basis, EPS was $0.27 versus $0.53 in Q1-2025.

Click here to download our most recent Sure Analysis report on MCHP (preview of page 1 of 3 shown below):

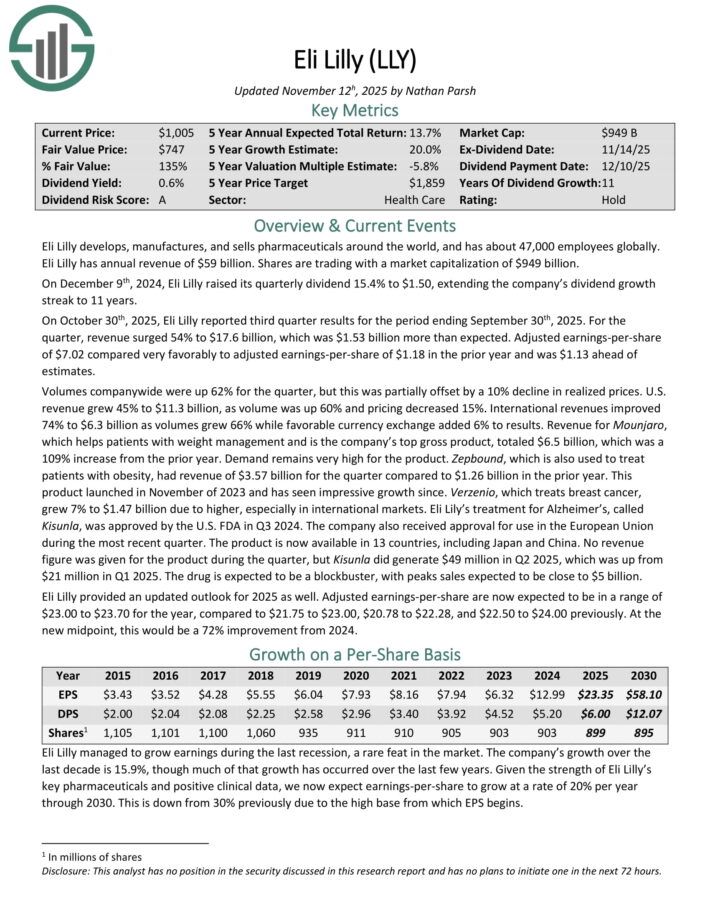

Dividend Growth Stock: Eli Lilly (LLY)

Eli Lilly develops, manufactures, and sells pharmaceuticals around the world, and has about 47,000 employees globally. Eli Lilly has annual revenue of $59 billion.

On October 30th, 2025, Eli Lilly reported third quarter results for the period ending September 30th, 2025. For the quarter, revenue surged 54% to $17.6 billion, which was $1.53 billion more than expected.

Adjusted earnings-per-share of $7.02 compared very favorably to adjusted earnings-per-share of $1.18 in the prior year and was $1.13 ahead of estimates.

Volumes companywide were up 62% for the quarter, but this was partially offset by a 10% decline in realized prices. U.S. revenue grew 45% to $11.3 billion, as volume was up 60% and pricing decreased 15%.

International revenues improved 74% to $6.3 billion as volumes grew 66% while favorable currency exchange added 6% to results. Revenue for Mounjaro, which helps patients with weight management and is the company’s top gross product, totaled $6.5 billion, which was a 109% increase from the prior year.

Zepbound, which is also used to treat patients with obesity, had revenue of $3.57 billion for the quarter compared to $1.26 billion in the prior year. This product launched in November of 2023 and has seen impressive growth since.

Verzenio, which treats breast cancer, grew 7% to $1.47 billion due to higher, especially in international markets.

Eli Lilly provided an updated outlook for 2025 as well. Adjusted earnings-per-share are now expected to be in a range of $23.00 to $23.70 for the year.

