Within the sales pitch for interval funds that open access to alternative assets like private credit, there are “fees that are easy to miss and hard to understand,” according to Morningstar.

The expense structure for interval funds — the name refers to the set periods when issuers offer to repurchase a percentage of the assets — can “encourage interval fund managers to take additional risks that disproportionately benefit them rather than investors,” research firm Morningstar found in a report last month. Fees tied to leverage margins and so-called “hurdles” based on the level of yield may, in certain cases, ratchet up the cost of interval funds to an adjusted, all-inclusive ratio of 3.39% shaved off the top of a 10% gain.

Due diligence brakes

Issuers are marketing the products to financial advisors and their clients as a means of tapping into the private credit boom or getting exposure to other alternative investments. The study shows the possibility for “scenarios in which more than investors will realize will be gobbled up by fees,” said Alec Lucas, a co-author of the report who is the director of manager research in the active funds research unit of Morningstar. That is not to say “that all of them are bad options or can’t play a useful role in a portfolio,” but the results should serve as a reminder to advisors and clients “to exercise some caution in what they’re getting for what they pay,” he added.

High potential yields from private credit instruments that aren’t always available to the mass market are drawing some investors to interval funds, according to Will Gholston, a chartered financial analyst and certified financial planner who is the vice president of investments with New York-based registered investment advisory firm Re-Envision Wealth. However, their high costs are “definitely a significant detractor from the appeal of that structure,” requiring careful due diligence of marketing efforts portraying interval funds as offering “attractive yields without outsize risk,” Gholston said. Those drawbacks and the lower liquidity than ETFs or other open-end funds explain why he has rarely recommended them to clients.

“More and more you’re starting to see various strategies being offered in more of an ETF wrapper, and private credit is getting there,” Gholston said. “You definitely have to analyze the full landscape of potential investments to make sure you can’t get that exposure for cheaper.”

READ MORE: Mindful of risks, RIAs steer clients into private markets

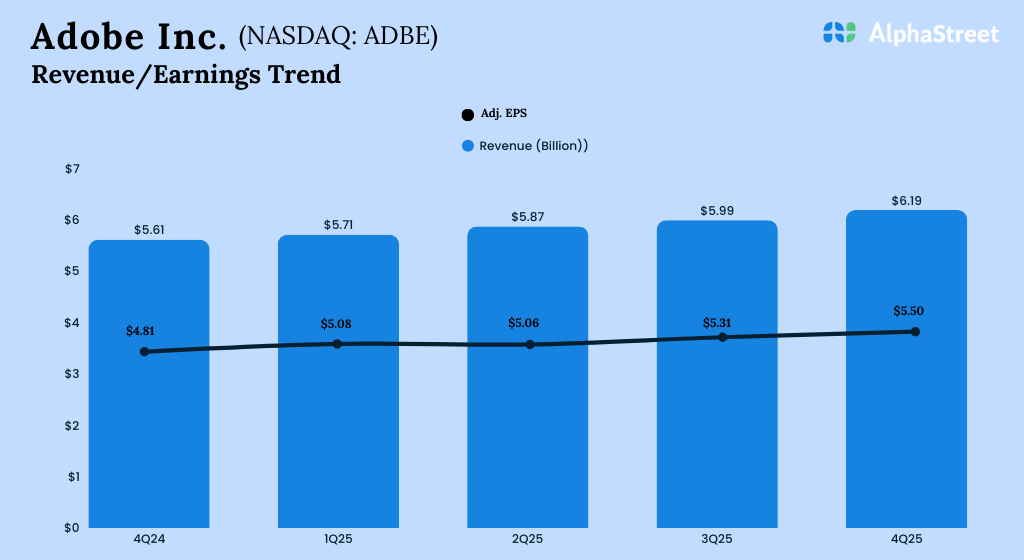

A relatively small but growing investment product

Interval funds represent “only a small percentage of pooled investment vehicle assets,” but their assets have grown at an annualized rate of 39% over the past decade to $80.76 billion, according to a primer on the products released by Morningstar last year. At the time, the five biggest interval fund issuers — Cliffwater, ACAP, Bluerock Capital Markets, Apollo Global Management and Versus Capital — managed about 60% of the assets held in the products. But the entrance this year of a series of collaborative interval funds launched by KKR and American Funds sponsor Capital Group could alter that composition. Taxable bonds including private credit represented the most prevalent type of investment in the category at 57 interval funds and $45.6 billion in assets under management.

As for the fees on interval funds, their adjusted expense ratio, according to Morningstar’s analysis of the products’ prospectuses, is 2.49%, compared to 0.58% for ETFs and 0.99% for mutual funds. But the costs could run even higher, based on the expenses the fund companies collect on the total assets and the particular hurdles of profits, Morningstar concluded last month. That’s how the margin loans that add a layer of leverage to the investments tack onto the cost of the vehicles.

For example, one of the products collects a base management fee of 1.375%. But if the yield goes above 7%, the hurdle or “incentive” fees kick in. The issuer collects a “catch-up” fee amounting to 100% of the net income on the investment between 7% and 8.235% and another hit of 15% of the profit above 8.235%. Then there are the 7.5% interest payments for the margin loan and another 0.80% of other expenses such as legal, accounting, custodian and transfer agent costs. In all, a $500 million portfolio with another $200 million in leverage invested in a product that generated an impressive yield of 10% would come with costs amounting to more than $33.2 million, according to Morningstar. Even excluding the interest charge, the net yield would drop to 7.36%. And there are several high-yield bond ETFs that get 7% yield at a cost of less than 0.10%, the study said.

“There may be some best-in-class asset managers that have access to cheaper leverage and are able to offer higher expected returns or unique return patterns,” Lucas and co-author Brian Moriarty wrote. “But the math becomes much harder to work out in favor of fundholders, and there is limited evidence of manager skill over long periods. It seems more likely that asset managers with lofty fee structures tied to leverage will be prone to borrow capital regardless of their ability to earn excess returns with that capital. It seems easier for investors to just opt for cheaper options.”

READ MORE: As SEC leans toward opening up alts access, advisors ring alarm bells

Read the prospectus closely

The Securities and Exchange Commission and FINRA similarly warn advisors and investors about the high fees of interval funds. For advisors, examining the costs of an investment is “something that they’d want to do in any case, but that’s especially the case here,” Lucas said. And, when they read the prospectus of an interval fund, they should also keep in mind that many of the funds list the fees as a quarterly figure, he noted. So they may need to multiply them by four to get the actual annual figure.

“It’s possible to use that structure and still be shareholder-friendly because you’re playing the long game,” Lucas said. Still, he continued, “Managers could be tempted to take more risks than they should. We wanted to get that piece out, because these things are being marketed right now.”