According to the Treasury Department’s monthly statement released on Thursday, Federal spending surged again in August, rising to the highest spending level reported in 30 months. At the same time, the deficit rose to the second-highest August deficit on record, topped only by August 2024.

In spite of the administration’s claims that its higher taxes on imports (taxes also known as “tariffs”) would lead to smaller deficits, the fact is federal spending has risen faster than tariff revenue. Moreover, even if tariff revenues were to rise faster than spending, this would do little to decrease the overall size of federal deficits.

Nonetheless, Trump spokesmen like Scott Bessent continue to invent increasingly implausible narratives about how, any day now, the federal government will begin paying off the federal deficit and federal spending will be reined in. Since Trump was sworn in, there has never been any evidence at all that the administration has any plans to make any meaningful cuts to spending. Rather, the administration has only celebrated its tax increases as a great victory.

Moreover, there is now good reasons to suspect that overall tax revenue will actually start to fall as the employment situation continues to worsen. That means falling revenue from income taxes (including payroll taxes) and tariffs. When revenues begin to fall—as they inevitably do during the bust phase of any business cycle—we can expect to see deficits rise quickly. Tariff revenue, which is still only a small percentage of total revenue, will not change this.

A Surge in Spending

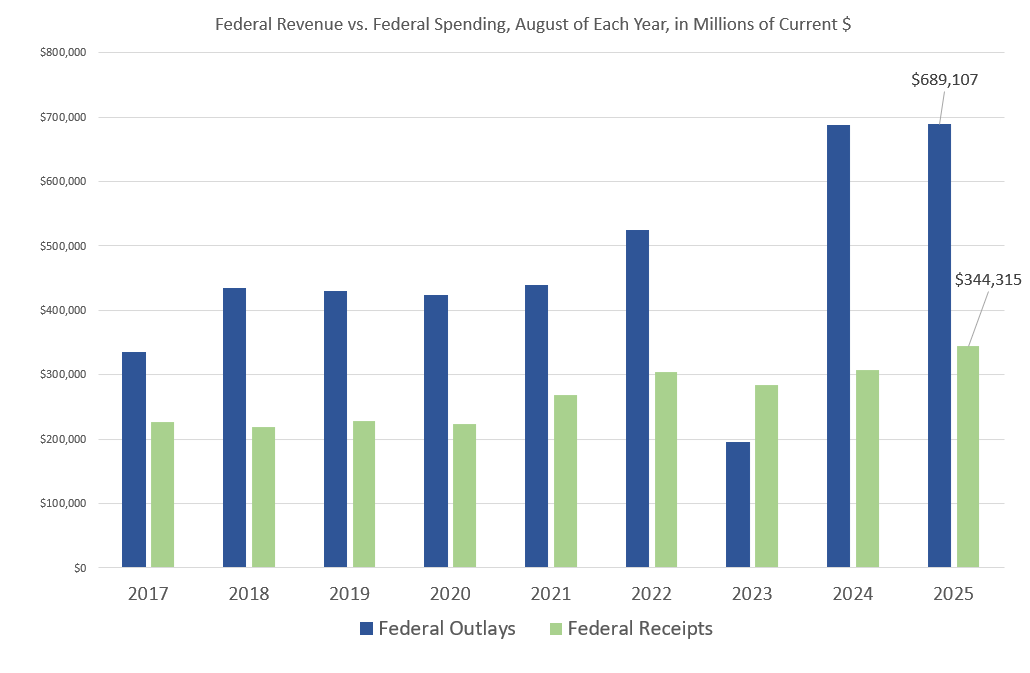

During August, federal tax revenues increased slightly, month over month, by $5.8 billion, to $344 billion. Unfortunately, federal spending increased during the same period by $59 billion to a total of $689 billion. In other words, spending was almost twice as high as revenue, so the deficit for August surged to $344 billion, the largest deficit since March of 2023, 30 months ago.

Compared to August of last year, both spending and revenue increased, with spending up, year over year, by 2.5 billion and revenue up by 37.7 billion. This led to a slight improvement in the August deficit, compared year over year.

