The Trump tariffs, announced on April 2, are so wantonly stupid and destructive that I can barely stand to discuss them. But because their impact will be so far ranging, I can’t not.

Amusingly, Russia, which is already super sanctioned, is a big relative winner by already having adapted by reoriented its trade to the Global South and becoming even more of an autarky. But it will still experience second-hand consequences as its trade partners start limping.

However, even thought the US is set to reap the harvest Trump is sowing, the US probably will not be the earlier big victim. Odds favor emerging economy crises first. Remember that Jomo has been warning for at least a year and a half of the rising odds of financial upheaval in developing countries, due among other thing to a continued high dollar and slow growth globally. Even though the business pointed to the dollar falling in a global currency index, that is weighted towards big economies. As we’ll discuss further, Southeast Asian currencies declined against the greenback. Some countries in this region were already see as at risk of a crisis, not due to foreign debt exposures but excessive domestic debt. Trump’s kick in the head could push them into the danger zone.

Another area at risk, with which I am less familiar, is Central America. Their economies depend in a big way upon remittances from the US, which Trump is working very hard to reduce. The US runs a trade surplus with Central America but its member states will still face the “base tariff” of 10%. Not that Trump cares much about niceties like treaties (see for instance the JCPOA), but per Reuters, Guatemala has already complained that the new tariffs violate the DR-CAFTA trade pact. Mexico, which does run a large surplus with the US, is somewhat financial crisis (as opposed to just plain super bad recession) protected by virtue of having large FX reserves.

The point about emerging markets is contagion. When (not if) a not-trivial emerging economy goes into a meltdown, investors reflexively run for cover. Any country that is colorably similar to the one having a seizure will be shunned. That means among other things the value of their currency will fall.

Now that we have some actual numbers, we can expect to see some stabs at analysis over the coming weeks. Some experts tried claiming that China would not be much affected because its export to the US were only 3% of GDP. First, that is not a de minimus number. Second, for reasons of cost and/or reduction of controversy, China has moved some production to Southeast Asia, particularly Vietnam, and Mexico. Third, Trump has also targeted every country except Russia and North Korea. At a minimum, they will see a reduction in their economic activity, which will blow back to trade with China.

If readers have any early sightings from manufactures, exporters, or middlemen, please pipe up.

Some overviews. Here is the White House Fact Sheet. Note Trump ritually invokes a national emergency when he is the one causing one. In a separate Fact Sheet, he eliminated the de minimus exemptions starting May 5. It is not well drafted but it seems to cover only goods from China and Hong Kong.

From the Wall Street Journal:

U.S. stock markets were poised to open sharply lower. The U.S. dollar sank more than 2% against the euro, Japanese yen and Swiss franc. Oil and gold both fell and investors dashed for the safety of Treasurys, a response to fears that the tariffs will tip the economy toward recession.

