The EU plans to continue the war with Russia are coming apart in a welter of debt and recriminations.

Putin Delivers an Address to People in the West

Putin told Western audiences that the problems they are experiencing is mainly down to the incompetence of the Western elites and their “Empire of Lies”. You can see the speech (with English subtitles) here.

Putin also addressed business leaders by saying that he can’t see an end to sanctions and that the previous relationship with the West is over. How does this effect the ‘sweeteners’ that the US is likely to try and tempt him with?

Russian Frozen Assets

The Belgian Prime Minister has said that seizing Russian assets would be an act of war. Consequently, the EU has decided against seizing the frozen assets giving the following reasons:

Legal restrictions: there is no way to legally seize the assets.

Financial risks: if the EU seizes these funds then it will undermine confidence in the Euro.

Existing Ukraine commitments: if they seize the assets then they’ll have nothing to underpin the loans that were previously given to Ukraine and so they’d have to repay them out of EU funds.

Leverage: the assets may be used as a ‘card’ in peace negotiations. But what happens if, as part of the peace deal, Russia gets the funds back, plus interest? Will the EU have to repay the loans they’ve already secured on them and will they have to repay the interest they’ve already taken?

Remember:

EU Commission Presents Re-Armament Plan

The EU has released its plan for preparing for war in 2030. The White Paper presents solutions to close critical capability gaps and build a strong defence industrial base. It proposes ways for Member States to massively invest in defence, procure defence systems and build up the readiness of the European defence industry over the long run. This is essential for Europe’s security. Europe must invest in the security and defence of the continent, while continuing to support Ukraine to defend itself from Russia’s aggression. To effectively address these challenges, the White Paper outlines a number of key lines of action:

Closing capability gaps, with a focus on critical capabilities identified by Member States.

Supporting the European defense industry through aggregated demand and increased collaborative procurement.

Supporting Ukraine through increased military assistance and deeper integration of the European and Ukrainian defense industries.

Deepening the EU-wide defense market including through simplifying regulations.

Accelerating the transformation of defense through disruptive innovations such as AI and quantum technology.

Enhancing European readiness for worst-case scenarios, by improving military mobility, stockpiling and strengthening external borders, notably the land border with Russia and Belarus.

Strengthening partnership with like-minded countries around the world.

The Commission President has stated that the EU is justified in arming for conflict, presumably with Russia, under Article 122 of the EU Constitution Lisbon Treaty. The strange thing is that Article 122 does not mention armaments at all, in fact it is mainly concerned with securing energy supplies; which the Commission has singularly failed to do:

Article 122

Without prejudice to any other procedures provided for in the Treaties, the Council, on a proposal from the Commission, may decide, in a spirit of solidarity between Member States, upon the measures appropriate to the economic situation, in particular if severe difficulties arise in the supply of certain products, notably in the area of energy.

Where a Member State is in difficulties or is seriously threatened with severe difficulties caused by natural disasters or exceptional occurrences beyond its control, the Council, on a proposal from the Commission, may grant, under certain conditions, Union financial assistance to the Member State concerned. The President of the Council shall inform the European Parliament of the decision taken.

Why has nobody questioned the wisdom of re-arming Germany – the last couple of times that happened the whole world was engulfed in wars. And wasn’t the founding motto of NATO: Keep Russia out, keep the USA in and keep Germany down?

The EU Plan to Provide €800 Billion for Re-Arming Europe Has Hit a Snag or two

The EU plan to borrow €800 Billion for defense was rejected by the Dutch Parliament. In particular, they objected to the fact that the money will be borrowed by the EU and the more fiscally responsible countries (mainly in the northern states of the Union) would end up paying for it.

