Due to wartime inflation of bills of credit (“Continentals”) during the American war for independence and the predictable economic effects, an old American colloquialism developed, “not worth a Continental” (although this phrase may have come about much later than the Revolutionary era). This article argues that Continentals only temporarily retained some value largely because of an initial promise of future redemption in gold and silver—a monetary “bait-and-switch.” (Additionally, interventions such as legal tender laws and the acceptance of paper money for tax payments may have offered some temporary support, but these measures were secondary to—and ultimately dependent upon—the original expectation of redemption in gold or silver).

This poses a significant problem for Modern Monetary Theory (MMT). Rather than demonstrating chartalism or a state’s ability to impose money on a people via a combination of legal tender laws and acceptance of their tokens in tax settlement, it demonstrates that the Continentals were only perceived as valuable because they were linked to gold and silver and carried explicit promises of future redemption in specie and were burned to avoid other problems.

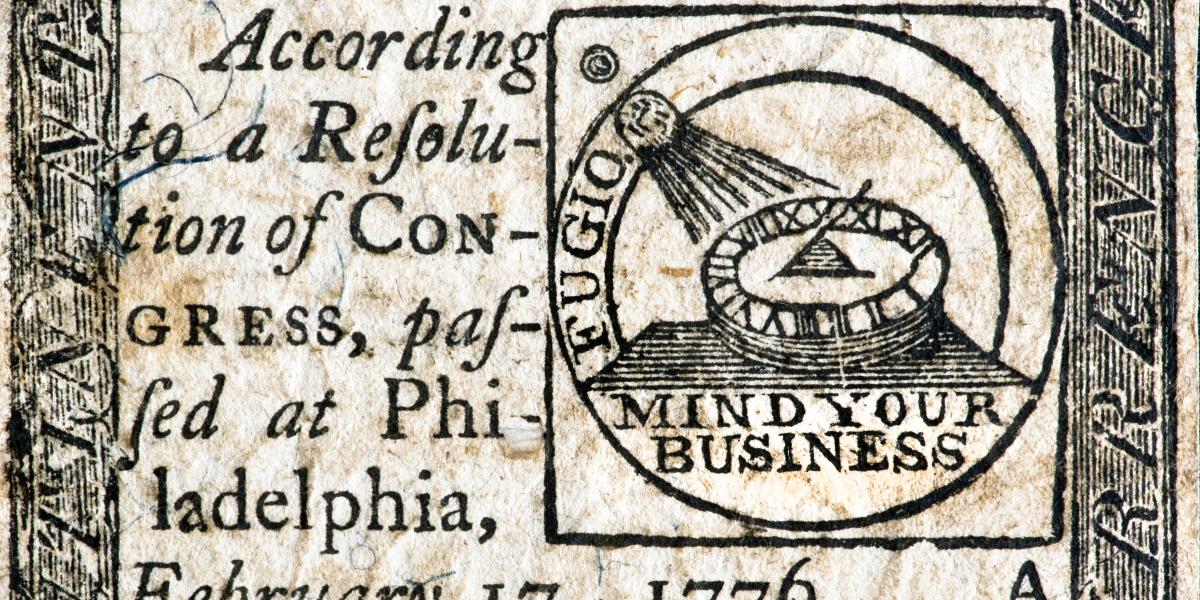

The Continentals

In order to fund and support the Continental Army in the style of a regular army—rather than as a guerilla force or forces—taxation was out of the question. The Continental Congress did begin to discuss borrowing (with the plan to repay through future taxes) in June 1775. That seemingly left one option—“coercive but seemingly painless, a device the British colonies had pioneered in the western world, the issue of paper money.” On June 22, 1775, Congress issued $2 million paper “bills of credit” (“Continentals”), but this would soon expand greatly. Rothbard explains the nature of this inflation,

Paper issues fraudulently pretend to be equivalent to units of specie and are used by the issuer to bid away resources in society from the producers and consumers, in the process depreciating the money itself. Its nature and consequences are equivalent to the process of counterfeiting.

The havoc this monetary inflation wreaked—followed by price controls, legal tender laws, and other interventions—can be explored in an excellent and informative article by Pearcy Greaves—a student of Mises—“From Price Control to Valley Forge: 1777-78” or in “Revolutionary Inflation: A Threat to the Cause of Independence” or “In Their Own Words: Revolutionary Voices on Inflation.”