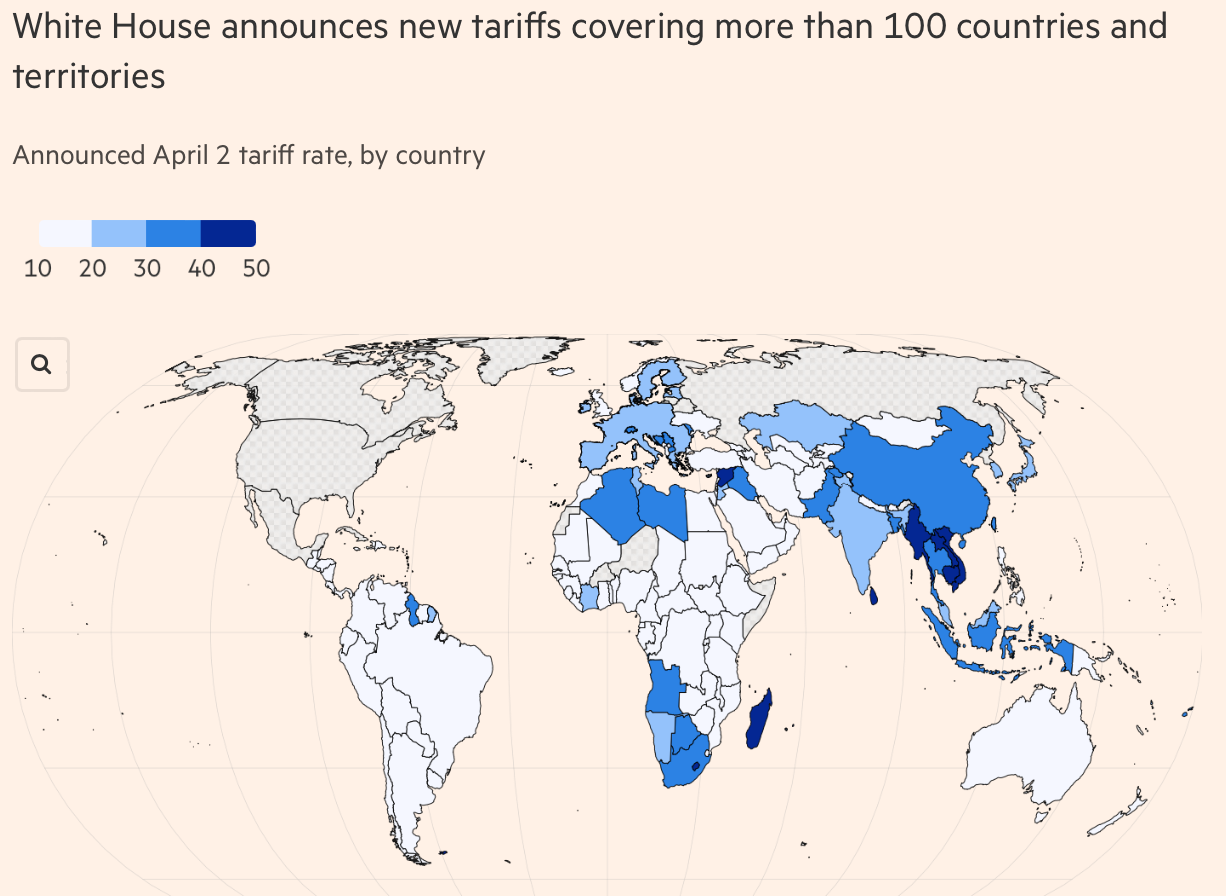

All U.S. imports will be subject to a 10% tariff, effective April 5.

Trump will impose even higher rates on some nations that the White House considers bad actors on trade. For example, Japan faces a 24% duty and the European Union faces a 20% levy, effective April 9.

China will be hit with a new 34% tariff, adding to previous duties, like the 20% tariff Trump imposed over fentanyl. That means the base tariff rate on Chinese imports will be 54%, before adding pre-existing levies.

The tariffs are pegged to amounts Trump says other countries impose on the U.S. Here’s the math behind the levies.

Some global leaders are vowing to retaliate, while others are hopeful there is still time to strike a deal with the U.S.

Canada and Mexico are excluded from the reciprocal tariff regime.They are still subject to plans to impose 25% tariffs on most imports to the U.S., though the administration has given an exemption for autos and many other goods. Here’s a list of the products and countries exempted from the tariffs.

Trump’s 25% tariffs on foreign-made autos and parts took effect at 12:01 a.m. ET.

More detail from the BBC:

Custom tariffs for ‘worst offenders’