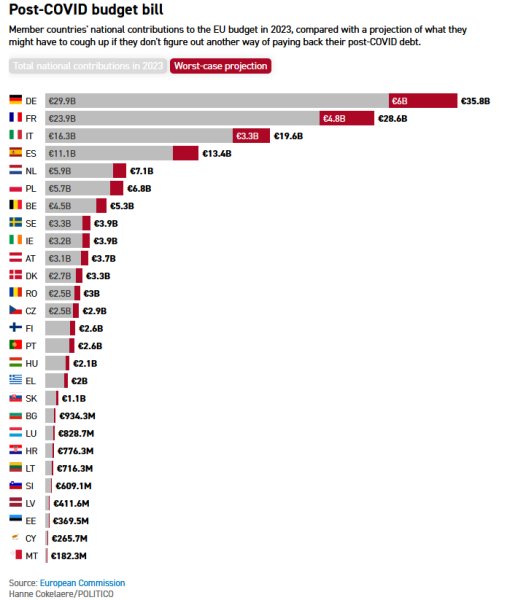

And that’s not the only problem, there is also the matter of the €300 billion that the EU borrowed to fund the recovery from COVID. The Commission wants to hand over this debt to EU members, but the northern states, who received a small percentage of the money that was handed out, are not happy to pay it. The southern states of the EU, who are regarded as being more profligate than their counterparts in the north, are pushing to have the EU take over all of their debts, so they don’t have to pay them all back, just a percentage of them, with the more fiscally conservative states picking up the rest of the bill. Countries like Germany and the Netherlands are, needless to say, not happy with this plan.

This chart shows how much extra each state will have to pay if the Commission succeeds in unloading its debt onto them.

Kaja Kallas, The EU High Representative for Foreign Affairs Doesn’t Know Why She’s Here

During a summit in Brussels on Thursday, Spanish Prime Minister Pedro Sanchez endorsed the idea of appointing an EU Ukraine envoy, which was previously backed by Finland and Croatia. “We need a negotiating team and a representative that speaks for European citizens,” Sanchez told reporters.

The Prime Minister’s comments “angered” Kallas, who argued that she was the right person to conduct talks with Russia and Ukraine, Euractiv reported, citing an EU diplomat. According to Bloomberg, Kallas “took offense” to Sanchez’s position, and the two had “a heated exchange” behind closed doors. “What am I here for?” she said, according to Bloomberg’s sources. Politico Europe cited two EU diplomats as saying that Kallas insisted that representing the bloc was her job and that appointing a new person would “not be useful.”

The question remains; is she experienced enough to negotiate with Sergei Lavrov, Russia’s veteran chief diplomat?

The EU Plan to Give €40 Billion in Military Aid to Ukraine Has Been Rejected

The EU plan, put forward by Kaja Kallas, who is not having a good week, has just been vetoed by EU leaders, “it’s dead” said one top diplomat. She then put forward a second plan, this time for a “mere” €5 billion, to supply 2 million artillery shells to the Ukraine, which was also quashed. António Costa, the president of the European Council, tried to point out that member states had already pledged €15 billion in additional support for Ukraine and new commitments were expected in the coming weeks as a result of the European Commission’s rearmament package. If it happens.

The last time a European country, namely Britain, tried to supply 155mm shells sourced from overseas (Japan) it ended in failure. The Wall Street Journal (WSJ) reported that “Efforts by the UK and Japan to replenish Ukraine’s artillery stocks have fallen through”. The failure was due to the fact that there was a technical mismatch of the British and the Japanese military blueprints, and the limited production capacity of the supposed Japanese contractor, which hadn’t been checked beforehand.

In addition, there was the EU’s own plan, put forward by Kaja Kallas’s predecessor, Josep Borrel, to supply 1.4 million shells to Ukraine also foundered with them only delivering around half that number. Many of the shells they did procure, from the open market (some of them were alleged to be from arms supplied by the US), failed to work. Meanwhile, the UK’s censorship committee modified the story slightly:

The EU’s Bête Noir, Victor Orban, Has Been Sidelined in Order to Save The EU

The European elites are celebrating the fact that they managed to put through an EU Council Resolution to continue arming Ukraine despite Hungary’s objections. Viktor Orban, had previously said that the plans would “ruin Europe”, but EU officials managed to bypass him. Rules that normally require all 27 EU countries to agree on a joint statement for it to be issued on behalf of the European Council were discussed two weeks ago, when he attempted to derail proposals for Europe to fill the gap left by an American aid cutoff for Kyiv. So, the EU decided to ignore him:

The text agreed by the remaining 26 countries was appended to the other resolutions, which were unanimously agreed. And while Hungary opted out, it was still issued as a formal European Council conclusion. That tactic seems to be working and diplomats told POLITICO they intend to use it again.