Redemption Promises, Money-Substitutes, and Monetary Value

There is an important distinction between money proper and money-substitutes. Mises carefully distinguished between money proper, money-substitutes, and fiat money. Money proper is “real money,” that is, a good that is a generally-accepted medium of exchange in itself and does not have to be exchanged with something else to possess the money (e.g., specie, tobacco, etc.). A money-substitute is an “absolutely secure and immediately payable [claim] to money,” the acceptability of which might also be “further increased by their standing in law and commerce.” Fiat money, on the other hand, is unbacked and irredeemable currency. Therefore, a money-substitute, while not money proper, is a claim to money and may often be exchanged as money.

This raises an important question: if the Menger-Mises theory of money is true—certain goods, given their qualities, come to be used for indirect exchange and then become generally-accepted media of exchange—then how is fiat money possible? Thankfully, Hans-Hermann Hoppe tackled this very question in his article “How is Fiat Money Possible?—or, The Devolution of Money and Credit,”

Yet without a doubt the coexistence of money and money substitutes and the possibility of holding money in either form and in variable combinations of such forms constitutes an added convenience to individual market participants. This is how intrinsically worthless pieces of paper can acquire purchasing power. If and insofar as they represent an unconditional claim to money and if and insofar as no doubt exists that they are valid and may indeed be redeemed at any time, paper tickets are bought and sold as if they were genuine money—they are traded against money at par. Once they have thus acquired purchasing power and are then deprived of their character as claims to money (somehow suspending redeemability), they may continue functioning as money. As Mises writes: “Before anby economic good begins to function as money it must already possess exchange-value based on some other cause than its monetary function. But money that already functions as such may remain valuable even when the original source of its exchange-value has ceased to exist” [Mises, Theory of Money and Credit, p. 111].

In other words, consonant with the Menger-Mises thesis, paper money-substitutes—believed to be exchangeable for money proper (i.e., specie, tobacco, etc.) as claims to money—could come to be accepted on a free market due to convenience and confidence in redemption. However, this is only true “insofar as they represent an unconditional claim to money” and “insofar as no doubt exists that they are valid and may indeed be redeemed at any time.” This is the only way we would expect “intrinsically worthless pieces of paper” to acquire and maintain purchasing power. From that point—and only because of the prior promise of redeemability and confidence in it—a government can abandon the promise of redemption.

What allows the fiat to continue to operate as a medium of exchange is the government’s dependence on the people’s continued recognition and usage of the money—which is not permanently guaranteed, especially if monetary policy is particularly reckless—to which may be added legal tender laws and the ability to use the money in tax settlement.

Interestingly, Pelatiah Webster (1726–1795)—who has been called the American republic’s first economist and the founding generation’s foremost economic thinker—wrote insightfully about inflation during the American war for independence and other economic issues. In his 1791 book, Political Essays on the Nature and Operation of Money, Public Finances and Other Subjects, there is an essay titled “An ESSAY Or Humble Attempt to Examine And State the TRUE INTEREST Of Pennsylvania With Respect To The Paper Currency” (first published on December 13, 1780), in which he wrote,

I PROPOSE, first, some remarks on the subject of paper money, and, secondly, some particular consideration of the Acts of our Assembly for issuing the new Continental bills, with some reasons why I think the true interest of Pennsylvania requires that those acts should be repealed, and the issuing of those bills should be stopped or suspended for the present…

Two things are essentially necessary to give paper bills a credit and currency equal to hard money. 1. Such certainty of honest and punctual redemption, as shall fully satisfy the mind of the possessor. 2. That the credit and demand for said bills should be so constantly kept up, from the time of their emission to that of their redemption, that the possessor may be able, at any time, to pass them at hard money value. (italics in original)

If paper money—bills of credit—were to be used successfully and justly, and considered equal to hard money, then “honest and punctual redemption” was necessary and governments must not destroy the credit of the paper bills by continuing to print to the point where people start to doubt redemption.

The “Bait”—Continental Redemption Promises

From 1775 onward, the Continental Congress repeatedly assured the public that Continentals would be redeemed dollar-for-dollar at par with specie once the war was won. Of course, the unfortunate plan to fulfill this promise of redemption would come from a future tax, that is, people would be taxed via inflation, then people would be taxed again to redeem the paper money. Therefore, the acceptance of the Continental (and other similar paper currencies) was based on the expectation to eventually exchange the paper for gold, while also coercing exchanges (under legal tender laws) and settle tax obligations. Fortunately, that promise was never fulfilled and the Continentals were not redeemed as promised, however, the point here is that the promise of redemption was key to gaining even limited acceptance of the Continental. As the Congress (and state governments) inflated more—along with several other interventions—and people rightfully became doubtful about fulfillment of redemption promises, the Continental continued to lose value. The “bait” of future redemption was key.

