As teachers spend more of their own money on classroom supplies, the One Big Beautiful Bill Act is removing the limits on itemized tax deductions for K-12 educators.

But that new benefit in 2026 — on top of the existing “above-the-line” deduction of $300 toward their unreimbursed qualifying expenses — applies only to households that itemize. The number that do so will probably be higher than under the Tax Cuts and Jobs Act of 2017, but not by a lot.

The K-12 teacher set isn’t known for high salaries. Those most likely to be able to take advantage of the new no-ceiling deduction include teachers paying mortgages or high state taxes, or joint filers whose spouses have high incomes.

“Many incredible people who are taking care of our kids and our youth spend a lot of money out of their pocket,” certified public accountant Miklos Ringbauer of Los Angeles-based MiklosCPA said, pointing out that the new, uncapped deduction applies to more educational activities and unreimbursed expenses for sports administrators and coaches as well. “It’s a very welcome adjustment,” he added. But, “It’s not going to impact as many people as we’d hoped.”

Fewer households have been itemizing since the TCJA raised the standard deduction in 2017. And teachers are a small group among those that do still itemize.

Most educators, since they still won’t likely benefit from itemizing over the standard deduction, will be stuck with the $300 cut to their adjusted gross income, noted Kevin Thompson, an enrolled agent and certified financial planner who is the CEO of Fort Worth, Texas-based 9I Capital Group, a registered investment advisory firm.

“It’s something, but I would rather see teachers be able to deduct everything they spend above the line,” he said. “It’s ridiculous. It’s a slap in the face to be honest with you.”

READ MORE: Non-grantor trusts could ‘stack’ big tax breaks under OBBBA

What the new rules say

Millions of teachers, counselors, principals and aides who work 900 hours or more in a year at a K-12 school take the available $300 standard deduction. Books, supplies, equipment and professional development courses can count toward that deduction.

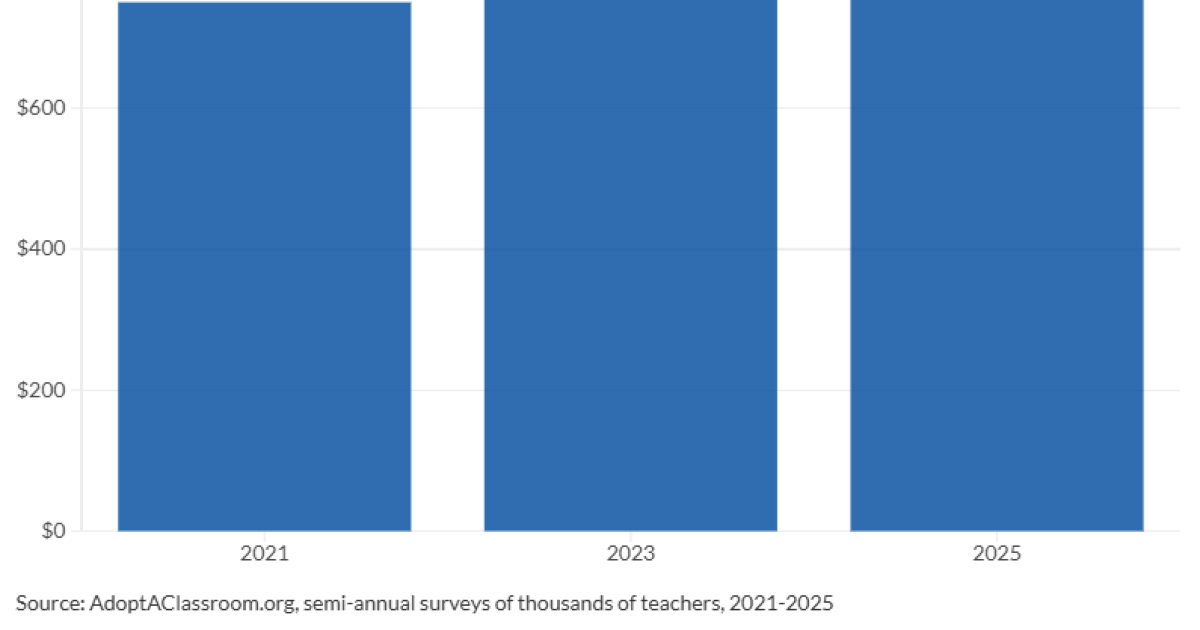

On the other hand, teachers spent an average of $895 of their own money in the last school year for basics like pencils and notebooks, food for students and books, according to a survey of more than 3,700 of them earlier this year by the nonprofit organization AdoptAClassroom.org. That number has jumped 49% in the past decade. At least 20% of the respondents said they have taken other jobs to supplement their income, and 97% said that their official budget didn’t provide enough money to meet their classrooms’ needs.

“The results paint a powerful picture of a profession stretched thin and what it takes for teachers to show up for their students every day,” the nonprofit organization’s report said. “This steady rise in out-of-pocket classroom costs underscores the growing crisis these teacher statistics show and reveals why many educators feel compelled to supplement classroom budgets with their own funds.”

While it’s unclear whether OBBBA could provide any meaningful relief to that problem, some teachers may benefit from its new miscellaneous itemized deduction for educator costs, according to a blog post about the provision by CPA firm Milliken, Perkins & Brunelle.

“Both who’s eligible and what expenses qualify are a little broader for the itemized deduction than for the above-the-line deduction,” the blog said. “For example, interscholastic sports administrators and coaches are also eligible. And, for courses in health and physical education, the supplies don’t have to be related to athletics. Keep in mind that you’ll have to itemize deductions to claim this new deduction next year. Taxpayers can choose to itemize this and certain other deductions or to take the standard deduction based on their filing status. Itemizing deductions saves tax only when the total is greater than the standard deduction. The OBBBA has made permanent the nearly doubled standard deductions under the TCJA, so fewer taxpayers are benefiting from itemizing.”

READ MORE: Caps, credits, contributions: Tax planning for parents under OBBBA

Take another look

Either way, tax experts point out that it’s important that educators hang on to the receipts for the unreimbursed expenses and document the purpose of them. OBBBA’s unlimited restoration of an itemized deduction that had been reduced to zero by TCJA provides a good reason for advisors and teachers to think through whether the new rules for state and local taxes and any other relevant provisions to their wealth could alter their itemization decisions, Ringbauer said. For some, it may be the first time they’ve considered that question since 2017.

“It’s very valuable for them now to evaluate and really go through their records to see whether they are going to itemize or not,” Ringbauer said. “This is where schools can also play a huge role with their foundations, their nonprofit arms, so educators don’t pay out of pocket.”