For many homeowners, moving to a new residence is a straightforward process of selling one home and buying another. But for clients who choose to keep their former primary residence as a rental, the decision opens a range of complex tax considerations – and, with them, planning opportunities. Converting a home to a rental fundamentally changes how expenses are treated, how gains are taxed, and how future sales can be structured to maximize tax efficiency. Advisors who understand these rules can help clients navigate the timing of deductions, leverage the home sale gain exclusion, defer gains through 1031 exchanges, or even use multiple strategies in combination to minimize taxes on property that’s converted to rental.

Once a primary residence becomes a rental, previously personal expenses may become deductible rental expenses. However, the timing of the conversion matters. Routine maintenance and repairs performed after the property is “available for rent” can often be deducted, but similar work done beforehand is generally considered a nondeductible personal expense. Depreciation also begins at conversion, using the lower of the home’s original basis or fair market value.

These upfront expenses – combined with potential delays in finding an initial tenant – can often result in a net loss during the property’s early years. But rental losses are generally ‘passive’ and can only offset other passive income. For individuals with AGI under $100,000 who ‘actively participate’ in managing the rental, up to $25,000 of losses may be deductible against other income (with the benefit fully phasing out at $150,000). Consequently, documenting expenses and activities such as marketing, screening tenants, or making repairs is essential for maximizing their rental deductions.

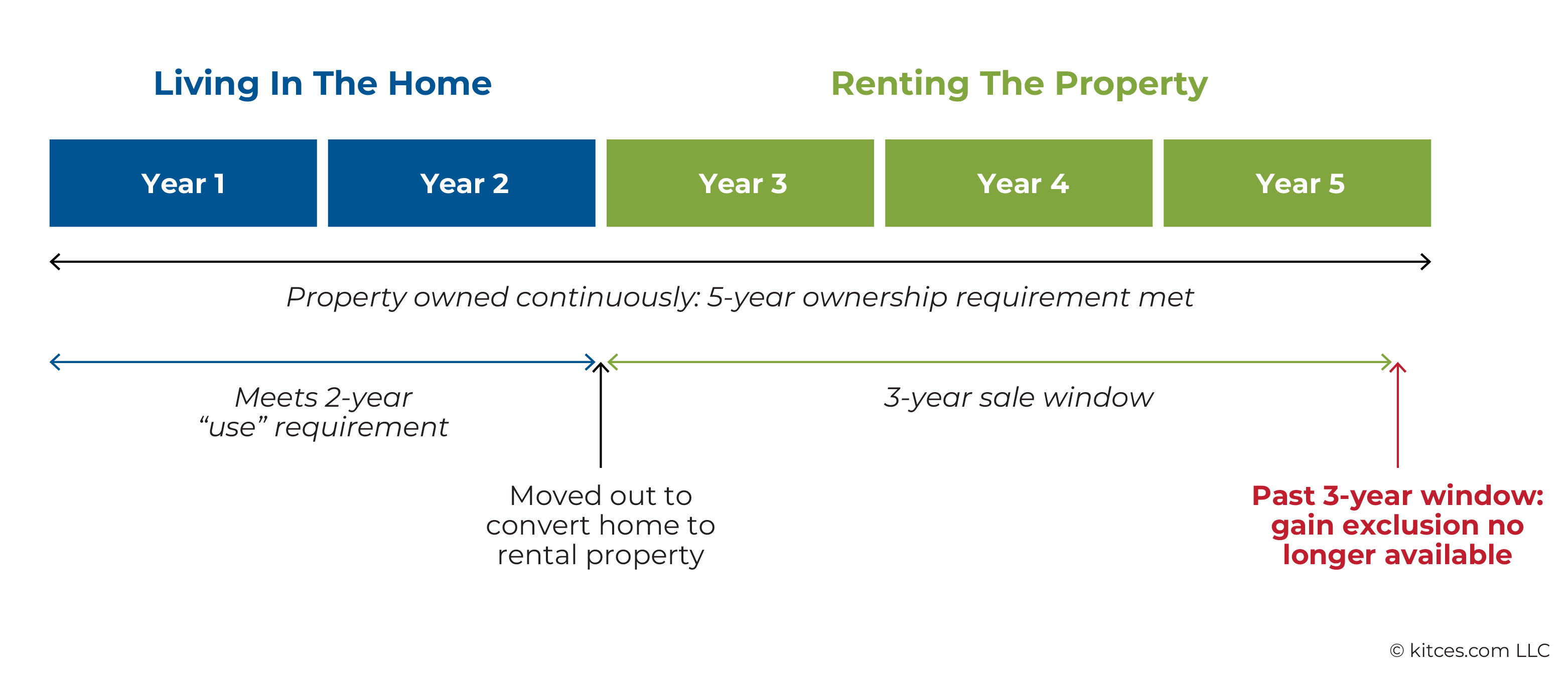

Other tax planning opportunities can center on the $250,000 (single) or $500,000 (joint) primary residence gain exclusion under Section 121, which can remain available for up to three years after the home ceases to be a primary residence. Some individuals may also consider selling the property to a wholly owned S corporation (i.e., owned fully by themselves) before the three-year deadline. This can lock in the gain exclusion, reset the property’s basis for depreciation, and preserve (indirect) ownership of the rental – though it may require careful structuring and strict adherence to sale terms to withstand IRS scrutiny.

For clients seeking to defer taxes – whether due to holding the property beyond the three-year gain exclusion window or realizing appreciation in excess of the Sec. 121 exclusion amount – a 1031 exchange can enable a tax-deferred swap into another investment property. And for clients who qualify for both the exclusion and a 1031 exchange beyond the exclusion limit, an “1152 plan” combines the benefits of Section 121 and 1031, offering a hybrid approach: By selling within the three-year window, pocketing the exclusion amount, and rolling the remainder into a like-kind property, clients can effectively ‘cash out’ the excluded tax-free portion while deferring the remainder. This strategy can be particularly useful for highly appreciated properties or for clients seeking to pass the property on to heirs with a step-up in basis.

Ultimately, converting a primary residence to a rental can unlock meaningful opportunities – but also potential tax pitfalls. Advisors can play a key role by helping clients maximize the deductibility of expenses, preserve gain exclusions, consider S corporation or 1031 strategies, and navigate passive activity loss limitations. By approaching the transition with careful tax planning and an eye on both short- and long-term goals, clients can transform a personal home into a productive rental asset in a way that aligns with their financial objectives and minimizes unnecessary tax costs!

Read More…