Despite the future promises of redemption and the several interventions that followed to compel acceptance (e.g., legal tender, price controls, threats of punishment, confiscation, etc.), none of this was sufficient to prop up a constantly-depreciated money-substitute. Due to monetary inflation, the money-substitute was coming to be viewed as fiat. In describing the events of the war chronologically, Webster later identified the government interventions as counterproductive. He wrote,

The people of the states had been worried and fretted, disappointed and put out of humor by so many tender-acts, limitations of prices, and other compulsory methods to force value into paper money, and compel the circulation of it, and by so many vain funding schemes, declarations, and promises, all which issued from Congress, but died under the most zealous efforts to put them into operation and effect, that their patience was all exhausted. . . (italics in original)

In A History of Banking in the United States (1900), John Jay Knox wrote,

The continental money was issued in anticipation of funds to be received from the taxation [redemption] that Congress from time to time recommended the several Colonies or States to lay for the benefit of the common Treasury. A connection may be traced between its depreciation and the gradually weakening power of the Continental Congress. (emphasis added)

Thomas Jefferson—as quoted in Knox—explained,

At the commencement of the late Revolution Congress had no money. The external commerce of the States being suppressed, the farmer could not sell his produce, and, of course, could not pay a tax. Congress had no resource then but in paper money. Not being able to pay tax for its redemption, they could only promise that taxes should be laid for that purpose, so as to redeem the bills by a certain day. They did not foresee the long continuance of the war, the almost total suppression of their exports, and other events which rendered the performance of their engagements impossible. The paper money continued for a twelvemonth equal to gold and silver but the quantities which they were obliged to limit for the purpose of the war exceeded what had been the usual quantity of the circulating medium. It began, therefore, to become cheaper or, as we expressed it, it depreciated, as gold and silver would have done had they been thrown into circulation in equal quantities. But not having, like them, an intrinsic value, its depreciation was more rapid and greater than could ever have happened with them. In two years it had fallen to two dollars of paper money to one of silver in three years to four for one in nine months more it fell to ten for one and, in the six months following, that is to say, by September, 1779, it had fallen to twenty for one. (emphasis added)

Did legal tender laws and tax settlement help prop up the value of the Continentals? Arguably, yes, to a certain limited extent. Given the increasing worthlessness of the fiat paper money, and the refusal of many to voluntarily accept it in exchange for goods and services, attempting to legally force people to exchange goods for the paper money or using paper money to settle a tax obligation were some of the only utilities of the paper bills of credit to citizens.

The “Switch”—Broken Redemption Promises

While it is arguably better that the Continentals were not ultimately redeemed as promised, as that would have meant an additional tax burden on the people—further transferring wealth in specie from Continental non-holders to Continental holders—we should not overlook the importance of the false promise of redemption to the limited acceptance of the Continental. In short, the original promise—dollar-for-dollar redemption in specie—was never fulfilled. The promise was the “bait” and the “switch” was the fraudulent taxing people through inflation—expropriating purchasing power to themselves and earlier recipients in exchange for depreciating currency, higher prices, economic dislocation, price controls, legal tender laws, threats, and coercion.

In 1780, Congress attempted a reorganization of the currency, though not redemption. Old Continentals could be exchanged for new ones at a ratio of 40:1—40 old Continental paper notes for 1 new Continental paper note. Already, this was an admission that the previous promise—at-par redemption—would be unfulfilled, but this paper-for-paper swap failed almost immediately. Eventually, through the Funding Act of 1790, the new federal government allowed holders of remaining Continentals to convert them into federal securities at 100:1 or one cent on the dollar. This is sometimes described as redemption, however, it was effectively a repudiation.

From these things we can conclude that the American people were, in effect, defrauded by the paper money through a “bait-and-switch,” that this worked because people believed the paper monies to be genuine money-substitutes—valid, redeemable claims to money, and that this casts doubt on the notion of chartalism because redemption promises—in a context of multiple commodity monies—not taxation were key to monetary value.