On Wednesday, the Federal Reserve’s Federal Open Market Committee cut the target policy rate by 0.25 percent, bringing the target down to 4.25 percent. This cut is the first since the Fed implemented a cutting cycle last year that reduced the target rate from 5.5 percent to 4.5 percent. That series of cuts began with a 50 basis-point cut in September of last year, ending with a 25 basis-point cut in December.

This month’s meeting is among the most-watched meetings of recent years with the FOMC now being expected to “do something” in response to a clear slowdown in job growth in recent employment data. Since January, the Fed has faced immense public pressure from the White House, from Wall Street, and from many financial-sector pundits demanding that the Fed cut the target interest rate and adopt an even more dovish stance. A frequent criticism of the Fed through this period—made by those who believe more monetary inflation can somehow strengthen an economy—is that the Fed is “too late” in implementing additional rate cuts to stimulate the economy.

The pressure to cut rates gained additional strength in the wake of new jobs reports, released earlier this month, showing that job growth had substantially weakened during June, July, and August of this year. Moreover, the release of revised benchmark employment data for much of 2024 and early 2025 showed that job growth had not been nearly as strong as previously reported.

Those pushing for more easy money used this jobs data as an opportunity to demand more rate cuts from the Fed. So, not surprisingly, Fed Chair Jerome Powell and the FOMC this week voted to lower the target rate, and the Fed will accelerate its open market operations, using newly created money, to intervene in the marketplace to further reduce short-term interest rates.

In this, we also see what really concerns the Fed. The Fed’s concern is not reducing prices and improving the cost of living for ordinary people. What really concerns the Fed is ensuring rising asset prices for Wall Street while pushing cheap credit to finance federal deficits.

Does the Fed Care about Price Inflation?

Generally, the mainstream narrative around Fed policy works like this: when inflation is “too high”—as defined by the Fed itself—then the Fed will allow interest rates to rise. This will slow monetary inflation and prices will stabilize. On the other hand, when employment is not sufficiently robust—again, as defined by the Fed itself—then the Fed will lower the target interest rate. That will lead to more monetary inflation which will “stimulate” job growth. This narrative, however, depends on the idea that when employment growth is weak, price inflation will also be weak, and vice versa.

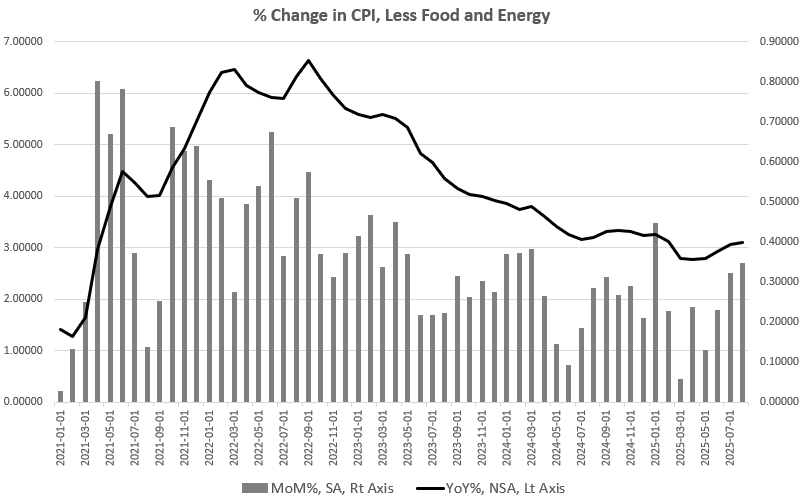

If a weakening employment situation were the only thing going on right now, then it would be very easy for the Fed to claim right now—using the popularly accepted narrative—that it is necessary for the Fed to cut the target rate to stimulate employment. But, the Fed face a complicating factor right now in that price inflation has been rising in recent months, and shows no signs of returning to the Fed’s arbitrary two-percent inflation target.

