Copper prices are near record highs with spot prices above $11,000 per ton. Grid expansion projects and data centers are copper-intensive, The supply chain in constrained and investors are anticipating future US tariffs reaching 25%. The press is claiming that these projects are the reason for the recent surge in copper hoarding, but the true driver is fear.

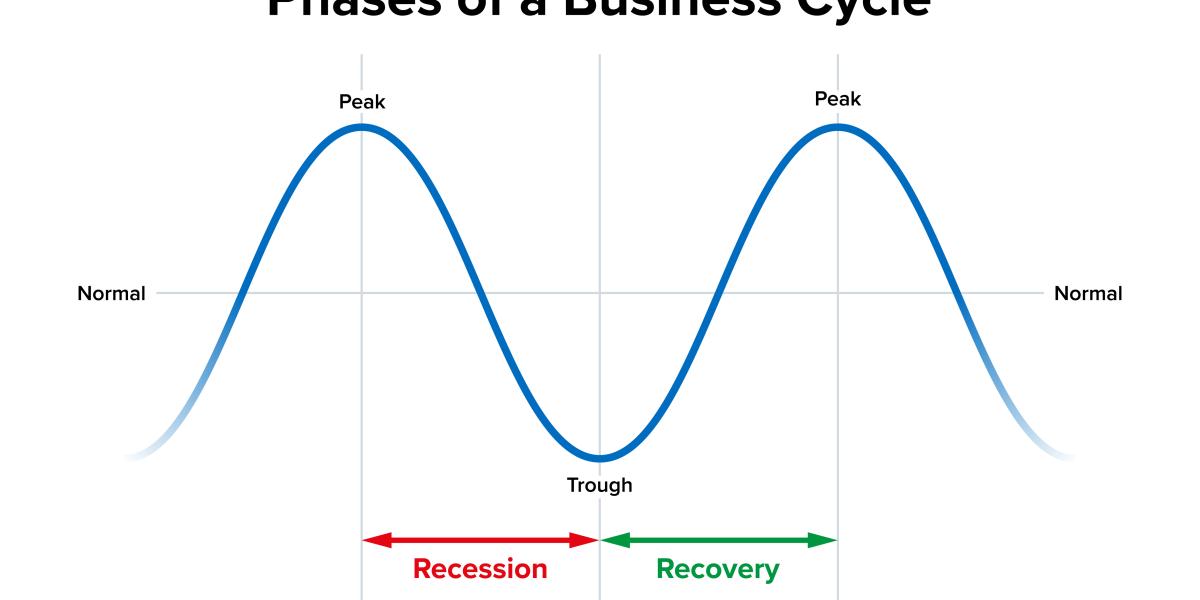

Commodities do not move simply because of “supply and demand” in the textbook sense. They move because of capital flows and confidence. Copper has always been called “Dr. Copper” because it supposedly has a PhD in economics. People believe the metal has an ability to predict overall global economic health, especially in terms of manufacturing. The old wives tale states that rising copper prices indicate economic recovery and growth since one would assume manufacturing is increasing.

When people begin hoarding raw materials, it means they no longer trust supply chains, governments, or currencies. This is exactly what happened in the 1970s. Inflation was not caused by “greed” or corporations. Rather, it was caused by government deficits, war spending, and the collapse of confidence in public institutions. The same forces are now aligning again.

Once politicians declare something “critical,” it ceases to be a free market. Governments are now talking openly about stockpiling copper for green energy, military use, and infrastructure. That alone guarantees shortages, because bureaucrats always buy at the worst possible time and hoard at the peak. Trade wars, sanctions, and geopolitical uncertainty force companies to hold excess inventory to hedge against supply chain constraints.

From the standpoint of the Economic Confidence Model, this fits precisely with the transition from private confidence to public distrust. Capital always moves to where it feels safest. When confidence in government collapses, money does not stay in bonds or paper promises. It moves into real assets, whether that is gold, land, energy, or copper sitting in a warehouse.