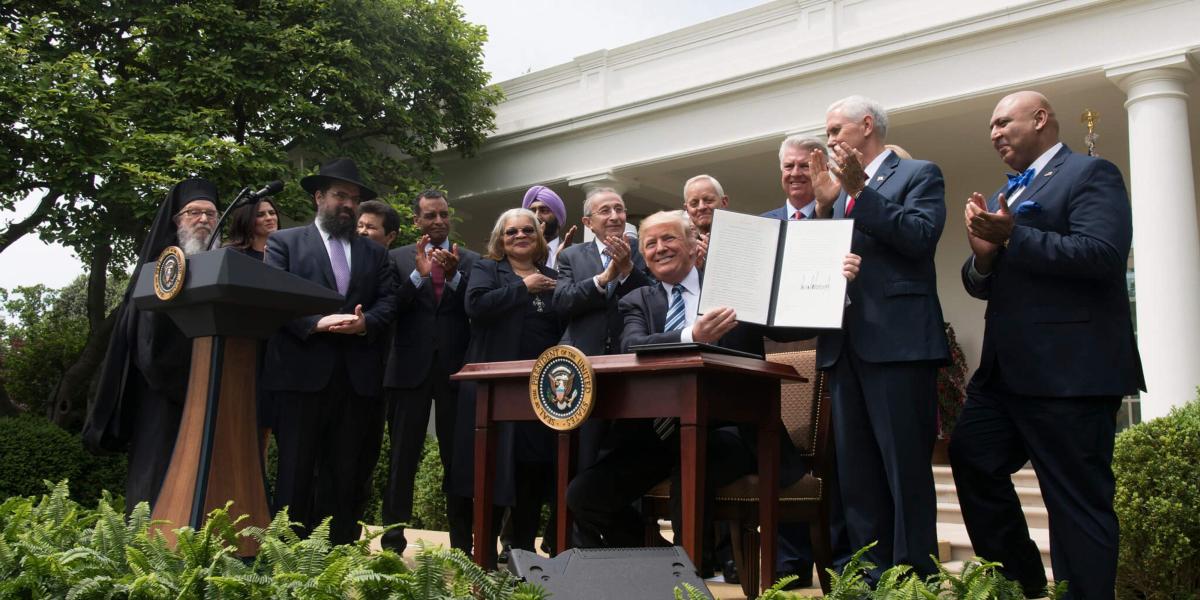

Today, April 2, 2025, is what Donald Trump and his team are calling “Liberation Day.” Because later, the president will host an event in the Rose Garden to sign reciprocal tariffs that, in the words of his press secretary, “will roll back the unfair trade practices that have been ripping off our country for decades.”

The prospect of sweeping new taxes on the goods, capital, and resources Americans buy from producers in several other countries has caused some panic throughout the economy in recent weeks—seen most clearly in the declining stock market.

Those concerns were not helped by the president’s comments over the weekend that he “couldn’t care less” if car prices go up due to tariffs because then people will be forced to buy more expensive American cars.

Trump, his team, and his allies are dismissing all the panic as the result of the “fake news media” reaching for new lies to try and tarnish his public support and cover up all the success his administration is having in this second term. And after the last ten years of biased, misleading, and outright false coverage deployed by the establishment media to unsuccessfully go after Trump, that’s a believable angle.

Establishment politicians, official “experts,” and media figures have cried wolf so many times that it’s remarkable that anyone still trusts them.

However, that does not necessarily mean that they are wrong one hundred percent of the time.

And in this case, the establishment media and the mainstream economic “experts” are more right than wrong in their warnings about these new tariffs.

But you don’t have to listen to them and their mostly right-but-somewhat-flawed economic arguments against tariffs. The best explanation of the effects of tariffs comes from economists in the Austrian School of economic thought—most of whom are just as opposed to the crony global trade system as the most ardent Trump supporters.

In short—like all other taxes—tariffs impart a new cost on producers. That new cost does not impact the price of whatever is being produced with the taxed good directly because prices are determined by how much people value the good or service in question, not the cost of production.

But that new cost is a problem for the companies operating right at the margin—meaning the price they can sell their good or service at is only a little higher than the cost of production. To companies operating right on that edge, anything that raises the cost of production could tip them over into the position where they cannot stay in business without taking economic losses. If they raise prices, they lose customers because people aren’t willing or able to pay more. But if they keep charging the market price, they lose money because their costs are now higher than their revenue.

Eventually these companies—be they foreign companies or, more commonly, American companies using taxed foreign capital and resources to produce things here—will have to stop offering whatever product or service they are losing money on. When that happens, supply falls. But Americans want whatever they had been consuming just as much as before, so a drop in supply without a drop in demand means that prices will rise.

Domestic suppliers cannot come in to fill the gap without first drawing resources away from some other, more highly-valued use. In other words, the shortage can be moved but not eliminated as long as the tax remains in place. Prices will necessarily be higher than they would have been without the tariff. That is inescapable.

All the tariffs other governments put on American goods that Trump plans to respond to today bring about the exact same effects in their own countries. It shouldn’t come as a shock to any right-winger that European governments—much less the Chinese Communist Party—are willing to harm their own people to raise revenue and warp trade to their regime’s own benefit. We, in the US, should not be looking to their decaying economies and increasingly totalitarian societies for inspiration.

Some claim that Trump is actually misleading his supporters about the benefits of tariffs and is only using them to try and negotiate his way to a world without tariffs. The global reciprocal tariff strategy he is expected to unveil and implement today is often pointed to as evidence that that is Trump’s true aim.

A world without tariffs is, of course, a good goal. But there are other forms of American leverage that Trump can use that, in contrast, will not hurt Americans at all. Imagine if Trump notified the EU that he was cutting off all economic aid, canceling all weapons deals, and suspending any payments for Europe’s defense while also threatening to pull the US entirely out of NATO unless European governments abolished all their tariffs. That would almost certainly work. And if not, the American people would still be significantly less burdened than they were before. Not so with the tariff strategy that will, at best, stick Americans with higher prices for the entire negotiation period.

We saw how badly the Biden administration was hurt by rising prices in their one term in office—even among loyal Democrats. Trump and his allies are gambling, not just the approval of the current administration, but to a large extent the credibility and future of their entire movement on either the theory that—in this one singular case—economic law does not apply or that a struggling American middle class will be uncharacteristically accepting of higher prices if they’re told it’s benefiting some American companies. That is a mistake.