The question came from veteran macro investor Dan Tapiero, one of the few old-guard financiers whose entire career has revolved around spotting inflection points. “What if hyperbitcoinization is really just about to start?” he asked on Sunday, just as gold went vertical and confidence in fiat money began to crack like thin ice.

It’s a question that’s hard to dismiss once you look at the data. Everywhere you turn, the signs point in the same direction. The world’s post‑war monetary system, stretched and strained by debt, inflation, and political distrust, is showing its seams.

Hyperbitcoinization and the gold prelude

Across commodities desks, analysts are calling it the most aggressive gold rally in living memory. The precious metal has surged nearly 25% since August and crossed $4,200 an ounce by October 17. Gold’s total market capitalization even eclipsed $30 trillion this week, outpacing Microsoft and Nvidia.

The move was fueled by geopolitical uncertainty, record central‑bank buying, and the Federal Reserve’s tentative shift toward easing after its first rate cut in nine months. Parabolic moves like this usually mark panic, either into safety or away from trust. And this time, that panic looks monetary.

If gold is repricing risk, history suggests Bitcoin won’t be far behind. The world’s largest crypto, long dubbed digital gold, already touched $126,000 in early October. But unlike bullion, Bitcoin doesn’t just store value; its network embodies a monetary architecture independent from the system investors are growing wary of.

The vanishing Bitcoin supply

Analytics firm Glassnode reports that exchange balances have dropped to their lowest level since 2019, with over 45,000 BTC ($4.8 billion) withdrawn in October alone. When coins leave exchanges, they typically move into cold storage, signaling long‑term conviction rather than short‑term speculation. It’s not traders chasing profits; it’s investors accumulating quietly, positioning for endurance.

Meanwhile, Bitcoin’s mining backbone looks stronger than ever. According to JPMorgan data, the network’s hashrate hovers near 1,030 exahashes per second, a record level. That represents confidence at scale. Miners don’t double down on expensive hardware unless they expect long‑term returns. The Bitcoin network has never been more secure, or more costly to attack.

Fiat fatigue

Beyond crypto, fiat currencies are losing credibility fast. As The Kobeissi Letter pointed out on gold and silver’s record highs:

“When safe havens are rallying with risky assets it tells you one thing: confidence in fiat currencies is eroding.”

When investors lose faith in both bonds and currency, they default to hard assets: real estate, gold, and increasingly, Bitcoin. The market isn’t just hedging anymore, it’s looking for lifeboats.Institutional tide rising

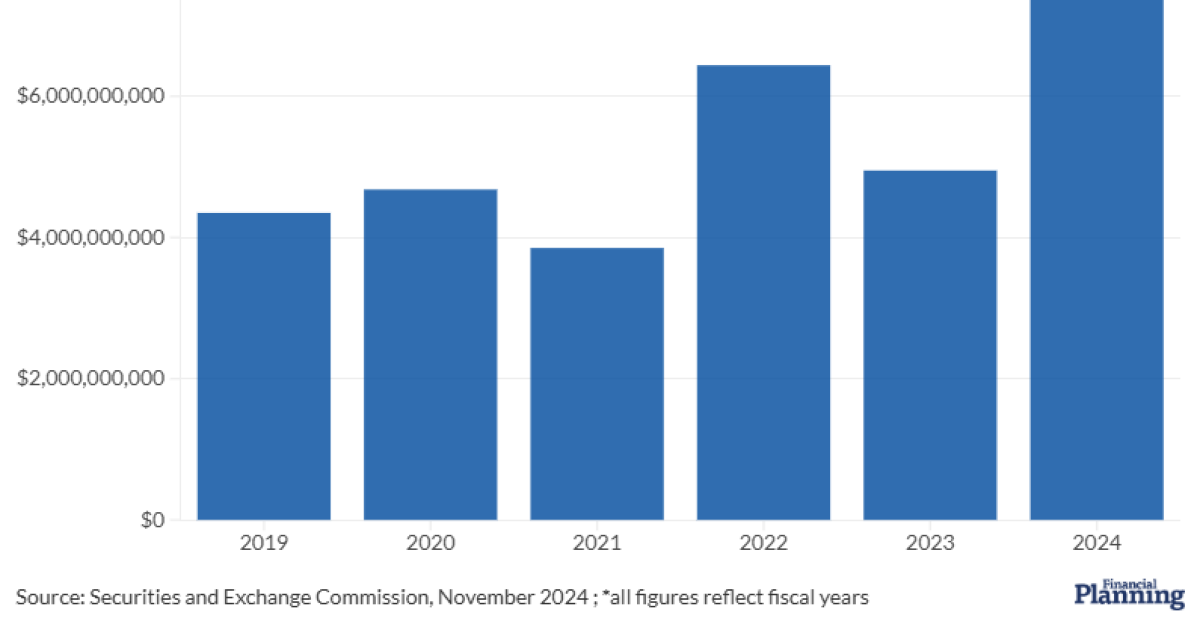

Institutional flows confirm the shift. Galaxy Digital Research reports that U.S. spot Bitcoin ETPs, approved less than two years ago, now hold roughly $250 billion AUM, less than 20% shy of surpassing gold ETPs.

Major hedge funds like Tudor Investment, Millennium, and D.E. Shaw have joined public pension funds such as the Wisconsin Investment Board in adding Bitcoin exposure. Bitcoin is no longer a rebellious niche holding; it’s a recognized macro asset class, liquid, auditable, and sovereign‑resilient.

Hyperbitcoinization or just another cycle?

Skeptics argue that “hyperbitcoinization” (the point where Bitcoin becomes the world’s de facto settlement layer) has been predicted too many times to still mean something. But Tapiero’s question cuts deeper: What if it starts not through public adoption, but through institutional debasement?

Each metric tells part of the story: record hashrate, dwindling exchange supply, surging institutional inflows, and collapsing trust in fiat. Individually, they look like market noise. Together, they sketch something larger—a migration of trust from paper promises to programmable scarcity.

Gold’s blow‑off top is a warning; central banks hoarding hard assets is another. Bitcoin, programmed, transparent, and scarce, now stands ready to absorb what the legacy system can no longer sustain. Confidence in fiat money is cracking from above, while Bitcoin’s network confidence builds from below.

If those two curves finally cross, hyperbitcoinization won’t arrive with fireworks. It will unfold the way all major monetary shifts do: slowly, then all at once.