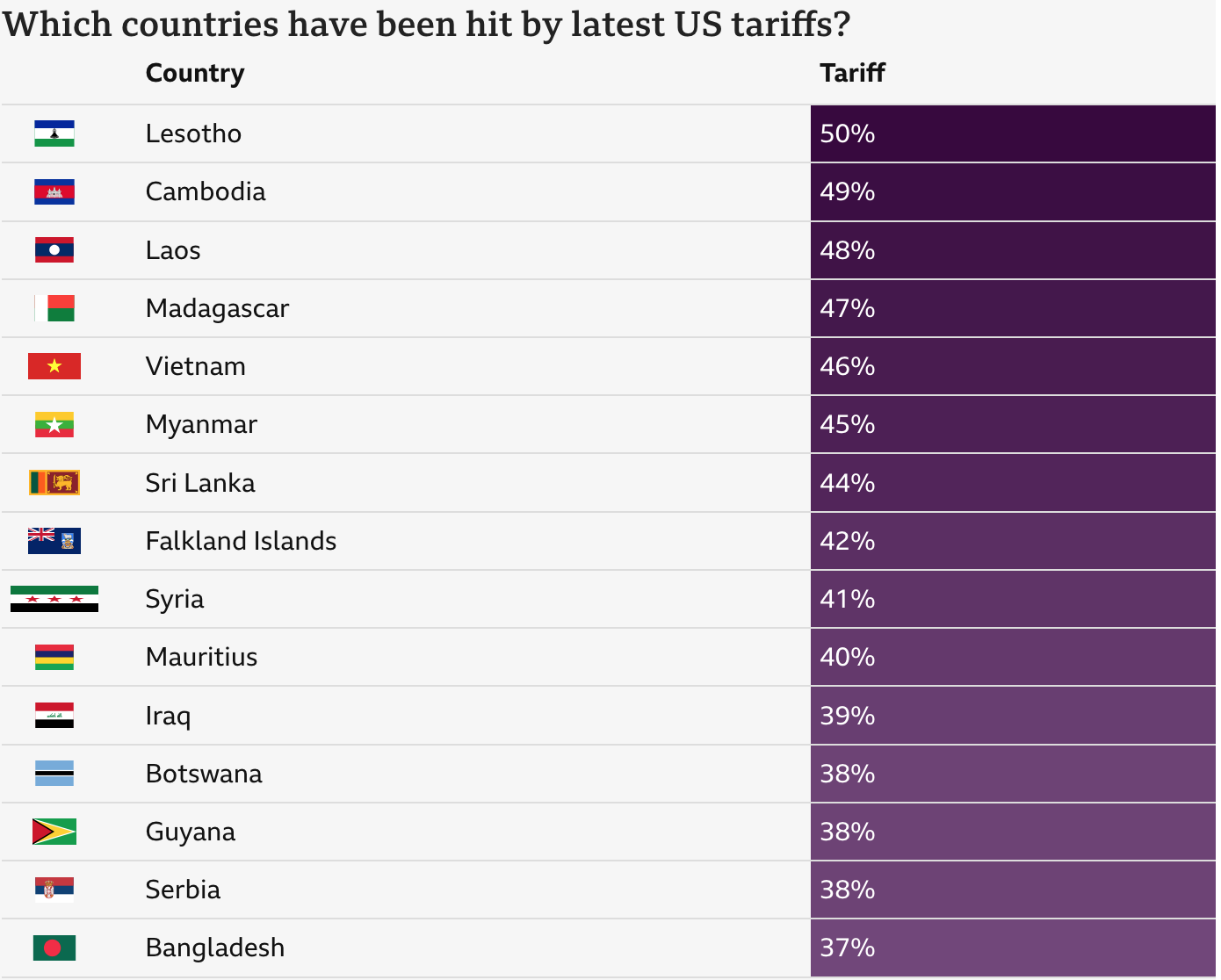

White House officials also said that they would impose what they describe as specific reciprocal tariffs on roughly 60 of the “worst offenders”.

These will go into effect on 9 April.

Trump’s officials say these countries charge higher tariffs on US goods, impose “non-tariff” barriers to US trade or have otherwise acted in ways they feel undermine American economic goals.

The key trading partners subject to these customised tariff rates include:

European Union: 20%

China: 54% (which includes earlier tariffs)

Vietnam: 46%

Thailand: 36%

Japan: 24%

Cambodia: 49%

South Africa: 30%

Taiwan: 32%

The Financial Times weighed in with Donald Trump baffles economists with tariff formula:

The formula used to calculate the tariffs, released by the US trade representative, took the US’s trade deficit in goods with each country as a proxy for alleged unfair practices, then divided it by the amount of goods imported into the US from that country.

The resulting tariff equals half the ratio between the two, resulting in countries such as Vietnam and Cambodia — which send large amounts of manufactured goods to the US but import only small quantities from the US — attracting punitive tariffs of 46 and 49 per cent respectively.

By contrast the UK, with which the US had an annual surplus in goods trade last year, will be hit only by the baseline 10 per cent tariff that applies to all countries barring Canada and Mexico.

Economists argued the USTR methodology was deeply flawed economically and would not succeed in its stated aim of “driving bilateral trade deficits to zero”. They added that, despite the White House’s claims that “tariffs work”, trade balances are driven by a host of economic factors, not simply tariff levels….

