Wealth managers are often cautioned to not try to be all things to all clients. But when it comes to ultrawealthy clients, most firms may not be doing enough.

Processing Content

A new report from the industry researcher Cerulli Associates this week finds that advisors who have large shares of their practices dedicated to ultrahigh net worth clients tend to have services stretching beyond basic welath management. The most common offering from firms specializing in this highly coveted client group is business planning, provided by 75% of the respondents to Cerulli’s survey.

What types of firms is Cerulli talking about? Those that derive at least half of their assets under management from clients with $20 million or more. Cerulli contrasts them high net worth firms — which tend to work with clients with $5 million or more — and finds big differences in the services on offer.

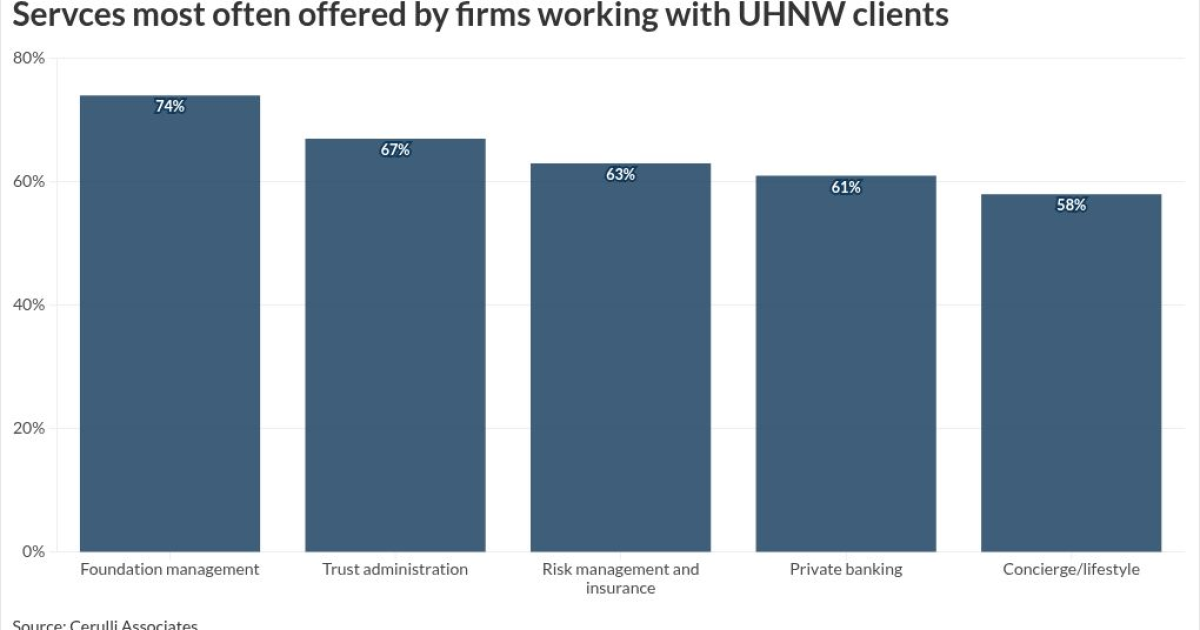

For instance, whereas nearly three-quarters of ultrahigh net worth outfits help clients manage foundations, only 59% of their high net worth counterparts do the same. The same difference shows up with services like trust administration (offered by 67% of UHNW firms and 53% of HNW firms) and private banking (61% vs. 43%.)

How about some help with a spa appointment?

An even bigger discrepancy appears among firms willing to offer “concierge” and “lifestyle” resources like assistance setting up appointments with fitness instructors and beauty spas. Nearly 60% of advisors working with ultrahigh net worth clients have these sorts of offerings, whereas only 31% of HNW firms do the same.

“For firms looking to serve as the core advisory provider to ultra-wealthy families, it is critical to deliver solutions that serve the client in every facet of their lives from wealth management to concierge services,” Chayce Horton, Cerulli associate director, said in a statement.

It’s a message that’s resonating with advisors. Scott Bishop, a partner and managing director at the Houston-based advisory firm Presidio Wealth Partners, said his firm over time has added services ranging from business planning to philanthropy support and outsourced accounting. What he and his partners have found is that ultrahigh net worth clients don’t necessarily need a lengthy “menu of extras.”

Far more important is a firm that can coordinate the abundance of services already on offer. To meet that need, Bishop said, Presidio has set up a personal advisory board consisting of a certified public accountant, financial advisor, and estate and tax and business lawyers. At its quarterly meetings, the group discusses every consideration likely to be of importance in their wealthy clients’ lives.

The goal is to have all the specialists on the board bringing their expertise to bear at the same time, rather than piecemeal.

“That multidisciplinary cadence reduces friction and prevents one-off advice from creating unintended tax or estate outcomes,” Bishop said.

Cerulli’s report also notes a big reason why advisors are so eager to work with ultrahigh worth investors. Although they made up only 0.3% of the U.S. population in 2024, they held nearly a quarter of all financial assets. Cerulli found that just 12 firms (unnamed in the report) manage nearly half of U.S. ultrahigh net worth clients’ assets.

If you’re looking to get a slice of that pie for yourself, read on.

Family office or not?

One common way to try to appeal to ultrahigh net worth clients is to set up a family office — a type of practice that essentially treats a wealthy family as though it were an independent business.

The services on offer through family offices run the gamut from help with paying bills and taxes to obtaining legal advice, insurance and strong cybersecurity. But as more firms have come to call themselves family offices, some in the industry have begun to worry the term is being stretched beyond all definition.

READ MORE: When everybody’s a ‘family office,’ what’s the term really mean?READ MORE: How family offices extend beyond wealth management

Keeping pesky capital gains taxes at bay

Call it one of the ultimate good problems to have.

Wealthy clients often have such success investing that one of their biggest concerns is holding down the taxes on the resulting profits. Recognizing this tendency, wealth managers have added an array of services designed to help keep the IRS at a comfortable distance from all those capital gains.

By far the most common offering is tax-loss harvesting, or using losses from stocks that have fallen in price since being bought to offset gains on stocks that have appreciated. But that’s just one possibility.

READ MORE: Avoiding capital gains with highly appreciated stocks

So you’re ultrawealthy and you want to retire?

As is true in so many ways, retirement planning for wealthy clients is often complicated by myriad factors.

One wrinkle was added by the sweeping retirement law known as Secure 2.0. Under the federal legislation, high earners aged 50 and older are set next year to lose the option to make pretax catch-up contributions to their 401(k)s. Although it seems contrary to common sense, many advisors say wealthy clients could actually come out better off.

READ MORE: High earners will lose pre-tax 401(k) catch-ups in 2026