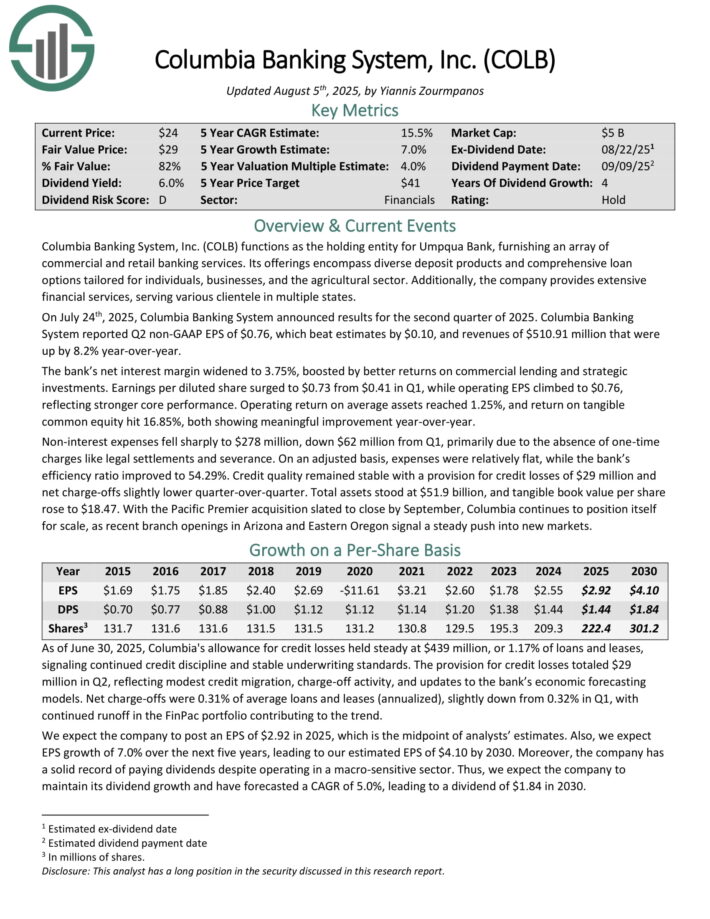

Published on October 7th, 2025 by Bob Ciura

Most investors who want to gain exposure to the financial sector focus solely on the well-known, mega-cap bank stocks such as JP Morgan Chase (JPM) and Bank of America (BAC).

However, some smaller financial services companies have maintained much longer dividend growth streaks than the popular big banks.

Regional banks have exhibited solid performance thanks to their quality business models, and reluctance to engage in the riskier lending and trading practices that got the big banks in so much trouble in the 2008 financial crisis.

At the same time, many banks have shareholder return programs in place with attractive dividend yields.

As a result, banks can be compelling investments for dividend growth investors.

With that in mind, we’ve compiled a list of more than 240 financial stocks, along with important investing metrics. The database is available for download below:

This article will rank the 10 best regional bank stocks in the Sure Analysis Research Database right now.

The stocks below are ranked according to their annual expected returns over the next five years, from lowest to highest.

Table of Contents

Regional Bank #10: OFG Bancorp (OFG)

Annual Expected Returns: 12.3%

OFG Bancorp is a leading financial holding company that operates Oriental Bank, providing a full suite of banking, mortgage, insurance, and wealth management services.

The bank serves retail, commercial, and institutional clients across Puerto Rico and the U.S. Virgin Islands. With its Digital First strategy, OFG has strengthened its competitive position, expanding its market share in key financial segments.

On July 17th, 2025, the company announced results for the second quarter of 2025. OFG Bancorp reported Q2 non GAAP EPS of $1.15, which beat estimates by $0.10.

Total core revenues climbed to $182.2 million, driven by solid net interest income, which benefited from a 5.31% net interest margin. Return on average assets reached 1.73%, while return on tangible common equity jumped to 16.96%, reflecting strong operating leverage.

Loan production surged 40% sequentially to $783.7 million, contributing to 4.2% quarterly loan growth. OFG also ended the quarter with record total assets of $12.2 billion and core deposits of $9.9 billion. Pre-provision net revenue hit $87.6 million, supported by increased mortgage banking and wealth management activity.

Credit metrics remained resilient, with net charge-offs declining to $12.8 million (0.64% of loans), and nonperforming loans at a low 1.19%. The company recorded a $21.7 million provision for credit losses, mainly tied to higher commercial loan volume and reserves on four credits.

OFG repurchased 186,024 shares in Q2, while tangible book value rose to $27.67.

Click here to download our most recent Sure Analysis report on OFG (preview of page 1 of 3 shown below):

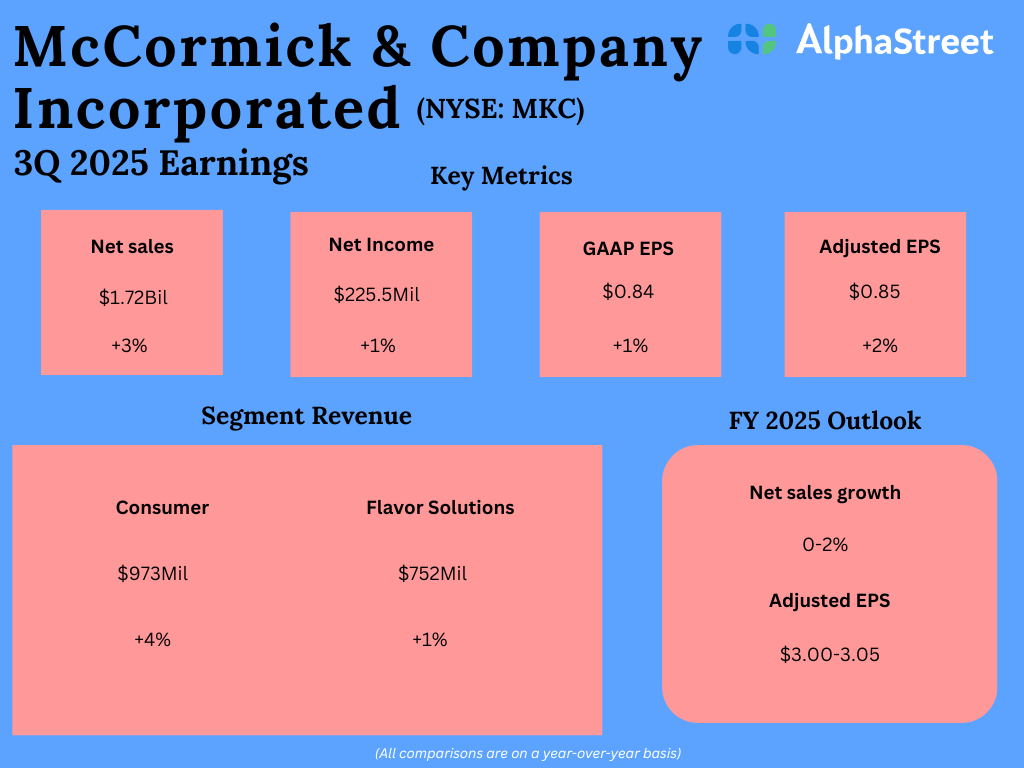

Regional Bank #9: Orrstown Financial Services, Inc. (ORRF)

Annual Expected Returns: 12.3%

Orrstown Financial Services, Inc. is a community bank. ORRF serves as the holding company for its operating bank subsidiary, Orrstown Bank.

The company provides banking and financial advisory services to customers located in the south-central Pennsylvania counties of Berks, Cumberland, Dauphin, Franklin, Lancaster, Perry, and York. ORRF also serves customers in Anne Arundel, Baltimore, Howard, and Washington counties in Maryland.

Its savings products include money market accounts, savings accounts, certificates of deposit, and checking accounts. Loan products offered consist of residential mortgages, home equity lines of credit, commercial mortgages, construction loans, and commercial loans.

Financial advisory services provided include fiduciary, investment advisory, and brokerage services.

On July 22nd, ORRF released its earnings report for the second quarter ended June 30th, 2025. The company’s net interest income jumped 89.7% over the year-ago period to $49.5 million during the quarter. That was mostly the result of the acquisition of Codorus Valley Bancorp.

A 53-basis-point expansion in the net interest margin to 4.07% also contributed to this sharp rise in net interest income in the quarter. ORRF’s noninterest income rose 80.1% year-over-year to $12.9 million for the quarter.

ORRF’s adjusted diluted EPS grew by 25.3% over the year-ago period to $1.04 during the quarter. This exceeded the analyst consensus in the quarter by $0.06.

Also of note, ORRF upped its quarterly dividend per share by 3.8% to $0.27. That was on top of the 13% boost announced earlier this year.

Click here to download our most recent Sure Analysis report on ORRF (preview of page 1 of 3 shown below):