Specifically, core CPI in August rose 3.1 percent, well in excess of the two-percent target. Moreover, the Fed’s preferred inflation measure, personal consumption expenditures, rose by 2.9 percent in July. Powell recent stated that their estimate for PCE growth in August is also 2.9 percent. In other words, price inflation isn’t going away, and by lowering the target rate, the Fed is pushing more monetary inflation which will put further upward pressure on prices.

Moreove,r the FOMC’s members now don’t expect the Fed to hit its target price-inflation rate until 2027. At least, that’s what the members are saying according to the Fed’s summary of economic projections (SEP). The SEP, however, can always be counted on the portray the economy as stable and generally improving. It’s the best scenario that Fed voting members think they can get away with predicting. So, if the SEP is telling us that price inflation will not fall to 2 percent until 2027, we can expect that there is plenty of monetary inflation in the works.

The scenario projected by the SEP is this: that the Fed will wisely manage the economy back to a state of growing employment and moderating price inflation, as the Fed threads the needle of discovering just the right target interest rate to optimize economic conditions. That’s what they want the public to believe.

If price inflation does come in coming months and years, the more likely scenario is this: the economy will weaken, just as is now suggested by recessionary trends in the index of leading economic indicators, in new home construction, in stagnating job growth, and in delinquency rates. Prices will fall as demand collapses in the face of rising unemployment, falling real wages, and overindebtedness.

The downside of a recession, of course, is temporary unemployment. But the upside—in the absence of central-bank meddling—is that the many inflationary bubbles that have grown as a result of monetary inflation finally pop and prices fall. Zombie companies that only existed thanks to cheap credit go bankrupt and more efficient owners take over and build a more productive economy out of the rubble of the old Fed-created inflationary economy. This is all to the good in terms of the cost of living because the bubble economy has become unaffordable for ordinary people who are forced to deal with incessantly rising prices and unaffordable homes.

That’s what would happen if the Fed actually cared about reducing price inflation. Unfortunately, the Fed isn’t going to let that happen. Rather than allow prices to fall substantially, and allow for a new, less wasteful, less frothy and bubbly economy to arise, the Fed will instead continue to force down interest rates and push more monetary inflation as the economy slows. This will prevent a reset in prices, and it will help ensure that the same, wasteful bubble enterprises continue to dominate the economy.

The Fed will say, as it is already now saying, that it must “balance” its efforts to combat inflation against the need to stimulate employment.

In other words, as the economy slows, American policymakers have the opportunity to allow home prices to fall and to make homes available to millions of Americans who have been priced out thanks to decades of easy-money-fueled asset price growth. Americans policymakers have an opportunity to allow a flowering of new competition and new efficiency in the economy as the old incumbent firms that now subsist on debt and speculative manias actually make way for new entrepreneurs and new dynamic economy.

But, as we saw this week, the Fed will do everything it can to stop that from happening. Even as price inflation continues to grow, the Fed is telling us it has to print more money to ensure that “number go up” in terms of asset prices and GDP.

Sure, the Fed will frame all this as a service to ordinary people, and as a prudent means of ensuring a vibrant job market. In truth, the central bank is serving its most important clients: Wall Street and the US regime. On the one hand, the Fed is intervening to make sure that asset prices—i.e., stocks—continue to rise for the benefit of existing wealthy asset owns. On the other hand, the Fed is lowering interest rates to ensure the Treasury can borrow at low interest rates as the federal debt continues to climb to $40 trillion.

In contrast to all this central planning from the central bank, what the Fed should be doing right now is nothing. The Fed could simply refrain from taking any action toward meddling in the private economy at all. The Fed could end its open market operations which employ monetary inflation to manipulate interest rates. The Fed could allow markets to function, and could allow the economy to heal. Unfortunately, the Fed was created to do anything but allow the private economy to function. It has always been an instrument of central planning, and we should not expect anything different from it now.