Join Our Telegram channel to stay up to date on breaking news coverage

The Solana price has surged 7% in the last 24 hours to trade at $223 as of 4 a.m. on a 26% increase in daily trading volume to $9.04 billion.

The SOL price rise comes as VisionSys announced a $2 billion Solana treasury plan with Marinade Finance. The company will start with $500 million purchase of SOL in the first six months, which will be staked through Marinade to ensure security and compliance.

🚨 NEW: Nasdaq-listed VisionSys AI launches up to $2B Solana treasury strategy with Marinade Finance, aiming to acquire and stake $500M $SOL within 6 months. pic.twitter.com/7yS5mZNwGc

— Cointelegraph (@Cointelegraph) October 2, 2025

News of the plan triggered an initial 57% plunge in VisionSys AI shares amid concerns about funding and risk. The stock pared losses to close yesterday down 7.3%.

VisionSys AI (VSA) stock plunged 57% after announcing plans for a $2B Solana treasury, starting with $500M in SOL buys & staking. A stark reminder of the risks when public firms dive into crypto. #TOAINews2025 #VisionSysAI #Solana #CryptoMarkets #StockVolatility pic.twitter.com/u6qoK7zrjl

— Times Of AI (@TimesOfAI_) October 2, 2025

VisionSys said the move will help strengthen its balance sheet, improve liquidity, and create long-term value.

Solana Price Network Activity Surges, Staking Grows

Solana’s bullish price action is backed up by on-chain data. The network reported over $1.25 billion in revenue so far this year, with rapidly rising activity and a daily active user count above 2.3 million.

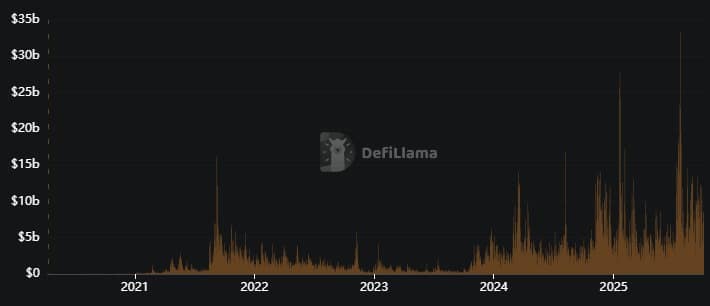

Transaction volumes on Solana’s decentralised exchanges are at record highs, accounting for more than 81% of all DEX activity, which means trading and liquidity are high..

With companies like VisionSys AI pledging to stake hundreds of millions in SOL, network staking participation also looks set to climb. Marinade Finance, VisionSys’s partner, already delegates more than 10 million SOL, showing big players are taking long-term positions in the blockchain.

Glassnode and Token Terminal data reveal that more SOL is being moved off trading platforms and into wallets, signalling confidence and reducing risks of sudden sell-offs.

The ultimate driver for Solana could be the approval of spot ETFs in the US. These products would allow institutional investors to hold SOL easily, fueling another wave of demand.

Alongside corporate treasuries adopting SOL, these catalysts may keep the uptrend hot as long as technical and support levels hold.

Solana Holds Key Levels: Outlook Turns Bullish

Solana’s price has rallied strongly, helped by the news of fresh corporate demand and strong on-chain activity. After dropping earlier in the year, SOL found support at $160 and then climbed above its critical 50-week simple moving average (SMA), now sitting at $182.62 according to the latest chart data.

SOLUSD Analysis Source: Tradingview

The 200-week SMA is far below current prices at $101.86, showing the market’s continued strength and bullish bias.

SOL price action has been marked by a series of higher highs and higher lows since a breakout in mid-2024. This is a strong technical sign that buyers are in control. Resistance remains strong at the $240 level, where the chart indicates previous selling pressure. But if SOL can break above that zone, analysts see targets at $252, and potentially higher if new buyers step in.

SOL’s RSI (Relative Strength Index) is now at 59.67, suggesting there’s still room for the price to climb before reaching overbought levels. The MACD (Moving Average Convergence Divergence) indicator is positive (5.77 and 16.29), supporting continued bullish sentiment.

The ADX (Average Directional Index) at 17.35 shows buyers are gaining strength, but the trend is not exhausted yet.

So, traders are watching the $182–$200 support zone, which has repeatedly brought in new buyers. As long as SOL stays above these levels, the uptrend is likely to continue. If resistance at $240 is cleared, SOL could move quickly towards $252–$265. Especially if large-scale buying from new corporate treasuries and ETFs picks up.

Could Solana Price Hit $300–$350?

If momentum keeps up and the VisionSys treasury plan goes forward, there is a real chance for SOL to retest all-time highs and move into the $300–$350 range.

Elon Musk’s AI prediction tool, Grok, highlighted this potential, with growth supported by technological upgrades (Firedancer, Alpenglow), increasing institutional adoption, and expectations for spot Solana ETF approval in the US.

With so much new demand from treasury buyers, technical signals turning bullish, and ETF news pending, a run towards the upper end of those estimates is on the table.

The main risk remains any sudden drop below $182, which could lead to a test of lower supports at $160 and $120.

Solana is proving its strength as an institutional-ready blockchain, and it keeps gaining popularity as an asset for both treasuries and crypto traders. If momentum continues and on-chain trends stay strong, Solana could remain one of the top-performing coins this quarter.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

Easy to Use, Feature-Driven Crypto Wallet

Get Early Access to Upcoming Token ICOs

Multi-Chain, Multi-Wallet, Non-Custodial

Now On App Store, Google Play

Stake To Earn Native Token $BEST

250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage