This is Naked Capitalism fundraising week. 101 donors have already invested in our efforts to combat corruption and predatory conduct, particularly in the financial realm. Please join us and participate via our donation page, which shows how to give via check, credit card, debit card, PayPal. Clover, or Wise. Read about why we’re doing this fundraiser, what we’ve accomplished in the last year,, and our current goal, strengthening our IT infrastructure.

Yves here. We haven’t done a “How’s your economy?” reader query in quite a while. The latest GDP revision suggests it might be useful to get some sightings. Even if the plural of anecdata is not data, it can make sense of things that don’t seem to add up.

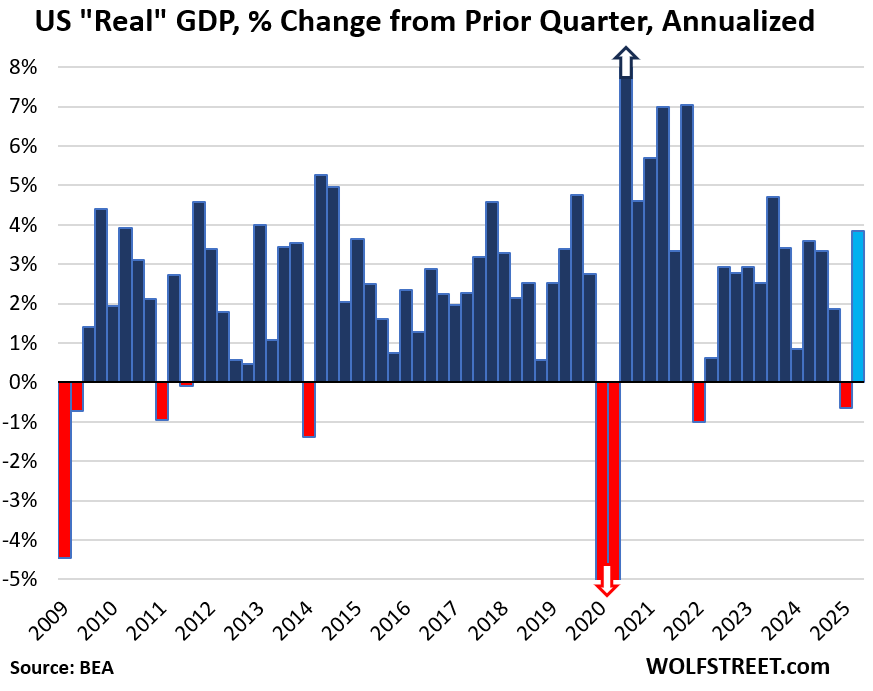

The big anomaly here is the now-very-peppy 3.8% second quarter GDP, now revised two times upward from its original 3% level. That stands in stark contrast with anemic jobs growth. It also seems inconsistent with many reports, both in the press and from readers, of many small businesses suffering bigly from tariffs, making them unable to sell their wares at anything like their former price points, having great difficulty finding US sources, and seeing their revenues shrink to the point of vanishing.

Similarly, growth in the US has increasingly been help up by spending at the very top of the income chain. Yet there are signs of less than robust health there, from luxury vendors faring badly to a collapse in art sales.

Perhaps what is going on in the economy parallels the stock market, with averages propped by ginormous AI valuations at a very few companies, along with ginormous AI “capital investment” which as Ed Zitron has chronicled in detail, has produced almost bupkis in the way of revenues. AI is one sector with superheated activity. Are there other very strong pockets that could more than compensate for what seems like way too much lackluster activity?

By Wolf Richter, editor at Wolf Street. Originally published at Wolf Street

Government consumption and inventories were a bigger drag though. All adjusted for inflation.

Back on July 30, the “advance estimate” of GDP for the second quarter showed 3.0% growth, held down by anemic consumer spending growth and plunging inventories. The “second estimate,” released on August 28, revised GDP growth for Q2 higher to 3.3%.

Today, the “third estimate” of Q2 GDP revised Q2 GDP growth to 3.8%, the fastest growth since Q3 2023, driven largely by a big up-revision of consumer spending. This 3.8% rate of growth is in the hot zone for the US, whose average GDP growth over the past 10 years is just over 2%. All growth figures are adjusted for inflation.

The “first estimate” of GDP growth is the one that gets all the attention in the media. The revisions are normally not the focus of any attention. For that reason, I will compare today’s “third estimate” to the “first estimate,” in part because the up-revisions were so big and cumulative.