Economists also attacked Trump’s obsession with reducing bilateral trade deficits to zero as economically illiterate, since there will always be items that it is impossible or economically unviable for countries to grow or make themselves — for example, the US cannot grow its own bananas on any meaningful scale.

Some hope this is just a Trump opening bid and relief might be possible. But the Administration is making confused noises. From NBC:

Trump surrgoates were sending mixed messages in the wake of his shock tariffs announcement yesterday.

On X, Eric Trump, the president’s second-oldest son and the principal of The Trump Organization, predicted talks would commence.

“I wouldn’t want to be the last country that tries to negotiate a trade deal with @realDonaldTrump,” he wrote. “The first to negotiate will win — the last will absolutely lose. I have seen this movie my entire life … ”

But on CNN, White House Press Secretary Karoline Leavitt said there would be no negotiations. She urged Wall Street to “trust in President Trump” and rejected the idea that Trump would pull back on tariffs before they go into effect.

From CNBC:

Pharmaceutical companies breathed a sigh of relief Wednesday after U.S. President Donald Trump revealed that they would not be subject to reciprocal tariffs — but that reprieve could prove fleeting as the White House moves ahead with plans for the sector.

The Trump administration is considering launching a so-called 232 investigation into pharmaceuticals, among other industries, which could lead to import duties under the Trade Expansion Act, Bloomberg cited a senior administration official as saying on Wednesday.

But also from CNBC, evocative of Annie Lennox, “Some of them want to be abused”:

The latest U.S. tariffs could cost the Polish economy 0.4% of gross domestic product or roughly 10 billion zlotys ($2.64 billion), according to a preliminary estimate shared by Polish Prime Minister Donald Tusk.

“A severe and unpleasant blow, because it comes from the closest ally, but we will survive it. Our friendship must also survive this test,” he said

Bloomberg clears its throat and points out that so far, US investors are the biggest losers (not clear this is true outside big and advanced economies; Southeast Asian currencies fell versus the dollar):

Donald Trump’s shake-up of the global trading system is hurting US assets more than those in many of the big economies he has just slapped with additional tariffs.

US equity index futures tumbled more than 4% after the US President announced a sweeping series of tariffs following the market close on Wednesday, and a gauge of the dollar slumped. But the impact elsewhere was less extreme. The Stoxx Europe 600 was down 1.3% in morning trading while the euro was up 1.3% against the dollar, hitting its highest level since October. A broad gauge of Asian stocks fell as much as 1.7%

For what may seem a parochial take, from the Bangkok Post:

Southeast Asian stocks and currencies fell after Asian emerging nations were given some of the biggest tariff increases by US President Donald Trump. Vietnamese shares tumbled.

Vietnam’s main stock index slid as much as 6.2%, heading for its biggest one-day drop in more than four years, while equities in Thailand, the Philippines, Malaysia and Singapore also declined. The Thai baht weakened as much as 0.8% against the dollar, and the Vietnamese dong and Malaysian ringgit also dropped.

Southeast Asian assets slipped after the region was hit particularly hard by the reciprocal tariffs announced by Trump on Wednesday. He said the US would place a 46% tariff on Vietnam’s exports, 36% on Thailand’s, and 32% on Indonesia’s. The region’s largest trading partner — China — was heavily targeted, with Beijing now facing a cumulative 54% tariff….

‘It’s not surprising to see panic selling as local investors only expected 10%-to-15% tariffs,” said Nguyen Anh Duc, head of institutional brokerage and investment advisory at SBB Securities Corp. “Margin lending balances of brokers is quite high and can make things worse. If stock prices plunge another 10%, we may see margin call pressures.”…

The cost to insure Southeast Asian countries’ sovereign debt also climbed. Credit-default swaps tracking emerging Asia bonds widened by the most in 19 months, according to traders…

A further uptick in trade tensions may heap additional pressure on Asian currencies. The Indonesian rupiah has slumped 2.8% this year and last month fell to the weakest level since the Asian financial crisis in 1998.

We’ll need to wait for other shoes to drop, particularly reciprocal tariffs. But it’s hard to adequately express how this is an ignorant and savage act of destruction.