A core requirement of the CFP mark could soon be on the chopping block: a bachelor’s degree.

Processing Content

On Tuesday, the board announced that it would establish an Academic Pathways & Standards Working Group to review the bachelor’s degree requirement and consider whether it should be maintained or modified. The group is set to deliver its recommendations in the first quarter of 2027.

The announcement of the working group came along with a slew of updates to the CFP Board’s competency standards, the result of an 18-month review led by the board’s competency standards commission. The changes — including a 25% increase in continuing education (CE) requirements, the addition of pro bono work to the experience requirement and the inclusion of the certified investment management analyst (CIMA) designation in the accelerated pathway — will be phased in through mid-2027.

The working group is expected to present its recommendations on the bachelor’s degree requirement to the board early next year, after which the board will release them for public comment. K. Dane Snowden, the CFP Board’s COO and recently named successor to CEO Kevin Keller, said during a webinar Wednesday that any changes would not take effect until 2027 at the earliest.

“This will be informed by public comment, public input, impact analysis and the practices across comparable professions,” Snowden said. “This working group will include a diverse mix of CFP professionals. You’ll have educators and key stakeholders reflecting the breadth and perspectives across the financial planning ecosystem.”

READ MORE: Why diversification matters when it comes to marketing

An ‘arbitrary requirement’ or a ‘higher standard’?

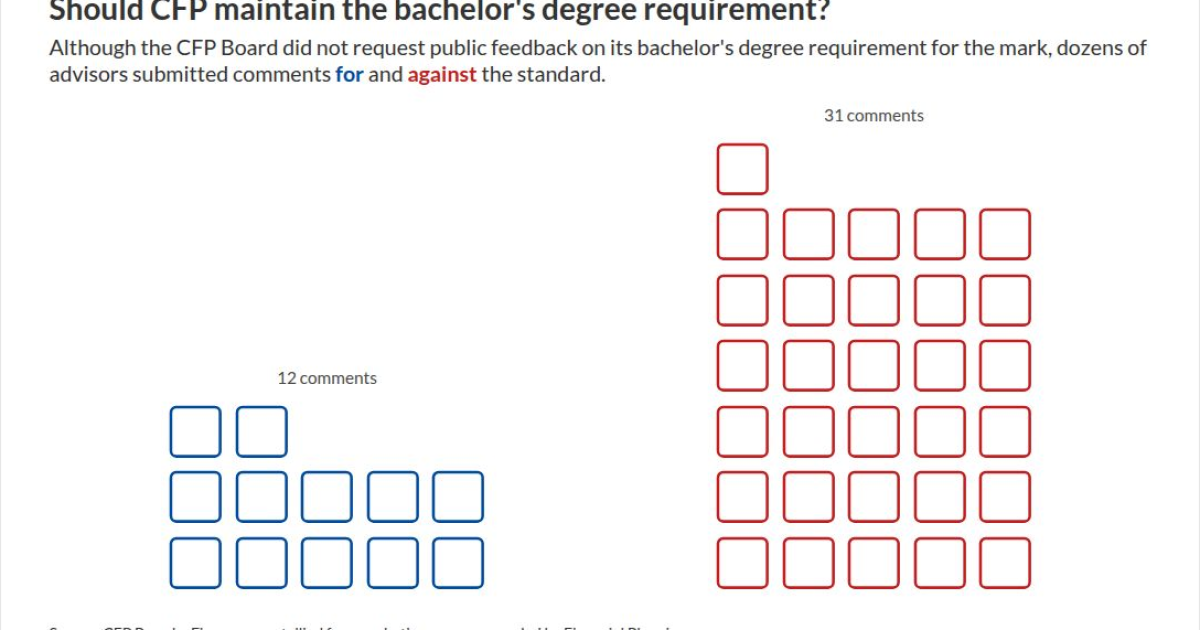

During a comment period on the proposed updates last year, dozens of advisors took the opportunity to voice their concerns about the bachelor’s degree requirement.

A Financial Planning analysis of verbatim comments published by the CFP Board identified 43 comments addressing the requirement, with most urging the board to eliminate it.

One critic of the requirement said it’s a “needless boundary to those eager to pursue the career and the certification.”

Others argue that the blanket requirement for a bachelor’s degree — which currently has no major requirements — makes it easier for a “music history major” to obtain a CFP mark than an “experienced practicing advisor who may not have completed a bachelor’s degree.”

Supporters of the requirement argue that the current broad degree requirement is reason to tighten the rule, not eliminate it. One commenter suggested that only “relevant” majors, such as mathematics and psychology, should fulfill the requirement.

“The board should not be ‘watering down’ the certification requirements to achieve diversification or demographic goals,” one advisor commented. “Rather, the board should remain focused on and committed to ensuring that CFP certification remains the standard of excellence for financial planners, and that consumers remain confident in that trust when selecting a CFP professional.”

READ MORE: CFP exam pass rates are on the rise — how come?

A growing education push

Since adopting its current bachelor’s degree requirement in 2007, the CFP Board has steadily expanded its education initiatives, both internally and through partnerships with outside institutions.

In 2008, the board established a Council on Education to advise staff on the development and clarification of education policies tied to CFP certification. Four years later, it added the capstone requirement, mandating that prospective CFP certificants complete a course integrating multiple areas of financial planning.

The board currently partners with more than 350 academic institutions through CFP Board registered programs, including certificate and degree programs.

Johel Brown-Grant, director of education at the CFP Board, said that the organization has “established a solid and enduring relationship with the academic community to strengthen and support the growth of financial planning education across the U.S.”