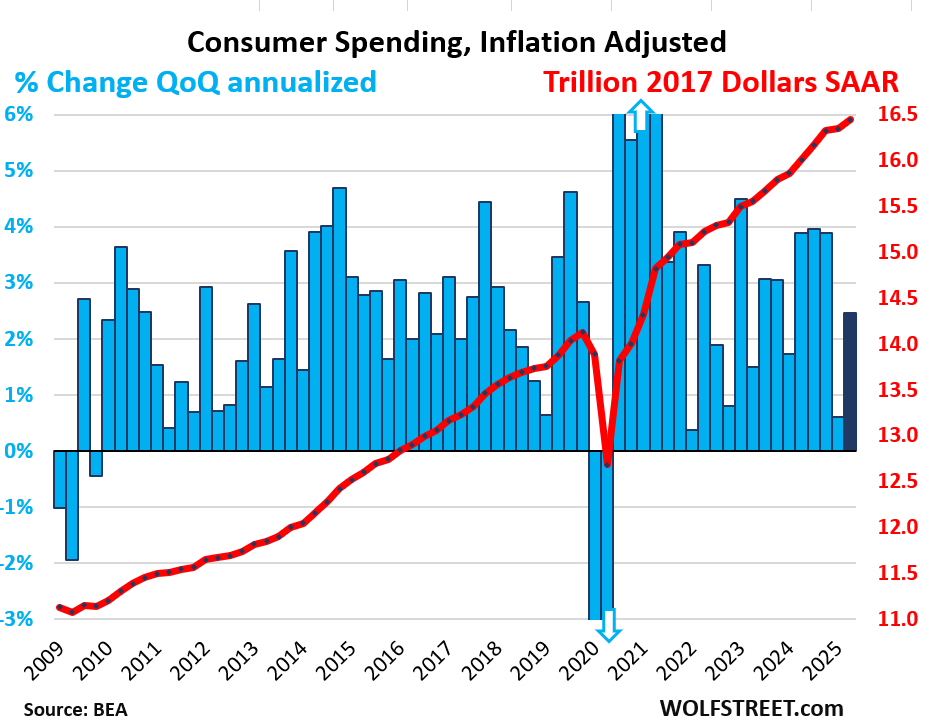

Consumer spending growth was revised up to +2.5% in Q2. The first estimate had pegged consumer spending growth at a worrisomely anemic 1.4%, the second estimate at 1.6%. Today’s massive up-revision to +2.5%, nearly doubling the growth rate of the first estimate, was the biggest contributor to the up-revision of overall GDP growth (all adjusted for inflation).

This 2.5% is healthy growth in consumer spending. The red line shows the annualized consumer spending in 2017 dollars (right scale). The blue columns show the growth rate in percent (left scale).

Private fixed investment was revised to a growth rate of 4.4%, from the dreadfully anemic 0.4% in the first estimate. Today’s up-revision substantially contributed to the up-revision of overall GDP growth:

Investment in equipment was revised up to +8.5%

Investment in intellectual property was revised up to +15.0%.

Investment in structures had plunged by 10.3% in the first estimate. This plunge was reduced to -7.5% today.

But residential fixed investment (such as construction of single-family and multifamily homes) was pegged in the first estimate at a drop of -4.6%; this drop increased to -5.1% in today’s third estimate, and lowered the up-revision of private fixed investment.

Revisions That Pushed the Other Way v. First Estimate:

Net exports (exports minus imports) were revised lower, they worsened:

Imports plunged a little less (-29.3%) than the first estimate (-30.3%); imports subtract from GDP.

Exports fell by 1.8%, same rate as the first estimate. Exports add to GDP.

Government consumption shrank by 0.1% (federal, state, and local governments combined), compared to growth of 0.4% in the first estimate.

The plunge in private inventories worsened, and deducted 3.44 percentage points from GDP growth, versus 3.17 percentage points in the first estimate. Inventories had soared in Q1 on tariff-frontrunning, and in Q2 they undid some of that increase.

What Slowdown?

The strong Q2 growth came after the explosion of imports on tariff-frontrunning had knocked Q1 GDP growth into the negative (-0.6%). Consumer spending growth in Q1 was also weak. So there were a lot of concerns about growth. And the first estimate of Q2 consumer spending growth (+1.4%) did nothing to alleviate those concerns.

But the revised Q2 growth figures, especially the up-revisions of consumer spending back into the healthy range, should relieve those anxieties.

And Q3 consumer spending so far looks pretty good, as indicated by strong retail sales in July and August. So maybe the wait for the downward spiral of the economy – despite reduced government spending – may have to be extended a little further?