Click here to download our most recent Sure Analysis report on LLY (preview of page 1 of 3 shown below):

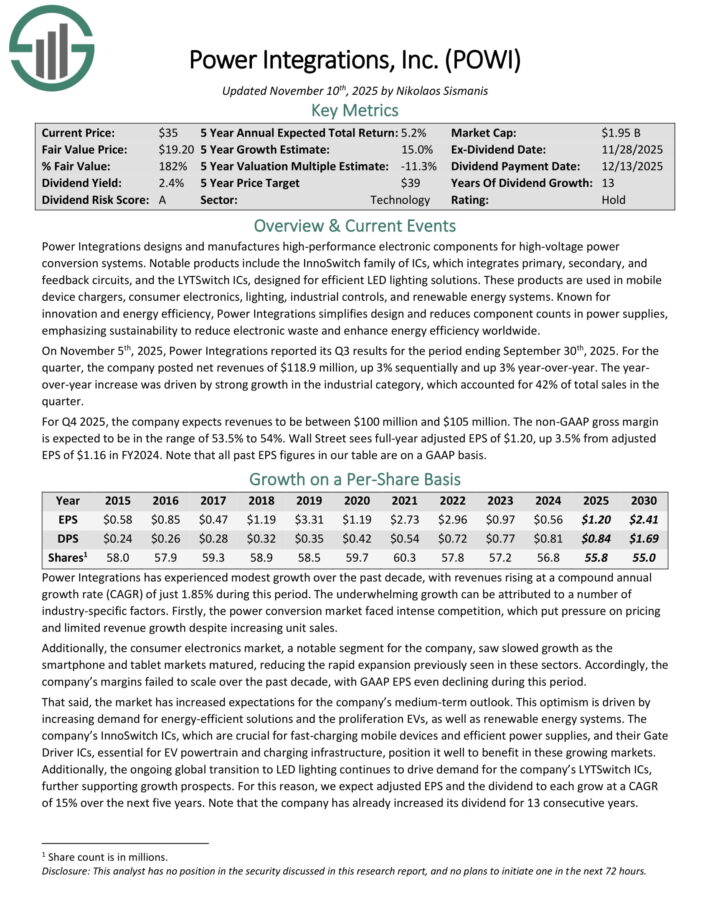

Dividend Growth Stock: Power Integrations Inc. (POWI)

Power Integrations designs and manufactures high-performance electronic components for high-voltage power conversion systems.

Notable products include the InnoSwitch family of ICs, which integrates primary, secondary, and feedback circuits, and the LYTSwitch ICs, designed for efficient LED lighting solutions. These products are used in mobile device chargers, consumer electronics, lighting, industrial controls, and renewable energy systems.

Known for innovation and energy efficiency, Power Integrations simplifies design and reduces component counts in power supplies, emphasizing sustainability to reduce electronic waste and enhance energy efficiency worldwide.

On November 5th, 2025, Power Integrations reported its Q3 results. For the quarter, the company posted net revenues of $118.9 million, up 3% sequentially and up 3% year-over-year. The year-over-year increase was driven by strong growth in the industrial category, which accounted for 42% of total sales in the quarter.

For Q4 2025, the company expects revenues to be between $100 million and $105 million. The non-GAAP gross margin is expected to be in the range of 53.5% to 54%.

Wall Street sees full-year adjusted EPS of $1.20, up 3.5% from adjusted EPS of $1.16 in FY2024. Note that all past EPS figures in our table are on a GAAP basis.

Click here to download our most recent Sure Analysis report on POWI (preview of page 1 of 3 shown below):

