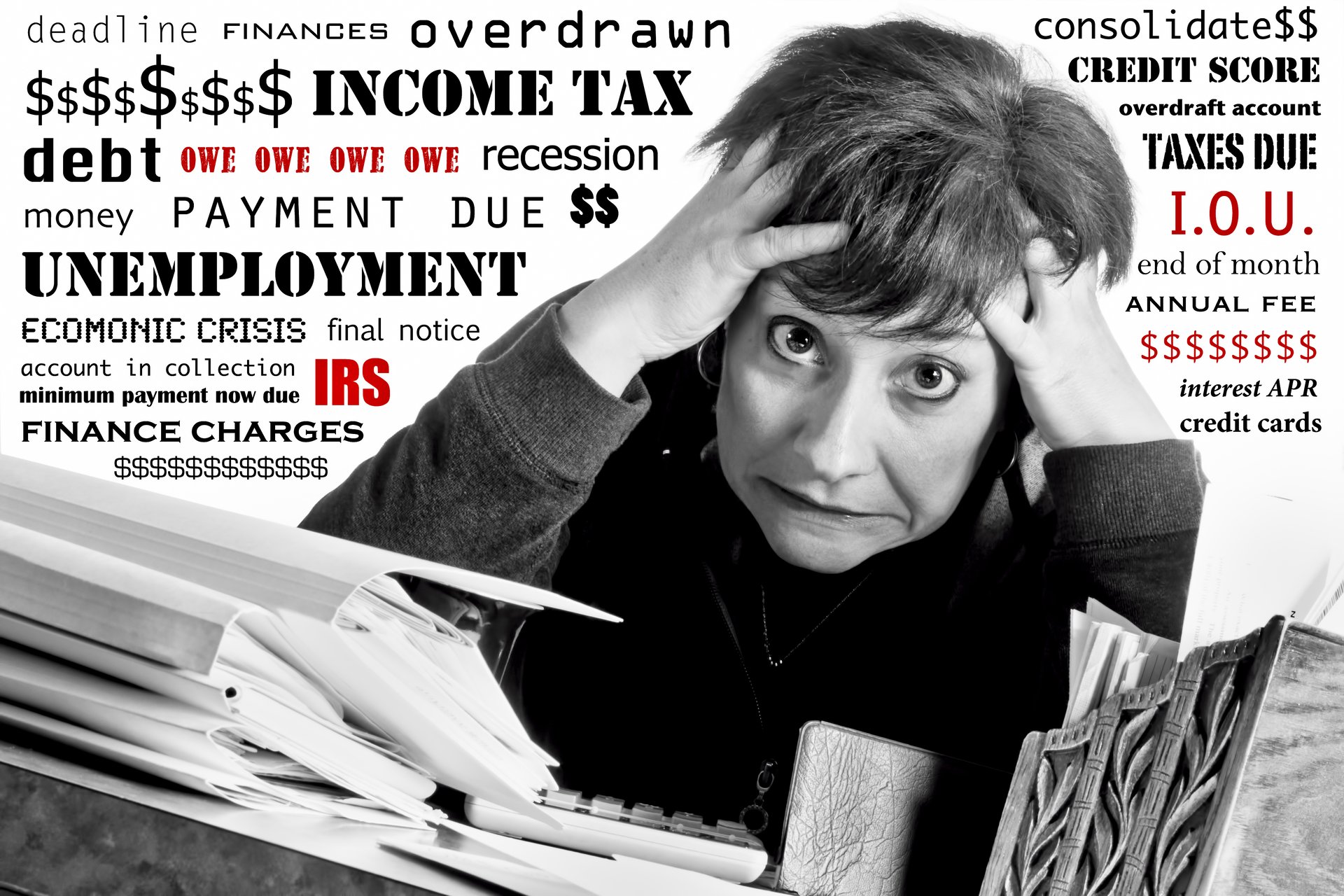

For financial advisors and wealth management firms, the risks of social media extend well beyond potential hits to reputation.

After the killing of right-wing activist Charlie Kirk, many people were fired or disciplined after their personal posts drew attention, a reminder that whether on Facebook, LinkedIn or another platform, online speech can have professional consequences.

