The largest independent brokerages reaped the benefits of rising asset values and consolidation last year. Those trends drove some small but notable changes among the 15 biggest firms in the channel, as ranked by their annual revenue.

The top 15 list below is based on data that a total of 38 independent wealth management firms provided to Financial Planning for the 2025 IBD Elite study and reflects a healthy yet competitive industry. Led by perennial No. 1 LPL Financial and rivals Ameriprise and Osaic, the exact same firms as last year captured the top eight slots. But LPL’s giant acquisition of the No. 7 firm, Commonwealth Financial Network, earlier this month will remove that firm from next year’s group. And another huge M&A deal last year by LPL to purchase former No. 11 firm Atria Wealth Solutions opened a slot for newcomer First Command Financial Services in the top 15.

Consolidation can complicate advisor choices

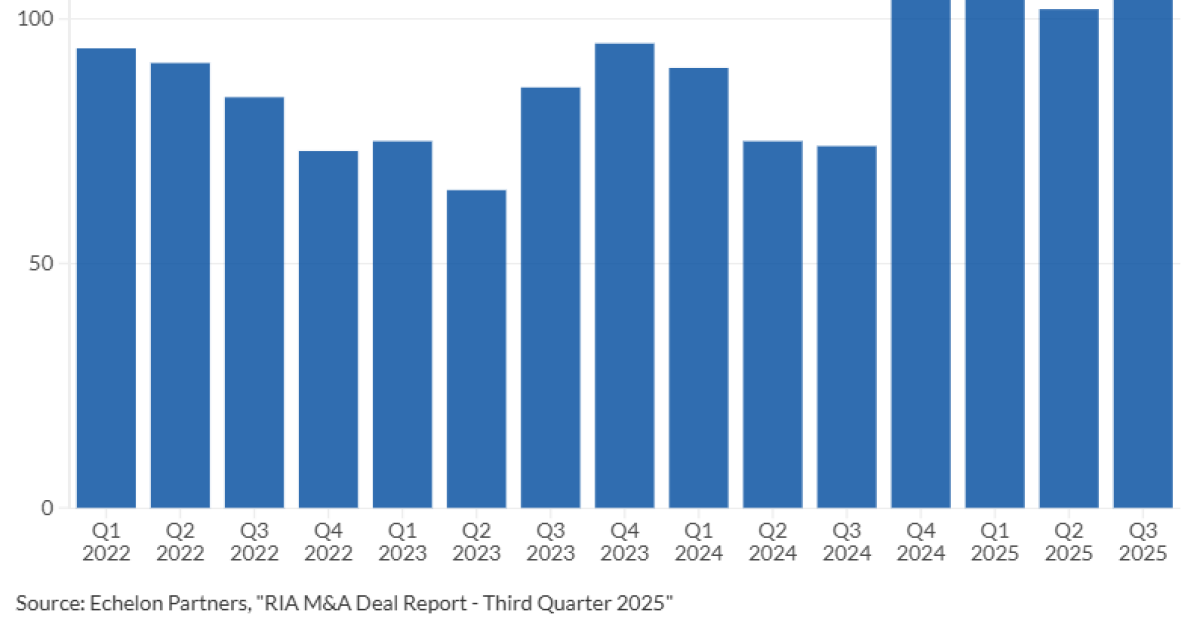

Accelerating M&A activity may cause many independent financial advisors to “feel like there are much fewer options,” said Jodie Papike, CEO of advisor and independent wealth management firm executive recruiting firm Cross-Search. But the deal flow also shows the continuing rise of registered investment advisory firm aggregators, she noted. With “so many different forms of independent firms right now,” the M&A consolidation means that, “more so than ever before, advisors need to be very cautious about the type of firm they’re considering,” Papike said. The M&A momentum led by the growing competitors to independent brokerages has eliminated the notion that the word “independence” applies to every RIA.

“The world and the options have changed so dramatically. It’s very easy for an advisor to be overwhelmed and confused with what’s available to them,” Papike said. “That is absolutely not the case anymore. In fact, many RIAs are employee-based, and you use their models and you use their branding and you use their proprietary technology stack.”

Solid business metrics amid rapid M&A turnover signal how organic expansion is distinct from and more valuable than a bunch of rollup deals and market appreciation, said Trisha Qualy, a managing partner of New York-based Affiliated Advisors, an independent branch with about $8 billion in client assets across more than 130 advisors who use Osaic as their brokerage. The “inorganic growth isn’t necessarily a net positive for the industry as a whole,” because M&A deals can amount simply to “moving poker chips around” from one firm to another, she said.

“The way that the industry has consolidated small firms into larger organizations continues to happen, and that’s coming at an interesting time right now,” Qualy said. The channel has arrived over the past 10 years at a “crossroads” between the need to provide advisors with “that relationship-based business that they may have gotten 20 to 30 years ago from a smaller firm” and the raw competition for advisors and client assets, she added. “The independent financial advisor is demanding personalized service more than ever before.”

So, despite the strong numbers in the channel, to the tune of an average rise of 18% in annual revenue last year across the top 15 firms below, these independent brokerages must navigate the risks of the many shifts that will determine the industry’s future.

Scroll down the slideshow to see the rankings of the 15 largest independent brokerages in wealth management by their annual revenue. And read the 2025 IBD Elite cover story, “How independent advisors win the AI adoption race.” Plus, follow these links to see all of the data in printable PDF format, as part of an interactive table and the top 15 firms last year.

Notes: The companies below are ranked by their 2024 revenue, as reported by the firms themselves. FP relies on each firm to state its annual metrics accurately and rounds each figure. The industry term “producing registered representatives” refers to each firm’s most accurate count of financial advisors using the firm as their brokerage or RIA. “Other revenue” means any other business besides sales commissions and advisory fees. Each metric is as of year-end 2024. “N/A” stands for “not available.”