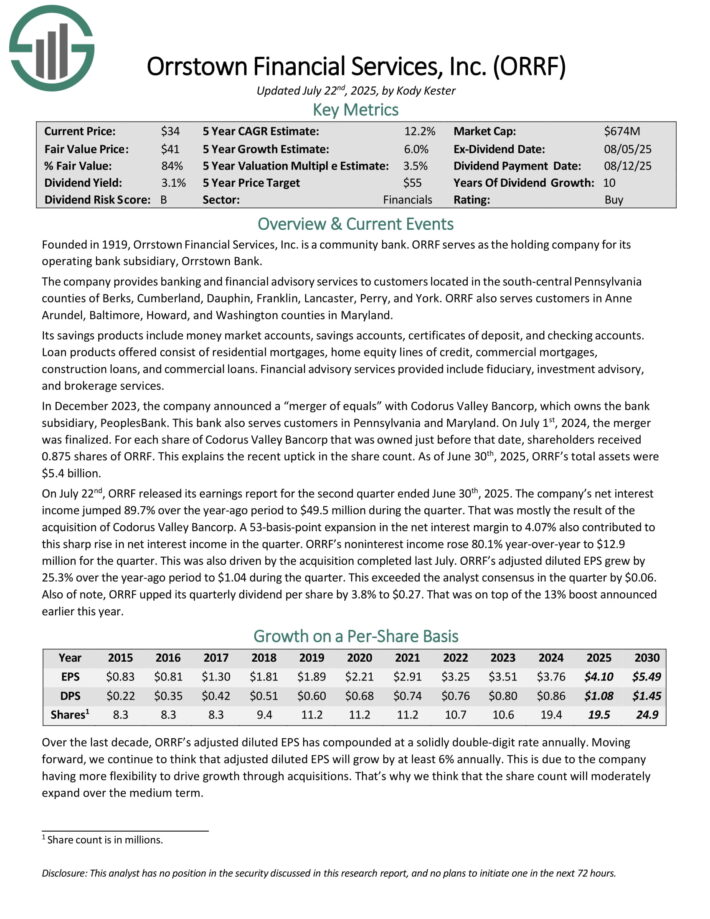

Regional Bank #8: Eastern Bankshares (EBC)

Annual Expected Returns: 12.6%

Eastern Bankshares Inc. provides commercial banking products and services primarily to retail, commercial and small business customers.

It provides banking, trust, and investment services, as well as insurance services, through its full service bank branches and insurance offices.

As of March 31, 2025, Eastern Bankshares had total consolidated assets of $25.0 billion, total gross loans of $18.2 billion, and total deposits of $20.8 billion. The company was founded in 1818 and has 1,744 employees.

On July 24th, 2025, Eastern Bankshares announced its second-quarter 2025 results for the period ending June 30th, 2025.

For the quarter, the company reported a net income of $100.2 million, a strong rebound from a net loss of $217.7 million in the first quarter. Reported earnings per diluted share for the same periods were $0.50 and $(1.08), respectively, marking a significant improvement.

Despite the prior GAAP loss, operating net income rose to $81.7 million, up from $67.5 million in the first quarter, reflecting enhanced core profitability.

Net interest income increased by $13.1 million, or 7%, to $202.0 million for the second quarter, compared to $188.9 million for the first quarter of 2025. This improvement was driven by higher asset yields and ongoing benefits from the Cambridge merger.

Click here to download our most recent Sure Analysis report on EBC (preview of page 1 of 3 shown below):

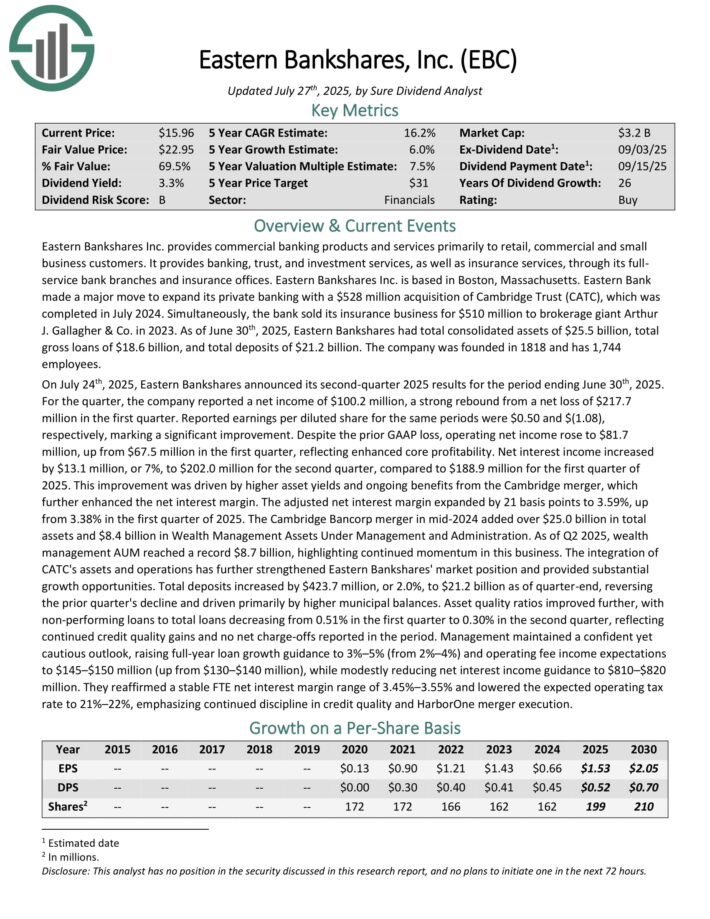

Regional Bank #7: Columbia Banking System (COLB)

Annual Expected Returns: 13.0%

Columbia Banking System functions as the holding entity for Umpqua Bank, furnishing an array of commercial and retail banking services.