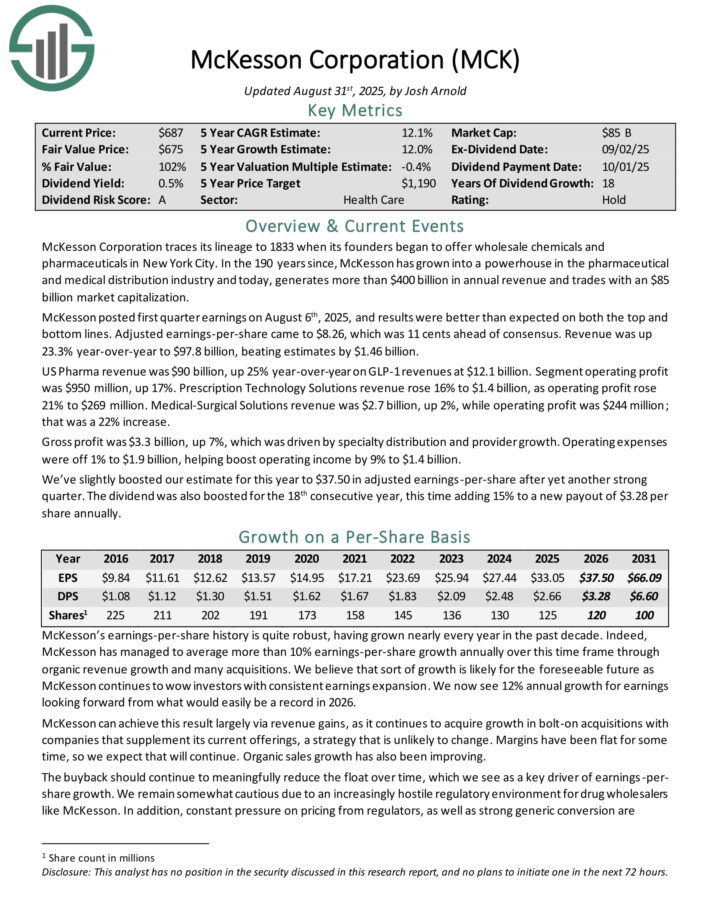

Dividend Growth Stock: McKesson Corporation (MCK)

McKesson Corporation traces its lineage to 1833 when its founders began to offer wholesale chemicals and pharmaceuticals in New York City.

In the 190 years since, McKesson has grown into a powerhouse in the pharmaceutical and medical distribution industry and today, generates more than $300 billion in annual revenue.

McKesson posted first quarter earnings on August 6th, 2025, and results were better than expected on both the top and bottom lines.

Adjusted earnings-per-share came to $8.26, which was 11 cents ahead of consensus. Revenue was up 23.3% year-over-year to $97.8 billion, beating estimates by $1.46 billion.

US Pharma revenue was $90 billion, up 25% year-over-year on GLP-1 revenues at $12.1 billion. Segment operating profit was $950 million, up 17%.

Prescription Technology Solutions revenue rose 16% to $1.4 billion, as operating profit rose 21% to $269 million. Medical-Surgical Solutions revenue was $2.7 billion, up 2%, while operating profit was $244 million; that was a 22% increase.

Gross profit was $3.3 billion, up 7%, which was driven by specialty distribution and provider growth. Operating expenses were off 1% to $1.9 billion, helping boost operating income by 9% to $1.4 billion.

Click here to download our most recent Sure Analysis report on MCK (preview of page 1 of 3 shown below):

