Here is modern economic theory in one sentence: money needs to be plentiful for a prosperous economy. As a corollary: No problem is too big that can’t be resolved with enough money.

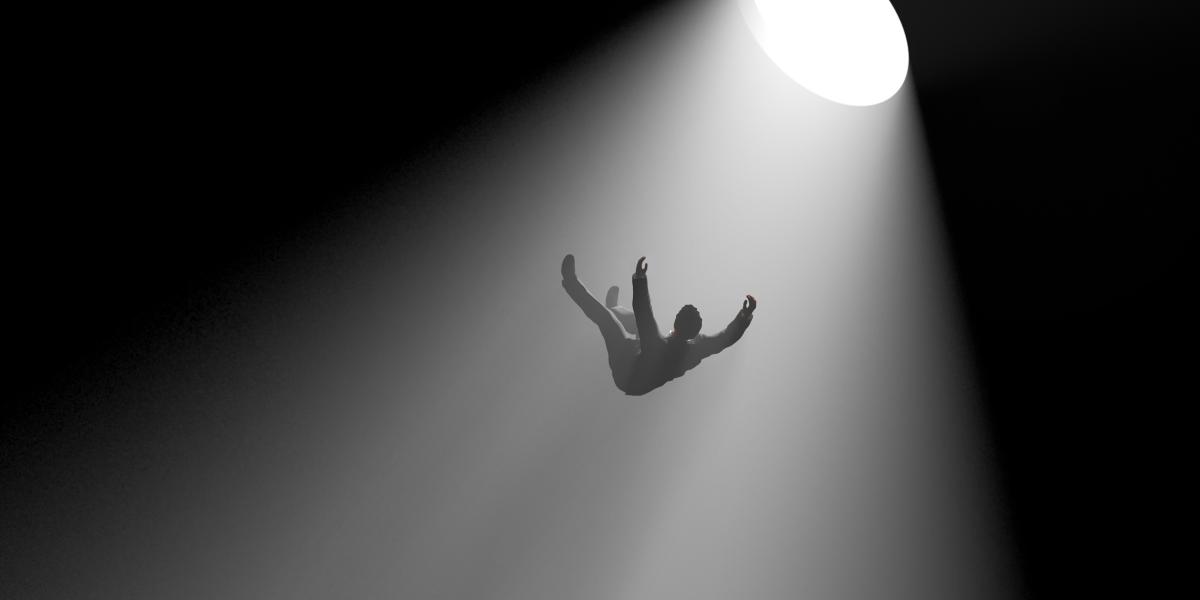

On the other hand, here are modern economic results in one sentence: a boom eventually nosedives into crisis, which is the necessary correction, but is delayed or fought by the process that caused it—massive money printing to save significant market participants.

Politicians favor money printing—leading to artificially low interest rates—to win favor with voters. An economy flush with money can keep people employed, keep GDP figures sparkling, and best of all keep pundits off the politician’s backs, that is, for a while. Gold being the “Great Tattle-Tale,” central banks sometimes sell it to signal their faith in fiat but today even the money printers are looking for salvation and are accumulating the barbarous relic, ignoring gold’s stark testimony.

I’m viewing the rush to gold, although some people are advising caution because gold is in for a price correction. But there’s another take, offered by Tavi Costa, Partner & Macro Strategist at Crescat Capital. The price of gold could go to the moon “if the U.S. were to revalue its gold inventory relative to outstanding Treasuries.” Currently, US gold reserves cover about 2 percent of its roughly $36 trillion in Treasuries outstanding, compared to 17 percent in the 1970s and about 40 percent in the 1940s. Getting back to the 17 percent mark would mean gold at $25,000 an ounce, and to reach 40 percent would see gold close to $55,000 an ounce.

But there are assumptions in this analysis that need exposure. What would astronomical gold prices imply for dollar holders? At $55K, Big Macs would be close to $80, given an average price today of around $5.66. To arrive at $80 over the near horizon, the Fed would need to go into overdrive with guns blazing, in Zimbabwe fashion. What would that do to the politicians who promised milk and honey for all, especially retirees?

From a political (criminal) standpoint it makes no sense to counterfeit if everyone benefits—the so-called helicopter drop proposed by Milton Friedman and made famous by former Fed governor and eventual chair ”Helicopter” Ben Bernanke. The idea behind money printing is to steal wealth surreptitiously from dollar holders, to create a hidden tax, thereby increasing government revenue. Your dollars buy less so that the government can spend more. But incomes would lag, and that too would create political instability.

Some governments have hyperinflated their currencies as a way of canceling debt, with ruinous effects on the currency and particularly debt holders. In the West, the model has been Weimar Germany in 1923, which hyperinflated the Mark.

Rather than hyperinflation, a more ethical and effective method advanced by Rothbard is “outright debt repudiation.” When government sells its debt, he points out, both parties in the transaction realize the money will be paid back “not out of the pockets or the hides of the politicians and bureaucrats, but out of the looted wallets and purses of the hapless taxpayers.”

In short, public creditors are willing to hand over money to the government now in order to receive a share of tax loot in the future. This is the opposite of a free market, or a genuinely voluntary transaction. Both parties are immorally contracting to participate in the violation of the property rights of citizens in the future.

Canceling public debt, therefore, is an acknowledgement that the transactions amounted to “robbers parceling out their shares of loot in advance” and is not a violation of legitimate contracts.

It’s doubtful government officials would cite this reasoning for canceling the debt, but they might see it as a way of avoiding the final destruction of the currency, which they hold in various forms close to their thieving hearts. They know that even if they did destroy the common medium of exchange the economy would limp on, and—in the absence of sound economics—with the aid of massive propaganda, they would eventually reinstate their inflationary house of cards, from which they profit at the expense of others.

Government and Markets are Enemies

The problem we face is the foundational conflict of states and markets, or coercion versus voluntary exchange. Ordinary people and ordinary experts alike see the state as somehow necessary, in spite of its long history of exploitation and destruction. It’s viewed as the concerned head of a family instead of an alien presence. It survives on deceit and plunder, and is promoted as the will of the people through their elected representatives. Any alleged failings, therefore, can be ascribed to defects in human nature and not the state as such.

Markets don’t work properly under state sovereignty, whether it’s the market for shoes, bikinis, or anything else. The failings of state interventions have been blamed on the market, with more interference regarded as the cure. Then more and more, as the cure seems forever elusive. What began as close to a free society begins to resemble a slave state. The propaganda machine ensures it will head that way until markets have capitulated to total bureaucratic control—or the courage of the plundered makes itself known.

If we are to have a future, we need to educate ourselves and others on the value of free markets. Reformers have opposed them since people began trading. In this regard few remarks are more enlightening than the ones Mises wrote in the epilogue to Socialism (1950), in which he succinctly presented the contradictions of interventionism.