Its offerings encompass diverse deposit products and comprehensive loan options tailored for individuals, businesses, and the agricultural sector. Additionally, the company provides extensive financial services, serving various clientele in multiple states.

On July 24th, 2025, Columbia Banking System announced results for the second quarter of 2025. Columbia Banking System reported Q2 non-GAAP EPS of $0.76, which beat estimates by $0.10, and revenues of $510.91 million that were up by 8.2% year-over-year.

The bank’s net interest margin widened to 3.75%, boosted by better returns on commercial lending and strategic investments. Earnings per diluted share surged to $0.73 from $0.41 in Q1, while operating EPS climbed to $0.76, reflecting stronger core performance.

Operating return on average assets reached 1.25%, and return on tangible common equity hit 16.85%, both showing meaningful improvement year-over-year.

Non-interest expenses fell sharply to $278 million, down $62 million from Q1, primarily due to the absence of one-time charges like legal settlements and severance. On an adjusted basis, expenses were relatively flat, while the bank’s efficiency ratio improved to 54.29%.

With the Pacific Premier acquisition slated to close by September, Columbia continues to position itself for scale, as recent branch openings in Arizona and Eastern Oregon signal a steady push into new markets.

Click here to download our most recent Sure Analysis report on COLB (preview of page 1 of 3 shown below):

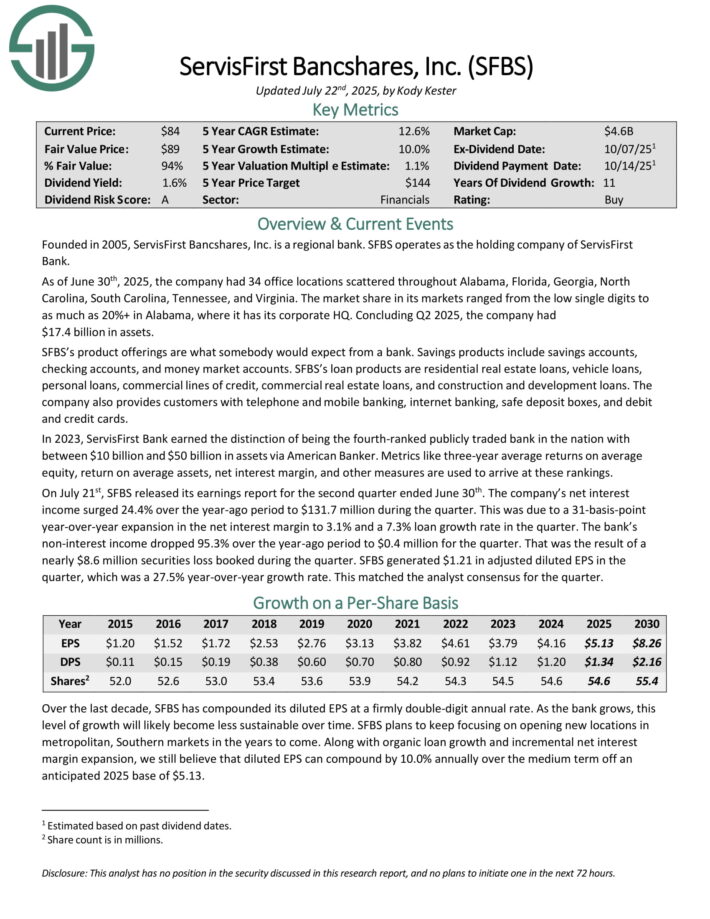

Regional Bank #6: ServisFirst Bancshares (SFBS)

Annual Expected Returns: 13.1%

ServisFirst Bancshares is a regional bank and operates as the holding company of ServisFirst Bank. As of June 30th, 2025, the company had 34 office locations scattered throughout Alabama, Florida, Georgia, North Carolina, South Carolina, Tennessee, and Virginia.

The market share in its markets ranged from the low single digits to as much as 20%+ in Alabama, where it has its corporate HQ. Concluding Q2 2025, the company had $17.4 billion in assets.

SFBS’s savings products include savings accounts, checking accounts, and money market accounts.

SFBS’s loan products are residential real estate loans, vehicle loans, personal loans, commercial lines of credit, commercial real estate loans, and construction and development loans.

On July 21st, SFBS released its earnings report for the second quarter ended June 30th. The company’s net interest income surged 24.4% over the year-ago period to $131.7 million during the quarter. This was due to a 31-basis-point year-over-year expansion in the net interest margin to 3.1% and a 7.3% loan growth rate in the quarter.