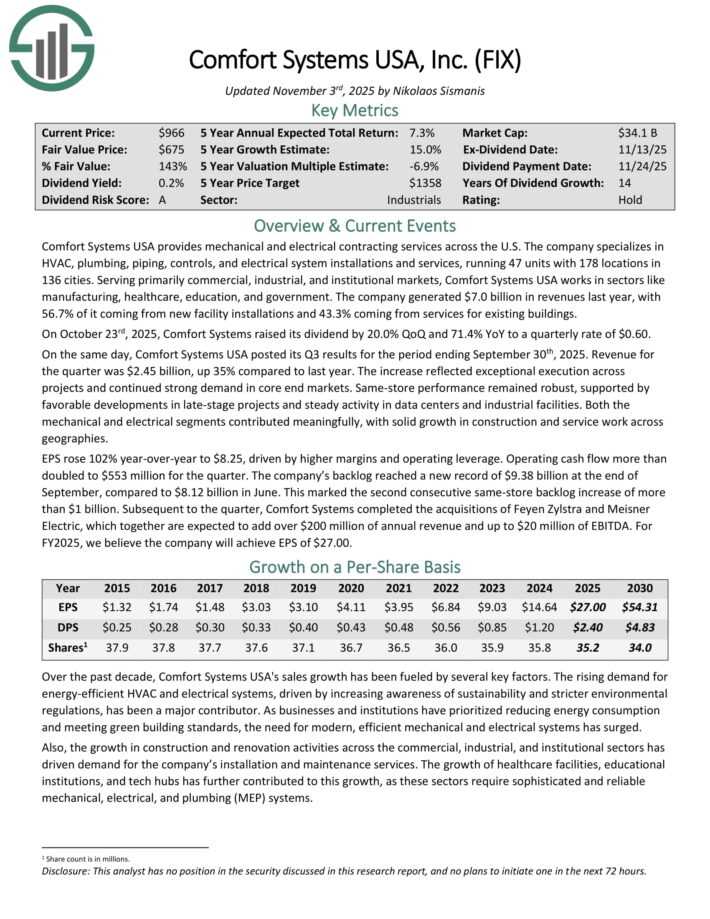

Dividend Growth Stock: Comfort Systems USA (FIX)

Comfort Systems USA provides mechanical and electrical contracting services across the U.S. The company specializes in HVAC, plumbing, piping, controls, and electrical system installations and services, running 47 units with 178 locations in 136 cities.

Serving primarily commercial, industrial, and institutional markets, Comfort Systems USA works in sectors like manufacturing, healthcare, education, and government. The company generated $7.0 billion in revenues last year, with 56.7% of it coming from new facility installations and 43.3% coming from services for existing buildings.

On October 23rd, 2025, Comfort Systems raised its dividend by 20.0% QoQ and 71.4% YoY to a quarterly rate of $0.60. On the same day, Comfort Systems USA posted its Q3 results for the period ending September 30th, 2025. Revenue for the quarter was $2.45 billion, up 35% compared to last year.

The increase reflected exceptional execution across projects and continued strong demand in core end markets. Same-store performance remained robust, supported by favorable developments in late-stage projects and steady activity in data centers and industrial facilities.

Both the mechanical and electrical segments contributed meaningfully, with solid growth in construction and service work across geographies.

EPS rose 102% year-over-year to $8.25, driven by higher margins and operating leverage. Operating cash flow more than doubled to $553 million for the quarter. The company’s backlog reached a new record of $9.38 billion at the end of September, compared to $8.12 billion in June.

This marked the second consecutive same-store backlog increase of more than $1 billion. Subsequent to the quarter, Comfort Systems completed the acquisitions of Feyen Zylstra and Meisner Electric, which together are expected to add over $200 million of annual revenue and up to $20 million of EBITDA.

Click here to download our most recent Sure Analysis report on FIX (preview of page 1 of 3 shown below):

Dividend Growth Stock: Lemaitre Vascular (LMAT)

LeMaitre Vascular develops, markets, services, and backs medical devices and implants to treat peripheral vascular disease.

Their offerings include restore flow allografts, angioscopes, embolectomy and thrombectomy catheters, occlusion and perfusion catheters, artery graft biologic grafts, carotid shunts, radiopaque tape, valvulotomes, vascular grafts, cardiac patches, and closure systems.

On August 5th, 2025, LeMaitre announced results for the second quarter of 2025, reporting Q2 non-GAAP EPS of $0.60 that beat analysts’ estimates by $0.03.

LeMaitre Vascular delivered strong Q2 2025 results, with sales climbing 15% year-over-year to $64.2 million, entirely driven by organic growth.

Gains were led by catheters, which were up 27%, and grafts, which were higher by 19%, with price increases contributing 8% and unit volumes adding 7% to growth. Regional performance was broad-based, with EMEA sales up 23%, Americas up 12%, and APAC up 12%.

