NVIDIA Corporation (NASDAQ:NVDA) is one of the best performing S&P 500 stocks in the last five years.

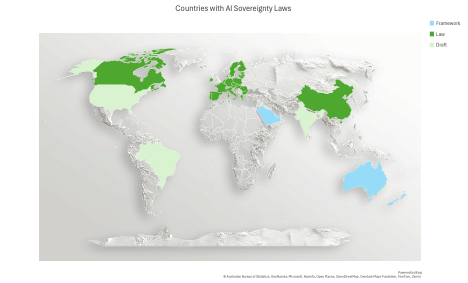

Reuters reported on February 10, 2026, that NVIDIA Corporation (NASDAQ:NVDA) is required to comply with strict U.S. licensing terms for exports of its H200 AI chips to China, according to Howard Lutnick, the Commerce Secretary. Aligned with the State Department, the conditions follow a U.S.-China trade truce brokered in October last year.

It is reported that NVIDIA Corporation (NASDAQ:NVDA) has been resisting provisions, including ‘Know Your Customer’ requirements. The current situation reflects ongoing geopolitical constraints on its China-facing AI revenue despite limited export permissions.

Additionally, on February 3, 2026, Reuters reported that NVIDIA Corporation (NASDAQ:NVDA) is getting closer to acquiring a $20 billion stake in OpenAI as part of the AI startup’s latest funding round. OpenAI is seeking up to $100 billion at an $830 billion valuation.

With the deal not yet finalized, NVIDIA Corporation (NASDAQ:NVDA)’s CEO Jensen Huang mentioned plans for a massive investment, one that could potentially be the company’s largest ever.

In September, reports cited chip-related concerns as a factor behind the pause of NVIDIA Corporation’s (NASDAQ:NVDA) earlier $100 billion investment. On February 2, 2026, OpenAI expressed dissatisfaction with some of Nvidia’s latest AI chips.

Alongside Huang, OpenAI’s CEO, Sam Altman, stated that NVIDIA remains the company’s long-term customer.

NVIDIA Corporation (NASDAQ:NVDA)’s leading role in powering generative AI infrastructure is evident from the deal, where its strategy to retain leadership in high-performance AI chips remains key amid increasing competition from Amazon and SoftBank-backed initiatives.

NVIDIA Corporation (NASDAQ:NVDA) focuses on designing GPUs and AI computing platforms for data centers, gaming, and enterprise markets. The company supports high-performance graphics, AI workloads, and accelerated computing solutions globally.

While we acknowledge the potential of NVDA as an investment, we believe certain AI stocks offer greater upside potential and carry less downside risk. If you’re looking for an extremely undervalued AI stock that also stands to benefit significantly from Trump-era tariffs and the onshoring trend, see our free report on the best short-term AI stock.

READ NEXT: What Are the Best Stocks to Buy Right Now? and 10 Stocks Under $1 That Will Explode.

Disclosure: None.