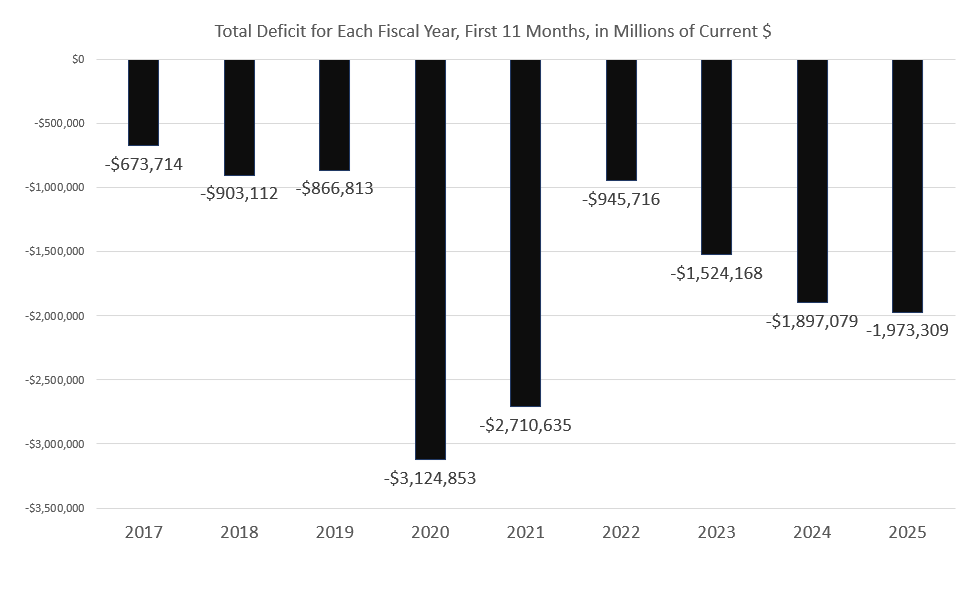

But, this is nowhere near enough to change the trajectory of the annual deficit. We now have data for the first eleven months of the 2025 fiscal year (which ends September 30) and this fiscal year is on course to finish with a $2-trillion deficit, the largest since 2021 when the federal government was engaged in runaway deficit spending in the name of “covid stimulus.” 2025’s deficit will likely be the third-worst on record, behind only Trump’s 2020 deficit and Biden’s 2021 deficit.

Looking at the first eleven months of each fiscal year, we find that the 2025 FY deficit of $1.97 trillion is up by four percent compared to the same 11-month period of last year, when the deficit totaled $1.90 trillion.

No Windfall in Revenue

The administration has for several months claimed it would soon bring out-of-control deficits down significantly using revenues from the administration’s large tax hikes on imports (tariffs). This has never been realistic given that in recent years, tariff revenue has not exceeded two percent of total federal spending. Even if the administration were able to increase tariff revenues by ten fold, this would hardly eliminate, or even substantially reduce, deficits.

This can be seen in recent numbers. For example, Treasury Secretary Bessent recently declared on Fox News that the federal government “collected more than $31 billion in tariff revenues in August, already the highest monthly total so far for 2025.” That may sound impressive to some, but $31 billion is less than five percent of total federal spending during August, and less than ten percent of federal receipts.

To be sure, this is in impressive increase in the amount of revenue form import taxes. But in the context of total spending, its a small amount, and certainly not anything meaningful when federal spending is coming in at 30-month highs. Moreover, overall federal receipts (from all sources) has shown no signs of trending upward. On average, monthly federal receipts have been $442 billion per months since Trump was sworn in. August’s receipts fall below the average. Indeed, if the employment situation continues to worsen, as has been the clear trend over the past three months, we can expect revenues to fall further.

