Financial advisors’ confidence levels have risen out of negative territory for the first time in half a year.

That’s the overall sentiment reflected in Financial Planning’s July Financial Advisor Confidence Outlook (FACO), a survey of financial advisors and planners that measures confidence in the economy and other factors on a scale of minus-100 to 100.

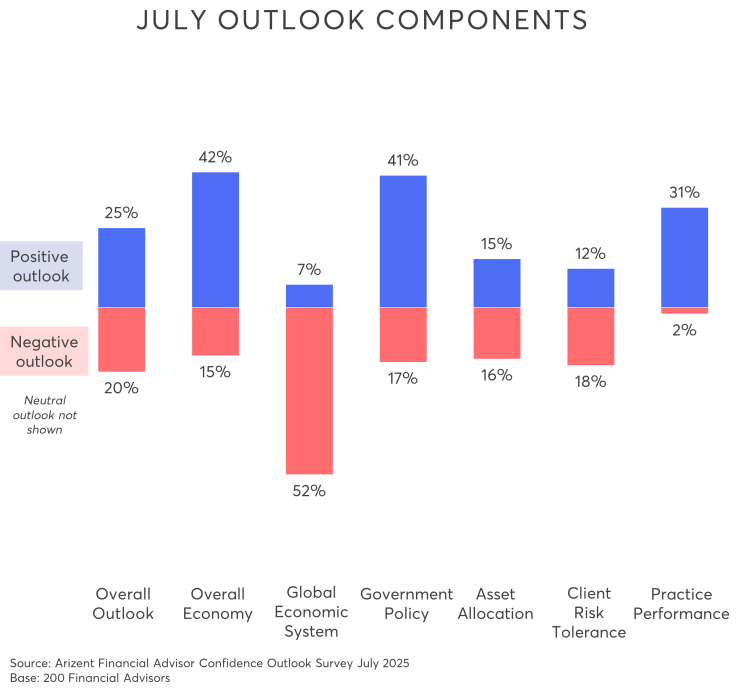

In April, advisors’ overall outlook hit an all-time low of minus-24 before recovering slightly in May, when that score was up to minus-18. June’s figures saw an even greater bounce upward to minus-5. That trajectory continued in July when the score climbed to 5, marking the first time advisors’ overall sentiment has been positive since a score of 8 was recorded in January.

Every individual category in the monthly survey saw similar gains; for example, confidence in the overall economy surged from a score of 13 in June to 28 in July.

“MAGA policies are winning, and clients like the focus on the U.S. versus other countries,” said one advisor. “Other economies will grow as a result of lower regulations on tariffs for U.S. goods in their countries.”

READ MORE: Policy, economic concerns sinking advisor confidence

Though positive sentiment was on the rise, some areas remained decidedly negative.

Advisor confidence in the global economic system chronically polls in negative territory, yet it hit its highest levels in over half a year, up from minus-52 in June to minus-45 in July. That’s nearly on par with results from December 2024, when the score was minus-44.

One advisor pointed to “general uncertainty in the world, both economic and otherwise” as reasons for concern among clients.

Confidence in government policy represented the largest single category gain this month, rising from a score of 8 in both May and June all the way to 25 in July.

READ MORE: Uncertainty drives sharp decline in advisor confidence

While many respondents expressed hope that the tariff-induced uncertainty of previous months would be winding down, others were less enthusiastic about the effects of President Donald Trump pursuing his party’s conservative agenda.

“As of the moment, with my clientele being mainly Filipino immigrants, our concern is still related to Trump’s immigration policies,” said one advisor. “Depending on developments here, we could see our clients pull out funds should things go south.”

When this month’s FACO survey was fielded, the so-called Big Beautiful Bill was still being debated in the halls of Congress. One advisor said clients were wondering how the tax and spending megabill (now signed into law) would affect their investments.

Some advisors were optimistic about the legislation.

“We hope that the tax bill will pass and will impact people’s ability to spend as they will have more money in their pockets, and they will also have more money to invest and save for retirement,” said one advisor.

Others had a less rosy outlook.

“The fallout from this is going to take weeks to understand, months to appreciate and years to realize,” said another advisor about the bill. “So far, I expect the outcome to ultimately be negative for those who I serve.”

“Cutting Medicaid and SNAP benefits to fund tax cuts will increase inequality and cause economic and social instability,” said another advisor, whose concerns about the Trump administration extended beyond the megabill. “Increased tariffs are inflationary. Pressuring the Fed to decrease interest rates when it should not can cause more inflation and even stagflation.”

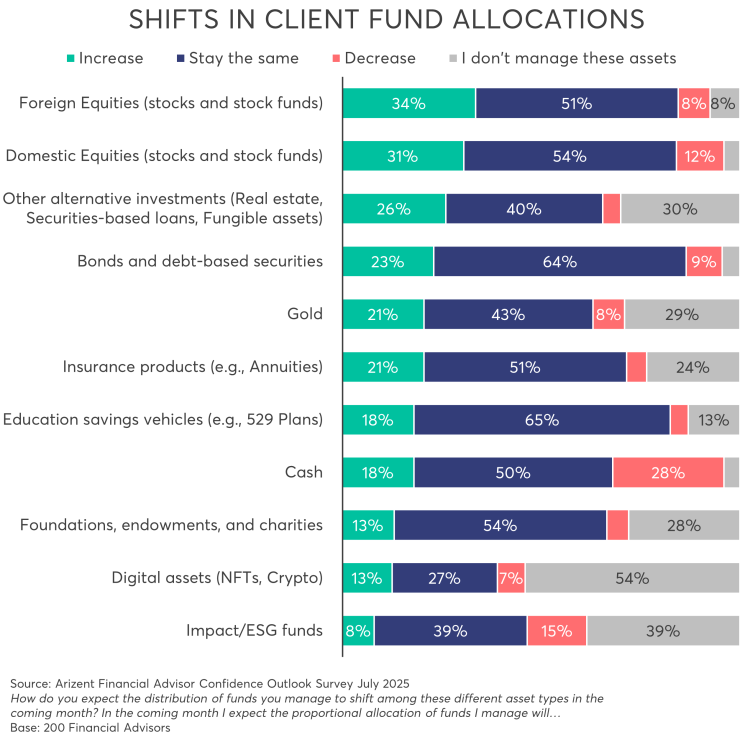

Advisors’ outlook on asset allocations almost made it into the green for the first time in six months, going from minus-7 in June to minus-1 in July. That’s the highest that category has been since its January score of 1.

One advisor cited “political misinformation” as a driver of asset allocation decisions in client portfolios.

“I am hearing more and more about clients not wanting to work with certain asset managers and companies than ever before,” they said.

Client risk tolerance continued to bounce back from its previous lows. Along with other categories, it reached its lowest point ever in April, dropping to minus-41. By June that was up to minus-18 and in July it reached minus-6.

“Clients are looking to reduce risk by accepting a limited downside,” said one advisor. “Floor registered index-linked annuities (RILAs) are helping with this as well as advisory portfolios that align with their risk tolerance.”

The sentiment on practice performance also continued to gain ground this month, nudging upward from a score of 26 in June to 30 in July.

“Our business has remained steady and consistently grown through the downs and ups over the past five years,” said one advisor. “We are not worried about anything in particular and look forward to growing with whatever the economy, Fed or market brings.”

Despite all the recent volatility, many advisors feel their services are more needed than ever.

“There’s always change,” said one advisor, “but people are willing to pay for a service if it provides them a value.”