Updated on Febuaury 12th, 2026 by Felix Martinez

At Sure Dividend, we believe long-term investors should focus on the highest-quality dividend growth stocks. Broadly speaking, these are companies with long histories of raising dividends, competitive advantages, and growth potential to sustain dividend growth in the years ahead.

Therefore, we tend to steer investors toward the Dividend Aristocrats, a group of 69 S&P 500 companies with 25+ consecutive years of dividend increases. We have compiled a complete list of Dividend Aristocrats and relevant financial metrics, including dividend yields and price-to-earnings ratios.

You can download your free list of all the Dividend Aristocrats by clicking on the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

We review each of the 69 Dividend Aristocrats every year. The next stock to be reviewed in this year’s edition is AbbVie (ABBV).

AbbVie is coming off a multi-year period of excellent growth, driven by the massive success of its flagship product, Humira. There are questions about the company’s future growth amid intensifying competition for Humira in the U.S. and Europe, but it has a plan to continue growing over the long term.

This article will discuss AbbVie’s business model, growth potential, and valuation.

Business Overview

AbbVie is a global pharmaceutical giant with a $390 billion market capitalization, making it a mega-cap stock.

AbbVie began trading as an independent company in 2013 after it was spun off from Abbott Laboratories (ABT), a fellow pharmaceutical dividend aristocrat.

Additional Resource: Stock Spin-Off Calendar from Stock Spin-Off Investing.

AbbVie is a pharmaceutical products company that is focused on a couple of key treatment areas, including immunology, oncology, and neurological health

Thanks to its growth since its spin-off, AbbVie now generates approximately $61 billion in annual revenue.

AbbVie’s most important product is Humira. Humira is an immunology drug used to treat rheumatoid arthritis, Crohn’s disease, and several other indications. It has been the top-selling drug in the world for a couple of years.

The challenge for AbbVie is that Humira is now facing biosimilar competition in Europe and the US (since January 2023).

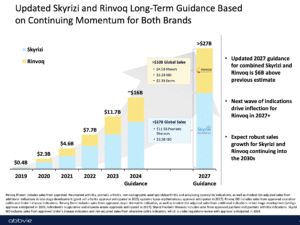

AbbVie delivered strong Q4 2025 results, beating expectations with adjusted EPS of $2.71 (+$0.06 vs. estimates) and revenue of $16.6 billion, up 10% year over year. Growth was led by immunology, where Skyrizi rose 33% to $5.0B, and Rinvoq increased 30% to $2.4B, more than offsetting Humira’s 26% decline to $1.25B.

Neuroscience also performed well, with segment revenue up 18%, driven by Vraylar ($1.0B) and Botox Therapeutic ($990M). Adjusted operating margin reached a strong 38.3%, though GAAP EPS was pressured by $0.71 per share of acquired IPR&D and milestone expenses.

For the full year 2025, AbbVie generated record revenue of $61.2 billion (+8.6%) and adjusted EPS of $10.00, despite a $2.76 per-share headwind from acquisition-related charges. Immunology revenue grew 14% to $30.4B, led by Skyrizi ($17.6B) and Rinvoq ($8.3B), confirming a successful post-Humira transition.

Neuroscience sales climbed 20% to $10.8B, while oncology grew modestly to $6.7B. Looking ahead, management guided 2026 adjusted EPS of $14.37–$14.57, signaling strong earnings acceleration supported by continued immunology momentum, pipeline progress, and operating leverage.

Growth Prospects

The major risk for global pharmaceutical manufacturers is patent loss. When a particular drug loses its patent, the market is typically flooded with competition, especially for the world’s top-selling products.

AbbVie’s biggest risk is the competition about to hit its flagship drug, Humira. This multi-purpose drug is used to treat rheumatoid arthritis, plaque psoriasis, Crohn’s disease, ulcerative colitis, and more.

Humira once generated over half of AbbVie’s annual sales. The loss of patent exclusivity in the US in early 2023 is a significant overhang.

Going forward, AbbVie expects to return to growth from its expanded portfolio. The company prepared for the loss of patent exclusivity for Humira by investing heavily in new products and acquisitions to drive growth.

For example, Rinvoq and Skyrizi are two additional products that represent long-term growth catalysts.

Source: Investor Presentation

AbbVie’s $63 billion acquisition of Allergan also remains a source of future business and earnings growth.

Allergan’s flagship product, Botox, diversifies AbbVie’s portfolio by expanding its exposure to global aesthetics and neurological indications. Both markets continue to grow, enabling AbbVie to benefit from increased spending in these areas.

Overall, we expect AbbVie to deliver 6% annual EPS growth over the next five years.

Competitive Advantages & Recession Performance

The most important competitive advantage for AbbVie, and any other pharmaceutical company, is its patent portfolio. Pharmaceutical giants need to spend heavily to innovate new drugs and therapies when one of their blockbusters loses patent protection.

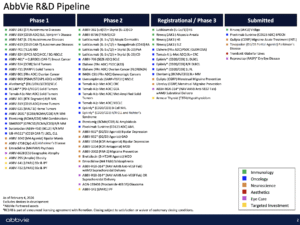

Like many of its peers, AbbVie spends billions on R&D every year. Thanks to significant investment in new therapies, AbbVie is well-positioned in growth markets such as oncology and immunology.

The company has numerous new products at various stages of development.

Source: Investor Presentation

AbbVie was not a stand-alone company during the last financial crisis, so it has no recession track record. However, because patients with illnesses require treatment regardless of economic conditions, AbbVie would likely continue to perform well during a recession.

The COVID pandemic has not negatively impacted AbbVie, as the company hit new record profits in 2020, 2021, and 2022.

Even if AbbVie’s earnings were to decline slightly in a recession, the dividend should remain secure. AbbVie’s dividend payout ratio is expected to be approximately 47% in 2026.

Valuation & Expected Returns

AbbVie is expected to generate adjusted EPS of $14.47 for 2026, at the midpoint of guidance. At this EPS level, the stock is trading at a P/E of 15.2. AbbVie is valued considerably below the S&P 500 Index.

Our fair value estimate for AbbVie is a price-to-earnings ratio of 13.0, reflecting increased leverage from the Allergan acquisition and the expiration of Humira patent exclusivity. These overhangs persist on the company’s earnings growth potential.

As a result, we view AbbVie as slightly overvalued. A compression in P/E multiple could reduce shareholder returns by approximately 3% per year over the next 5 years.

In addition, we expect annual earnings growth of 6% through the next five years. Lastly, the stock has a current dividend yield of 3.1%.

In total, we expect annual returns of approximately 6.1% over the next five years, making AbbVie stock a hold.

Final Thoughts

AbbVie is a high-quality business with a strong pharmaceutical pipeline and long-term growth potential. It is also a shareholder-friendly company that returns excess cash flow to investors.

The near-term outlook is uncertain, as AbbVie faces a significant challenge in replacing lost Humira sales following the expiration of patent exclusivity.

While the company has prepared for this through significant R&D investments, earnings-per-share growth has stalled over the past few years.

With expected returns slightly above 6.1% per year going forward, even after accounting for the dividend yield, AbbVie stock is rated a hold.

If you are interested in finding high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].