The bank’s non-interest income dropped 95.3% over the year-ago period to $0.4 million for the quarter. That was the result of a nearly $8.6 million securities loss booked during the quarter.

SFBS generated $1.21 in adjusted diluted EPS in the quarter, which was a 27.5% year-over-year growth rate.

Click here to download our most recent Sure Analysis report on SFBS (preview of page 1 of 3 shown below):

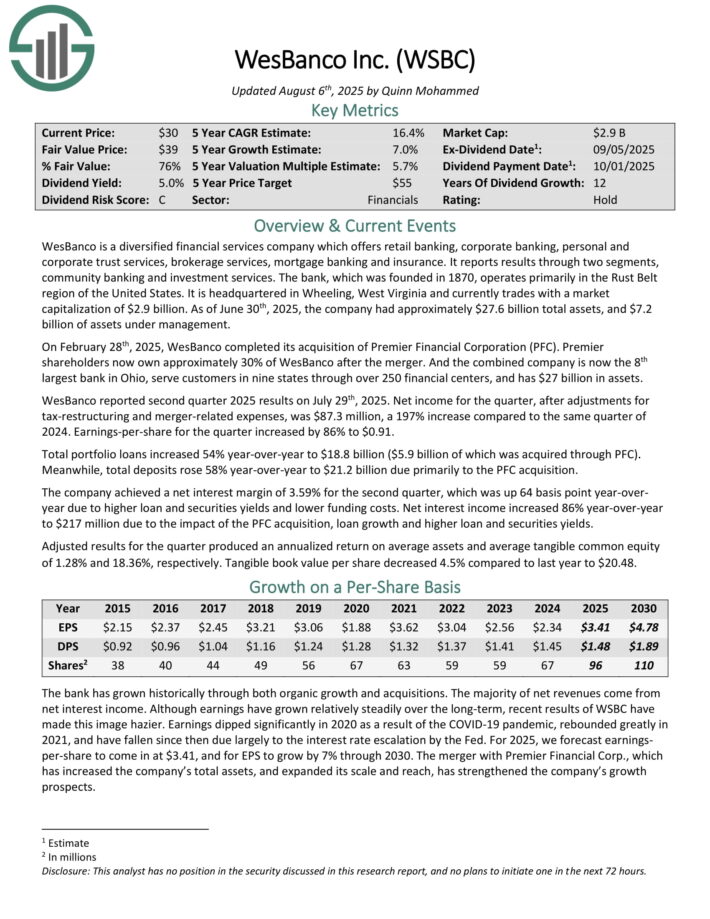

Regional Bank #5: WesBanco, Inc. (WSBC)

Annual Expected Returns: 13.6%

WesBanco is a diversified financial services company which offers retail banking, corporate banking, personal and corporate trust services, brokerage services, mortgage banking and insurance. It reports results through two segments, community banking and investment services.

The bank, which was founded in 1870, operates primarily in the Rust Belt region of the United States. It is headquartered in Wheeling, West Virginia. As of June 30th, 2025, the company had approximately $27.6 billion total assets, and $7.2 billion of assets under management.

WesBanco reported second quarter 2025 results on July 29th, 2025. Net income for the quarter, after adjustments for tax-restructuring and merger-related expenses, was $87.3 million, a 197% increase compared to the same quarter of 2024. Earnings-per-share for the quarter increased by 86% to $0.91.

Total portfolio loans increased 54% year-over-year to $18.8 billion ($5.9 billion of which was acquired through PFC). Meanwhile, total deposits rose 58% year-over-year to $21.2 billion due primarily to the PFC acquisition.

The company achieved a net interest margin of 3.59% for the second quarter, which was up 64 basis point year-over-year due to higher loan and securities yields and lower funding costs.

Net interest income increased 86% year-over-year to $217 million due to the impact of the PFC acquisition, loan growth and higher loan and securities yields.

Adjusted results for the quarter produced an annualized return on average assets and average tangible common equity of 1.28% and 18.36%, respectively. Tangible book value per share decreased 4.5% compared to last year to $20.48.