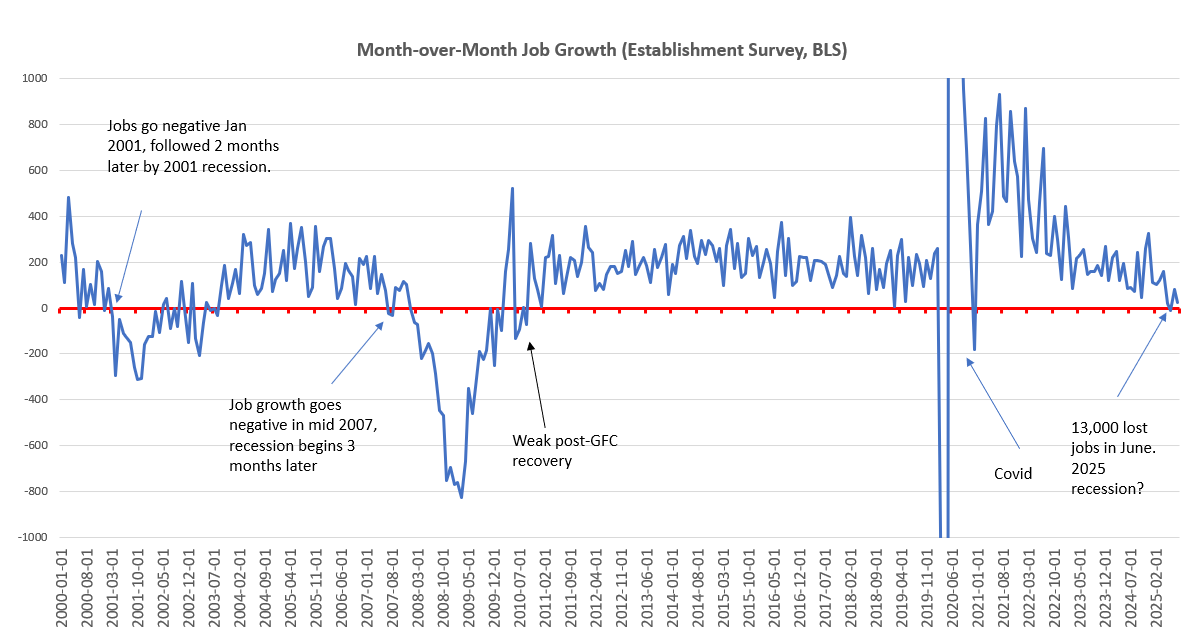

There is no reasons to expect that raising taxes on imports will increase employment or overall demand. No country has ever taxed itself in prosperity. Tariffs make goods more expensive, and these include goods used by employers who themselves produce goods and services. So, we should not be surprised to find that in spite of the administration’s claims that tax hikes on imports would lead to a surge in manufacturing jobs, manufacturing payrolls have fallen by 7 million over the past three months. Moreover, total employment actually went down in June—an indicator of recession—and we’re still waiting on revisions for July and August which may show job losses as well.

Taken all in all, it is clear that the fiscal situation in the United States continues to worsen. In the seven months since Trump was sworn in in January, total federal debt has increased by $1.2 trillion, surging to above $37. 4 trillion. Federal spending also continues to grow. An extra $30 billion here and there in tariffs revenues—assuming other tax revenues remain level into a slowing economy, which is a big assumption—will do nothing of consequence to change the current trend.

This will continue to impact ordinary Americans as the US continues to see increases in interest payments on the debt. During August, the federal government paid out $111 billion in interest on federal debt. That’s more than the federal government paid to the Department of Defense ($78 billion) and only $32 billion less than what the federal government spent on Social Security. Year-to-date, interest payments are now up 7.2 percent, following years of previous increases. In other words, the federal debt is slowly devouring tax revenue which increasingly must go to pay interest, and which offers no value to current taxpayers.

All this is partly why the White House is so desperate to pressure the FOMC and the Federal Reserve into cutting the target policy interest rate at the FOMC’s meeting next week. The US Treasury faces a challenge of refinancing more than $9 trillion in US debt during the next year. With Treasury yields now at much higher levels than they were in recent years, refinancing at current interest rates will add a enormous amount of new interest expense to for the federal government, as the dept-to-GDP ratio continues to climb to 120%. The administration really wants to see the Fed force short term yields back down to ease the expense of massive federal deficits.

There’s a big downside here for regular people. If the Fed starts forcing down interest rates further, that will require the Fed to buy assets with newly created money and that means more monetary inflation. That’s likely to translate into both consumer price inflation (i.e., food, energy, healthcare, insurance) and asset price inflation (i.e., home prices). So, the government will get cheaper debt, but most people will get only a higher cost of living. Monetary inflation at this time is especially inopportune because price inflation, as measured by the CPI, accelerated in August. The most recent CPI data shows that price inflation increased in both the month-over-month measure and the year-over-year measure.

Trump wants more monetary inflation so he can more easily finance his huge deficits, but ordinary people will pay the price. More tariffs won’t fix this.