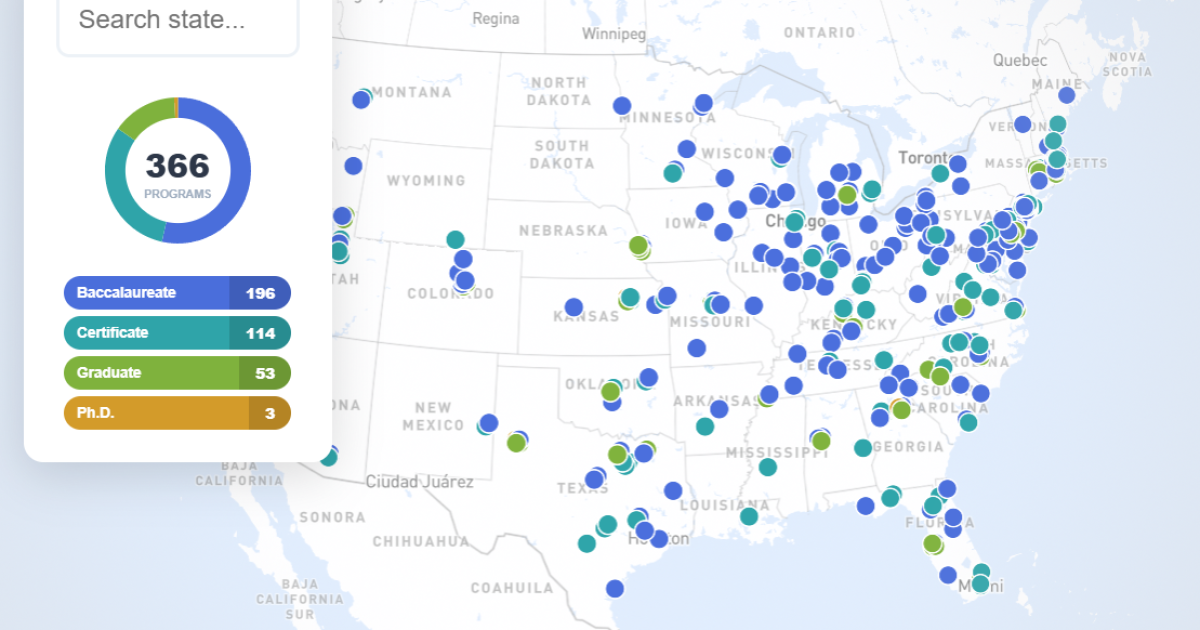

Enjoy the current installment of “Weekend Reading For Financial Planners” – this week’s edition kicks off with the news that a recent report examining salary expectations of financial planning job candidates finds that paraplanners and associate planners with experience are seeking higher salary premiums than they did in the past (with expected salary of paraplanners with prior experience growing 12% to more than $73,000 in the past year, not including bonuses or other benefits), while the expectations of experienced financial planners (whose expectations rose 4% to approximately $115,000) and students in CFP Board-eligible programs (who saw a 2% rise to nearly $61,000) increased by a smaller percentage. Which ultimately suggests that firms looking to make a new hire face a tradeoff between offering a relatively lower salary to recently graduated students or paying an (increasing) premium for candidates who come with advisory firm experience under their belts (though investing in new hires’ development once they come onboard could also be key to retaining them over time).

Also in industry news this week:

The SEC signaled this week that it would grant exemptive relief to allow Dimensional Fund Advisors to offer dual share class funds, opening the door for additional asset managers to eventually introduce these funds (that were long the purview of Vanguard) that offer potential tax-savings opportunities for clients holding mutual funds with large capital gains distributions

The third quarter saw the largest volume of RIA M&A deals ever, according to a recent report, as private equity-fueled aggregators remain active and seek increasingly large firms to acquire

From there, we have several articles on investment planning:

A 150-year stress test of the 60/40 portfolio shows its ability not only to limit the depth of portfolio drawdowns, but also their length as well

Three behavioral challenges that explain the difficulty of holding a diversified portfolio (and how these demonstrate the value of working with a financial advisor)

Why portfolio diversification could be a limiting factor for investors whose goals are focused on total growth rather than stability

We also have a number of articles on client communication:

Nine ways advisors can leverage the power of questions to build closer (and more lasting) relationships with prospects and clients

How advisors can approach client conversations to increase the likelihood that clients will open up about their underlying financial values and goals

Why going “deep” with clients into emotional topics too early in the relationship can backfire and alternative questions that can build trust without putting clients on the defensive

We wrap up with three final articles, all about the (current) limits of Artificial Intelligence (AI):

Why expectations of “hockey-stick growth” of AI platforms appear not to have come to pass (yet), with recent model releases not showing exponential returns to their additional training and computing power inputs

Why humans tend to be superior to AI tools when it comes to solving problems that require subjective judgments of “meaning”

Why radiologists continue to thrive despite the impressive performance of AI tools at reading images and suggesting diagnoses

Enjoy the ‘light’ reading!

Read More…