Click here to download our most recent Sure Analysis report on WSBC (preview of page 1 of 3 shown below):

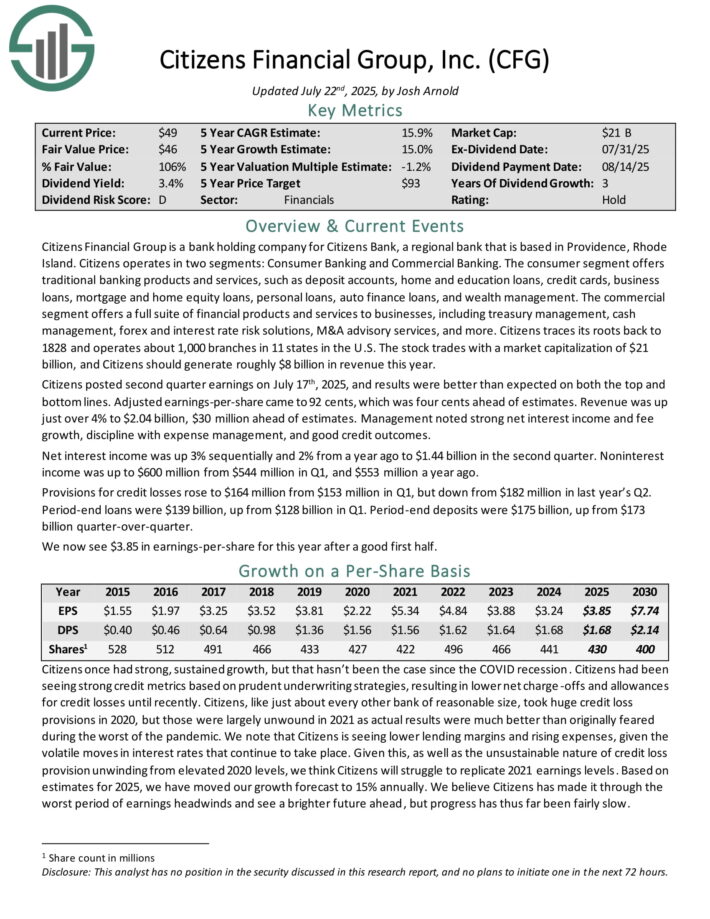

Regional Bank #4: Citizens Financial Group (CFG)

Annual Expected Returns: 13.6%

Citizens Financial Group is a bank holding company for Citizens Bank, a regional bank that is based in Providence, Rhode Island. Citizens operates in two segments: Consumer Banking and Commercial Banking.

The consumer segment offers traditional banking products and services, such as deposit accounts, home and education loans, credit cards, business loans, mortgage and home equity loans, personal loans, auto finance loans, and wealth management.

The commercial segment offers a full suite of financial products and services to businesses, including treasury management, cash management, forex and interest rate risk solutions, M&A advisory services, and more. Citizens traces its roots back to 1828 and operates about 1,000 branches in 11 states in the U.S.

Citizens posted second quarter earnings on July 17th, 2025, and results were better than expected on both the top and bottom lines. Adjusted earnings-per-share came to 92 cents, which was four cents ahead of estimates.

Revenue was up just over 4% to $2.04 billion, $30 million ahead of estimates. Management noted strong net interest income and fee growth, discipline with expense management, and good credit outcomes.

Net interest income was up 3% sequentially and 2% from a year ago to $1.44 billion in the second quarter. Noninterest income was up to $600 million from $544 million in Q1, and $553 million a year ago.

Provisions for credit losses rose to $164 million from $153 million in Q1, but down from $182 million in last year’s Q2. Period-end loans were $139 billion, up from $128 billion in Q1. Period-end deposits were $175 billion, up from $173 billion quarter-over-quarter.

Click here to download our most recent Sure Analysis report on CFG (preview of page 1 of 3 shown below):

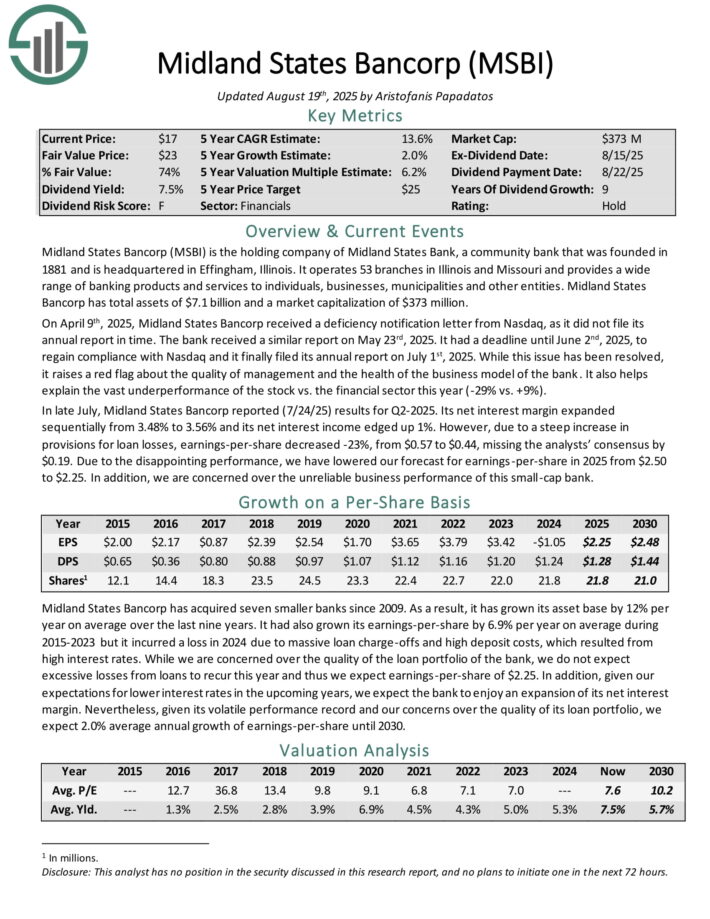

Regional Bank #3: Midland States Bancorp (MSBI)

