UBS is introducing three new training programs for advisors, even as its CEO expressed doubts that the firm’s U.S. wealth management business could approach the profitability of its rivals.

In a memo circulated to employees on Thursday, U.S. wealth head Mike Camacho said the training initiatives include a three-year program for new advisors, a new role for people who will be called associate financial advisors and an initiative for advisors on teams. UBS will begin accepting applications and nominations for all three in January.

“They reflect our dedication to investing in our Financial Advisor teams, strengthening our talent pipeline and providing clear, structured pathways for career advancement,” Camacho said in the memo.

Meanwhile, UBS CEO Sergio Ermotti said Thursday at the JPMorgan European Financials Conference in London that he thinks it very unlikely UBS’ U.S. wealth management unit will ever boast a pretax profit margin similar to its U.S. rivals. UBS’ pretax margin — the share of revenue left over after expenses other than taxes are subtracted — hit 13% in the third quarter, and Ermotti and other executives are pushing to move it closer to 15%.

But even that would lag far behind the profitability of a firm like Morgan Stanley, which reported a 30% margin in its third quarter.

Ermotti has said in the past that other large Wall Street institutions gain an advantage from their other businesses; Morgan Stanley, for instance, has a giant investment bank, while Merrill is a subsidiary of Bank of America.

“I’m still convinced, and actually, it’s a fact that it’s going to be very challenging and probably even impossible for us to have the same pretax margins of our U.S. peers on a like-for-like basis, considering the nature of their businesses in the U.S., which allows them to spread fixed cost of the banking infrastructure across different businesses,” Ermotti said Thursday.

UBS announced in a memo last month that it has applied for a national charter for a U.S. bank. If granted by the Office of the Comptroller of the Currency, the charter will allow UBS to offer banking products like checking and savings accounts and payment services to its U.S. wealth clients.

Ermotti said Thursday that UBS is on “de facto a three-year journey to get to” a 15% margin and “frankly, it’s not going to be a straight line.”

“It may be a little bit bumpy because, when you make so many changes like we are doing right now, inevitably, you have some collateral consequences,” Ermotti said.

Ermotti said UBS is dedicated to making sure its advisors are the most productive in the industry.

That means working with ultrahigh net worth family offices and making advisors “even more efficient and successful with their clients by rolling out IT capabilities and enhancing the products we give them, both from assets, but also from a banking standpoint … banking services, credit, deposits.”

UBS has struggled with advisor departures over the past year after announcing compensation changes that reduce pay for advisors on the lower end of the revenue-generation scale while providing more incentives for bringing in new assets or wealthy clients. The Swiss firm announced it would roll back some of those changes with its compensation plan for next year; large teams, however, are still leaving.

Separately, the firm had hired Ben Firestein, formerly of Morgan Stanley, to be the new head of national recruiting and retention in its U.S. wealth management unit.

How UBS plans to up-skill advisors

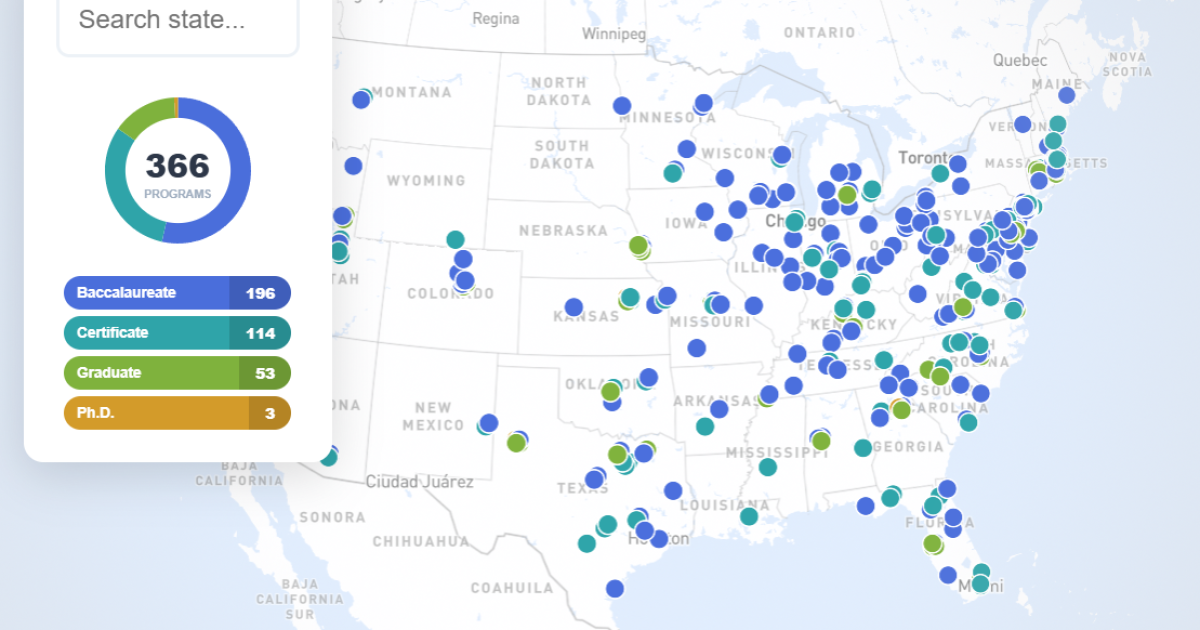

UBS’ new training programs come at a time when many firms are struggling to replace advisors who are not only departing for other firms but also settling into retirement.

UBS ended its third quarter with 5,779 advisors in its Americas unit, which includes Canada and Latin America. That was up slightly from the number for the second quarter but down from 5,986 advisors in the third quarter of 2024.

A few details about UBS’ new training programs:

The offering for new advisors is called the Advancing Advisor Development Program. It will help bring newcomers to the firm, provide them with training on wealth management and business development and give them opportunities to become equity partners in established teams. The program is open both to advisors who’ve already identified a team they want to join and to advisors in the firm’s Wealth Advice Center, which works mainly with retail investors. “The program has a limited number of seats and will be highly selective to ensure quality and success,” according to the memo.The firm’s new title of associate financial advisor will be for members of special groups called Signature Teams. AFAs will undergo training giving them expertise in relationship management, investing, financial planning and more. They’ll be compensated by a financial advisor on their team, making their pay independent of business development.UBS is also offering what it’s calling a Team Associate Career Path. This will provide members of advisory teams with a means of obtaining licensing support and technical skills training, among other things. Those on this path will be able to further specialize in certain areas of wealth management and possibly earn new business titles.

Most large Wall Street wealth managers have some sort of training program for industry novices. The best known program is Merrill’s, which now has roughly 2,400 enrollees and has earned the firm the phrase “Merrill trains the Street.”

Jason Diamond, president of the industry recruiting firm Diamond Consultants, said he doesn’t think training will prove any firm’s salvation.

“Most of the other firms can say, ‘We also have an advisor training program,'” Diamond said. “It’s not the answer to not having robust recruiting or not being able to compete for advisors.”