“The statement on Ukraine today will be issued as an annex on behalf of the 26,” said one senior EU diplomat, granted anonymity to discuss Thursday’s closed-door talks. “This is the new normal. And it is useful when it comes to political intent. Maybe down the line though we will encounter other problems.”

Meanwhile, a top EU official added, Hungary’s objections are being priced in — and quickly ignored.

The EU is now studying ways of using Article 7 of the EU constitution Treaty of Lisbon to take away Hungary’s vote in order to “save the EU”. The article, written by two ex-EU MEPs, said:

Europe now faces the greatest challenge since its formation. The continent’s peace, prosperity and core values depend on confronting those who would destroy it from within, and if the bloc fails to act decisively, it risks remaining caught between a dysfunctional confederation and the “ever closer union” it hopes to become.

This proposed simultaneous suspension strategy offers a pathway forward. The legal tools to address this crisis exist — Europe just needs to use them, and meet the moment with creativity and courage.

It goes on to say that Commission President Ursula von der Leyen has begun conducting business via select groups of trusted Commissioners rather than the whole college, building coalitions of the willing by excluding the unwilling.

The Starmer Coalition of The Willing Is Not Quite So Willing After All

UK Prime Minister Keir Starmer’s plan to create a ‘coalition of the willing’ to provide peacekeepers in Ukraine in the event of a ceasefire seems to be suffering from some setbacks. Italy, a key partner, has pulled out, with Italian Prime Minister Meloni suggesting that Ukraine should instead be offered de facto NATO membership; where it is defended by NATO, through Article 5, even though its not actually a formal member of the organization. It seems doubtful that the US will accept that idea.

Meanwhile, even the joint lead in the putative coalition is getting cold feet. President Macron of France is now said to be exploring a UN peacekeeping force there instead. Steve Witkoff, President Donald Trump’s special envoy, has dismissed the Starmer plan as “…a posture and a pose.” He went on to say that the idea was based on a “simplistic” notion of the UK prime minister and other European leaders thinking “we have all got to be like Winston Churchill”.

Is 300 Billion a Magic Number?

According to the EU Council President, António Costa, the EU has lost €300 billion in investments because of high energy costs and excess bureaucracy, which, of course, they have a bold plan to address. Last year, Ursula Von Der Leyen said “The European Union is losing €300 billion of European savings, which are transferred abroad every year, mainly to the United States. This is the money our companies need, and it undermines our competitiveness”. The US negotiators were told, during the talks in Riyadh, that US companies have lost $300 billion by divesting from Russia. During the recent COP29 conference a plan to supply $300 billion per year for developing countries was agreed. And there are supposed to be $300 billion in frozen Russian assets in Euroclear after the EU seized them.

The Green Party is Losing Support

Rising public concerns over inflation, energy costs, and migration have overshadowed the once-popular green agenda, leading to a decline in support for Green parties across Europe.

For example, in the 2024 European Parliament elections, the Greens lost support in most EU countries where they govern, dropping 8.6% in Germany, 7.97% in France, 7.15% in Luxembourg, 6.01% in Ireland, 4.7% in Finland, 3% in Austria, and 1.25% in Belgium compared to 2019. And in Germany’s recent elections, the Greens fell to 11.61% (down from 14.8% in 2021) and lost their place in the CDU-SPD coalition. Foreign Minister Annalena Baerbock is set to step down from leading the party. Fortunately, she is being proposed for the post of the next president of the UN general assembly.

In Germany, the Greens hung around long enough to vote for the release of the debt brake. Merz’s government will spend the new borrowings mainly on arms. European markets soared on the news, in particular defense stocks. Frankfurt’s DAX index, home to Germany’s biggest companies, closed up 0.98% as corporates including Rheinmetall, Bayer, Thyssenkrupp and Continental all advanced.

Oh no!