Annual Expected Returns: 13.8%

Midland States Bancorp is the holding company of Midland States Bank, a community bank that was founded in 1881 and is headquartered in Effingham, Illinois.

It operates 53 branches in Illinois and Missouri and provides a wide range of banking products and services to individuals, businesses, municipalities and other entities. Midland States Bancorp has total assets of $7.1 billion.

On April 9th, 2025, Midland States Bancorp received a deficiency notification letter from Nasdaq, as it did not file its annual report in time. The bank received a similar report on May 23rd, 2025. It had a deadline until June 2nd, 2025, to regain compliance with Nasdaq and it finally filed its annual report on July 1st, 2025.

In late July, Midland States Bancorp reported (7/24/25) results for Q2-2025. Its net interest margin expanded sequentially from 3.48% to 3.56% and its net interest income edged up 1%.

However, due to a steep increase in provisions for loan losses, earnings-per-share decreased -23%, from $0.57 to $0.44, missing the analysts’ consensus by $0.19.

Due to the disappointing performance, we have lowered our forecast for earnings-per-share in 2025 from $2.50 to $2.25.

Click here to download our most recent Sure Analysis report on MSBI (preview of page 1 of 3 shown below):

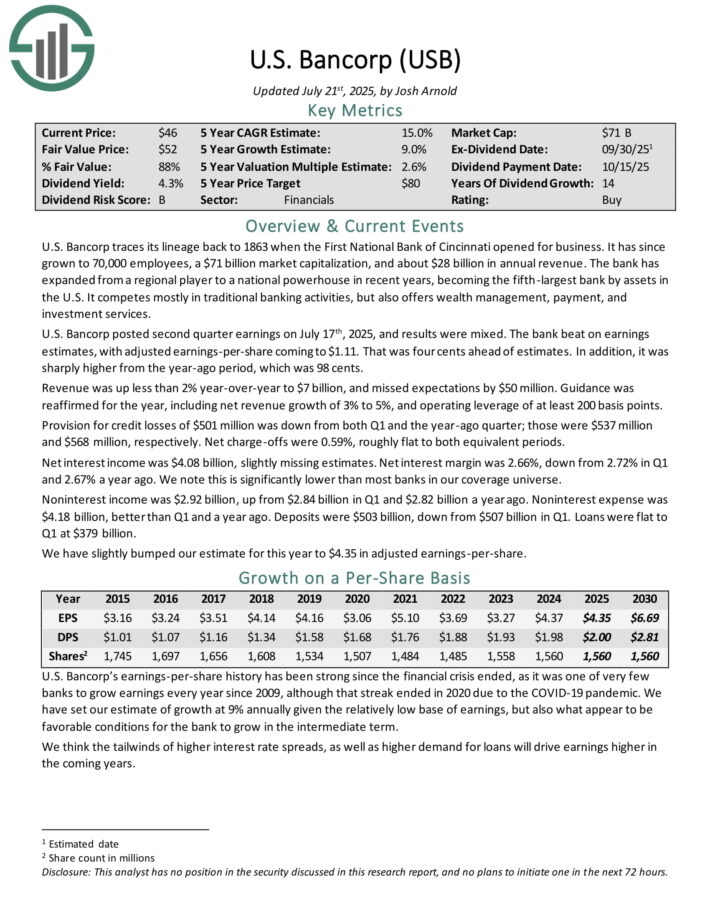

Regional Bank #2: U.S. Bancorp (USB)

Annual Expected Returns: 14.2%

U.S. Bancorp traces its lineage back to 1863 when the First National Bank of Cincinnati opened for business. It has since grown to 70,000 employees, and about $28 billion in annual revenue.

The bank has expanded from a regional player to a national powerhouse in recent years, becoming the fifth-largest bank by assets in the U.S. It competes mostly in traditional banking activities, but also offers wealth management, payment, and investment services.

U.S. Bancorp posted second quarter earnings on July 17th, 2025, and results were mixed. The bank beat on earnings estimates, with adjusted earnings-per-share coming to $1.11. That was four cents ahead of estimates. In addition, it was sharply higher from the year-ago period, which was 98 cents.

