Many financial advisory clients might work for 40 years or more, ideally seeing their income – and capacity to save for retirement – increase over time as they advance in their careers. While many retire in their 60s (or even later), others with sufficient savings and/or guaranteed income sources might seek an earlier retirement, perhaps in their 50s. Still others, including adherents of the Financial Independence Retire Early (FIRE) movement, may hope to retire even sooner. But not every client may want to leave the workforce early. Some might prefer to retire at a more traditional age while gaining flexibility during their working years by switching to a lower-paying but more meaningful job, reducing their work hours, or taking occasional unpaid sabbaticals. For these clients, financial advisors can offer meaningful ongoing value by introducing and supporting a strategy known as “Coast FIRE”.

A client reaches Coast FIRE when their retirement savings are projected to grow – without further contributions – into a portfolio large enough to support their anticipated future retirement spending needs. Which means they ‘only’ need to earn enough to cover their ongoing expenses while continuing to work, though their ability to keep saving can further strengthen their financial position, reduce risk, and provide additional flexibility. Determining when an individual has ‘reached’ Coast FIRE relies on a formula that calculates the current savings required to support income needs in retirement over the period that investments are expected to compound. Still, the strategy is often better viewed as offering a spectrum of possibilities, with clients adopting varying levels of commitment and risk.

While Coast FIRE might sound appealing to many clients, the best candidates will tend to have already accumulated sufficient savings earmarked for retirement and have relatively predictable expenses, since a sharp increase in future spending would require a larger portfolio to compensate. Such clients could include diligent savers (particularly those with additional savings outside of retirement accounts) or those who have received a windfall, such as from a workplace liquidity event or an inheritance.

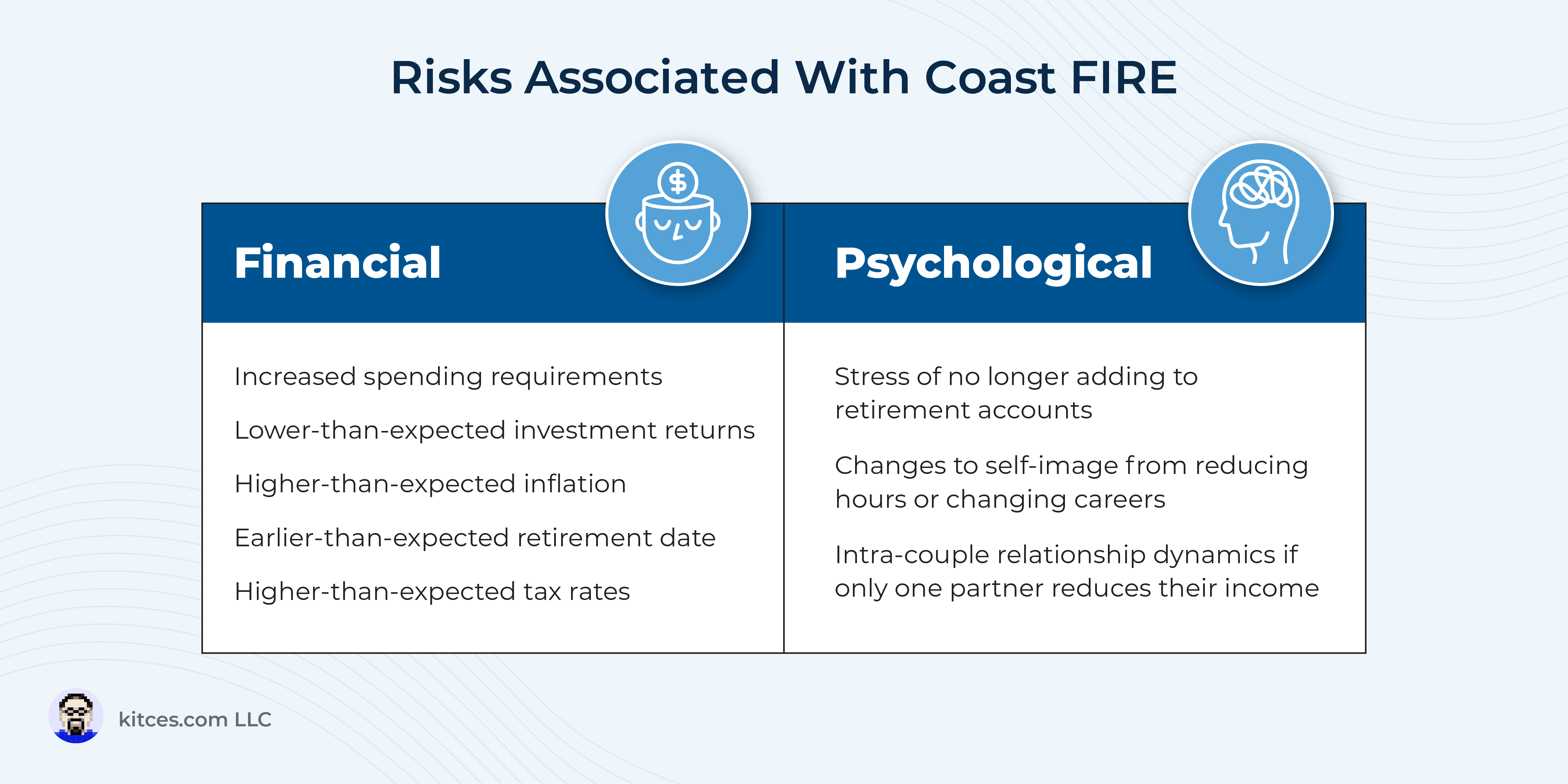

Coast FIRE can be an attractive option for clients who value career flexibility, but the strategy also comes with both financial risks (e.g., changes to the client’s spending, real rate of return, or retirement date) and psychological risks (e.g., stress from not necessarily contributing to retirement accounts) that could derail – or at least require adjustments to – a client’s financial plan. This creates an opportunity for financial advisors to help clients assess whether Coast FIRE is sustainable (e.g., by stress-testing different scenarios) and to conduct regular reviews to determine whether adjustments may be needed.

Ultimately, while most clients won’t tap into their retirement savings during their working years, those assets can still play a powerful role. By reducing the amount of income they need to earn, sufficient accumulated retirement assets can open the door to career changes, sabbaticals, or more flexible work schedules. This, in turn, allows financial advisors to add tremendous value – both by analyzing whether (and to what degree) Coast FIRE might be viable, and, at a more fundamental level, helping clients realize that they don’t necessarily need to keep climbing the income ladder until the day they fully retire!

Read More…