Gross margin expanded 110 basis points to 70.0% on improved pricing and manufacturing efficiencies, while operating income rose 12% to $16.1 million, representing a 25% margin. Cash increased by $16.9 million sequentially to $319.5 million.

The company raised full-year guidance to $251 million in sales (+14%) and $2.30 EPS (+19%) at the midpoint.

Click here to download our most recent Sure Analysis report on LMAT (preview of page 1 of 3 shown below):

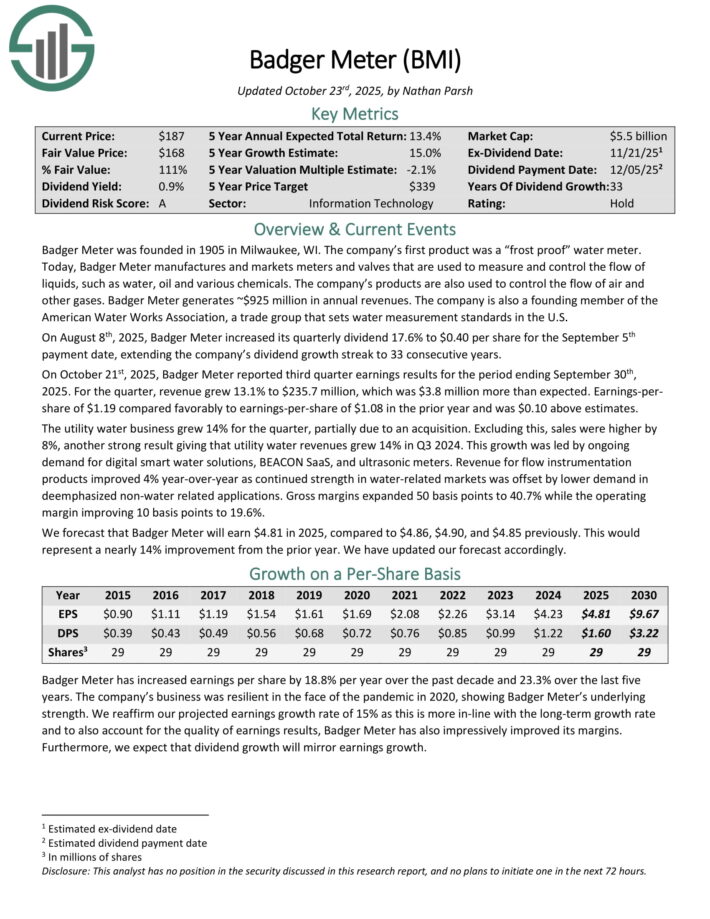

Dividend Growth Stock: Badger Meter (BMI)

Badger Meter manufactures and markets meters and valves that are used to measure and control the flow of liquids, such as water, oil and various chemicals.

The company’s products are also used to control the flow of air and other gases. Badger Meter generates ~$925 million in annual revenues.

On August 8th, 2025, Badger Meter increased its quarterly dividend 17.6% to $0.40 per share for the September 5th payment date, extending the company’s dividend growth streak to 33 consecutive years.

On October 21st, 2025, Badger Meter reported third quarter earnings results. For the quarter, revenue grew 13.1% to $235.7 million, which was $3.8 million more than expected.

Earnings-per-share of $1.19 compared favorably to earnings-per-share of $1.08 in the prior year and was $0.10 above estimates.

The utility water business grew 14% for the quarter, partially due to an acquisition. Excluding this, sales were higher by 8%, another strong result giving that utility water revenues grew 14% in Q3 2024. This growth was led by ongoing demand for digital smart water solutions, BEACON SaaS, and ultrasonic meters.

Revenue for flow instrumentation products improved 4% year-over-year as continued strength in water-related markets was offset by lower demand in de-emphasized non-water related applications.

Click here to download our most recent Sure Analysis report on BMI (preview of page 1 of 3 shown below):

Additional Reading

If you are interested in finding other quality dividend growth stocks, the following Sure Dividend resources may be useful:

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].