Revenue was up less than 2% year-over-year to $7 billion, and missed expectations by $50 million. Guidance was reaffirmed for the year, including net revenue growth of 3% to 5%, and operating leverage of at least 200 basis points.

Provision for credit losses of $501 million was down from both Q1 and the year-ago quarter; those were $537 million and $568 million, respectively. Net charge-offs were 0.59%, roughly flat to both equivalent periods.

Net interest income was $4.08 billion, slightly missing estimates. Net interest margin was 2.66%, down from 2.72% in Q1 and 2.67% a year ago. We note this is significantly lower than most banks in our coverage universe.

Noninterest income was $2.92 billion, up from $2.84 billion in Q1 and $2.82 billion a year ago. Noninterest expense was $4.18 billion, better than Q1 and a year ago. Deposits were $503 billion, down from $507 billion in Q1. Loans were flat to Q1 at $379 billion.

Click here to download our most recent Sure Analysis report on USB (preview of page 1 of 3 shown below):

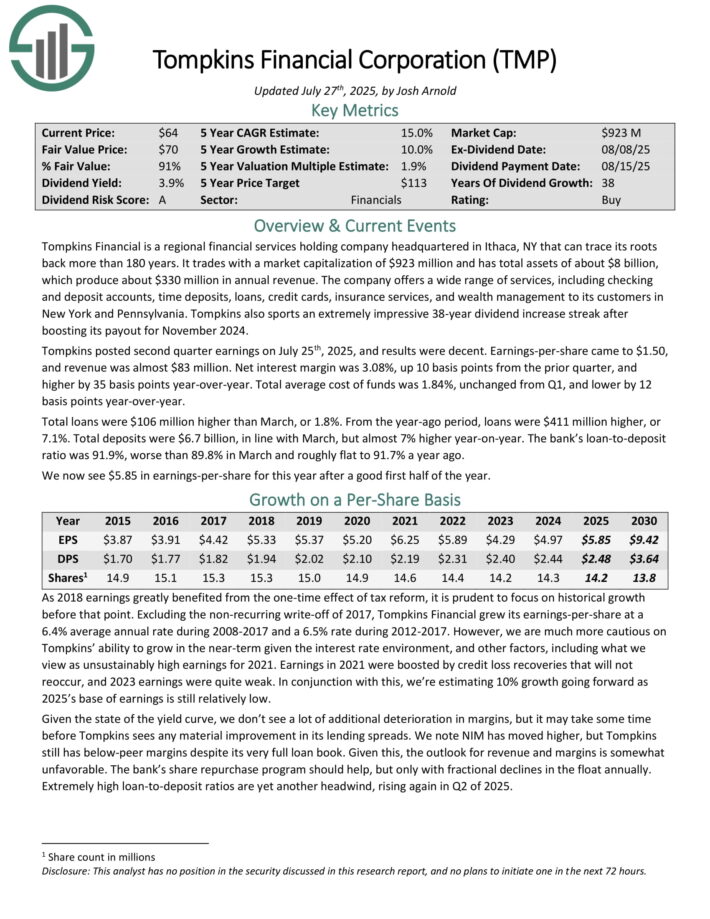

Regional Bank #1: Tompkins Financial (TMP)

Annual Expected Returns: 14.3%

Tompkins Financial is a regional financial services holding company headquartered in Ithaca, NY that can trace its roots back more than 180 years. It has total assets of about $8 billion, which produce about $300 million in annual revenue.

The company offers a wide range of services, including checking and deposit accounts, time deposits, loans, credit cards, insurance services, and wealth management to its customers in New York and Pennsylvania.

Tompkins posted second quarter earnings on July 25th, 2025. Earnings-per-share came to $1.50, and revenue was almost $83 million.

Net interest margin was 3.08%, up 10 basis points from the prior quarter, and higher by 35 basis points year-over-year. Total average cost of funds was 1.84%, unchanged from Q1, and lower by 12 basis points year-over-year.

Total loans were $106 million higher than March, or 1.8%. From the year-ago period, loans were $411 million higher, or 7.1%.

Total deposits were $6.7 billion, in line with March, but almost 7% higher year-on-year. The bank’s loan-to-deposit ratio was 91.9%, worse than 89.8% in March and roughly flat to 91.7% a year ago.

Click here to download our most recent Sure Analysis report on TMP (preview of page 1 of 3 shown below):

Final Thoughts

The 10 regional banks above may fly under the radar of most investors due to their low profile and their smaller businesses.

However, such lower-risk stocks are sometimes great candidates for the portfolios of income-oriented investors. This is certainly the case for these 10 stocks, which have rewarded their shareholders with consistent dividends for years.

Dividend increases should continue each year for many more years to come.

Additional Reading

The following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

If you’re looking for stocks with unique dividend characteristics, consider the following Sure Dividend databases:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].