Industry consultants and compliance experts say the events of the past week should serve as a wake-up call for RIAs and other firms to ensure their social media policies are updated and enforceable.

How to craft strong social media policies

Most firms’ social media policies are tailored but follow a similar pattern, said Brian Robling, a consultant at the compliance firm SEC³. He said it’s common for financial services firms’ social media policy to:

Ban the use of personal social media to promote an advisor.Categorize advisor social media as advertising for the firm, which therefore brings it under advertising policies.Test social media sites periodically to ensure compliance.Distinguish between advisor activity and personal accounts.Spell out what is allowed without needing approval, like including firm name and job title.Require advisors to ensure social media communications are properly archived.

Firms may also want to update policies to address permitted political statements and more. Social media policies can forbid employees from making controversial political and social statements, said Rogge Dunn, managing partner at the law firm Rogge Dunn Group in Dallas. Some firms even go further and prohibit employees from expressing any type of social or political opinions, he said.

READ MORE: Advisors clamor for estate planning tools as attorneys wave red flags

“Comments or opinions that some investors, or wholesalers, insurance carriers and other financial firms consider to be offensive have caused RIAs to lose business with investors and firms providing financial products,” he said. “The safest course of action is to instruct employees to steer clear of discussions or debates over controversial subjects of any type. There is little to no upside, and a tremendous downside.”

As someone who has helped RIAs craft social media policies and training programs, April Rudin, founder of the marketing firm The Rudin Group, said the best practice for advisors and wealth management firms is to simply avoid the topics of religion and politics online.

“As a trusted professional, your public brand should remain neutral and without bias,” she said.

Marketing, advertising and social media policy for advisors

It’s important for RIAs to remember that social media posts, even personal social media posts of employees who identify their affiliation with the firm, can constitute advertisements, said Richard Chen, a legal advocate for advisors and the founder of New York-based Brightstar Law Group.

“Therefore, such social media posts may need to go through advertising review and pre-approval, depending on the content,” he said.

If firms allow employees to use their personal social media accounts to publish work-related content, the compliance team may need to monitor those accounts to make sure content is not being posted that violates firm policy, said Chen.

“If there is any firm-related content on the social media posts, it’s important to ensure that there are appropriate disclaimers,” he said. “Just because it’s a social media post does not absolve it from having appropriate disclaimers, particularly if the post is deemed to be an advertisement.”

READ MORE: How much time AI saves advisors — and how they spend it

Amy Lynch, the founder and president of the regulatory consultant FrontLine Compliance,said her firm creates social media policies for RIA clients all the time. Social media is part of a firm’s marketing and, therefore, subject to the SEC marketing rule, she said.

“A social media policy should be part of a firm’s written marketing policy,” she said. “The policy should cover the approved uses of social media by employees, approved channels and the process employees should follow to submit posts to compliance for review and approval.”

On the compliance and surveillance side, social media posts should be captured within a firm’s electronic communications surveillance platform, said Lynch.

“This only works if the appropriate email addresses attached to the social media accounts are being captured within the system,” she said. “Regular reviews should take place monthly to monitor accounts.”

Thanks to compliance requirements, financial services firms will probably see less fallout from employees’ problematic social posts than other industries, said Ray Hennessey, CEO and executive partner of VOCATUS. Advisors in particular are generally more careful because they often serve client bases with a wide range of views and want to remain as close to neutral as they can, he said.

“Additionally, though, they are often forced to be neutral, even neutered, in their social media profiles because of company policies and compliance,” he said. “Some chafe under these policies, but, in times when we see such meaningful negative fallout, they serve to insulate advisors and their firms. After all, as every social media controversy reminds us, there is no difference between personal and professional anymore. When you say something awful online, invariably your company, your clients and your colleagues are often targeted, too. That’s why I have no doubt that companies are reviewing their own policies now.”

One firm owner who did exactly that is Benjamin Simerly, founder of Lakehouse Family Wealth in Cleveland.

Simerly said recent events spurred him to revise not only his firm’s social media and communications policies, but broader firm policies as well. The updates make clear the firm is “politically agnostic,” he said, and that “in our financial work, we wish to bring benefit, peace, calm and open-minded discussion to all, in our own small way.”